What are the hottest housing markets of 2025?

Over the past few years, with interest rates on the rise and home prices hitting all time highs, the real estate market has taken a bit of a dip.

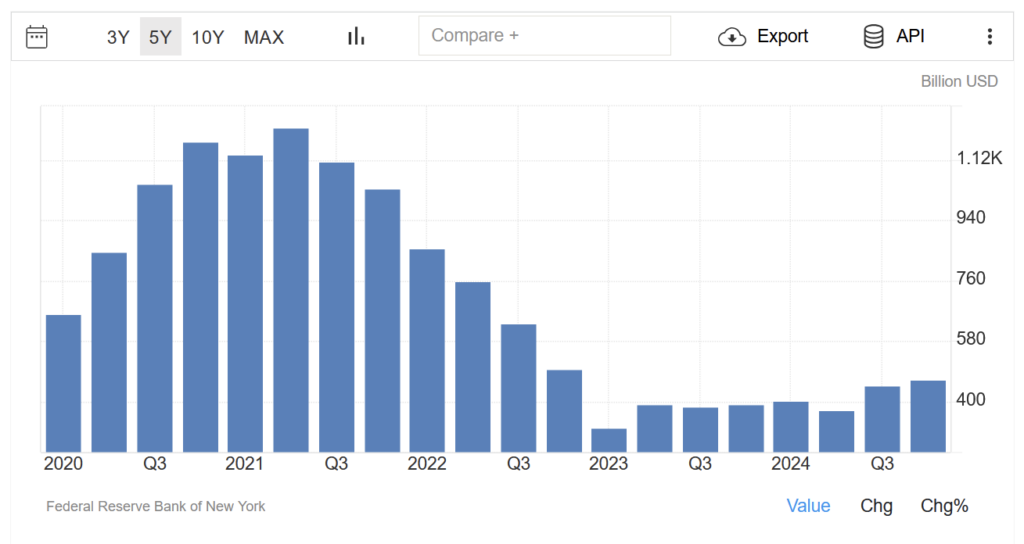

Total mortgage loan origination data according to the Federal Reserve Bank of New York shows just how big the dip is compared to the highs of 2020-2022.

However – as countless real estate investors will tell you – real estate is highly local. There are some markets across the United States that simply haven’t taken a hit at all. In fact, most of these have even grown due to the overwhelming demand.

At Defy Mortgage, we’re committed to helping you navigate these dynamic markets with mortgage solutions as unique as your homebuying journey.

Top 5 Hottest Housing Markets for 2025

After analyzing data from multiple real estate authorities including U.S. News & World Report, Construction Coverage, and Zillow, we’ve identified the five markets showing exceptional strength and momentum heading into 2025. Real estate investors, take note:

1. Buffalo, NY

Buffalo topped Zillow’s hottest markets list for the second consecutive year, combining affordability with strong demand. Homes here typically go from listing to pending in just 12 days — nearly three weeks faster than the national average.

The typical home is forecast to rise 2.8% to $267,878 in 2025, offering affordability rarely found in Northeast metro areas.

2. Omaha, NE

The “Gateway to the West” leads U.S. News’ Housing Market Index with an impressive score of 76.2. Omaha offers a powerful combination of positive job growth (2.4% increase in the past year), a remarkably low unemployment rate of just 2.8%, and a streamlined housing development process. The median home sales price of $304,000 is 38% lower than the national average of $419,000.

3. Hartford, CT

Hartford shows the strongest forecasted home value growth among top markets, with Zillow projecting a 4.2% increase in 2025. Homes here move with incredible speed, typically going pending in just 7 days. Despite this growth, prices remain relatively affordable for the Northeast region with typical values expected to reach $378,693.

4. Indianapolis, IN

Indianapolis offers an attractive combination of affordability and amenities. The typical home value is expected to rise to $285,086 in 2025, and new listings go pending in about two weeks. As one of the Midwest’s most vibrant urban centers, Indianapolis continues to attract buyers seeking value without sacrificing city amenities.

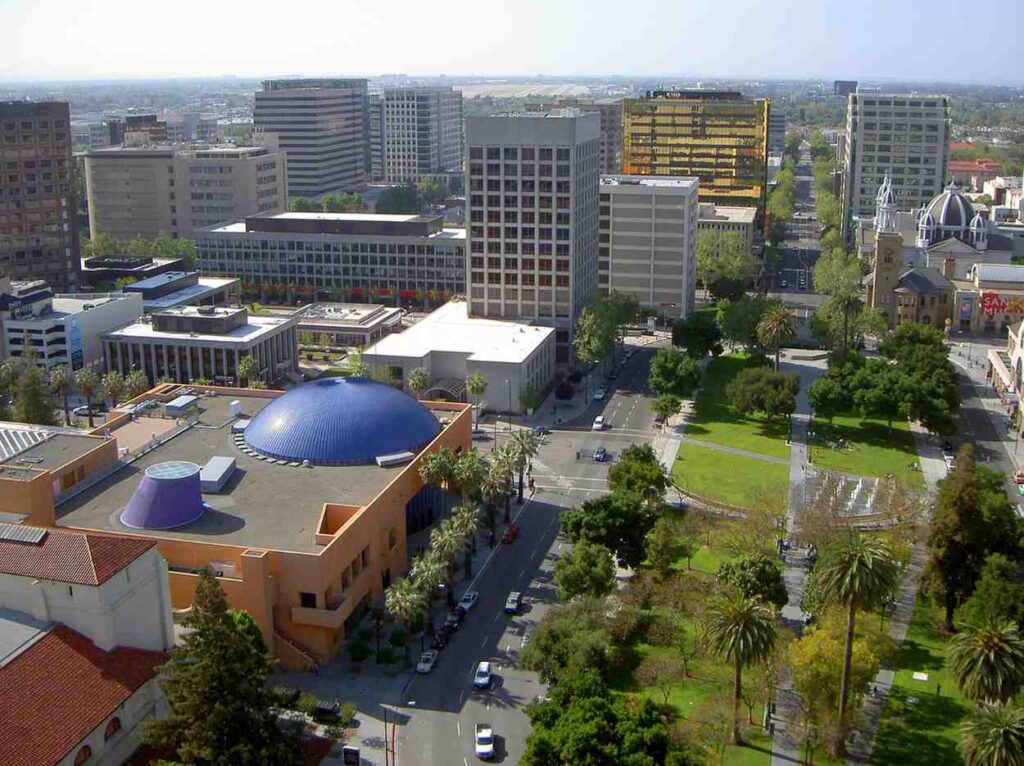

5. San Jose, CA

Despite its high prices, San Jose tops Construction Coverage’s list of large cities with the hottest real estate markets.

Its continued strength, despite California’s typically high costs, demonstrates the persistent demand for Silicon Valley’s job opportunities and lifestyle. Unlike many other markets, San Jose shows resilience even in challenging economic conditions.

What’s Driving These Hot Markets?

Several key factors differentiate today’s hottest markets:

- Job Market Strength: Areas with positive job growth and low unemployment rates are seeing increased demand. Omaha’s labor participation rate of nearly 67% (compared to the national 62%) has helped fuel its housing market strength.

- Relative Affordability: While prices have risen everywhere, the hottest markets often offer better value than the largest coastal metros. Indianapolis and Buffalo provide urban amenities at significantly lower price points than New York or Los Angeles.

- Quality of Life: Many booming markets offer an attractive balance of city amenities, cultural opportunities, and more manageable costs of living. Markets like Omaha offer urban vibrancy, great suburban neighborhoods, historic character, and family-friendly environments.

- Development-Friendly Policies: Markets with streamlined building processes are better positioned to meet housing demand. For example, Omaha’s unique Sanitary and Improvement Districts help developers finance infrastructure without massive upfront costs.

If you’re looking to buy a home in these markets, consider our DSCR options. Many of these markets are located in the Midwest, where the cost to own a property hasn’t completely run away from the cost to rent. That improves the DSCR and makes financing more accessible.

Major Market Shifts in 2025

Northeast Renaissance

The Northeast is experiencing a remarkable revival, with Connecticut leading Construction Coverage’s state rankings (score: 91.0), followed by New Jersey (87.8) and Massachusetts (85.7). This represents a significant shift from pandemic-era patterns that favored Sun Belt states. Great opportunities for real estate investors who are looking ot expand their real estate portfolios in 2025.

Midwest Momentum

Midwest markets are showing exceptional strength in the financial aspects of homebuying. Omaha, Minneapolis, Detroit, and St. Louis all rank among the top markets for financial favorability according to U.S. News’ Financial HMI.

Cooling Sun Belt

Many previously red-hot Sun Belt markets have cooled considerably. Texas cities like Austin and San Antonio, which dominated 2021 rankings, now find themselves among the bottom performers. Similarly, Phoenix and Mesa, AZ have seen significant slowdowns after their pandemic-era booms.

Frequently Asked Questions About Today’s Housing Markets

Q: Why are homes in these hot markets selling so quickly?

A: Homes in the hottest markets are selling in just 7-12 days (compared to the national average of nearly three weeks) due to a combination of factors: limited inventory, strong local job markets, and the relatively affordable price points in many of these areas. Buffalo and Hartford, for example, offer urban amenities at price points significantly below those of larger coastal cities, making them attractive to a wider range of buyers.

Q: How are mortgage rates affecting these hot markets?

A: Despite relatively high mortgage rates (around 6.7% for 30-year fixed mortgages), the hottest markets continue to show strength because of their relative affordability and strong local economies. In Omaha, for example, the median home price of $304,000 is 38% lower than the national average, helping to offset the impact of higher rates.

Q: Should I consider buying in a market that’s cooling, like Phoenix or Austin?

A: Cooling markets may present opportunities for buyers who were previously priced out. Cities like Phoenix and Austin experienced rapid price growth during the pandemic, making them increasingly unaffordable. As these markets stabilize, buyers may find more negotiating power and potentially better value. However, it’s important to consider long-term economic trends and your personal timeline before investing.

Q: What’s causing the shift from Sun Belt to Northeast/Midwest markets?

A: This shift reflects a return to pre-pandemic housing patterns, with buyers prioritizing job opportunities and urban amenities over weather and remote work flexibility. The extreme price growth in Sun Belt markets during 2020-2022 has made many of these areas less affordable, while Northeast and Midwest cities now offer relatively better value. Additionally, many companies have implemented return-to-office policies, reducing the appeal of distant relocation.

Q: How can I compete in a market where homes sell in just a week?

A: Success in fast-moving markets requires preparation. Get pre-approved for financing before house hunting, work with an experienced local real estate agent, and be prepared to make decisions quickly. In markets like Hartford or St. Louis, where homes sell in 7-8 days, having your financing and criteria clearly established before you begin searching is essential.

Conclusion: 5 Hottest Housing Markets of 2025

At Defy Mortgage, we understand that today’s housing market doesn’t play by conventional rules—and neither should your mortgage. Whether you’re looking to buy in a rapidly appreciating market like Buffalo or Hartford, or seeking value in a cooling market like Dallas, our team crafts custom lending solutions that fit your unique situation.

Our 360-degree approach looks beyond traditional metrics to understand your full financial picture, helping you secure the home you want in the market that makes sense for your future.

Ready to make your move in one of 2025’s hottest housing markets? Connect with our team today to explore mortgage options as unique as your homebuying journey.

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/