Luxury Real Estate Investments: Why Invest?

Luxury property investments are on the rise in 2025 – and they show no sign of slowing down.

The 2025 Trend Report from Coldwell Banker’s found that home price growth for single-family luxury properties jumped by 7.6% in 2024. The rest of the market only grew by 3%. The biggest trends highlighted in the report that experts are forecasting in the 2025 luxury real estate market include a growing and more balanced luxury market stemming from real estate remaining a constant necessity, the rise of premium amenities and lifestyle benefits, and much more.

With that, homebuyers are seeking primary or secondary homes outside traditional business-friendly luxury destinations like New York City and Downtown Miami. Because of this, real estate investors are following suit.

Let us explore all there is to know about luxury real estate investments, financing high-end real estate, the benefits of luxury property investments and more.

Introduction to Luxury Real Estate Investments

Although there’s no strict by-the-numbers definition of a luxury property, it’s typically defined by features such as premium locations, exclusive amenities, and high-end finishes. Additionally, luxury properties generally fall within the top 10% of a given market.

Found in top-tier destinations such as the Hamptons, Aspen, and Miami, luxury properties provide a lifestyle advantage alongside investment potential – and they tend to hold onto their value more than the rest of the market during economic downturns, since they aren’t as tied to fluctuations in employment and there’s a smaller pool of potential buyers.

Furthermore, unlike stocks or bonds, luxury real estate provides intrinsic value with potential use benefits. Buyers not only gain in social status, they also gain an asset that tends to grow with (or even exceed) inflation over time.

What Makes a “Luxury Property”?

Well, for starters, it’s going to depend on what your definition of “luxury” is. Keep in mind that this will vary from person to person, and rightfully so. Generally speaking, however, “luxury property” describes properties at the highest tier of the market in terms of price, features, and location. True luxury homes typically boast prime locations, exceptional craftsmanship, and distinctive design elements. Exclusivity is a defining factor, whether it’s a gated community, amenities and networking opportunities, a private estate, or a penthouse in a prestigious building. Luxury real estate is designed to be rare and highly desirable.

Benefits of Investing in Luxury Real Estate

High Appreciation Potential

As we mentioned above, one of the key benefits to investing in luxury real estate over the past few years has been market appreciation in excess of the middle cohort of homes. The value of luxury properties over 2024 grew twice as fast as the value of a typical home.

If you zoom out, luxury properties have historically outperformed the broader real estate market in terms of value appreciation. In top-tier locations, demand consistently outstrips supply, driving property values higher over time.

Stable & Resilient Asset Class

The luxury market is largely insulated from economic downturns, as high-net-worth individuals tend to maintain their investment portfolios regardless of short-term market fluctuations. Wealthy buyers often view luxury properties as long-term wealth preservation assets rather than speculative investments.

Additionally, the total number of wealthy people is increasing. The top 1% of American earners own more wealth than the entire middle class. “The number of deca-millionaires has more than doubled since 2000, and the number of centi-millionaires has quadrupled,” said Owen Zidar, a Princeton University economist.

A greater number of buyers means more demand for luxury properties.

Rental Income Opportunities

Short-term rentals (STRs) in high-demand areas generate significant revenue. A beachfront villa in Miami or an Aspen ski chalet can command thousands of dollars per night, making luxury real estate an attractive investment for those seeking rental income. Gone are the days when, if you went on a month-long trip to Europe, your house sat empty (or you needed to hire a caretaker to look after it). Now, a luxury property can actually generate income while you’re gone.

Diversification & Wealth Protection

Luxury real estate provides a hedge against inflation and financial market volatility. Unlike stocks or other paper assets, luxury properties retain tangible value and can serve as a safe haven for preserving wealth.

Lifestyle & Networking Benefits

Talk about premium amenities! Owning a luxury property offers more than financial rewards—it also grants access to exclusive communities, top-tier schools, and elite social circles. Many investors purchase high-end real estate as both an investment and a personal retreat.

How to Finance a Luxury Property Investment

Challenges of Financing High-End Properties

While luxury real estate is an attractive investment, financing it comes with unique challenges. The price points for these properties often exceed conventional loan limits, requiring alternative financing solutions. Lenders also impose stricter qualification requirements, such as higher credit scores, larger down payments, and multiple income verifications. Furthermore, many luxury buyers are business owners or investors with unconventional income streams, making traditional underwriting processes more complex.

How to Combat Challenges Associated with Luxury Real Estate Investments

Navigating Higher Price Points

Because luxury homes exceed conventional mortgage limits, most buyers rely on jumbo loans. These loans are specifically designed for high-value properties and offer competitive interest rates for well-qualified borrowers. However, they require more stringent financial qualifications, including higher credit scores and larger cash reserves.

Managing Stricter Qualification Requirements

To improve the chances of securing financing for a luxury home, borrowers should:

- Work with financial advisors to ensure all necessary documentation is in order.

- Consider non-QM lending solutions such as asset depletion loans, DSCR loans, and bank statement loans.

- Establish relationships with lenders who specialize in luxury real estate financing.

Successful luxury real estate transactions often require assembling a team of specialized professionals, including real estate attorneys, CPAs, and wealth managers who can work together to navigate these challenges effectively.

Addressing Complex Income Structures

Many high-net-worth individuals have diverse income sources, including business earnings, investments, and rental income. For borrowers who do not have traditional W2 income, lenders offer alternative qualification methods such as:

- Bank statement loans based on 12-24 months of deposits instead of tax returns.

- P&L statement loans that assess business income instead of personal paychecks.

- Asset depletion loans where liquid assets are used as proof of repayment ability.

Types of Loans for Luxury Property Financing

Jumbo Loans

Jumbo loans are the most common financing method for luxury properties. These loans exceed conventional mortgage limits and cater to buyers with strong financial credentials. They offer flexible repayment options and competitive rates but require more stringent qualifications.

Debt Service Coverage Ratio (DSCR) Loans

DSCR loans allow investors to qualify based on a property’s rental income rather than personal income. These loans are particularly beneficial for those looking to purchase luxury investment properties intended for short-term or long-term rentals.

Alternative Financing Options

For investors who do not qualify for traditional loans, alternative options include:

- Bridge Loans: Short-term financing to bridge the gap between buying and selling properties.

- Bank Statement Loans: Approval based on deposits rather than tax returns.

- Asset-Based Loans: Using high-value assets like stocks or bonds as collateral.

Using DSCR Loans for Luxury Investment Properties

What Is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) loan is a type of real estate financing that allows borrowers to qualify based on the cash flow generated by a property rather than their personal income. Instead of requiring traditional proof of income like W2s or tax returns, lenders use the rental income from the property to determine eligibility.

For luxury real estate investors, this can be a game-changer. Many high-net-worth individuals have diverse income streams, and traditional mortgage underwriting often struggles to accommodate them. If that sounds like you, book a call with Defy Mortgage and we’ll see how we can help.

How DSCR Loans Work for Luxury Properties

Lenders calculate the Debt Service Coverage Ratio by dividing a property’s net operating income (NOI) by its total debt obligations. The formula is:

DSCR = Net Operating Income ÷ Total Debt Obligations

A DSCR of 1.0 means the property’s income just covers the loan payments, while a DSCR above 1.2 is generally preferred by lenders, as it demonstrates strong cash flow.

For luxury properties, especially short-term rentals in prime locations like Aspen or Miami Beach, DSCR loans can provide substantial financing. High-end properties that command premium rental rates can often meet or exceed the DSCR requirement, making it easier to secure a loan without needing traditional income documentation.

For example, an investor purchasing a beachfront estate in Malibu as a vacation rental might struggle to qualify for a jumbo loan due to unconventional income sources. However, if the projected rental income from short-term stays is high enough, a DSCR loan can enable financing based purely on the property’s revenue potential.

Benefits of DSCR Loans

- No Personal Income Verification: Borrowers do not need to provide W2s, tax returns, or employment history.

- Easier Qualification for Investors: Those with multiple properties or non-traditional income streams can still secure financing.

- Rental Income Qualification: Investors can utilize the rental income generated from the property to qualify for the home loan.

- Scalable Financing for Luxury Portfolios: Investors looking to expand their real estate holdings can use DSCR loans without being capped by personal income limits.

Challenges of DSCR Loans

- Typically Higher Down Payments & Interest Rates: Compared to conventional loans, DSCR loans may require larger down payments (typically 20-25% – so not too far outside the range of most loans) and the interest rate might be slightly higher.

- Property Performance Is Critical: If the rental income does not meet the lender’s DSCR requirement, securing financing can be difficult.

- Market Dependency: DSCR loans work best in areas with strong rental demand, ensuring that projected income is realistic and sustainable.

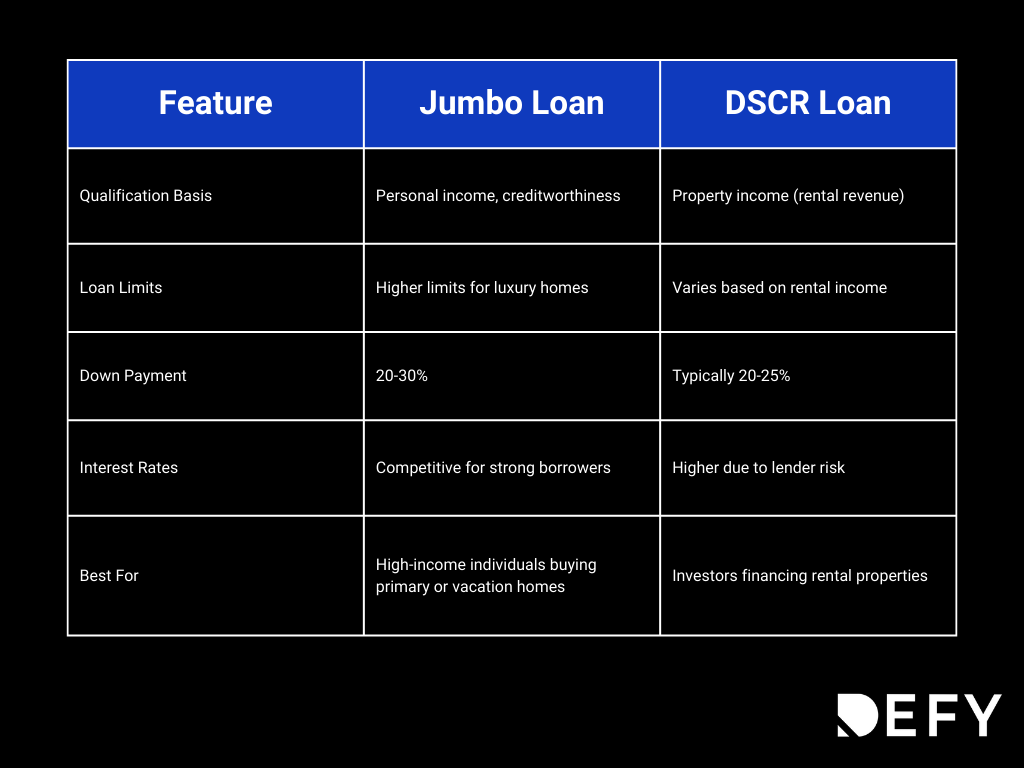

Jumbo loans and DSCR loans serve different purposes and have distinct qualification criteria.

When to Choose a Jumbo Loan

Jumbo loans are ideal for:

- Buying a primary residence or second home in a luxury market.

- Borrowers with stable, high income and excellent credit.

- Those who can provide full income documentation to qualify for favorable terms.

When to Choose a DSCR Loan

DSCR loans are best suited for:

- Financing luxury investment properties, such as vacation rentals or high-end apartments.

- Investors looking to scale their portfolios without personal income limits.

- Borrowers who prefer qualification based on property cash flow rather than personal earnings.

Additional Financing Options for Luxury Real Estate

Bridge Loans

Bridge loans provide short-term financing for buyers who need to transition between properties. For example, an investor purchasing a new luxury home while waiting for another asset to sell may use a bridge loan to cover the gap.

Bank Statement Loans

These loans allow self-employed borrowers to qualify based on 12-24 months of bank deposits rather than traditional income verification. This is ideal for high-net-worth individuals whose tax returns may not accurately reflect their true income.

Profit and Loss (P&L) Statements

For business owners and real estate investors, lenders may accept profit and loss statements as an alternative to tax returns, making it easier to qualify for high-value luxury loans.

Asset-Based Loans & Asset Depletion

Some luxury buyers qualify for loans based on their high-value assets, such as stocks, bonds, or other real estate holdings. In asset depletion loans, liquid assets are converted into an income calculation for loan qualification.

Note: Defy Mortgage offers asset depletion loans for primary and secondary residences only.

Tips for Financing Luxury Property Investments

Preparing for the Loan Application

Luxury property financing requires meticulous preparation. Investors should:

- Gather proof of assets, credit reports, and property details well in advance.

- Work with a lender experienced in high-value property financing to navigate unique loan structures.

Choosing the Right Loan

- Assess your financial goals and long-term investment strategy.

- Work with a mortgage specialist to determine whether a DSCR loan or jumbo loan is the best fit.

Considerations for Luxury Rentals

For investors purchasing luxury properties for rental income, it’s crucial to:

- Analyze the rental market to determine short-term vs. long-term rental potential.

- Evaluate tax benefits, property management costs, and expected cash flow.

FAQs About Financing Luxury Property Investments

How do you finance a luxury home?

Financing options include jumbo loans, DSCR loans, bridge loans, asset-based loans, and asset depletion loans.

What credit score is required for a jumbo loan?

Most jumbo lenders require a 700+ credit score for approval.

Can rental income be used to qualify for a luxury property loan?

Yes, through DSCR loans, which base qualification on the property’s cash flow.

How do DSCR loans differ from traditional mortgages?

Traditional loans rely on personal income, while DSCR loans qualify borrowers based on rental revenue.

Are there tax benefits to investing in luxury real estate?

Yes, investors can benefit from depreciation, deductions, and rental income tax advantages.

What’s the minimum down payment for a luxury property?

Most jumbo loans require 20-30% down, while DSCR loans typically require 20-25% down.

What are some flexible loan solutions for high-end properties?

Options include bank statement loans, bridge loans, asset depletion loans, and DSCR loans.

How can I obtain a luxury property investment loan?

Work with a luxury real estate lender who understands the nuances of high-value financing.