Securing the right financing is crucial for real estate investors and entrepreneurs. The DSCR loan Ohio offers a specialized option for those looking to invest in properties within the state.

Favored by both investors and lenders, DSCR loans provide a pathway for investors who may not have flourishing personal finances but are perfectly positioned to purchase and develop a highly lucrative investment property.

At Defy Mortgage, we specialize in nontraditional lending solutions for easy mortgage management, such as DSCR loans, foreign national loans, P&L loans, and more for a variety of states in the US. Many entrepreneurs and real estate investors have successfully purchased and refinanced income-generating properties through our DSCR loans, enabling their investments to thrive.

With over 75 different loan programs and a team with more than 100 years of combined industry experience, we empower clients to efficiently manage their mortgage portfolios without bottlenecks or delays.

Honed by our extensive experience in providing DSCR loans, we’ve crafted this blog to provide insights into taking out a DSCR loan in Ohio. We’ll go into how DSCR works and why lenders favor it. Following that, we’ll go over the eligibility criteria and other considerations that potential borrowers should keep in mind, such as how to calculate the DSCR. This blog is intended to give an overview of the DSCR loan process as it might apply in Ohio, but keep in mind that every lender is different.

What that said, let’s get started!

What is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) is a metric used to evaluate a property’s income-generating potential to cover its debt. When considering financing options for real estate, a DSCR loan Ohio can be advantageous due to the state’s favorable market and population growth, enhancing property value and rental income potential.

Apart from that, Columbus, Ohio is one of the top 10 cities for foreign real estate investors in the United States. It is considered the most populated city in the state and the 14th most populous in the country. Extending DSCR loan programs in Ohio’s growing real estate market can be a great option among real estate investors as the loan focuses on a property’s income rather than the borrower’s overall personal financial situation.

Why DSCR is a Crucial Metric for Lenders

Lenders prefer the DSCR loan because it directly assesses the risk associated with lending on a property, providing an easy metric for gauging its financial health and stability. The higher the DSCR, the more likely a property is to cover its debt obligations regardless of the ebb and flow of business. Conversely, a low DSCR suggests a higher risk of borrower default, which may lead to less favorable loan terms or even outright denial of loan. Let’s explore this in more detail below.

DSCR Loan Ohio Eligibility Criteria

Securing a DSCR loan Ohio involves meeting several specific criteria. Properties need to stay above a certain DSCR, and the type of property can also affect the likelihood of a DSCR loan being approved. Below is an in-depth look at all the conditions that play a critical role in qualifying for a DSCR loan.

DSCR Loan Requirements

To be eligible for a DSCR loan in Ohio, a borrower needs to meet loan requirements such as minimum DSCR, property type and condition, and financial documents from both the property and the borrower, as well as have a FICO score of at least 620. Some lenders may also have their own specific requirements. The loan payment term and amount can also affect the chances of getting approved and being offered interest rates lower than the current average of 7.25%.

A property may have a favorable DSCR ratio, but if it costs too much to purchase, a lender may consider it too risky to approve a loan for, especially if the borrower is inexperienced in real estate investment or does not have a strong track record. Being in an area that may experience significant commercial downturns in the future, such as areas prone to natural disasters, can also negatively affect the chances of getting approved.

Minimum DSCR

DSCR loans typically require a minimum DSCR ratio for loan approval, which in most cases is 1.2. A DSCR ratio of 1.2 means that the property’s net operating income (NOI) must be at least 120% of the debt service. However, Defy offers DSCR loans in other states for properties with ratios as low as 0.75, which includes 3 months cash reserve and no tax returns required. We also offer loan options for foreign nationals who don’t have US credit scores or social security numbers.

Properties with higher DSCR ratios, such as 1.5 or above, may offer better loan terms and increased chances of approval. A higher ratio indicates a stronger financial cushion. Properties with lower DSCR ratios might still be eligible, but they could face higher DSCR loan interest rates or more stringent approval conditions.

Additional Fees and Costs

Beyond the basic eligibility criteria, potential borrowers should be aware of any additional fees or costs associated with DSCR loans, such as:

- Application Fees: Lenders often charge application fees to process the loan request.

- Appraisal Fees: Depending on how well-known and well-documented a property is, an appraisal may be required to assess the property’s income potential and value.

- Closing Costs: Standard closing costs, including title insurance and recording fees, can add to the overall expense of obtaining a DSCR loan.

Understanding these additional fees and costs is crucial for potential borrowers, as they can significantly impact monthly loan payments. It’s important to budget for these costs and factor them into the total investment analysis when considering a DSCR loan.

Property Type and Condition

The type and condition of the property can significantly impact eligibility for a DSCR loan. Lenders often have specific criteria based on the property’s use and state.

- Residential Properties: DSCR loans are commonly available for single-family homes, multi-family units, and residential rental properties. To qualify, these properties should be well-maintained and located in stable neighborhoods. Note that DSCR loans are for secondary and investment properties.

- Commercial Properties: Office buildings, retail spaces, and industrial properties are also eligible. However, due to the variability in rental income and market conditions, commercial real estate may face stricter loan requirements and higher DSCR thresholds.

- Condition and Age: Older properties or those in poor condition might need additional scrutiny. Properties requiring significant repairs or renovations could face challenges in obtaining a DSCR loan.

As with any real estate loan, lenders also consider the local real estate market conditions for a DSCR loan in Ohio. Properties in high-demand areas or those with strong rental markets are usually more attractive to lenders, while those in less favorable areas may discourage them from approving, even if their earning potential is strong.

Income Verification and Documentation

Although DSCR lenders focus on the property’s ability to generate enough income, they often still ask for personal income and other financial details to ensure that the borrower won’t mismanage the property. Some lenders may ask for detailed documentation to verify income, as well as to assess the financial stability of the property. This can include the following information:

- Net Operating Income (NOI): NOI is a critical component of the DSCR calculation. The NOI should be documented through financial statements, rent rolls, and other income reports.

- Historical Income: Lenders often review historical income to ensure consistency and reliability, so a track record of stable or increasing rental income can make the loan application process easier. This includes the borrower’s income record, and they may need to provide documents such as tax returns, credit reports, profit and loss statements, lease agreements, and bank statements.

- Property Management: If the property is managed by a third party, the management agreement and performance reports may need to be provided to demonstrate effective income management.

Providing thorough and accurate documentation helps build a stronger case for loan approval. But with Defy, you won’t have to provide tax returns or anything like that. No tax returns or income documentation required. We also have interest-only options for those with variable income or who want to optimize cash flow.

Calculating Your DSCR

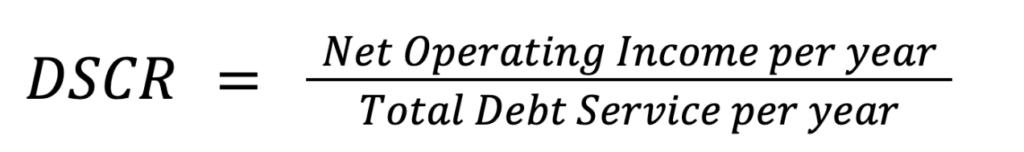

Understanding how to calculate the DSCR of a property is crucial for ensuring that you can get approved for a DSCR loan to purchase it. Here’s the DSCR formula:

The Total Debt Service is the sum of the loan’s principal, interest, insurance, and any association dues that you will have to pay over a year, should the loan be approved.

The net operating income, which is the annual income that the property earns after overhead, taxes, salaries, and other expenses, is divided by this in order to arrive at the DSCR. You may note that this means that the DSCR will vary depending on the lender.

Example Calculation

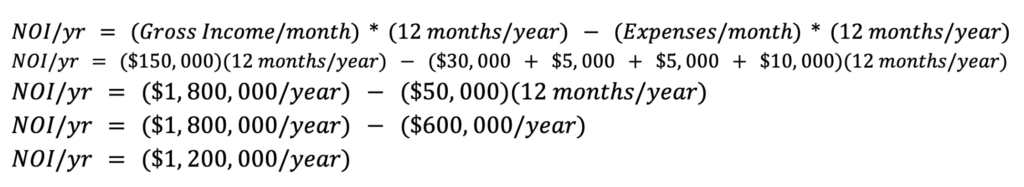

Suppose you have a property that earns $150,000 in rent and other revenues each month and has to pay $30,000 in utilities, $5,000 in maintenance, $10,000 in salaries, and $5,000 in miscellaneous expenses monthly. Since DSCR is calculated based on yearly income and debt service, we multiply both the monthly income and monthly overhead by 12:

Once we’ve obtained the Net Operating Income per year, we can divide it by the total debt service per year. Total Debt Service is the total of all debt obligations paid out over one year, such as principal, interest, and other payables such as property taxes and insurance.

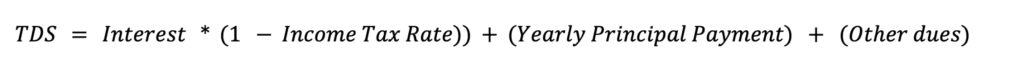

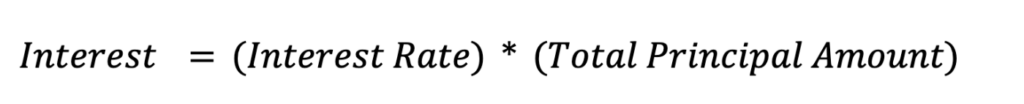

However, since interest payments are tax-deductible, they can complicate your TDS calculations. You can account for the impact of interest payments like so:

Where:

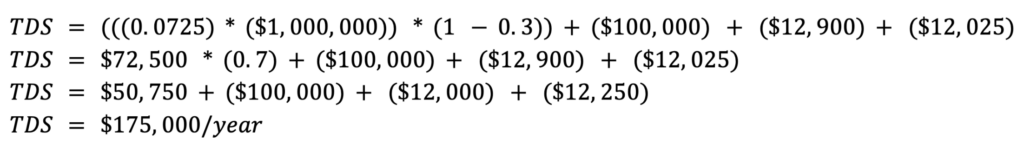

Assuming a principal loan amount of $1,000,000, with a repayment period of 10 years, we get a yearly principal payment of $100,000. Adding a yearly interest rate of 7.25%, a yearly income tax rate of 30%, yearly total taxes amounting to $12,000, and yearly insurance payments of $12,250, we can compute the Total Debt Service like so:

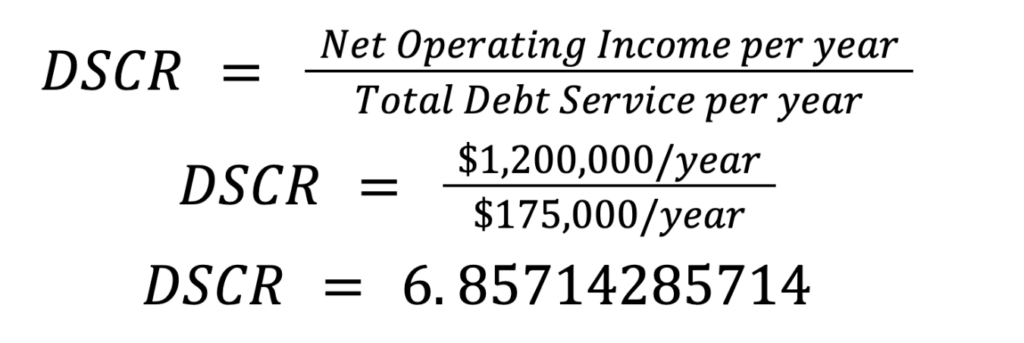

We arrive at a TDS of $175,000 per year. Applying the DSCR formula, we get:

A property that makes $1,200,000 each year, for which you have to pay $175,000 in total debt payments per year, will have a DSCR of 6.86, which means that the property makes enough to pay your yearly debt obligation more than 6 times over. Lenders generally favor properties with high DSCR, as this indicates a lower risk of default, and thus offer lower interest rates. Keep in mind, however, that a longer payment term can also increase interest rates.

DSCR Loan Ohio FAQs

1. Can I use a DSCR loan for a primary residence in Ohio?

No, DSCR loans are only approved for those looking to purchase investment properties. You cannot use them to buy primary residences or to fix and flip a property because the property needs to have the income-generating potential to get approved for a DSCR loan.

Alternatively, you can get approved if you intend to rent out the property as an Airbnb or short-term rental, but you may need to give proof of a good track record as an Airbnb host. DSCR loans in Ohio and DSCR loans, in general, are primarily for second and investment properties.

2. What is the minimum DSCR ratio acceptable for lenders in Ohio?

Most lenders require the borrower to have a minimum DSCR ratio of 1.2. However, this can vary depending on the lender and the specifics of the loan, such as loan amount and repayment term. Defy offers DSCR loans for properties with ratios as low as 0.75. If you are interested in learning more about our DSCR loan options and the states we are licensed in, please give us a call: (615) 622-1032

3. How does property type affect DSCR loan eligibility?

Well-maintained properties with a healthy cash flow are more likely to qualify for a DSCR loan. Other factors that increase eligibility include stable occupancy rates, strong rental demand, and the property’s market value. Properties with a history of consistent income generation and are located in economically stable regions also tend to be more attractive to lenders offering DSCR loans.

4. Are there prepayment penalties for DSCR loans in Ohio?

The lender usually decides whether or not there are and what or how much they are. These would also often depend on the specific loan terms. Remember to ask your lender about prepayment penalties and review the loan agreement carefully.

5. Do DSCR loans in Ohio need a specific loan-to-value (LTV) ratio?

Most DSCR lenders require a Loan-to-Value (LTV) ratio of at least 80% for the DSCR loan program. This means that borrowers will have to pay at least 20% of the home’s value for down payment. Some lenders may accept a lower rate, but it typically results in a higher interest rate. At Defy we offer DSCR options up to 85% Max Loan to Value (LTV).

Key Takeaway

Securing a DSCR loan Ohio requires a comprehensive understanding of eligibility criteria, accurate DSCR calculation, and careful consideration of loan terms and requirements. With the right approach, DSCR loans can be a powerful financing option for obtaining valuable properties, whether you’re only beginning your journey in property investment or expanding your real estate portfolio.

Driven by a growing population and increasing demand for rental properties, a DSCR loan Ohio enables real estate investors to tap into the state’s thriving market conditions. Even if you don’t necessarily have a huge income or perfect credit score, you can still purchase a highly lucrative property that can diversify and strengthen your portfolio, providing long-term financial growth and stability.

Looking to explore other mortgage options to maximize your investment strategy? Defy Mortgage provides both conventional mortgages and non-traditional loan options with favorable terms and rates. We are committed to making real estate investment more accessible, whether you need a DSCR loan or would like to explore other financing options like fix-and-flip loans.