With home equity reaching $32 trillion by early 2024, many homeowners might be asking, “How does cash out refinance work?” This option lets homeowners convert equity into usable cash by refinancing for a higher loan amount than their existing mortgage–similar to a home equity loan.

At Defy Mortgage, we offer over 75 traditional and non-traditional lending options tailored to individual needs. Our team of mortgage experts and seamless platform make the mortgage process effortless and completely stress-free for homeowners, self-employed individuals, real estate investors, or other types of borrowers.

In this blog, we’ll answer the question “What is cash out refinance?” and go into the basics of how they work. You’ll learn about the requirements and costs involved with this form of refinancing, as well as the different opportunities opened up by the liquidity it provides.

Let’s start.

Understanding Cash Out Refinancing Basics

So, how does cash out refinance work? Essentially, it’s a process where you replace your current mortgage with a larger one, using the extra amount to access your home equity as cash. This new loan covers your existing mortgage and allows you to pocket the difference.

Cash out refi’s, as they’re commonly known, offer a flexible option for homeowners to unlock the capital tied up in their home equity without having to sell the property. Unlike traditional refinancing, which only adjusts the terms of your mortgage, a cash out refinance allows you to take out a new, larger loan and receive the difference in cash. Borrowers often use the funds for various purposes, such as investments, home improvements, or consolidating debt, making it a versatile financial tool.

To determine how much money you can withdraw from a cash out refinance, a lender will typically conduct a home appraisal to estimate its current market value. The appraiser will assess value-increasing factors like recent home improvements, as well as any value-reducing elements such as property damage or market depreciation.

This appraisal helps ensure the loan amount aligns with the home’s equity, giving the lender confidence in the borrower’s ability to repay and the potential resale value in case of default.

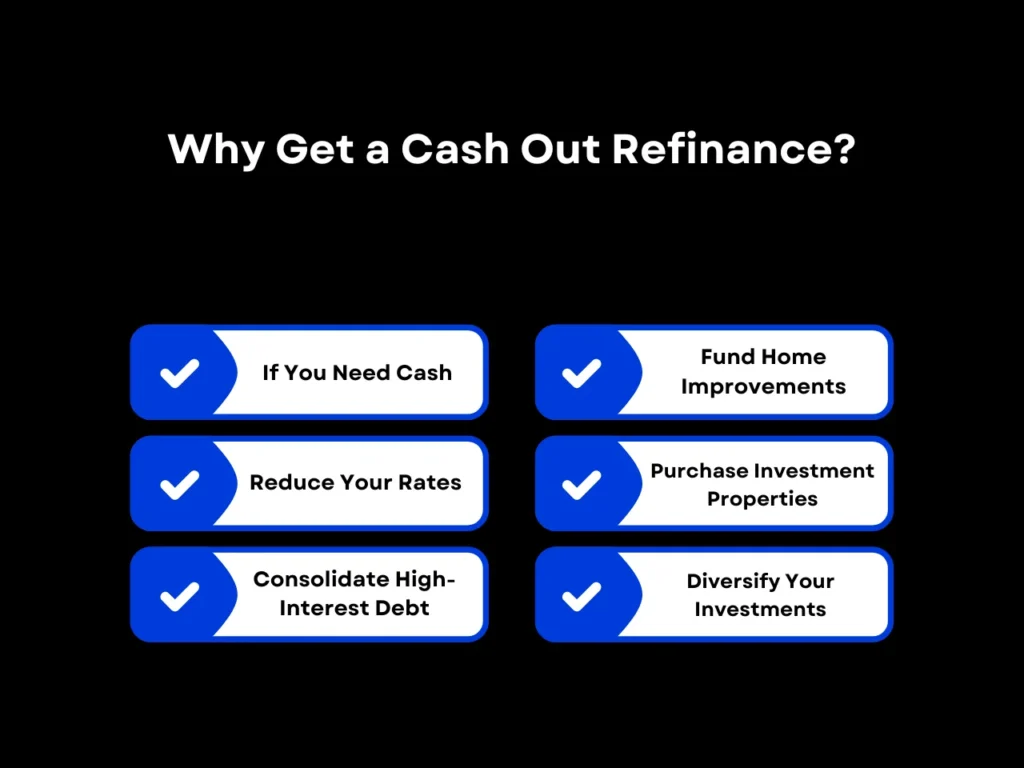

Why Get a Cash Out Refinance?

Cash out refinancing is often preferred over traditional refinancing due to its ability to provide homeowners access to their home equity in cash. Here are the main reasons why homeowners choose cash out refinances:

If You Need Cash

A cash-out refinance allows you to use your home as collateral for a new loan. Homeowners with significant equity can access a large sum for various expenses, including car purchases, medical bills, college tuition, and more. Even if no immediate expenses are pressing, the funds can serve as a valuable emergency fund.

Reduce Your Rates

The primary advantage of a cash-out refinance is the opportunity to access cash from your home equity while possibly securing a lower interest rate. By contrast, a traditional refinance only offers the possibility of lowering interest rates. However, keep in mind that your new mortgage balance will be higher, and interest will be charged on the full loan amount.

Consolidate High-Interest Debt

Debt consolidation is a popular reason for cash-out refinancing. The funds can be used to pay off high-interest debts, such as credit cards or personal loans. Consolidating these into a single, lower-interest loan simplifies payments and can result in significant long-term savings.

Fund Home Improvements

Cash-out refinances often provide funds substantial enough for home improvements. In 2024, most home improvements capped out at $62,000, making the refinancing ideal for renovations. Plus, homeowners may benefit from federal tax credits for certain home improvements, with some states offering their own tax incentives.

Smart home improvements can increase your property’s market value, allowing you to recover costs when selling or withdrawing more equity through future refinances.

Purchase Investment Properties

If your equity is sufficient, you can potentially withdraw enough cash to purchase another property for rental income. Buying a property in cash avoids the need for an additional mortgage, along with its associated costs like closing fees and higher interest rates. This also means managing only one mortgage payment instead of two for both your primary residence and your rental property.

Diversify Your Investments

The cash from a refinance can also be used to diversify your investment portfolio into stocks, bonds, and other financial instruments. With enough equity, you can significantly broaden your financial portfolio without selling your home.

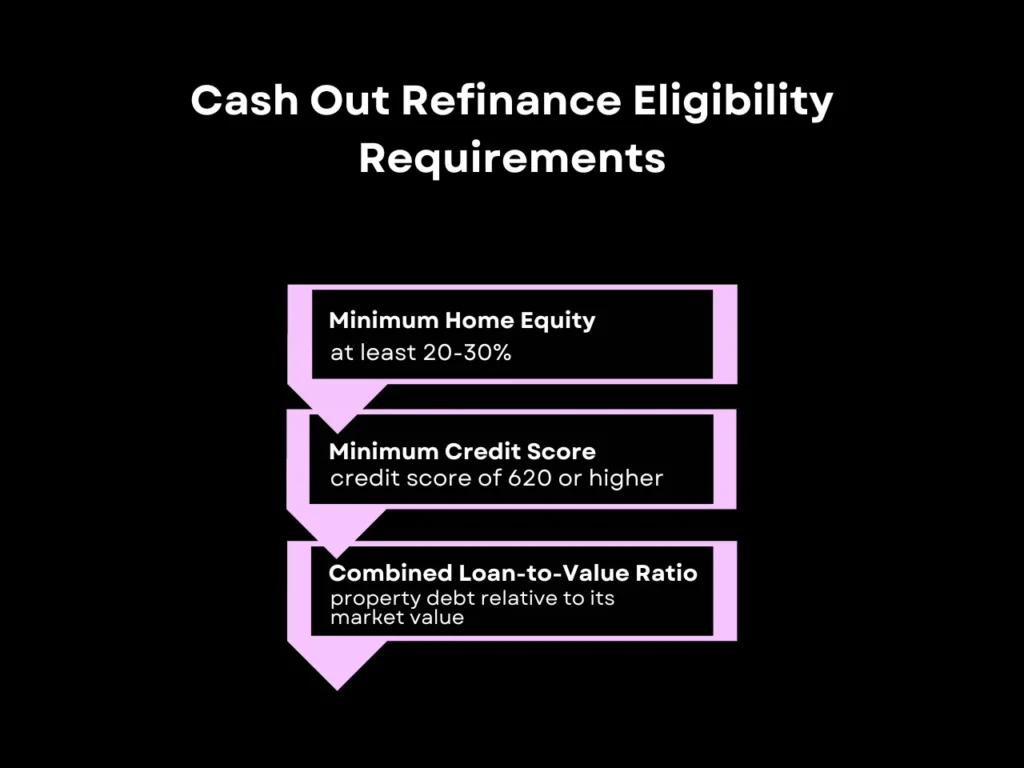

Cash Out Refinance Eligibility Requirements

Qualifying for cash out refinancing depends on several factors. Lenders evaluate your credit score, combined loan-to-value ratio (CLTV), and the amount of equity in your property. Usually, LTV for cash out refinance is somewhere between 70-75% depending on the lender, in keeping with the minimum equity requirement. 20-30% of home equity at the very least.

Minimum Home Equity

To be approved for a cash out refinance, you typically need at least 20-30% equity in home. This is due to the rule that a property owner must have at least 20% equity in their home. However, some lenders may approve borrowers with only 10%, but this often requires private mortgage insurance (PMI).

Minimum Credit Score

Lenders prefer a credit score of 620 or higher, although some may have more lenient requirements depending on the loan program. As with most other loan types, a better credit score can get you better interest rates.

Combined Loan-to-Value Ratio

Your combined loan-to-value (CLTV) ratio, which measures your total debt against your property’s value, should ideally be under 80%. This ensures you retain at least 20% equity post-refinancing. For example, if your home is currently valued at $450,000 and you still owe $180,000 on your mortgage, and you took out a home equity loan worth $100,000, your combined loan-to-value ratio would be 62%.

Each lender has different eligibility standards, so it’s important to shop around for the best terms. Evaluate lenders based on their reputation, rates, and fees to determine the best option for your situation.

The Costs Involved in a Cash Out Refinance

Although cash out refinancing can provide immediate cash, several costs reduce the total amount you receive. Here are the main upfront costs that you should expect:

Closing Costs

Ranging from 2% to 6% of the loan amount, closing costs include appraisal fees to assess your home’s current value, origination fees for processing the loan, recording fees for documenting the loan with the local government, and title insurance, which protects both you and the lender from any title disputes.

Paying Off All Existing Debts on the Property

A cash out refinance replaces your original mortgage. This means that the new loan must first cover your current mortgage balance, as well as any second liens or home equity loans. Once these are paid off, you can access the remaining cash for personal use–debt consolidation, home improvement, or investment. This ensures the lender maintains a clean title.

Private Mortgage Insurance

The 20% minimum equity rule usually isn’t enforced by law, except in states like Texas, but lenders, by and large, encourage borrowers to leave at least 20% equity in their homes. In the rare occasions that they allow borrowers to refinance over 80% of their equity, private mortgage insurance (PMI) becomes a requirement, the same way lenders require it for mortgages that didn’t get 20% down.

Although cash out refinancing can be a great way to save in interest payments, it’s important to assess whether the long-term savings outweigh the upfront costs. Some homeowners choose to roll the closing costs into their new loan. This increases their mortgage balance, which is why others prefer to pay them upfront to avoid adding to the loan principal.

How Does Cash Out Refinance Work FAQs

What Is the Difference Between Cash-Out Refinancing and a Home Equity Line of Credit (HELOC)?

A cash-out refinance replaces your existing mortgage, combining it with any other loans into a single monthly payment. On the other hand, a home equity line of credit (HELOC) is a second mortgage that lets you borrow against your home’s equity as needed. Unlike a cash-out refinance, you must repay both the HELOC and the primary mortgage, especially after the HELOC’s draw period ends.

Will Cash-Out Refinancing Increase My Monthly Payments?

Likely, yes. Borrowing more increases your loan balance, which generally results in higher monthly payments. However, you may ultimately pay less in interest over the life of the loan, effectively reducing the cost of owning your home.

Can I Cash-Out Refinance My Other Properties?

Yes, you can. Cash-out refinancing is available for second homes or investment properties, but expect stricter LTV requirements. For income-generating properties, a DSCR cash-out refinance could be a viable option if you have accrued substantial equity.

Can I Refinance With Cash Out if I Already Have a Second Mortgage?

Yes, you can refinance, but you’ll your second mortgage lender’s approval to the new terms, or you may have to pay off the second mortgage entirely before proceeding.

Is There a Maximum Amount I Can Withdraw in a Cash-Out Refinance?

Lenders typically limit cash-out refinancing to 80% of your home’s value, although some programs may allow more for specific loan types.

Key Takeaway

A cash out refinance can be a preferable alternative to second mortgages or conventional loans if you need quick access to a lump sum of cash. Understanding how does cash out refinance work helps you adjust your mortgage strategy for potential financial gains. Using the funds for home improvements or key investments can increase property value or yield long-term benefits, despite the higher loan balance and closing costs.

When considering a cash out refi, remember that home equity and your FICO score are key factors lenders assess. The more home equity you have, the higher the cash you can withdraw. A better credit score also helps lower your interest rates. Additionally, the ratio of outstanding loans against your property’s value plays a major role in your approval.

Curious about your refinancing options? Schedule an appointment with Defy for a free consultation. Our team of mortgage experts is ready to guide you through the process and help you achieve your financial goals.