DSCR loans are ideal for real estate investors and business owners looking to acquire, refinance, or develop properties, as they are based on a property’s net income rather than personal finances. DSCR loan Arkansas comes with the benefit of the Natural State’s affordable rental market that’s attractive to both renters and buyers, making it easier to secure a higher DSCR and better loan terms.

At Defy Mortgage, we provide 75+ non-traditional financing products, including DSCR and Fix-and-Flip loans, bank statement loans, and interest-only mortgages. Each loan is tailored to meet the unique needs of entrepreneurs, freelancers, business owners, or real estate investors. Our fast pre-approvals and reliable solutions can help you take on even the most complex loan situations.

Drawing from our vast experience in DSCR loans, this blog covers everything you need to know to qualify for a DSCR loan in Arkansas. We’ll discuss the factors lenders consider during your DSCR loan application. We’ll also share tips to maximize your DSCR for better approval chances and favorable terms.

Let’s jump right in.

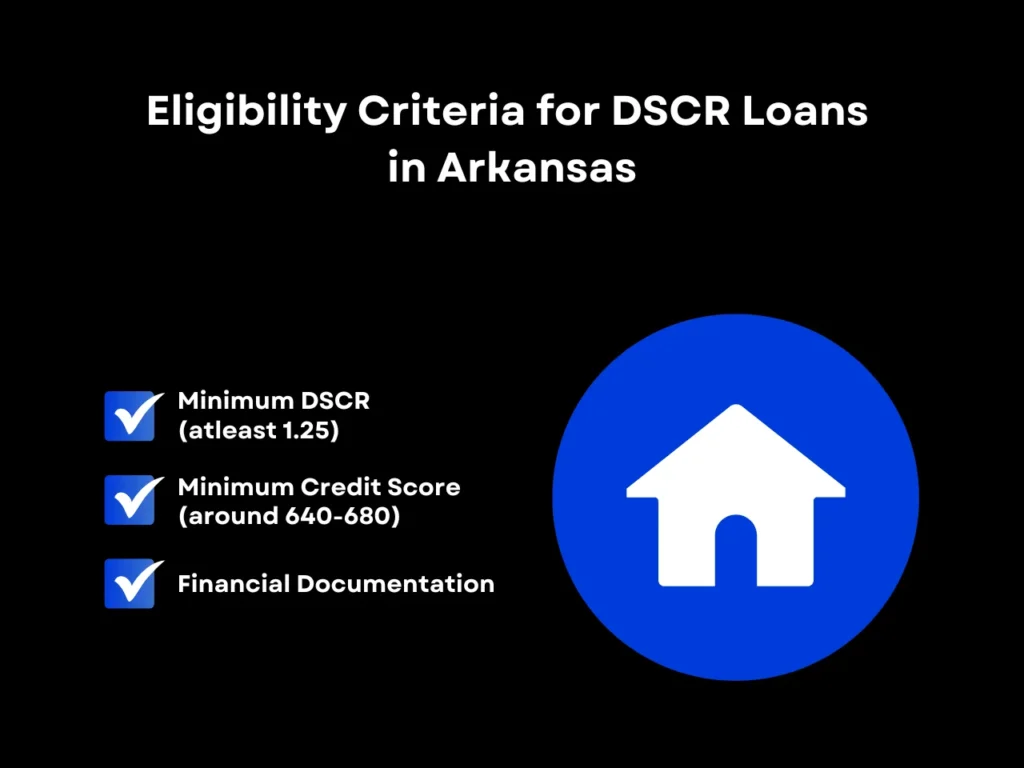

Eligibility Criteria for DSCR Loans

Qualifying for a DSCR loan Arkansas involves much the same eligibility criteria for DSCR loans everywhere else. Securing DSCR loan approval requires meeting a minimum DSCR and credit score. Unlike conventional loans, DSCR loans don’t require proof of personal income, such as tax returns or pay stubs.

Minimum DSCR

The basic requirement you have to meet is the Debt Service Coverage Ratio (DSCR). Most lenders look for a DSCR of at least 1.25. Fortunately, this DSCR is relatively easy to achieve in Arkansas due to the affordable rental market and real estate prices.

As of Q3 2024, a typical single-family unit in Arkansas is listed at around $209,251, with some multi-family properties selling for well below that. With the state’s median rent at $1,395, it is not as challenging as in some states to select a property with a healthy DSCR and gain quick returns on your investment.

At Defy, we provide DSCR loans for properties with a DSCR as low as 0.75, which includes up to 3 months’ cash reserve and no tax returns required. We also offer foreign national loans for those who do not have a social security number.

Minimum Credit Score

While DSCR loan programs are more focused on the property’s financial performance, lenders still prefer borrowers who are above a certain credit score. Minimum credit score requirements vary from lender to lender, but the score you need to be offered good terms can depend on the type and location of the property, with expensive markets needing higher credit.

Arkansas is a fairly affordable market, and thus, many lenders offer DSCR loans for borrowers with credit scores around 640-680. At Defy, we offer DSCR loans in Arkansas for those with FICO scores as low as 620.

Financial Documentation

To verify the property’s financial performance, lenders may also request documentation, such as proof of the property’s rental income and a rundown of its operating expenses. Evidence of stable tenant history and consistent rent payments from these tenants will also make your loan application more favorable.

Some lenders may also ask for documentation of your personal finances. But with Defy, you won’t have to provide tax returns or W2s.

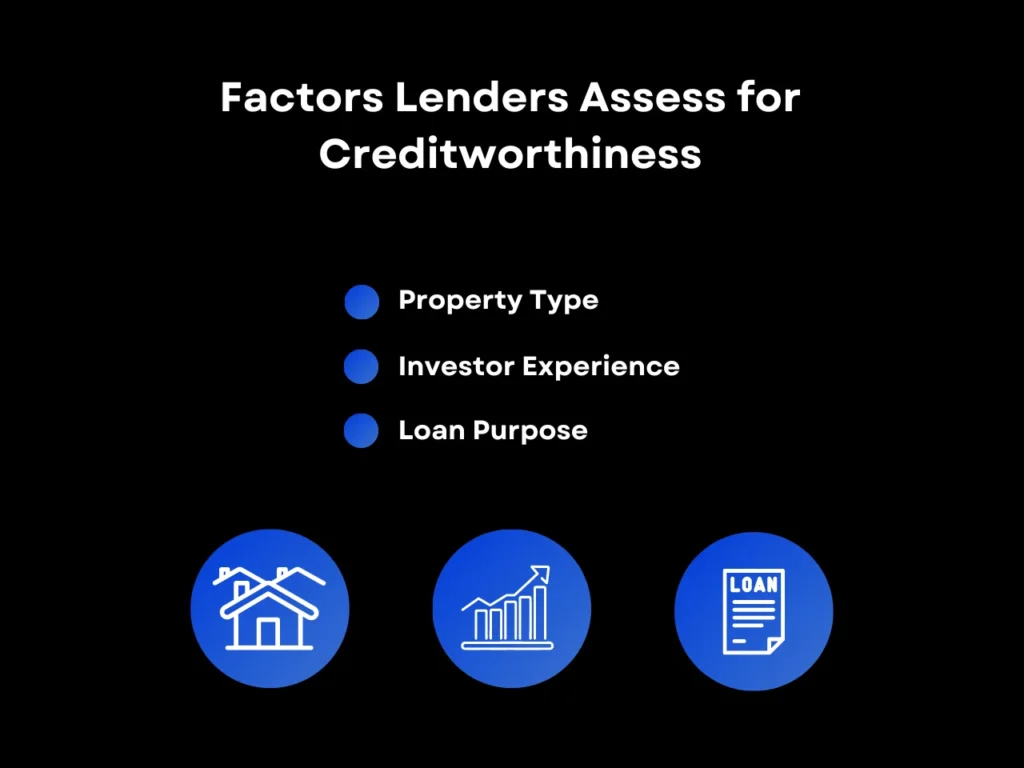

Secondary Consideration Factors

While the property’s DSCR is the primary metric for loan approval, lenders also consider other factors that influence creditworthiness:

Property Type

While any property that generates income can be approved for a DSCR loan, lenders often favor properties that have guaranteed income, such as multi-family units and long-term rental properties.

You can still get a DSCR loan for a commercial property or a short-term rental like a vacation home, but these will be subject to more scrutiny, as lenders will have to account for vacancy periods and potential economic downturns that may lead to commercial rental space emptying out.

Investor Experience

Lenders may also consider your experience managing income-generating properties. A history of successful investments will make them more confident about investing in you and more likely to offer better terms.

There is also such a thing as global DSCR, which in real estate is the DSCR that takes into account the net income and debt obligation of your entire portfolio. A high global DSCR for your portfolio exhibits that you are good at generating income from real estate and managing debts.

Loan Purpose

DSCR loans are typically used to acquire, refinancing, or renovate investment properties. Lenders may ask you about what you intend to spend your DSCR loan on to assess how this will affect the property’s income and the return on their investment.

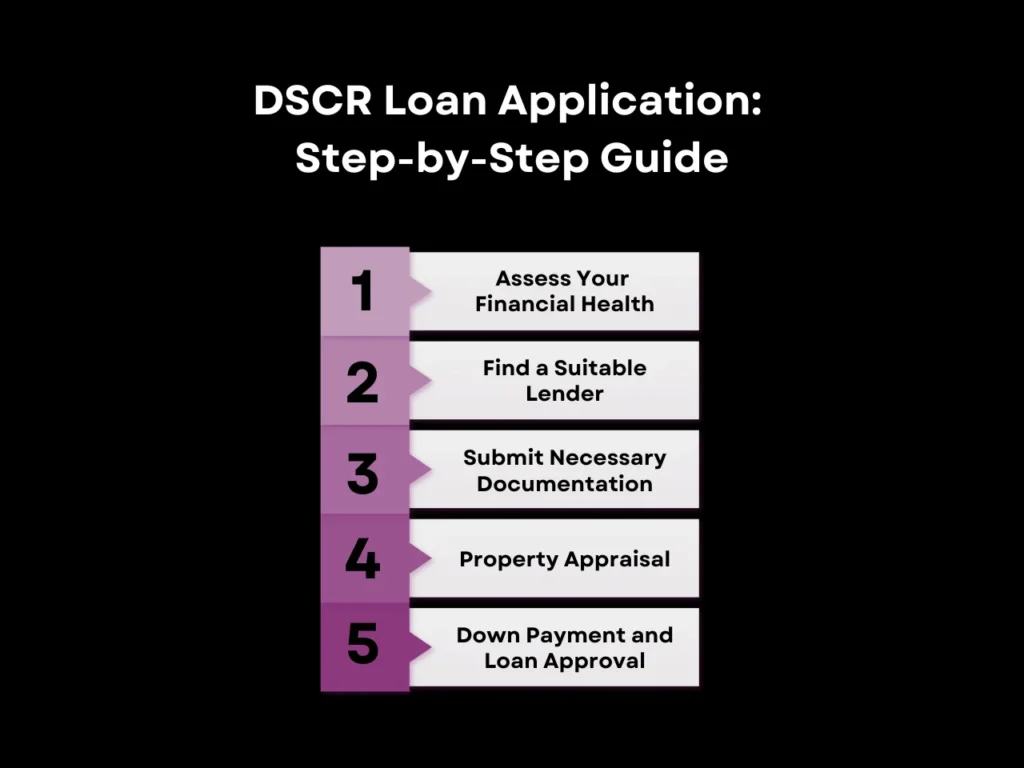

Step-by-Step Application Process

To get the best results from a DSCR loan, it’s vital to approach the application process in a methodical way. Ensure your finances are in order, vet your lenders, and provide comprehensive documentation. Follow these steps for a smooth application:

Step 1: Assess Your Financial Health

Good financial health is crucial to getting favorable DSCR loan terms. Review your cash flow, property expenses, and any existing debt to estimate your DSCR. DSCR is essentially just the property’s net operating income divided by its total debt obligation.

Step 2: Find a Suitable Lender

DSCR terms can differ per lender, so doing your research can be crucial in getting the most favorable DSCR loan program for your specific needs. Those specializing in non-traditional loans and with experience working with real estate investors are often best-suited for DSCR loans, especially those familiar with the market in which you plan to invest.

At Defy, we have provided DSCR loans to various types of borrowers across several US states and are well-versed in the nuances of real estate investing in each of them. These states include states such as: Georgia, Ohio, California, New York, and Louisiana.

Step 3: Submit Necessary Documentation

Once you’ve chosen a lender, you’ll need to provide documentation that proves the property’s income potential. Lenders typically ask for income statements and cash flow reports from the property.

Some lenders may also require personal financial documentation, depending on your loan specifics, typically looking for evidence of basic liquid assets. At Defy, we do not ask borrowers to submit W2 income or tax returns at all.

Step 4: Property Appraisal

After you’ve submitted your documentation, the lender will appraise your property to verify its market value and potential to generate income. Their findings will determine the final terms, including the loan amount and mortgage rate.

Step 5: Down Payment and Loan Approval

Once the appraisal is complete and all documentation has been reviewed, the lender will approve your loan. You will have to make a minimum down payment, the amount of which will depend on the minimum LTV that your lender requires. Most lenders seek an LTV of 80%, meaning that you will have to put 20% down.

Maximizing Your Chances of Approval

If your initial DSCR estimate for your chosen property doesn’t exceed the minimum required by your lender, there are certain strategies you can employ to raise your DSCR and improve your chances of approval. And even if your DSCR is already above the minimum, it is still worth considering these techniques to maximize your DSCR and get the best possible loan terms.

Increase Property Rent

With how favorable the rental market is for renters, it may sound counter-intuitive to increase your rent and potentially scare away tenants. But if you can angle yourself towards those looking for slightly better accommodations, you can charge them increased rent without worrying about high vacancy rates or losing long-term renters.

Arkansas is also one of the most landlord-friendly states with fewer restrictions on raising rent and other management decisions. This gives you more flexibility to adjust rent based on market demand while maintaining compliance with state regulations, making it easier to manage cash flow and maximize your DSCR loan’s potential.

Restructure Existing Debt

The total debt service in the DSCR calculation includes all existing debt on the property you’re borrowing for. If you refinance all of this existing debt, you can decrease your interest payments, improve your overall cash flow, and raise your DSCR.

Demonstrate Profitability

Showing your lender a clear and detailed business plan will reaffirm the property’s profitability. Sharing your strategies to maintain or grow your property’s income will demonstrate to them that approving your loan will be a good investment.

DSCR Loan Arkansas FAQs

What Is the Ideal DSCR for Loan Approval in Arkansas?

DSCR lenders typically look for a DSCR of 1.25 or higher. Arkansas’ favorable real estate prices and healthy rental market make it easier to score higher DSCRs and may encourage some lenders to go lower than 1.25. Defy, however, offers DSCR loans for properties that score as low as 0.75 DSCR, even in Arkansas’ ideal rental climate.

Can I Qualify for a DSCR Loan with a Low Down Payment?

The amount of down payment required for a DSCR loan varies by lender, but most require at least 20% down. The more you put down, the more favorable your loan terms.

How Long Does the DSCR Loan Process Take?

The DSCR loan process can take from 2 weeks to 60 days from application to approval. The exact timeline will depend on your lender and the complexity of the property appraisal. Incomplete documents can introduce more delays.

Are There Specific Properties That Qualify for DSCR Loans in Arkansas?

Any property that generates rental income can qualify for a DSCR loan, including residential, commercial, and vacation rentals.

What Happens If My DSCR Is Below the Required Minimum?

If your DSCR falls below the required minimum, it’s unlikely that you will not get approved for a DSCR loan. Some lenders may still offer you a DSCR loan but with less favorable terms and a higher interest rate. In any case, it’s best to find a property with a DSCR above the required minimum or increase your property’s income if you’re refinancing a property you already own. With Defy, a DSCR of 0.75 is sufficient to qualify for a DSCR loan.

You might also try increasing your down payment, or consider alternate financing options such as other non-QM loans designed for property investment or interest-only mortgages if you have a variable income or want to maximize your returns.

Key Takeaway

A DSCR loan Arkansas can be a lucrative investment due to the state’s affordable property prices and landlord-friendly market. With no cap on the number of DSCR loans, investors can focus on property income rather than personal finances to acquire multiple properties.

To get approved for a DSCR loan in Arkansas with the best possible rates, remember to meet your chosen lender’s minimum DSCR and credit score requirements. Factors like property type and management experience can also impact approval. Improve your chances of DSCR loan approval by increasing rent, presenting a sound business plan, and restructuring existing debts.

Are you looking for DSCR loans with low credit score and DSCR requirements? Reach out to Defy today, and let’s talk about how we can finance your property to achieve the best possible ROI. Our loan application process is free from the excessive paperwork and lengthy procedures typical of traditional mortgages.