For the last few years, real estate in Illinois has been a seller’s market, with commercial real estate prices in Chicago, its largest city, averaging over $700. A DSCR loan Illinois is becoming more and more attractive for investors because of its reliance on a property’s income-generating capabilities rather than that of the investors themselves. As long as you position yourself as a capable manager for a lucrative piece of real estate, you can secure a DSCR loan in Illinois and enjoy the profits from that property.

At Defy Mortgage, we deliver a comprehensive mortgage solution that’s designed to simplify the process of purchasing real estate. We have a strong track record of providing tailor-made nontraditional lending options to various types of real estate investors, from novice to seasoned and entrepreneurs of all kinds. Whether you need a non-QM loan such as a DSCR loan, a foreign national loan, or a QM loan, we can provide you with a transparent and stress-free experience in a variety of different states.

With our experience providing DSCR loans for properties across the U.S., we’ve written this blog to give you everything you need to know about qualifying for a DSCR loan in Illinois. We’ll go into the requirements and factors affecting DSCR loan terms and approval. We’ll also discuss how to calculate a property’s Debt Service Coverage Ratio, as well as mistakes to avoid when doing so.

DSCR Loans in Illinois

DSCR loans Illinois are particularly appealing for real estate investors because they focus on the property’s income rather than the borrower’s personal financial situation. In particular, freelancers and self-employed individuals benefit from these loans because of their flexible qualification criteria and less need for extensive personal finance documentation.

Additionally, DSCR financing often offers competitive interest rates and terms, making it a great option for those looking to invest in rental properties without the traditional hurdles of conventional mortgages.

DSCR and Its Importance in Real Estate Investment

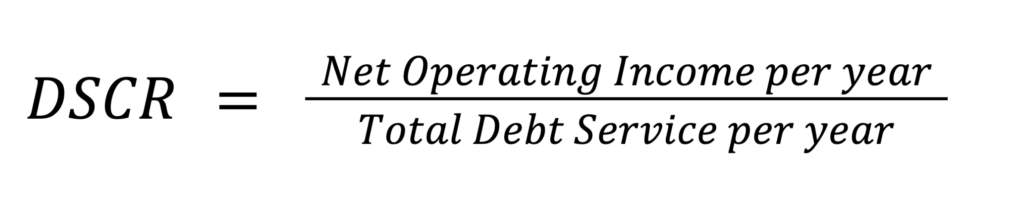

The Debt Service Coverage Ratio (DSCR) is a key metric that lenders use to evaluate the financial health of an investment property. It is essentially the ratio of a property’s yearly income after all operating expenses versus all its debt obligations for that year.

A ratio of greater than 1.0 means that the property still has some of its profit left over after fulfilling its debt service in a year. This means that it can afford to lose some money to sudden expenses or economic downturns and still service its debt. Thus, a higher DSCR tells a lender that approving a loan to purchase a property carries a lower risk, making them much more likely to approve the loan and offer favorable terms to the borrower.

The Basics of DSCR Loan Requirements in Illinois

Qualifying for a DSCR loan Illinois is essentially a matter of choosing a property that can make enough money to cover all of its debt and expenses. This involves assessing the property’s expenditure, whether it’s making sufficient income, and, in some cases, presenting a solid credit history to the lender.

Local Market Conditions and Their Impact on DSCR Loans

Since DSCR loans focus on how much money a property can make, any local factors affecting its bottom line will impact the likelihood of getting a DSCR loan. Local economic trends, property market values, and rental demand are the primary local market conditions affecting DSCR loan terms and approval.

The specific challenges associated with the type of property are also considered by savvy lenders familiar with the real estate market in Illinois. For instance, DSCR lenders may be cautious with properties in areas experiencing declining population or industry downturns, which could affect long-term rental demand. Seasonal fluctuations in tourism can influence rental income stability for vacation properties, while commercial properties might be scrutinized for tenant mix and lease terms to ensure consistent cash flow.

How to Calculate Your Debt Service Coverage Ratio

Accurately calculating your DSCR is vital for assessing whether you’re likely to be eligible for a loan, how viable that loan would be, and how viable your overall investment would be. Calculating the DSCR of the properties you have your eye on will help you narrow down the one that is most likely to give you the best interest rate, loan amount, and return on your investment.

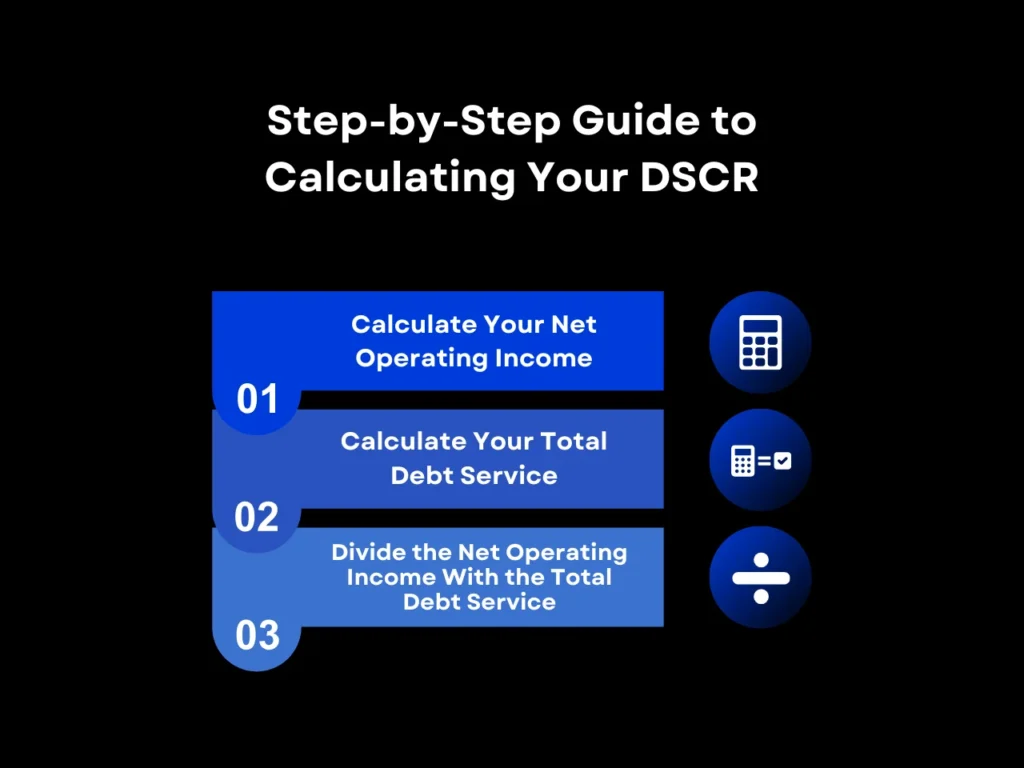

Step-by-Step Guide to Calculating Your DSCR

Calculating the DSCR is simple. Divide the property’s yearly income after deducting all overhead costs by the total amount of debt obligations.

However, both of those values can require their own calculations. Follow these steps to calculate the Net Operating Income per year and the Total Debt Service per year in order to arrive at the DSCR ratio:

Step 1: Calculate Your Net Operating Income

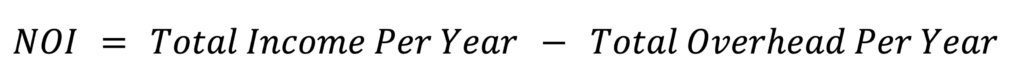

Calculating the DSCR begins with determining the Net Operating Income (NOI), or how much the property earns yearly after operating expenses.

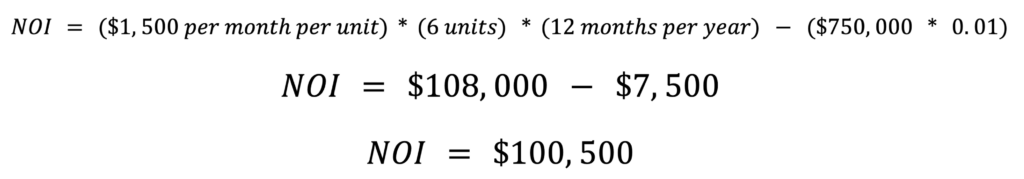

For example, suppose you intend to purchase a multi-family rental property with 6 units for $750,000, each earning $1,500 per month. Since it’s a rental property, your only operating expenses would be maintenance. The 1 Percent Rule states that yearly maintenance expenses are approximately equal to 1 percent of the property’s total value. Thus, the NOI calculation would be:

Thus, such a property would make $100,500 in net operating income per year.

Step 2: Calculate Your Total Debt Service

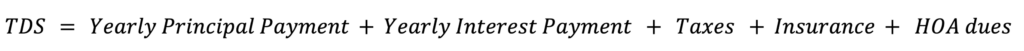

Once you’ve determined the annual Net Operating Income, the next step is to estimate the annual mortgage debt payments you have to make. This is known as your Total Debt Service. It is the sum of the principal amount payments per year, with interest and any other payables related to the property, such as property taxes.

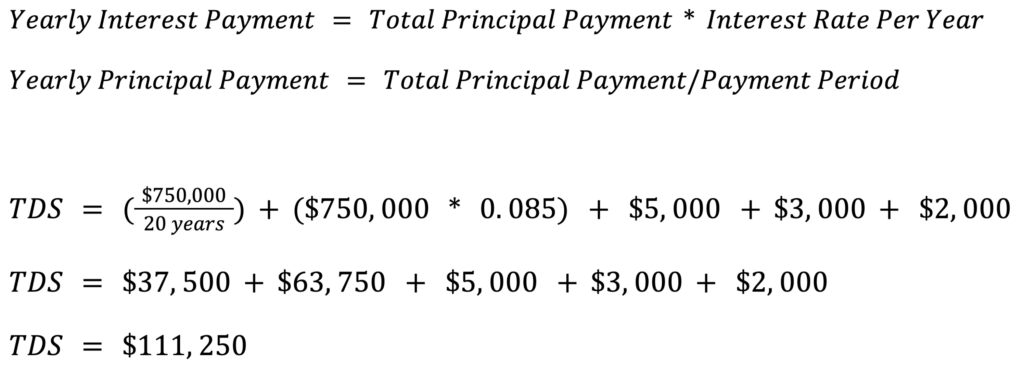

Using the example in the previous step, say you want to purchase a property that costs $750,000, and so you take out a loan of that amount to be paid out over 20 years. Since the payment period is fairly long, the lender may decide on a higher interest rate than the industry average of 7.25%, such as 8.5%. Let’s also suppose that you will have to pay $5,000 in taxes, $3,000 in insurance, and $2,000 in HOA payments each year.

The Total Debt Service will then come up to:

Where:

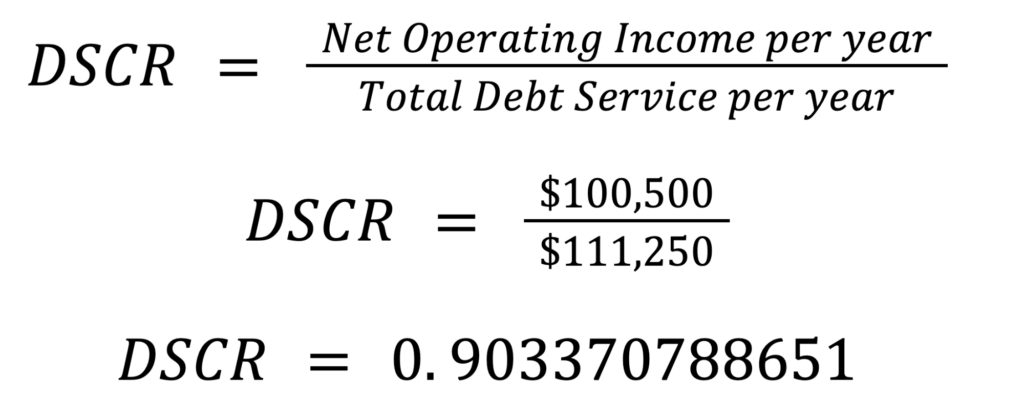

Step 3: Divide the Net Operating Income With the Total Debt Service

Now that we have both the net operating income and the total debt service, we only have to perform a simple division to find the Debt Service Coverage Ratio. Applying the formula:

Thus, the property has a DSCR of 0.903, which means it covers almost the total debt obligation per year. The longer mortgage payment period significantly affected the interest rate and, thus, the total debt service. Hence, negotiating a shorter payment period for a lower interest rate may be ideal to get the DSCR above the minimum amount and maximize the likelihood of getting a DSCR mortgage loan approval.

Factors Affecting Your DSCR Value

Various factors can influence your DSCR calculation, including rental income stability, operating expenses, and debt levels. Ensuring accurate and realistic estimates for these components is crucial for a precise DSCR calculation.

- Rental Income Stability: Consistent rental income is crucial; fluctuations can impact your DSCR ratio.

- Operating Expenses: Accurately account for all expenses, including maintenance and property management costs.

- Debt Levels: Higher loan payments reduce DSCR; aim to minimize debt or secure favorable terms.

Common Mistakes in DSCR Calculation and How to Avoid Them

Calculating DSCR is simply a matter of arithmetic, but a few common mistakes can skew your DSCR calculation and give you the wrong impression of how feasible a property is. Make sure you watch out for these common errors:

- Underestimating Expenses: Ensure all operating costs are included and realistically estimated.

- Overestimating Rental Income: Use conservative income projections based on market research and property history.

- Ignoring Fluctuations: Factor in potential income and expense variations to avoid an overly optimistic DSCR assessment.

To avoid these errors, use conservative estimates and verify all figures with supporting documentation.

Eligibility Criteria for DSCR Loans in Illinois

Getting approved for a DSCR loan usually involves selecting a property whose Debt Service Coverage Ratio exceeds the lender’s expectations. Lenders may also consider the type of property to judge its prospects based on market trends. Please be aware that this blog is intended to give an overview of the DSCR loan process as it might apply in Illinois, there might be some nuances based on various difference

Minimum DSCR Values for Qualification

With the high cost of real estate in Illinois and other factors that can alter the income stream of an investment property, the average lender in the state would likely be looking for a minimum DSCR of 1.2 to 1.5. For seasonal rentals, this could be higher, as some years may see very low-activity tourist seasons during which the property would make significantly less money.

However, non-traditional lenders like Defy offer DSCR loans for properties with ratios as low as 0.75.

Property Types Eligible for DSCR Loans

DSCR loans Illinois are available for various property types, including residential, commercial, and even specialty properties, as long as they are secondary or investment properties. Understanding which properties are eligible can help you target your investments more effectively.

Residential Investment Properties

Residential properties are popular among Illinois investors due to the state’s high cost of living, which can ensure competitive rental rates and steady occupancy. Single-family homes, condos, and well-chosen short-term rentals are particularly profitable. Lenders assess DSCR loan eligibility based on the property’s rental income potential, considering factors like location, condition, and market demand.

Commercial Real Estate and Mixed-Use Properties

Investing in commercial real estate in Illinois is most lucrative in Chicago, though high taxes and prices can impact your DSCR. Other cities offer lower income potential due to smaller populations. Opting for mixed-use properties can enhance returns by combining commercial and residential income streams.

Specialty Property Considerations

Specialty properties include factories and unique real estate assets like marinas or self-storage facilities. They can still qualify for DSCR loans if they can generate income by appealing to niche markets or specific tenant types. Lenders will have to find the income potential, tenant demand, lease terms, and the property’s potential use to decide whether or not to approve a loan for it.

Additional Criteria for New Investors and Established Businesses

New investors and established businesses may face different criteria for DSCR loans. For new investors, lenders may require higher DSCR values or additional collateral. Established businesses might benefit from more flexible terms based on their investment track record.

In many cases, a minimum credit score of 620 is also required to demonstrate that the borrower is a good payer. Some lenders may also ask for personal income documents aside from proof of the property’s cash flow, such as tax returns, as well as other specific requirements.

Defy, however, lets borrowers skip submitting tax returns for DSCR loans, even offering foreign national loans for those who want to invest in real estate in the United States but do not have a US credit score or social security number. Keep in mind though that this is for other states that are not Illinois.

DSCR Loan Illinois FAQ

What is the minimum DSCR required to qualify for a loan in Illinois?

The minimum DSCR value required by lenders in Illinois typically ranges from 1.2 to 1.5, depending on the lender and specific loan terms. But with current housing market conditions in Illinois, you may need a higher DSCR to secure good loan terms, especially if you are looking to purchase a residential property to rent out. At Defy Mortgage, we allow for negative DSCR ratio down to .75.

Can I Qualify for a DSCR Loan with a New LLC?

Yes, newly formed LLCs can qualify for DSCR loan programs, but they may face stricter minimum requirements, such as higher DSCR values or additional collateral.

How Do Seasonal Rentals Affect DSCR Calculation?

Seasonal rentals are only active for 3-6 months every year, so they have to make enough income in that period to cover the debt obligation. Using an average monthly income figure to calculate the yearly gross income, you must multiply it by 3-6 months instead of 12, or however long the property is active.

What Factors Can Affect DSCR Loan Terms in Illinois?

Property location is one of the most significant factors affecting DSCR loan terms because of the area’s specific property values and economic conditions.

What Documentation Is Required for a DSCR Loan Application in Illinois?

DSCR loans focus on the property’s ability to generate income, so lenders typically require comprehensive documentation of the property’s revenue. Some lenders may also ask for documents on the borrower’s personal finances, such as credit reports and tax returns. However, at Defy, with DSCR loans, you can qualify using rental income without the need to show tax returns or income documentation.

Key Takeaway

A DSCR loan Illinois can make real estate investing much more accessible in the state’s expensive property market. As long as you understand DSCR loan eligibility criteria, accurately calculate your DSCR, and stay informed about local market conditions, you can maximize your chances of qualifying for these valuable loans.

With the flexibility and benefits of DSCR loans, investors can diversify their portfolios and potentially achieve higher returns. Along with a deep understanding of the nuances of the Illinois real estate market, they can be just what you need to create a successful investment strategy. Are you interested in taking out a Debt Service Coverage Ratio loan to purchase a property elsewhere in the U.S.? Start a conversation with Defy Mortgage and we’ll work out a tailor-made solution for your real estate needs.