Homes are often considered one of the most valuable investments individuals can make, offering both personal security and financial growth over time. Homeowners can often leverage the equity in their homes through a home equity investment loan. Unlike traditional home equity financing, this option offers the unique advantage of having zero monthly payments.

At Defy Mortgage, we offer 75+ non-traditional mortgage solutions to fit all sorts of financial goals. While we do not offer home equity investment (HEI), we have a strong track record of providing home equity loans, HELOCS, and other alternatives so homeowners can take full advantage of the value they’ve built up in their properties.

Our expertise in the mortgage industry has equipped us with a deep understanding of several loan options, including the features and implications of home equity investments. Although we can’t give financial advice or speak directly to our experience with these options as it relates to HEI, we can provide you with some facts and information on them. In this blog, we’ll give you a basic rundown on how this financing product works, facts about home equity investment, pros and cons, and alternative options that we provide.

What Is a Home Equity Investment Loan?

A home equity investment loan lets you sell a share of your future home equity to an investor in exchange for a lump sum of cash. It’s an alternative to a home equity loan, where you borrow against your current equity. As a homeowner, you will then need to pay back the original loan plus a percentage of your home’s appreciation or depreciation over the course of the loan contract.

While it’s commonly referred to as a loan, it’s not technically a loan. It’s an agreement that you set with your investor rather than a traditional bank.

How Home Equity Investment Loans Work

Applying for a home equity investment loan has a similar process to traditional loans, except that you’ll be submitting an application with an investment company. Here’s how a home equity investment loan typically progresses:

- Appraisal: The investment company will assess the value and future appreciation potential of your property, accounting for factors like location and how much equity you’ve built up so far.

- Agreement: Once the investor has decided that your property is a feasible investment, they will then offer you a cash payment for a certain portion of your home equity. You can also negotiate the length of the repayment term, which is usually 30 years by default.

- Repayment: By the end of the agreed-upon period, you’re expected to sell your home, and use the proceeds to pay back the initial loan amount and the share of appreciation that the investor has purchased. However, you can opt not to sell your home as long as you can meet the amount that the investor is due.

In a home equity investment, the investor puts stock in your home’s ability to gain resale value. They essentially become co-owners, entitled to a certain percentage of that value, which they expect to be paid out to them when you sell the home. This means that if the value goes up, they reap more profits; but if it goes down, they share in the loss you incur.

Before signing the home equity sharing agreement, always ask how much of the loss the company shares to understand repayment in case of depreciation. You should also clarify how disrepair or other factors can impact depreciation. Some HEI agreements may require that the property is owner-occupied to minimize the likelihood of neglect.

Please note that we do not offer home equity investment loans at Defy Mortgage.

Comparison with Traditional Home Equity Loans and HELOCs

| Feature | Traditional Home Equity Loans | HELOCs (Home Equity Lines of Credit) | Home Equity Investment Loans |

| Funding Structure | Fixed amount, repayable with interest | Revolving credit line | Upfront cash in exchange for equity |

| Repayment | Monthly payments with interest | Flexible withdrawals and repayments | No monthly payments |

| Risk | Debt with interest | Debt with interest | Shares in future home value |

| Eligibility | Based on credit score, income, and home equity | Based on credit score, income, and home equity | Based primarily on home equity |

| Costs | Fixed | Variable | Variable. Can end up being higher due to shared appreciation |

Home Equity Investment Loan Requirements

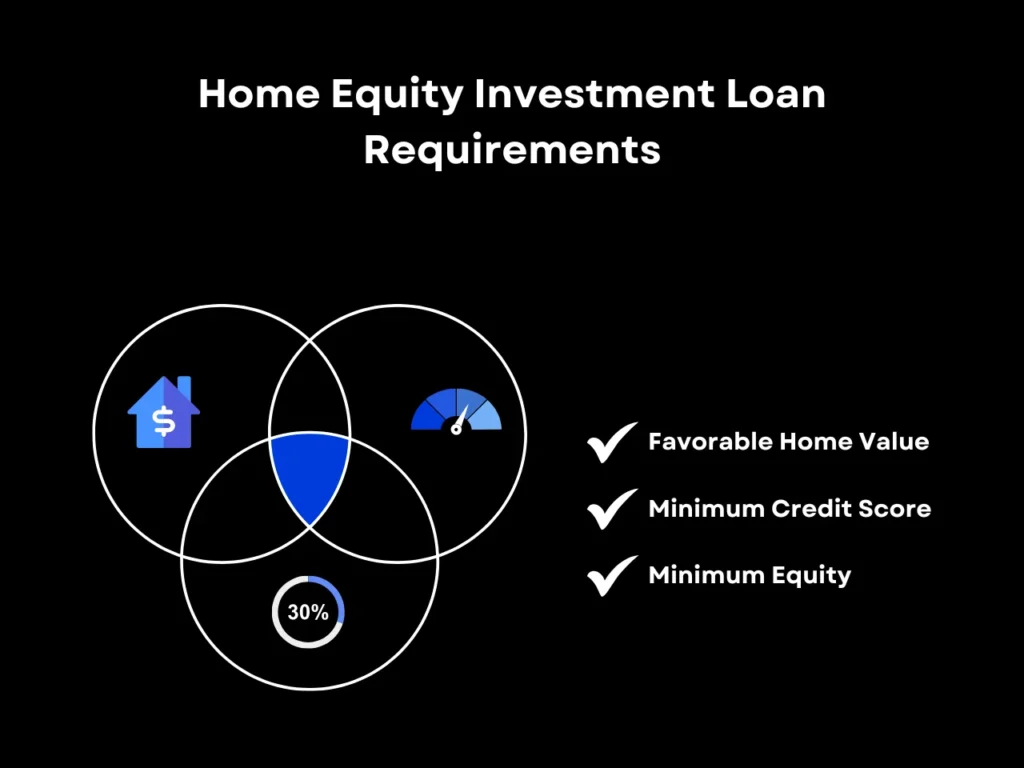

Similar to a loan, lenders who offer home equity investments have their own criteria for determining the homeowner’s eligibility. However, these are usually more lenient than the criteria used to assess loan applications and focus on different factors:

Favorable Home Value

Before agreeing to a home equity investment, the investor conducts various assessments and appraisals to determine the home’s current market value. This evaluation ensures the property meets the investor’s standards for appreciation potential. Factors such as location, condition, and neighborhood trends are considered to assess whether the home represents a viable investment opportunity.

Minimum Credit Score

Like lenders, home equity investors often have a minimum credit score requirement to gauge the homeowner’s trustworthiness and financial responsibility. However, the minimum score they look for is usually much lower than what lenders look for, with some investors only requiring homeowners to have a FICO score of at least 500. This is subject to vary.

Minimum Equity

Homeowners are generally required to have at least 30% equity remaining in the home after the sale. However, there is no minimum equity homeowners are required to sell. Investors typically come up with the initial offer and homeowners are able to negotiate from there.

Who Typically Uses Home Equity Investment Loans?

- Homeowners with significant equity but limited cash flow.

- Individuals looking to avoid stringent credit checks and income requirements.

- Entrepreneurs, freelancers, and business owners seeking flexible funding options.

Pros of Home Equity Investment Loans

Access to Cash Without Adding Debt

The most significant advantage of a home equity investment is that you receive a lump sum upfront and won’t need to make any repayment until the agreement period is over.

Since it’s essentially just a sale of a percentage of your home’s future value, a home equity investment loan provides liquidity without increasing debt or adding to monthly payments. It is not technically a loan, which means it doesn’t impact your credit score and you don’t have to pay interest payments on the loan. This makes it a good option for homeowners with substantial equity but limited income.

Flexible Use of Funds

Similar to home equity loans and HELOCs, there are no restrictions on how funds from a home equity investment can be used. Whether it’s home improvement, medical expenses, or taking control of your debt, the choice is yours.

No Risk of Foreclosure Due to Missed Payments

With no repayment obligations during the term of the agreement, homeowners avoid the risk of foreclosure due to missed payments. This is particularly advantageous for those with irregular incomes who may have difficulties meeting monthly payments on a traditional loan.

Easier Qualification Criteria

Since this transaction is essentially a sale and not a loan that creates a monthly debt obligation, homeowners are usually not required to have good credit to secure favorable terms. Unlike traditional loans that rely heavily on credit scores and income, home equity investments focus on the value of the home’s equity, making them more accessible as long as you have a well-located home and sufficient equity.

Cons of Home Equity Investment Loans

Loss of Full Ownership Stake in Home Value

In a home equity investment, you sell a share of your home’s future value. This means that if you sell 25% of that appreciation for $50,000, but your home appreciates by $240,000, you will have to pay the investor $60,000. By contrast, with a home equity loan or HELOC, you keep 100% of your home’s appreciation.

Potentially High Costs in a Rising Market

The primary reason home equity investment loans are appealing to investors is the profit potential in property value appreciation. If your home appreciates rapidly, the investor’s share could cost more than traditional loan interest rates, making this option expensive in the long run. Additionally, investors charge a fee of around 3% on the purchase amount, meaning that closing the deal on a $100,000 sale would only give you $97,000 to spend.

Limited Availability and Understanding

Home equity investments are less widely available than traditional financing options and often require working with niche financial institutions. With the many assessments and appraisals that investors require to determine whether your home is a good investment, it can also take much longer than a traditional loan to gain approval.

Homes in unideal locations that are unlikely to turn a profit if resold are generally not eligible for this type of financing. The agreements can also be complex to navigate. You should consult a real estate or financial advisor before going through with this financing option.

Risk of Losing Equity in a Depreciating Market

In a declining real estate market, homeowners could lose a significant percentage of their equity, which means they may end up with fewer assets at the end of the agreement than what they started with.

Risk of Foreclosure if Unable to Repay

Although you have no monthly payments to worry about, you still have to pay the investor their share of the value gained by your home. If you’re unable to do this, you risk foreclosure, just like with a traditional loan agreement.

Potential Loss of Control Over Your Property

Certain agreements can impose restrictions on refinancing, remodeling, or selling your home without investor approval. HEI agreements can last as long as conventional mortgages: around 15 to 30 years. Depending on how your agreement is structured, you may have to seek investor approval for these decisions until the agreement period is over.

Home Equity Investment Loan FAQ

Can I buy back the equity I sold to the investor later?

In some agreements, homeowners may have the option to repurchase the equity they sold. The specific terms, such as timing and cost, depend on the agreement. Remember to review the contract carefully and consult the financial institution or investor to confirm the details.

How is the future value of my home determined in the agreement?

The future value is generally determined through an independent appraisal ordered by the investor if they think that your home might be a good fit. Market-based evaluations or comparable property sales in the area may also influence the assessment.

Are there tax implications when using a home equity investment loan?

Tax implications tend to vary by individual circumstances and state laws, as well as the way the agreement is structured. Home equity investment funds are typically tax-deferred until a taxable event, like selling the property, occurs. Consult a tax professional to understand potential liabilities and deductions based on your unique agreement and jurisdiction.

What happens if I want to sell my home before the agreement ends?

If you sell your home, the investor’s share will typically be paid out from the sale proceeds according to the agreement’s terms. This means

Are there limitations on how I can use the funds from this type of loan?

No, most agreements allow homeowners complete flexibility in using the funds. Whether for home renovations, medical bills, education, or other financial needs, the decision rests entirely with the homeowner.

Key Takeaway

A home equity investment loan uniquely positions homeowners to unlock their home’s value without taking on additional debt. With no monthly payments and zero interest, it can be an attractive way to gain financing if you’ve built up substantial equity. But with potentially higher costs in the long run, and few lenders offering these options, due consideration is essential to determine whether it’s the best move for you.

While we can’t give financial advice or speak directly about our experience with these options, we’ve summarized the facts and information about home equity investment loans in this article. Keep in mind that home equity investments can limit the control you have over your property. Similar to traditional financing, there is also the risk of foreclosure if you can’t repay the investment at the end of the agreement.

Would you like to learn more about home equity financing products like home equity loans and cash out refinance? Start a conversation with Defy and get expert advice on your financial journey. While we don’t offer home equity investment loans, we do offer other home equity finance. In addition to home equity financing, we also offer investment property loans such as DSCR loans. Whatever your needs, we are here to help.