Homebuying can be daunting even in more affordable markets like Illinois, especially for first-time homebuyers or those with imperfect credit. An FHA loan Illinois can be the best solution for those whose financial history may make it difficult to qualify for a conventional mortgage. Since they’re backed by the Federal Housing Administration (FHA), these loans can help individuals with lower credit scores, limited savings, or other financial constraints achieve homeownership.

At Defy Mortgage, we simplify the homebuying process for all borrowers, including those with irregular income streams, such as self-employed individuals and freelancers. With more than 75 fully customizable lending solutions, including non-QM options like P&L loans and foreign national loans, we’ve helped borrowers of diverse financial backgrounds reach their mortgage goals.

Although we don’t offer FHA loan Illinois at this time, we have experience in providing FHA loans to borrowers in various US states, including Florida, Tennessee, and Texas. In this guide, we will cover the FHA loan requirements in Illinois for 2025 and its key features. We’ll also go over essential details such as loan limits, mortgage insurance premiums, property eligibility, and the appraisal process.

Let’s get started!

Eligibility Criteria for FHA Loan Illinois

Qualifying for an FHA loan Illinois involves meeting several eligibility requirements: a credit score of at least 580, a favorable DTI ratio, steady income, and sufficient savings for a down payment. These guidelines ensure homebuyers can responsibly manage the loan while accessing affordable housing.

Minimum Credit Score Requirements

One of the main attractions of FHA loans is their lenient credit score requirements compared to conventional loans. To get the lowest down payment allowed by the FHA, 3.5%, borrowers must have a credit score of at least 580. Some lenders may still allow homebuyers to qualify for an FHA loan with a FICO score as low as 500, but this comes with a higher down payment of at least 10%.

Remember that private lenders can have their own rules on top of the FHA’s guidelines – not all lenders will approve borrowers with credit scores down to 500. A higher credit score can help you qualify more easily and potentially secure a lower interest rate, reducing the overall cost of your mortgage.

Personal Financial Requirements

Debt-to-income ratio, DTI, and employment history are the chief factors lenders assess to gauge your capacity to manage your FHA loan. Generally, your debt-to-income ratio should be under 43%, although individual lenders may approve FHA loans for those with higher DTIs. Your DTI ratio is the percentage of your monthly income that goes to your monthly debt payments, including mortgage payments, credit cards, and property taxes.

Lenders also assess a borrower’s employment history to ensure their ability to meet mortgage payments consistently. Typically, a steady income over the preceding two years is necessary to secure approval when applying.

Down Payment Requirements for FHA Loans

FHA loans are known for their low down payment requirements. Borrowers with a credit score of 580 or above can qualify for an FHA loan with as little as 3.5% down. For example, if you’re purchasing a $250,000 home in Illinois, your down payment could be as low as $8,750.

For those with credit scores between 500 and 579, a higher down payment of 10% is required. Even then, this requirement is still significantly more accessible than the 20% down payment often required by conventional loans, making homeownership more attainable.

Key Features of FHA Loans in Illinois

Since the government insures FHA loans, they pose a vastly reduced risk to lenders. This allows them to offer several features that make them highly advantageous to homebuyers, especially those who might have difficulty qualifying for conventional financing.

- Lower Down Payments: With down payments as low as 3.5%, closing on an FHA loan is much more affordable than closing on a conventional loan.

- Lower Interest Rate: FHA loans often have lower interest rates than conventional mortgages for those with credit scores under 680. FHA loan interest rates average 5.38%, while average conventional loan interest rates are currently around 6.625%.

- Flexible Financial Requirements: FHA loans are accessible to borrowers with financial difficulties, such as foreclosures, bankruptcies, or a history of bad credit. Depending on the lender, they may also allow borrowers with higher DTI ratios to qualify.

Another benefit of FHA loans is that the down payment can come from various sources, such as personal savings, gifts from family members, or government grants designed for first-time homebuyers. FHA loans are also assumable, meaning that if you decide to sell the home in the future, you can simply pass on the mortgage to the buyer.

Loan Limits and Their Impact on Buying Power

In Illinois, a single-family home’s purchase price is around $265,991, according to Zillow. In this case, the median home price in the state falls below FHA’s floor limit, making the floor limit automatically apply to all Illinois counties. The FHA sets its floor limit, or the maximum FHA loan amount for low-cost areas, equal to 65% of the national conforming loan limit, the highest loan amount that Fannie Mae or Freddie Mac are willing to guarantee.

Given the national conforming loan limits for 2024, here are the FHA loan limits that apply to all of Illinois:

| County Name | Single-family homes | Duplexes | Triplexes | Fourplexes |

| All Illinois Counties | $498,257 | $637,950 | $771,125 | $958,350 |

Although housing prices can be more expensive in areas like Chicagoland, with home prices rising upwards of $360,000, the median home prices in the state still fall below the floor limit. As a result, they do not get higher loan limits. Thus the maximum loan amount for a single-family home is still $498,257, even in the more expensive markets in Illinois, effectively cutting your buying power with an FHA loan in these areas.

If you want to purchase a home in Illinois that costs more than the FHA loan limits allow, it may be better to seek out other options, such as a conventional home loan or a bank statement loan, if your income is irregular.

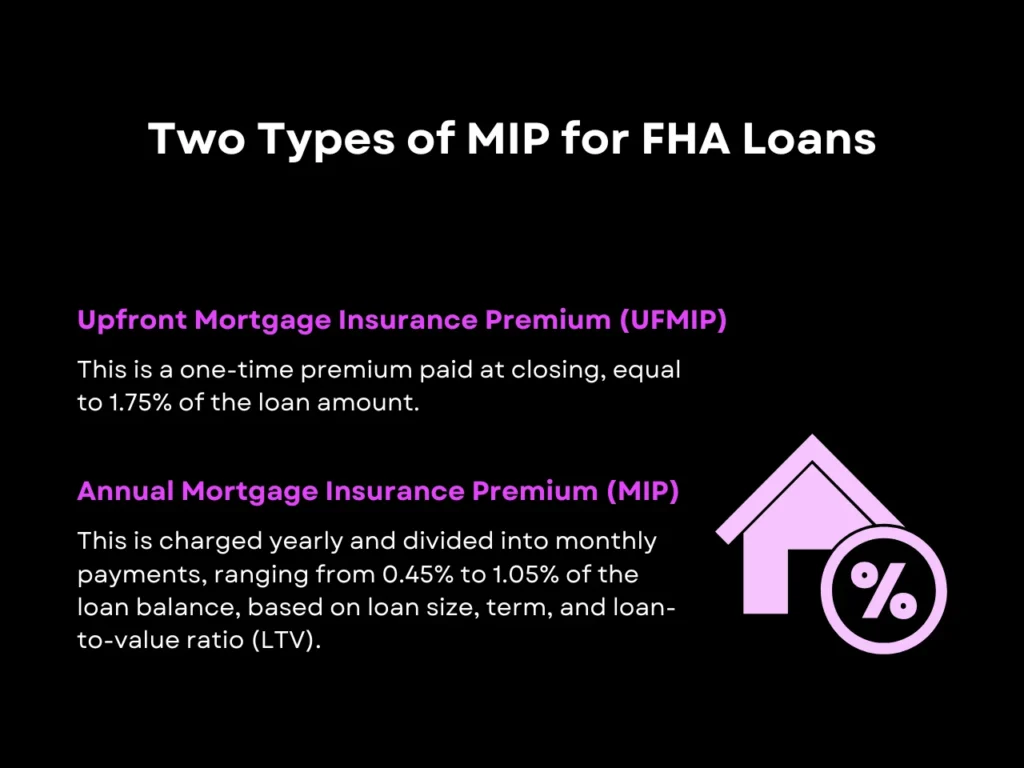

Mortgage Insurance Premiums (MIP) Explained

Mortgage Insurance Premiums (MIP) are a significant feature of FHA loans. It reinforces the government guarantee to lenders for offering favorable loans to high-risk borrowers. MIPs allow lenders to recoup some losses if a borrower defaults, mitigating the risk.

There are two types of MIP for FHA loans:

- Upfront Mortgage Insurance Premium (UFMIP): This is a one-time premium paid at closing, equal to 1.75% of the loan amount. For example, on a $200,000 loan, the UFMIP would be $3,500. This can be paid in cash or rolled into the loan.

- Annual Mortgage Insurance Premium (MIP): This is charged yearly and divided into monthly payments, ranging from 0.45% to 1.05% of the loan balance, depending on factors like loan size, term, and loan-to-value ratio (LTV).

MIP is required for the life of the FHA loan. However, you can refinance into a conventional loan after gaining enough equity.

Property Requirements and Inspections for FHA Loans

FHA loans come with specific property requirements to ensure the home meets certain safety, security, and soundness standards. These guidelines protect the FHA borrower and the mortgage lender by ensuring the property is in good condition.

Property Eligibility Criteria

Not all properties are eligible for FHA financing. Make sure that the property you want to purchase meets these key criteria:

- Qualifying Properties: FHA loans can be used for single-family homes, multi-family homes (up to four units), condominiums, and manufactured homes that meet specific standards.

- Primary Residence Requirement: The property must be used as a primary residence for at least 12 months. It must be your main home and cannot be used as a rental or second property during this time.

- Minimum HUD Safety Standards: The property must be structurally sound, free of significant defects, and suitable for living. For example, the roof must be in good condition, the plumbing must function correctly, and there must be no significant safety hazards like exposed wiring or broken windows.

The Department of Housing and Urban Development (HUD) provides a full list of safety standards that all FHA loan-purchased housing must meet on their official website.

The FHA Appraisal Process

The property must undergo an FHA-approved appraisal before an FHA loan or an FHA refinance is approved. Here’s what you can expect:

Step 1: Scheduling the Appraisal

Once you submit your FHA loan application, your lender will order the appraisal through an FHA-approved appraiser. The appraiser will then schedule a visit to the property to assess its market value and condition.

Step 2: Condition Inspection

The appraiser inspects the property to confirm it meets FHA’s minimum property standards, including safety, security, and soundness. They’ll look for peeling paint, damaged roofing, or plumbing problems.

Step 3: Property Valuation

The appraiser determines the home’s fair market value, which helps ensure that the loan amount does not exceed the property’s value. If the home is overvalued, the loan may be reduced.

Step 4: Reporting Findings

The appraiser provides the lender with a detailed report outlining the property’s value and any required repairs. If the property does not meet FHA standards, necessary repairs must be made before the loan can proceed.

Step 5: Post-Repair Inspection (if required)

If repairs are needed, the appraiser may need to conduct a follow-up inspection to confirm that the required repairs have been made.

Remember that the cost of an FHA appraisal is included in the closing costs in most situations. Once the appraisal is complete and any required repairs are verified, the appraisal report is sent to the lender, who can then finalize the loan approval process.

Note that an FHA appraisal is not the same as a home inspection. While the appraisal will check for major issues, it doesn’t offer the in-depth evaluation that a full home inspection provides. Therefore, it’s recommended that buyers get a separate home inspection to identify any hidden problems.

Frequently Asked Questions

What are the updated FHA loan limits in Illinois for 2025?

While FHA loan limits vary by county, the limit for Illinois uses the FHA floor limits for 2025. This is because the median home price in Illinois, $265,991, falls below the FHA floor limit for a single-family home, which is $498,257. The maximum amount you can get from an FHA loan in Illinois is $498,257 for a single-family home, $637,950 for a duplex, $771,125 for a triplex, and $958,350 for a fourplex.

Can I buy a home in Illinois with a low down payment through an FHA loan?

Yes, one of the major benefits of an FHA loan is the low down payment requirement. Borrowers with a credit score of 580 or higher can qualify for an FHA loan with as little as 3.5% down. If your credit score falls between 500 and 579, you may still qualify but must put down at least 10%. This flexibility makes FHA loans a popular option for first-time homebuyers and those with limited savings.

Can you use an FHA loan to buy a multi-family property?

Yes, you can use an FHA loan to purchase a property with up to four units if you plan to live in one of the units as your primary residence.

Do FHA loans have income limits?

No, FHA loans do not have income limits, but they have loan amount restrictions based on the property’s location. These loan limits vary depending on the county and whether you’re purchasing a single-family home or a multi-unit property.

When is it preferable to get a conventional loan over an FHA loan?

FHA loans are designed to keep homebuying affordable for those with imperfect credit. However, if you have a stronger credit score above 680, you may be able to qualify for a conventional mortgage with rates that can compete with FHA interest rates. Plus, you won’t have to deal with MIPs.

Key Takeaway

FHA loan Illinois is a popular option for many homebuyers due to their flexible credit score requirements, low down payments, and government-backed security. As you consider applying for an FHA mortgage in Illinois in 2025, check whether you meet eligibility criteria such as DTI requirements and a reasonable credit score. Also, remember loan limits and costs like mortgage insurance premiums to understand how an FHA loan can impact your finances.

Additionally, ensuring the property meets FHA standards through the appraisal process will help smooth the path toward securing your new home. Be sure to select a home that meets HUD safety standards for an FHA loan to prevent bearing the extra cost of repairs or the inconvenience of searching for another home that meets standards.

Are you considering an FHA loan in Alabama, California, Colorado, Florida, Georgia, Oregon, Tennessee, or Texas? Reach out to Defy today to learn more about your options. Although we don’t offer FHA loans in Illinois, we have experience in providing FHA loans in other states. FHA loans can be your doorway to an affordable mortgage. Understanding FHA loan Illinois specifics can guide you toward a successful application.