The Maine real estate market has been attracting the attention of real estate investors who are looking to leverage the state’s increasingly competitive rental market. As the 15th most expensive rent by state, Maine’s rental vacancy rate still hit a 10-year low at just 2.9% in 2023, which is nearly half of the 5.5% vacancy rate in 2013. With such a tight rental market, demand for housing is high, making it a prime time to grow your real estate portfolio in the Pine Tree State.

But for most real estate investors, financing is a key tool that’s needed to build a solid portfolio. This is where a DSCR loan Maine can come in handy – a mortgage that you can qualify for based on your property’s cash flow.

This guide will cover what you need to know before choosing a DSCR loan for your next real estate investment venture. Keep reading to learn more!

What Is a DSCR Loan?

A DSCR loan, short for a debt-service coverage ratio loan, is a type of financing option specifically designed for real estate investors where you can qualify for a mortgage using your property’s cash flow instead of your own personal income. Using this type of alternative income verification can make it much easier for investors to qualify for investment property loans, especially those who have properties with strong cash flow.

DSCR loans are considered to be non-QM (non-qualified mortgage) loans since they don’t require any traditional income verification, such as tax returns, W2s, and pay stubs. Non-QM loans don’t need to follow the strict lending requirements set by the Consumer Financial Protection Bureau (CFPB), meaning every non-QM lender can set their own criteria as they see fit.

Calculating DSCR

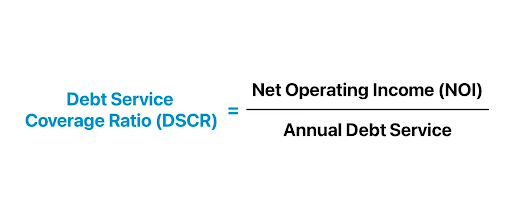

When calculating your property’s DSCR, you’ll need to start off by determining its net operating income (NOI) by subtracting its operating expenses from its rental income. Then, you can divide the property’s NOI by its annual mortgage payments to get the DSCR.

Below, we’ve included a simplified version of the formula:

What’s Considered a Good DSCR?

For most DSCR lenders, a “good” DSCR is 1.25 or above. Considering that any DSCR that’s 1.0 or higher means that a property can “pay for itself,” a DSCR of 1.25 means it can pay for itself with a buffer on top of that. If your property’s DSCR isn’t that high, there are lenders out there, like us at Defy, that accept a DSCR as low as 0.75.

DSCR Loans vs. Conventional Loans

DSCR loans and conventional loans have some key differences that can make one more appealing than the other, depending on your situation. With a DSCR loan, the focus is on the property’s income – if the rental income covers the debt payments and you meet the credit score requirements, you’re likely to get approved. Since DSCR loans don’t take debt-to-income (DTI) ratios into consideration, it can also make it much easier to qualify for more than one of them to quickly scale your portfolio.

Conventional loans, on the other hand, look more closely at your personal income, DTI ratio, and other financial factors to determine if you qualify. These requirements tend to be much more strict, making it trickier to qualify for if you have non-traditional income. So, while DSCR loans offer more flexibility for real estate investors, especially if you don’t have traditional income proof, they typically come with slightly higher interest rates compared to conventional loans.

Using DSCR Loans to Build Your Maine Rental Portfolio

If you’re a real estate investor who wants to build your Maine rental property portfolio, there’s no better time than now to expose yourself to the housing market. As of October 2024, the average rent in Maine is $1,601 per month, showing promising cash flow opportunities for landlords. Maine’s population has grown faster than any other state in New England, increasing by about 32,500 residents (2.4%) between April 2020 and July 2023, and is projected to reach just under 1.4 million by 2030. With the average home value rising 4.1% over the past year to $405,170, and properties going to pending in just 14 days, a DSCR loan can help investors quickly scale their portfolios and tap into this thriving market.

Eligible Property Types for a DSCR Loan Maine

You can finance a wide range of property types with a DSCR loan Maine, including:

- Single-family properties

- Multi-family properties

- Vacation rentals

- Short-term rentals (like Airbnb and Vrbo)

- Some commercial properties

Pros and Cons of a DSCR Loan Maine

Pros:

- Get approved based on your property’s rental income

- No need for personal income documents (e.g., paystubs, W2s, or tax returns)

- Capitalize on a growing rental market, along with potential for capital appreciation

- Scale your investment property portfolio quickly with no hard limit to how many DSCR loans you can get

- More flexible qualification criteria and loan terms

Cons:

- Limited availability

- Slightly higher interest rate

- Unexpected vacancies or other income fluctuations can impact cash flow, making it difficult to make mortgage payments during these times

DSCR Loan Maine Qualification Requirements

When it comes to DSCR loan requirements, each lender typically sets their own. At Defy, this is what we need if you apply for a DSCR loan with us:

- Minimum DSCR ratio of 0.75

- Minimum FICO score of 620+

- Maximum LTV of 85%

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns

- Interest-only options available

DSCR Loan Maine Down Payment Requirements

The amount you’ll have to put down for your DSCR loan depends heavily on the lender’s requirements and your credit score, but you can expect to put down anywhere between 15-25% of the purchase price. At Defy, we require a minimum DSCR down payment of 15%.

DSCR Loan Maine Interest Rates

Just like conventional loan rates, DSCR loan interest rates can vary based on a few different factors like the lender, your credit score, and the current market rates. However, you can expect DSCR rates to be slightly higher than conventional loan rates, which many investors think is a small price to pay to expand their portfolio.

How to Find a DSCR Lender in Maine

Finding an experienced DSCR lender with a proven track record is a must when financing your next investment property. While doing your research, try finding lenders who go above and beyond for their clients and are familiar with the Maine real estate market. Partnering with a good lender can make or break your next venture.

If you’re looking for a DSCR lender that provides customizable loan solutions with personalized service, look no further than us at Defy. We cater to non-traditional borrowers since we believe that those who forge their own path should have loan options too. Schedule a free consultation or give us a ring at (615) 622-1032 to speak with one of our mortgage experts and start your real estate investing journey with us today.

DSCR Loan Maine FAQs:

- How does a DSCR loan work for real estate investors in Maine?

A DSCR loan helps Maine investors qualify for financing based on their property’s rental income rather than their personal income. This makes it easier for investors to grow their portfolio if the property generates enough cash flow to cover its debt payments.

- How can I calculate my property’s DSCR?

To calculate your property’s DSCR, you need to calculate its net operating income (NOI) first by taking its rental income and subtracting its operating expenses. Next, divide the NOI by the property’s annual debt payments to arrive at its DSCR. A DSCR that’s 1.0 or greater means that the property earns enough income to cover its debt.

- What types of properties are eligible for a DSCR loan Maine?

A DSCR loan Maine can be used to finance several different types of properties like single-family, multi-family, vacation, and commercial properties, as long as it generates enough rental income to meet the lender’s requirements.

- What’s the difference between a DSCR loan and a conventional loan?

A DSCR loan qualifies based on the property’s income, while a conventional loan usually requires proof of your personal income and debt-to-income ratio. DSCR loans offer much more flexibility for investors who have strong property cash flow with less traditional income documentation.

- Is a DSCR loan Maine available for short-term rentals like vacation homes or Airbnb properties?

Yes! A DSCR loan Maine can be used to finance short-term rental properties like vacation homes or Airbnb properties, as long as they generate enough income to meet the lender’s requirements.

- What credit score do I need to qualify for a DSCR loan Maine?

Typically, you’ll need a credit score of at least 620 to qualify for a DSCR loan, but a higher credit score can help you secure better loan terms.

- What are the main benefits and potential drawbacks of using a DSCR loan for Maine investments?

The main benefits of using a DSCR loan for a Maine investment property is being able to qualify based on the property’s income without needing any personal income verification. Some potential drawbacks include limited availability and slightly higher interest rates.