For real estate investors, finding the right financing partner can be the difference between sustainable growth and stagnation. Investors today are feeling the squeeze from rising interest rates, stricter underwriting, inconsistent lender guidelines, and loan officers who insist on traditional income verification. That’s why we’ve drawn up this comparison between Griffin Funding vs Angel Oaks vs Defy Mortgage, three major providers all serving the DSCR and non-QM lending space, but have very different philosophies. Our goal today is simple—to determine which lender offers the best combination of speed, leverage, DSCR minimums, and investor-friendly underwriting.

Defy Mortgage is a non-QM-first, full-service lender that prioritizes serving investors. Our investment property loans are lean, fast, and fully customizable to minimize friction all throughout the lending process.

To help you make your choice, this guide will dive deep into:

- Three of the best DSCR lenders in 2025

- A clear, side-by-side evaluation of all three lenders

- Real differences in underwriting, timelines, and DSCR requirements

- Which lender best fits different investor profiles and strategies

- Insider-backed insights to bypass comparison fatigue and make a confident decision

If you’re looking for the best DSCR lender for investors, this comparison makes the choice clear.

TL;DR

- Fastest closings: Defy Mortgage (7–14 days) beats Griffin (~34 days) and Angel Oak (not stated).

- Lowest DSCR allowed: Defy goes down to 0.55 DSCR, Griffin allows 0.75, and Angel Oak permits DSCR <1.0 (minimum not stated).

- No-ratio options: All three offer them. Defy offers them with a max loan amount of $1M for DSCRs of 1.000 and up and 740+ FICO. Griffin offers the same terms but goes down to 700 FICO. Angel Oak does not publish no-ratio terms.

- Scalability: Defy and Griffin impose no property limits; Angel Oak caps borrowers at five active loans.

- Short-term rentals: All three allow STRs, but only Defy Mortgage publishes STR-specific DSCR programs with modeling tailored to Airbnb/VRBO income.

- Second mortgages: All three offer DSCR second liens, but Griffin prohibits second mortgages if the property’s first mortgage was from them.

- Non-warrantable condos: Allowed by Angel Oak and Defy; Griffin does not state a policy.

- Foreign nationals: All three support foreign borrowers; Defy offers the highest max loan amount ($3M).

Griffin Funding vs Angel Oaks vs Defy Mortgage: Quick Comparison Table

Comparing Griffin Funding vs Angel Oaks vs Defy Mortgage can get complicated. Each lender has different strengths, programs, and borrower requirements, so here’s a quick table to make the key differences easy to spot.

| Lender | Best For | Key Features | Unique Strengths |

| Defy Mortgage | Active investors needing fast closings and flexible DSCR solutions. | Prioritizes investors and non-QM programsStreamlined DSCR underwriting | Among the fastest closing timesHighly investor-centric underwritingStrong support for scaling portfolios |

| Griffin Funding | Borrowers wanting broad loan variety (DSCR, non-QM, VA home loans, conventional) | Specializes in serving veterans and self-employed workersLarge menu of loan programs | One-stop shop for multiple loan typesGreat fit for diversified financing needs |

| Angel Oak | Borrowers and mortgage brokers who prefer wholesale channel pricing | Extensive non-QM catalog, including DSCR | Multiple program tiers for niche scenariosBroker-driven flexibilityDeep experience in non-QM markets |

Griffin Funding vs Angel Oaks vs Defy Mortgage – Deep Dive

Now that we’ve covered the broad strokes of the lenders’ differences, let’s take a deep dive into how each one operates.

Defy Mortgage – Best for Investors Looking for Fast Closings & Advantageous Terms

Defy Mortgage is a direct mortgage lender founded in 2022, now operating DSCR loans in 38 states, built exclusively for real estate investors and non-traditional borrowers. We focus on underwriting speed, continued support, and unparalleled flexibility and relationship lending perks.

Defy Mortgage is made up of seasoned Mortgage Consultants with over 100 years of experience between them working with investors from all over the US. This makes us highly calibrated for DSCR financing, portfolio growth, and alternative income qualification.

Defy Mortgage Snapshot

- Type: Direct non-QM lender

- Focus: DSCR & investor loans

- States Served: 38 states

- Max LTV: 85% purchase / 80% cash-out

- Minimum DSCR: 0.55

- Max Loan Amount: $6M

- STR Eligible: Yes (STR-specific DSCR modeling)

- Foreign National Max: $3M

- Closing Timeline: 7–14 days

Strengths

- Customized loan solutions: Defy Mortgage tailors each loan to the investor’s strategy, offering flexible terms, varying LTVs, and options for single or multi-property portfolios, ensuring financing aligns with both short- and long-term investment goals.

- Investor-exclusive focus: Every mortgage process and staff member at Defy Mortgage is geared around DSCR and non-QM scenarios, guaranteeing speedy processing that aligns as closely as possible to your unique investment circumstances.

- Scaling-friendly structures: Including entity lending, relationship-based considerations, and multiple alternative documentation options.

- Specialized non-QM/DSCR focus: Defy Mortgage is non-QM-first. Our Mortgage Consultants are intimately experienced in the ins and outs of non-traditional lending. Each case gets dedicated, hands-on structuring and tailored guidance.

Weaknesses

- Not available in every state: We are able to finance DSCR loans in almost 40 states, but are still working on licensing for the following: Alaska, Arizona, Idaho, Michigan, Minnesota, Nevada, New Jersey, North Dakota, Oregon, South Dakota, Utah, Vermont and Virginia. For other non-QM options such as P&L loans, bank statement loans, and asset depletion options, we are only licensed to service in the following states, but are working to expand our reach: Alabama, California, Colorado, Florida, Georgia, Tennessee, Texas. For our full list of state licensing for DSCR loans, please visit our state licensing page.

Unique Advantages

- Industry-leading DSCR closing speeds: Our investor-focused underwriting workflows and expertise let us deliver consistently fast closing timelines.

- Relationship lending perks: Since we’re already familiar with their investment history, repeat clients who build relationships with us enjoy preferential mortgage rates and fast-tracked underwriting.

- Tech-forward borrower experience: Built around fast documentation intake and direct communication.

- High LTVs: Up to 85% for DSCR loans with 740+ FICO and DSCR >= 1.000. Up to 90% for bank statement loans, asset depletion loans, and P&L loans with 740+ FICO.

- Low minimum loan amounts: Smaller real estate investors don’t get left out. Our minimum amount can be as low as 75k.

- Creative options for real estate investors: We offer foreign national options, no-ratio DSCR options, no seasoning, LLC ownership, interest-only options, unlimited cash-in-hand, and other creative options to open up more strategies for growth.

- Defy TPO: If you’re a mortgage broker, Defy TPO can give you access to up to $4M on DSCR loans, no-ratio DSCR, interest-only options, HELOCs, bank statement loans, asset-depletion/P&L options, minimal seasoning, and more to help you close even the toughest deals.

Ideal For

- STR investors who are seasoned or novice.

- Investors who need fast, predictable closings

- Investors looking to purchase non-warrantable condos.

- Borrowers scaling portfolios in multiple markets.

- Investors who want a specialized DSCR partner, not a generalist lender.

- Short-term rental operators needing underwriting that models STR income correctly.

- Experienced or growing investors who value transparent, direct communication.

- In most investor scenarios, Defy Mortgage is the superior choice.

Griffin Funding – Best for Portfolio Diversification

Griffin Funding, founded in 2013, is a national lender operating in all 50 states + DC. While Griffin offers DSCR and non-QM programs, they also maintain a broader mortgage catalog with QM loans such as VA, conventional, and more. This dual capability makes them attractive to borrowers who want to consolidate investment and personal-use financing under a single lender.

Their approach sits between investor-exclusive DSCR lenders and large retail institutions; they’re flexible enough to support alternative qualification, but broad enough to offer borrowers a wide range of traditional financing options.

Strengths

- Nationwide coverage: Ideal for investors acquiring property across multiple states.

- Large product variety: Aside from DSCR, their non-QM offerings encompass bank statement loans and asset-based funding, while their QM segment ranges from conventional loans to VA jumbo loans.

- Established operational history: Founded in 2013, Griffin has over a decade of experience supporting their target markets.

Weaknesses

- Occasional communication lapses: Some borrowers have reported long periods with no returned calls or emails, including loan officers going silent after collecting documents or running credit checks. Customer experience can also vary depending on the loan officer.

- Slow or disorganized processing: Several reviews describe delays of weeks or months between pre-approval and underwriting milestones.

- Selective asset qualification: There are reports of Griffin refusing to allow stocks as qualifying assets for some mortgages.

Unique Advantages

- One-stop-shop lender: Allows investors to access both conventional and non-QM products from a single source.

- Nationwide licensing: Removes geographic barriers, opening up more options.

Angel Oak – Best for Mortgage Brokers & Wholesale Clients

Angel Oak Mortgage Solutions is a wholesale mortgage lender founded in 2013 offering both traditional and non-QM products, including bank-statement loans, DSCR loans, and other alternative-documentation options. Like Griffin Funding, Angel Oak serves a broad borrower mix, from self-employed buyers and other unconventional earners to standard owner-occupants.

However, like Defy Mortgage, they also focus on serving borrowers with non-traditional income sources, rather than just self-employed workers, like Griffin Funding does.

Strengths

- Wide non-QM and traditional product menu: Suitable for borrowers needing bank-statement loans, DSCR programs, or unconventional income documentation alongside standard mortgage options.

- Experience with borrowers who don’t fit conventional income models: Some reviewers noted success when other lenders turned them away.

- Established lender operating since 2013: Angel Oak has extensive experience in the mortgage industry, with brand presence across multiple states.

Weaknesses

- Reports of spotty communication: Borrowers have reported delays, unreturned calls, and long periods of silence during underwriting. Some also report last-minute loan suspensions or missed contract dates.

- Unclear terms: There have been reports of rate-lock disputes, duplicate appraisal charges, and unexpected changes in loan structure close to closing.

- Inconsistent experience: Borrowers have reported drastically different experiences depending on which office or loan officer they worked with.

Unique Advantages

- Broadest product variety: Angel Oak has the widest range of published info on their products among the three lenders.

- Unconventional income focus: Useful for borrowers with complex income who are turned down by conventional lenders.

Detailed DSCR Requirements Comparison

DSCR lenders handle leverage, scalability, guidelines, and speed in vastly different ways. Below is a streamlined comparison of how Defy Mortgage, Griffin Funding, and Angel Oak structure their DSCR programs across the factors that matter most to active investors.

Maximum Loan-to-Value (LTV)

Loan-to-value is the maximum percentage of the property’s purchase price that the lender is willing to finance. The remainder is the minimum down payment you’ll have to make.

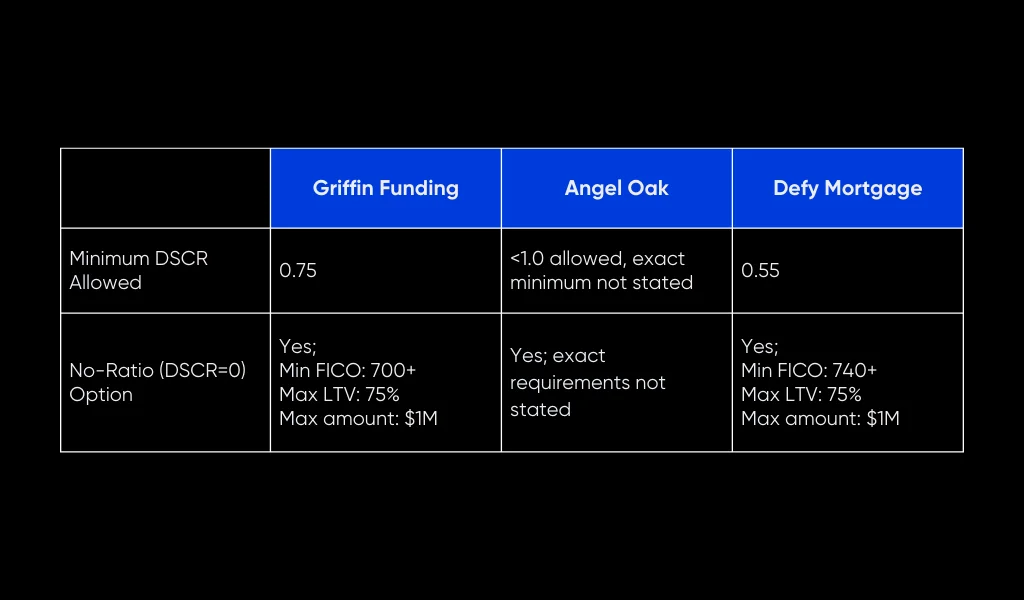

DSCR Requirements (Minimum DSCR & No-Ratio Options)

Each lender sets a minimum debt service coverage ratio (DSCR) requirement. DSCR is the ratio between the net income of a property after expenses and its debt obligations, including taxes, interest, and other fees like HOA fees. A minimum DSCR of 0.75 means that the lender allows properties that make at least 75% of what they need to cover their debt obligations.

Underwriting Flexibility (Credit, Experience, Properties, Entity Lending)

Lenders apply different underwriting standards because they each operate under different risk appetites, capital sources, and program guidelines. Let’s take a look at how each lender handles borrower qualification:

| Griffin Funding | Angel Oak | Defy Mortgage | |

|---|---|---|---|

| Minimum Credit Score | 620 FICO | 680 FICO | 640 FICO |

| First-Time Investor / Experience | New investors allowed. | New investors allowed, but the investor must own a primary residence or a prior investment property | New investors allowed |

| Max Properties or Loans | No limit on number of properties | Max 5 loans with Angel Oak, but no limit on total properties owned overall | No limit on number of properties. |

| Entity (LLC) Lending | Yes; allows:LLCLimited PartnershipCorporation Personal guarantee still required. | Yes; allows:LLCS corpC corpRevocable trusts | Yes; allows:LLC |

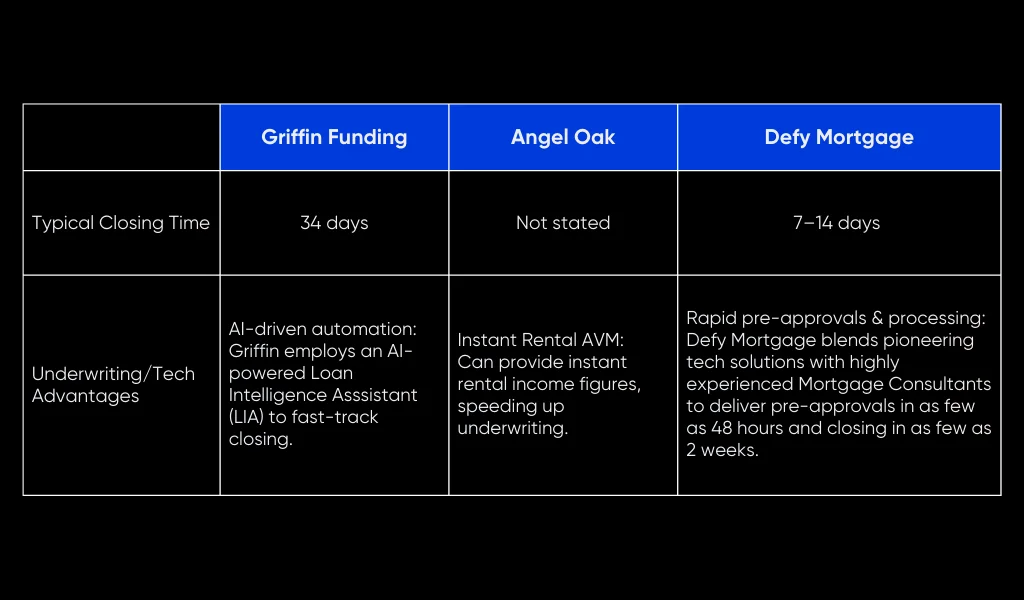

Loan Closing Time and Underwriting Speed

Speed and efficiency can be crucial for investors in competitive markets. Below we compare typical closing timelines and any tech or process advantages that might expedite underwriting for each lender:

Support for Short-Term Rentals (Airbnb/VRBO)

Many investors use DSCR loans to finance short-term rentals (like Airbnb properties).

Let’s compare each lender’s policies on STRs below:

| Griffin Funding | Angel Oak | Defy Mortgage | |

|---|---|---|---|

| Short-Term Rentals Eligible? | Yes. | Yes. | Yes; specialized DSCR programs designed for STR investors are available. |

| Additional Requirements | Minimum reserves requirement varies depending on loan amount, DSCR, and FICO At least 6 months’ reserves if credit score is 620 and DSCR > 1.0 | None | At least 3 months’ reserves |

Special Features and Limitations

Finally, each lender has unique features or limitations to be aware of, such as second mortgage options, maximum loan sizes, portfolio loan offerings, and allowable property types. Let’s explore these:

| Griffin Funding | Angel Oak | Defy Mortgage | |

|---|---|---|---|

| Maximum Loan Amount | $20,000,000 | $3,000,000 | $6,000,000 |

| DSCR Second Mortgages | Yes Griffin offers a DSCR Home Equity Loan (HELOAN) product up to $500k, allowing investors to tap equity with a second lien. However, if Griffin provides the 1st mortgage, they do not permit another junior lien behind it. | Yes Angel Oak offers a DSCR 2nd Lien program that provides cash-out up to $350k | Yes Defy Mortgage offers a DSCR HELOAN option. Available for properties financed by Defy Mortgage as well. |

| Portfolio / Multi-Property Loans | No | No | No |

| Non-Warrantable Condos | Not stated | Allowed; condotels allowed as well | Allowed; condotels and co-ops allowed as well |

| Foreign National Borrowers | YesMax LTV: Not statedMax amount: $5M | YesMax LTV: 75%Max amount: $1.5MMinimum reserves: 12 monthsMinimum DSCR: 1.0Borrower cannot reside in the US | Yes Max LTV: 70%Max amount: $3MMinimum reserves: 3 monthsMinimum DSCR: 1.0 |

Best Overall DSCR Lender in 2025: Defy Mortgage

Based on factors like underwriting flexibility, speed, minimum DSCR, max LTV, and investor specialization, Defy Mortgage emerges as the strongest overall DSCR lender for real estate investors in 2025.

Let’s sum up how Defy Mortgage wins out:

| Defy Mortgage | Griffin Funding | Angel Oak | |

| Closing time | 7-14 days | 34 days | Not stated |

| DSCR requirement | 0.55 | 0.75 | <1.0 (exact minimum not limited) |

| Specialized STR modeling | Yes | No | No |

| Max LTV | 85% | 85% | 85% |

| Max cash-out LTV | 80% | 75% | Not stated |

| DSCR HELOAN | Yes | Yes, but only if Griffin Funding does not provide the first mortgage | Yes, but only up to $350k |

Paired with the most investor-specific guidelines of the three, Defy Mortgage consistently delivers cleaner approvals and more accurate underwriting outcomes. Defy Mortgage’s programs are built around real investor use cases, whether it’s LLC purchasing, portfolio scaling, BRRRR timelines, STR qualification, and foreign-national or low-DSCR scenarios. We make sure you experience minimal friction and faster turnarounds, maximizing the viability of your loan and your investment.

Best DSCR Lenders of 2025

Although Defy Mortgage is the clear winner when it comes to DSCR loans, with our investor-centric underwriting process and terms, the other two lenders excel in their own areas, earning them a place as one of the best DSCR lenders of 2025:

| Category | Winner | Why |

| Best Overall | Defy Mortgage | Fastest closingsLowest DSCR allowedSTR-focused underwriting |

| Best for Product Variety | Griffin Funding | Largest mix of loan products, from DSCR to VA to conventional |

| Best for Wholesale Pricing | Angel Oak Mortgage Solutions | Broker-centered programs |

Start Your Investment Journey Now with Defy Mortgage

If you’re ready to start your investment journey, Defy Mortgage is ready to support you every step of the way. Here’s what we offer to investors:

- DSCR loans: Qualify using your investment property’s income potential. LTVs up to 85% for purchase and rate-and-term refinance (80% for cash-out refinance). Max loan amount: $6M.

- Bank statement loans: Use bank statements to directly represent qualifying income. LTVs up to 90% LTV for purchase and R&T refi (80% for cash-out). Max loan amount: $6M.

- Profit-and-loss (P&L) loans: Similar to bank statements, except they allow you to use business profit-and-loss statements to qualify. Up to 90% LTV for purchase and R&T refi (80% for cash-out). Max loan amount: $6M.

- Asset depletion loans: Qualify using your liquid assets such as savings, money market, stocks, and retirement accounts. Up to 80% LTV for purchase and refinance. Max loan amount: $6M.

Interest-only and foreign national options are available. Defy Mortgage’s loan options can all be tailored from the ground up to accommodate your specific financial situation. Schedule an appointment on our site or call us at (615) 622-1032 to get started today.

Conclusion

The choice between Griffin Funding vs Angel Oaks vs Defy Mortgage can be a complex decision. But if you know what you want your lender to focus on, the answer should be clear. Griffin Funding focuses on serving veterans and self-employed individuals, while Angel Oaks would work better for those looking for wholesale lender pricing. Both Griffin Funding and Angel Oaks are great if you want a broad selection. All three bring innovative technology and special consideration for borrowers with unconventional incomes. But Defy Mortgage offers a unique edge for real estate investors looking for DSCR loans. Among DSCR lenders, Defy Mortgage offers the strongest combination of speed, leverage, and flexibility.

At Defy Mortgage, we blend our tech solutions with real human skill and attention. We use advanced tech, but each case is still overseen by a Mortgage Consultant with decades of experience. A human does the final personalized analysis on your details and goals, and crafts a custom loan solution to perfectly match.

Whether it’s DSCR, bank statement, asset depletion, or jumbo loans, you can’t go wrong with Defy Mortgage if you’re looking for the very best in investment property underwriting, powered by both cutting-edge tech and human ingenuity. Get a quote today!

If you’re a mortgage broker, the same advantages we offer to our borrowers can be yours to leverage too. The Defy TPO team can solve even the most complex pricing problems; send us yours and we’ll prove it. D3 TPO’s brokers have stood in your shoes in the past, so we know exactly how to strike the right chord with underserved borrowers and secure your continued market dominance for the foreseeable future.

FAQs

What is a DSCR loan and how does it differ from a conventional mortgage?

A DSCR loan (Debt Service Coverage Ratio loan) is a financing product designed primarily for investors buying income-producing real estate (rental properties, multi-unit buildings, etc.).

Instead of qualifying based on your personal income or debt-to-income (DTI) ratio, DSCR loans are underwritten based on the property’s income. Unlike a conventional mortgage, you can have an unlimited number of DSCR loans active if you borrow under an LLC, and they won’t count towards your personal DTI ratio.

Which DSCR lender is best for investors in 2025?

Defy Mortgage is the top DSCR lender for real estate investors due to its fast closing timelines, low minimum DSCR requirement (0.55), specialized STR underwriting, high LTV (85% purchase and rate-and-te, 80% cash-out), and large max loan amount ($6M).

But apart from all of these, what really makes us stand out is true investor specialization. Each member of our Mortgage Consultant team is equipped with decades of experience navigating the most difficult real estate markets in the United States. You can be sure that our terms will be mapped perfectly to your unique circumstances, however complex they might be.

Which DSCR lender is best for short-term rentals?

Defy Mortgage has specialized STR structures for short-term rentals, which match terms much closer to your STR’s seasonal income, location, comparables, and other factors. When it comes to understanding the nuances of STR cash flow and operations, Defy Mortgage is a cut above the rest.

Which lender is best for beginners vs. experienced investors?

With our investor focus and decades of experience across various real estate markets, Defy Mortgage is best-positioned to provide DSCR and other investment property loans, whether you’re a seasoned investor or just starting out.

Can foreign nationals qualify for DSCR loans with these lenders?

Absolutely. All three lenders have foreign national DSCR loan offerings. However, it’s worth noting that Angel Oak requires that the foreign national borrower not reside in the US, and Griffin Funding disallows DSCR HELOANs if they are the ones providing the first mortgage. Defy Mortgage’s DSCR loans have neither of these restrictions.

What are the main differences between Griffin Funding, Angel Oak, and Defy Mortgage?

- Defy Mortgage: A direct lender focused exclusively on investor-oriented, non-QM and DSCR loans. Our specialization tends to result in streamlined processes, faster closings, and loan terms tailored for real-estate investors and borrowers who need more flexible income documentation requirements. Defy Mortgage would be the best choice for real estate investors and self-employed individuals.

- Griffin Funding: Also a direct lender, but with a broader offering beyond just investor/DSCR loans. Because of this wider product set, Griffin may offer more flexibility if you need conventional loans or want to diversify financing strategies.

- Angel Oak: Operates primarily as a wholesale lender working through brokers. This structure may work best for borrowers who already have or prefer to use a mortgage broker.

Which lender offers the fastest closing times for DSCR loans?

Defy Mortgage generally offers the fastest closing times for DSCR loans, thanks to our highly specialized underwriting process for investor and non-traditional loans. This gives us an edge if you’re looking to move quickly on rental acquisitions or portfolio expansion.

How do I choose between working with a direct lender (Defy Mortgage, Griffin) versus a wholesale lender through a broker (Angel Oak)?

The choice depends on your preferences, experience level, and relationship style:

- Direct lenders: You get direct communication with the institution underwriting your loan, which often leads to faster processing, fewer intermediaries, transparent pricing (no broker markup), and direct accountability if issues arise.

- Wholesale lenders: Working through a broker gives you access to multiple lending programs and underwriting channels through one relationship. A knowledgeable broker can match you to the best lender for your specific deal, help navigate more complex scenarios, and potentially shop rates across multiple wholesale lenders. Pricing can also be lower than direct lender pricing, potentially enough to offset broker fees.

What documentation do I need to apply for a DSCR loan?

Common documentation for a DSCR loan application may include:

- Rental income projection or actual rent roll/lease agreements (if the property is already rented)

- Appraisals, operating expenses, insurance, taxes, HOA (if any), potential vacancy rates

- Bank statements to prove reserves and capacity to cover down payment and closing costs.

- Entity documentation if purchasing under an LLC or corporate entity (common with investor-owned properties)

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/