The FHA loan Missouri program offers a great opportunity for individuals with limited savings or lower credit scores to achieve homeownership. This government-backed loan allows flexibility with low down payments and lenient credit score requirements, even accommodating those with past bankruptcies or financial hardships. For anyone facing credit issues or recent foreclosures that prevent eligibility for conventional mortgages, FHA loans offer a strong alternative.

At Defy Mortgage, we simplify the home-buying process. Our various non-traditional loan options like bank statement loans and DSCR loans, have helped entrepreneurs, freelancers, and real estate investors achieve their financial goals. Although we are not licensed for FHA loans in Missouri, we have provided homebuyers with FHA loans in several US states, including Florida, Georgia, and Tennessee.

With extensive FHA loan experience, we’ve crafted this blog to inform aspiring homebuyers in Missouri on how to secure the lowest possible down payment on an FHA loan. We’ll cover eligibility requirements, benefits, and the application process.

Let’s begin.

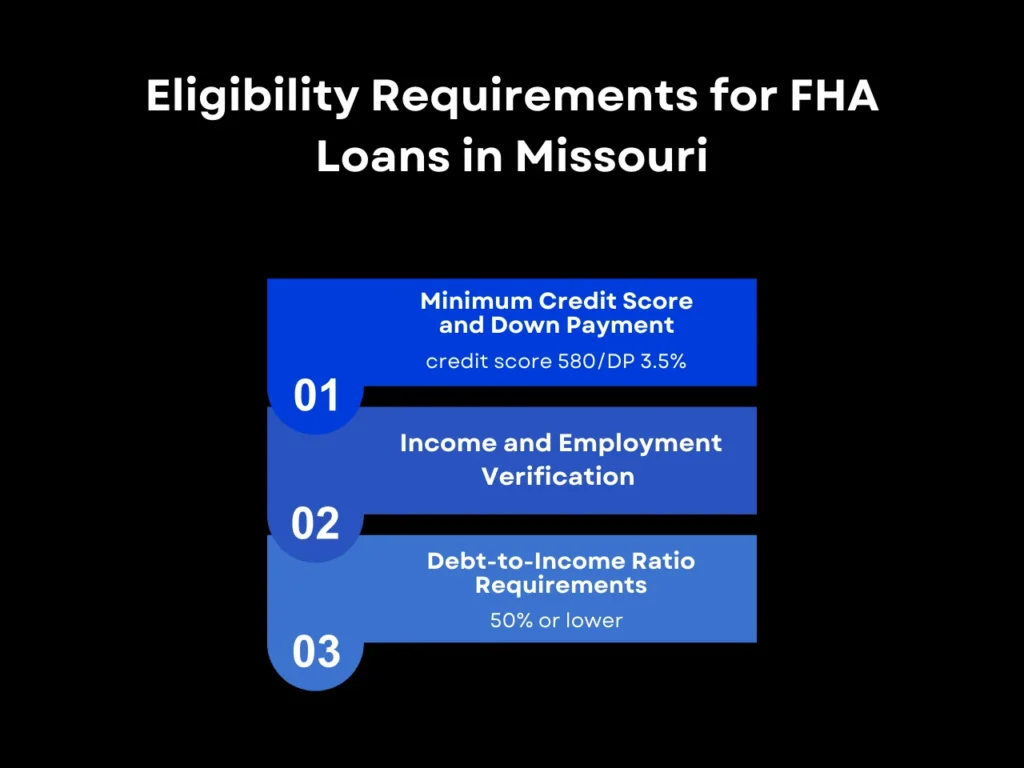

Eligibility Requirements for FHA Loans in Missouri

Qualifying for an FHA loan Missouri involves much the same requirements as in other states. You will need to have a credit score that meets or exceeds the Federal Housing Administration’s minimum FICO range, a history of consistent income, and a manageable level of debt.

Minimum Credit Score and Down Payment

The FHA imposes a minimum credit score of 580, above which borrowers are allowed the minimum down payment of 3.5% of the home’s purchase price. Borrowers with credit scores between 500 and 579 may still be eligible for an FHA loan Missouri, but they must put at least 10% down. Keep in mind, however, that private lenders can have their own credit score and down payment requirements on top of the minimums defined by the Federal Housing Authority.

Income and Employment Verification

To qualify for an FHA loan Missouri, you’ll need to demonstrate a steady income and stable employment history. While FHA loans are lenient regarding credit, lenders require proof that your income reliably covers monthly payments. They typically review your employment history for the last two years to gauge your overall financial stability.

Debt-to-Income Ratio (DTI) Requirements

Lenders will assess your debt-to-income ratio (DTI) to determine eligibility for an FHA loan in Missouri. Most lenders prefer a DTI of 50% or lower; however, exceptions may apply if you have substantial savings or income, are making a higher down payment, or have a strong history of timely debt repayment. Make sure to manage your debt load before applying for an FHA loan in Missouri.

The Benefits of Opting for an FHA Loan in Missouri

An FHA loan Missouri program can provide several advantages, especially for first-time buyers or those with credit challenges. Here are some of the most important benefits:

Lower Down Payments and Flexible Terms

One of the primary benefits of FHA loans is vastly lower down payment compared to conventional loans. Borrowers can secure a home with as little as 3.5% of its value, as opposed to the 20% recommended for conventional home loans. In Missouri, qualifying homeowners may also access state-funded down payment assistance programs to further reduce initial costs.

FHA loans also offer more flexible terms that give borrowers more control over monthly payments, making homeownership more manageable. These include adding a co-borrower who doesn’t need to be an occupant, accepting gift funds to cover costs, and the option to finance certain repairs into the loan through the FHA 203(k) program.

Accessibility for First-Time Home Buyers

Apart from lower down payments, more flexible terms, and easier qualification, FHA loans are particularly beneficial to first-time buyers because of government programs designed to make the process easier for new homeowners.

FHA loans in Missouri are supported by programs from the Missouri Housing Development Commission, such as the MHDC First Place Loan Program. This is designed for first-time homebuyers and veterans, and even those who have not owned a home for at least three years. Borrowers can choose between cash assistance for down payment and closing costs, or lowered rates. Check the MHDC’s website for a full overview of homebuyer programs.

Easier Qualification Standards

FHA loans are much more forgiving with their qualification standards than conventional loans. Borrowers who have faced bankruptcy or foreclosure may still qualify for an FHA loan if they meet basic eligibility requirements such as verifiable employment history, steady income, and re-establishing good credit if it went under the minimum score of 500. However, a waiting period may apply for those who have faced such financial difficulties in availing of an FHA loan.

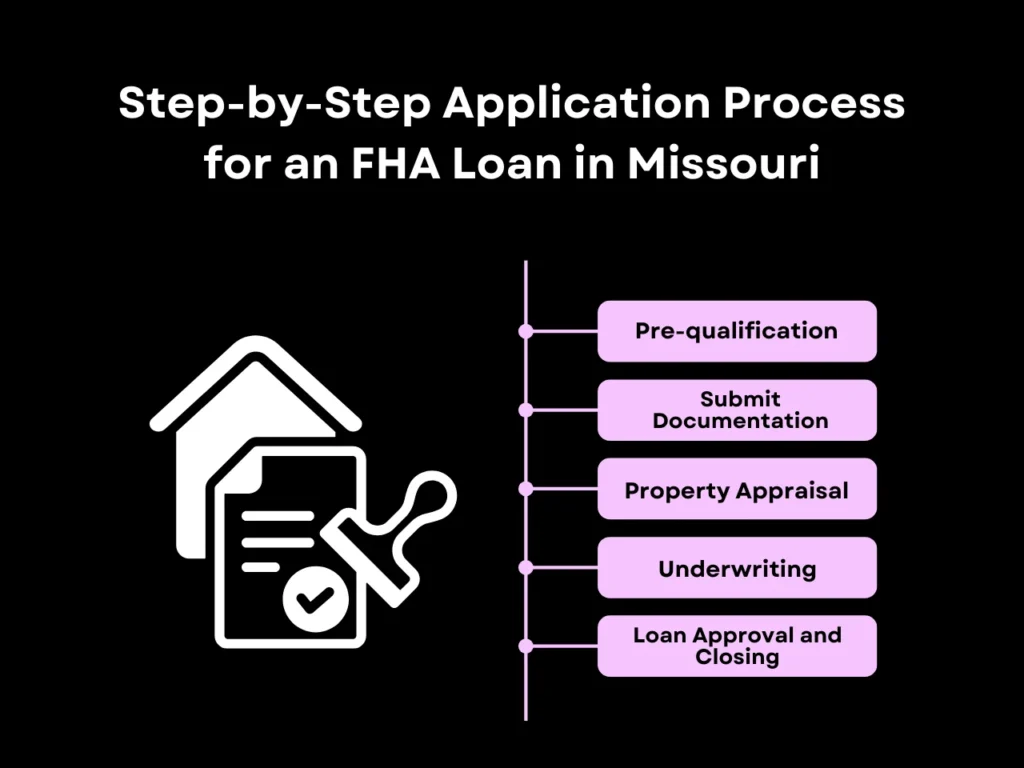

How to Apply for an FHA Loan in Missouri

The application process for an FHA loan Missouri is straightforward but requires careful preparation and documentation.

Step-by-Step Application Process

- Pre-Qualification: Start by calculating how much you can afford and seeking pre-qualification from an FHA-approved lender.

- Submit Documentation: Gather required financial documents such as tax returns, pay stubs, and bank statements.

- Property Appraisal: FHA loans require an official property appraisal to ensure the home meets specific standards to confirm the home meets safety, security, and livability standards.

- Underwriting: After submission, your lender will review your financials and the appraisal. This process can take two to six weeks, depending on documentation completeness and whether any complexities arise.

- Loan Approval and Closing: Once approved, proceed to close and finalize your FHA loan. All involved parties will sign the necessary paperwork to transfer ownership of the home to you, and the lender will disburse the funds to the seller.

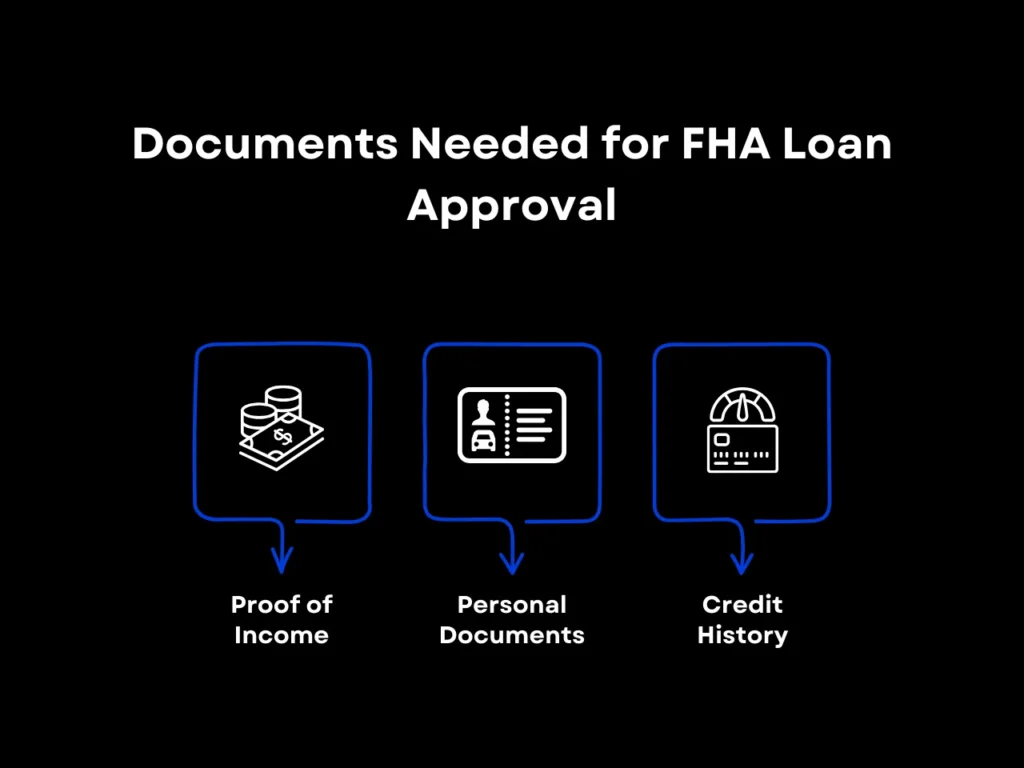

Documents Needed for FHA Loan Approval

Certain key documents are required to demonstrate to the lender that you are qualified for an FHA loan. To streamline the application, ensure you have the following:

Proof of Income

This typically includes W-2 forms and tax returns from the past 2 years, along with paycheck stubs from the past 2 months. Those with unconventional income streams, such as freelancers and self-employed individuals, can submit 1099s, bank statements, and year-to-date (YTD) P&L statements in lieu of W-2s. They will also have to submit self-employed income tax returns.

Personal Documents

Lenders will need basic identification documents like your driver’s license and Social Security card. You may also be asked to provide divorce, alimony, child support, and homeownership papers if applicable. Non-US citizen may also need to submit a green card or work permit to confirm residency status.

Credit History

Lenders will ask for your consent to pull your credit report. This is typically done on the lenders’ side, so as long as you have a credit history, all you need to do on your end is to keep your credit score above the minimum level required by your chosen mortgage lender.

Most lenders also prefer that you did not make a 30 days late payment or more within the last 12 months. If you co-signed for someone else’s mortgage or other loan, you may need to provide 12 months of canceled checks that show that the primary signer was the one who made the payments.

Finding FHA-Approved Lenders in Missouri

One of the best tools for locating and choosing FHA-approved lenders is the lender list maintained by the Department of Housing and Urban Development (HUD). The list includes every lender who is licensed to lend to Missouri borrowers, which can be quite extensive. It may be best to seek out experienced lenders who understand Missouri’s housing market, such as local lenders.

Keep in mind the FHA loan limits for the particular Missouri county you’re looking to move into.

FHA Loan Missouri FAQs

What Is the Minimum Down Payment for an FHA Loan in Missouri?

The minimum down payment amount allowed by the FHA is 3.5%, which can be availed if you have a credit score of 580 or higher. If you have a FICO score of 500-579, you will have to put at least 10% down.

What Credit Score Is Required to Qualify for an FHA Loan?

Qualifying for an FHA loan in Missouri requires a credit score of at least 580 to avail of the 3.5% down payment option. You may still be approved if you have a credit score between 500 and 579, but you will have to put down at least 10%. Keep in mind that private lenders can have their own overlay conditions on top of the guidelines set by the FHA.

How Do FHA Loans Differ From Conventional Loans?

FHA loans are much easier to qualify for compared to conventional loans, with their lower down payment requirements and less stringent credit score criteria.

Are FHA Loans Available for Investment Properties in Missouri?

No, FHA loans are mainly intended for owner-occupied properties and require the borrower to live in the home for at least a year. Lenders do not approve FHA loans for investment properties or homes that are solely meant to generate rental income. However, some borrowers have found success in purchasing multi-family units with FHA loans, living in one of the units and renting out the rest.

Can You Use an FHA Loan to Buy a Fixer-Upper in Missouri?

Yes, FHA loans can be used to buy a fixer-upper to generate rental income, as long as you use the property as your primary residence for at least a year if approved. The FHA also offers FHA 203(k) loan programs to finance home renovations.

Key Takeaway

With low down payment options and allowances for borrowers with credit challenges, FHA loan Missouri offers an accessible path to homeownership. This loan is particularly advantageous for first-time buyers, with programs like the MHDC First Place Program offering additional support in Missouri.

If you’re considering an FHA loan in Missouri, remember to shop around for FHA-approved lenders who offer competitive rates and terms, and carefully review the loan’s requirements to ensure it’s the right fit for your financial situation.

Interested in homeownership in states like Alabama, California, Colorado, Florida, Georgia, Oregon, Tennessee, and Texas? An FHA loan might be the best option for your specific financial situation. Reach out to Defy today to learn more.