Non-QM Loans: The Complete Guide

When it comes to mortgages and buying a home, not everything is black and white. If you have a unique circumstance and you find it hard to qualify for a conventional mortgage, did you know there’s another option? Non-QM loans exist outside of the box of conventional mortgages, and they can be a great option if you’re having trouble securing traditional financing.

Never heard of a non-QM loan before? With only 4% of the mortgage market in 2022 being non-QM loans, they may very well be America’s best-kept secret in the mortgage world. Despite non-QM loans only accounting for a small market share of the mortgage market, they’re still growing steadily – and for good reason.

In this guide, we’ll be going over everything you need to know about non-QM loans. From the qualification requirements to all of the different types of non-QM loans, we’ve got you covered.

Keep reading to find out how you can make your homeownership dreams a reality.

What is a Non-QM Loan?

A non-QM loan is short for a non-qualified mortgage loan. It’s a type of mortgage that doesn’t conform to the lending criteria set by the Consumer Financial Protection Bureau (CFPB). This means that non-QM loans allow lenders to be more flexible with their standards and requirements for borrowers. Depending on the lender and the type of non-QM loan, applicants may be able to qualify with a higher DTI ratio and lower credit score than a traditional mortgage. Some types of non-QM loans, like bank statement loans, accept alternative forms of income verification if the applicant is self-employed or has a non-traditional income stream. Lastly, some non-QM loans allow borrowers to make interest-only payments – something that isn’t permitted for a QM loan.

All in all, non-QM loans give aspiring homeowners with unique circumstances an opportunity to buy property in the US.

Who is a Good Candidate for a Non-QM Loan?

- Entrepreneurs

- E-commerce Professionals

- Small Business Owners

- Self-Employed Individuals

- Freelancers

- Gig Workers

- Foreign Nationals

- Individuals With Multiple Streams of Income

- Retirees

- Bad Credit Borrowers

- High-net-worth individuals with liquid assets

- Independent Contractors

- Self-Employed Lawyers

- Doctors in Private Practice

- Artists

- Real Estate Investors

- Truck Drivers

- Individuals with unique circumstances who would not be able to qualify for a traditional mortgage

The Benefits of Non-QM Loans

One of the main benefits of a non-QM loan is the flexibility it offers individuals with less common circumstances. Here are some ways that non-QM loans are more flexible than conventional loans:

- Wider variety of loan types: When it comes to non-QM loans, there’s a wider variety of loan types that cater to the needs of those in unique situations. In the next section, we’ll be covering the different types of non-QM loans in further detail.

- Less strict credit requirements: Since non-QM loans are targeted toward individuals who may not qualify for a traditional mortgage, lenders will generally have less strict credit requirements for non-QM loans compared to traditional loans.

- Flexible underwriting standards: Non-QM loans have the ability to use alternative forms of income verification, such as bank statements, alternative asset-based income, or rental income and options for no tax returns.

- Accept other forms of income verification: Having other ways to verify an applicant’s income makes it easier to qualify for those who have non-traditional employment.

Overall, non-QM loans can make homeownership more accessible for a wider group of people, which is a significant benefit for those who aren’t able to qualify for a conventional mortgage.

Types of Non-QM Loans

Several different types of loans fall under the non-QM category. Since non-QM borrowers tend to have more unique circumstances, there’s no one-size-fits-all loan type for them all. Below, we’ve broken down a few of the most common non-QM loan types to help you determine which one could be right for you.

- Bank Statement Loans: Bank statement loans offer an alternative income verification method by using an applicant’s bank statements rather than traditional documents, such as W2s, pay stubs, and tax returns. These loans are a great option for self-employed individuals who rely on a variable or non-traditional income source.

- Foreign National Loans: Foreign national loans allow non-residents of the United States to be able to qualify for a mortgage on a US property. Since foreign individuals may not have a US credit score or source of income, foreign national loans allow them to use alternative methods to verify creditworthiness and income.

- DSCR Loans: DSCR is short for debt-service coverage ratio. A DSCR loan uses the cash flow that a property generates as a qualification rather than the borrower’s income. For individuals looking to purchase an investment property as a rental, this could be a great option.

- Alternative Asset-Based Loans: Alternative asset-based loans are designed for borrowers with significant assets who are high-net-worth but have lower income levels. These loans review the borrower’s total net worth and use the borrower’s assets, such as investments, real estate, and/or savings, as collateral for a loan instead of income.

- Profit & Loss Statements: Profit & loss statements are a record of how much your business has spent and earned over a certain amount of time. PL statements are great for business owners and can be used to verify income from a business, which can be used toward loan qualification purposes.

- Interest-Only Options: Interest-only options allow borrowers to pay only the interest on the loan for a set period of time, with adjustable rates and no requirement for a principal paydown. This is great for self-employed borrowers and can help lower monthly payments giving flexibility to managing cash flow.

- Fix-and-Flip Loans: Fix-and-flip loans give borrowers the opportunity to purchase and renovate a property. Typically, the goal is to sell the property at a profit in a relatively short period of time.

- Construction Loans: Construction loans help finance the construction of a new property or real estate project. They’re usually short-term and distributed in stages during construction.

Typical Non-QM Loan Terms

Although specific non-QM loan terms depend on the lender and the type of loan you’re looking for, these are the typical terms you can expect for a non-QM loan:

- Up to 90% LTV

- 620 min FICO required

- Loan amounts up to $6M

- ARM and fixed-rate options

- All 1-4 unit properties

- Interest-only options

- 12-24 months of bank statements required

- Purchase, rate/term refinance, and cash-out refinances allowed

Qualification Requirements for Non-QM Loans

Similarly to loan terms, qualification requirements can differ amongst lenders and depending on the non-QM loan type. However, generally, you can expect these requirements:

- Income verification (could be bank statements if self-employed or rental income cash flow for DSCR loan)

- Credit score of at least 620

- DTI ratio of up to 50%

- Down payment verification through bank statements or gift letters

- Proof of cash reserves (depending on the lender)

When shopping for a lender, it’s important to reach out to them early on to determine their specific qualification requirements to stay informed and prepared throughout the loan application process.

Non-QM Loan Down Payments

Down payments for non-QM loans can vary anywhere between 10-30% depending on the lender and your credit score. Compared to some types of conventional mortgages that allow down payments as low as 3%, non-QM down payments are slightly higher. However, a non-QM loan can offer a path to homeownership that otherwise might not be possible.

What Are The Interest Rates For Non-QM Loans?

The interest rates that lenders offer you may vary depending on your credit score, but they’re generally 1-2% more than the prime 30-year fixed mortgage rate. Though the interest rates are typically higher for non-QM loans, it can give individuals who can’t qualify for a conventional mortgage the opportunity to own a home and establish equity.

The Application Process for Non-QM Loans

Although the application process may sound more complicated than a traditional mortgage, the non-QM loan application process isn’t too different. Actually, it can often-times be much more efficient. We’ve outlined the non-QM application process to walk you through each step below.

Determine How Much Home You Can Afford

Before calling up your realtor and going on property tours, it’s important to determine how much home you can afford first. This way, you can streamline your property search and save time by filtering out properties that are out of your price range. Shopping for a home can be overwhelming enough – Narrowing down your search by price can help you better evaluate your option, while also reducing buyer’s fatigue.

When determining your budget, you should take into consideration your income, debt, and expenses. Using a mortgage calculator can help by taking into account other variables, such as interest rate and down payment.

Begin The Home Shopping Process

Now that you have an idea of your maximum budget for a home, you can get started on the home shopping process by searching for properties that could be a good fit for you. On top of property prices, you can use other variables to try to narrow down your search, such as school districts and proximity to work.

During this stage, make sure to work with a reliable and knowledgeable realtor who’s familiar with both the area and the non-QM loan process.

Prepare Your Documentation

Depending on the type of non-QM loan you’re applying for, you may need different types of documentation. However, generally, this would include:

- Identification documents (SSN may not be required for foreign nationals depending on the lender)

- Proof of income (could be bank statements if self-employed or rental income cash flow for DSCR loan)

- Proof of assets

- Credit report (may not be required for foreign individuals who don’t have a US credit report depending on the lender)

- Debt information

- Down payment verification using bank statements or gift letters

- Proof of cash reserves (may be optional depending on the requirements of the lender)

Since each lender has different documentation requirements, keep in mind to reach out to lenders early in the process to be prepared with the correct documentation.

Research Your Loan Options

Similarly to a traditional loan, there are many options for non-QM loans that are available on the market. Buying a home is a large financial decision, so it’s important to do your due diligence when researching loan options and comparing various offers.

The main factors to consider when researching your loan options are:

- Your personal and financial goals

- Interest rates

- Down payment requirements

- Terms of the loan

Additionally, there are several different types of non-QM loans that cater to certain circumstances. For example, if you’re a foreign individual with minimal US credit history, a foreign national loan would be a perfect fit compared to a bank statement loan.

Search For A Lender

Once you have an idea of what type of non-QM loan would suit you best, it’s time to start looking for a lender. During your search, make sure to compare offers from multiple lenders before choosing one since there are many lenders out there. On top of the loan terms they’re offering, you should also consider the lender’s reputation and experience with handling non-QM loans. You can find specialized lenders that offer non-QM loans by looking online or asking your real estate agent for recommendations. At Defy, we happen to specialize in non-QM loans.

Get Pre-Approved

After choosing a lender, you can get started with the pre-approval process. Even though you might’ve used the mortgage calculator to determine how much home you could afford, getting a preapproval will give you a more specific figure in terms of how much you can borrow. This step will also provide you with insight into what your interest rate is and how much your monthly mortgage payments will be. Being pre-approved also indicates to sellers that you’re a serious buyer when you’re home shopping.

Continue The Application Process

Now that you have a pre-approval, you can continue going through with the application process. A formal loan application will have to be completed, which will include providing the lender with any required documentation. The lender will then review your application and make a decision based on the information given. If your application is approved, a loan approval letter will be issued with details such as the total loan amount, interest rate, and monthly payment amount.

Get A Property Appraisal

For the lender’s protection, a property appraisal will also have to be completed prior to closing. A property appraisal will confirm the value of the home and the lender will compare that with the borrowed loan amount. If the loan amount is too large in comparison to the appraised value, the borrower may have to come up with the difference or the deal could be cut.

Get Ready For Closing

The final step in the non-QM loan application process is to get ready for closing. On closing day, you’ll sign the documents and the ownership of the property officially transfers to your name. It’s important to review all of the documentation carefully before signing anything. Even though the closing day is usually a day filled with excitement, don’t let that make you forget about additional closing costs, such as:

- Origination fee

- Appraisal fee

- Title insurance

- Recording fee

- Transfer tax

- Prepaid property taxes

- Prepaid homeowners insurance

- Attorney’s fees

Prior to closing day, the lender will provide you with an exact amount that’s due on the day of so you can arrive prepared. Ensuring that you have all of the funds ready to cover closing costs will help you avoid any delays.

Non-QM Loans vs. Conventional Loans

Non-QM loans are mortgages that aren’t required to follow the lending standards set by Fannie Mae and Freddie Mac. Because of this, non-QM loans have more lenient lending requirements and qualifications than QM loans.

Taking a look at the opposite side of the spectrum, the lending criteria set by Fannie Mae and Freddie Mac have to be followed by lenders when issuing QM loans. This means that conventional mortgages can be much more difficult to qualify for than a non-QM loan and not everyone can meet the strict lending requirements that come with a QM loan. This is where non-QM loans come in to bridge the gap between those who might not qualify for a conventional loan, but are still dreaming of becoming homeowners or expanding their real estate portfolio.

Non-QM Loans vs. DSCR Loans

A DSCR loan is considered to be a type of non-QM loan. DSCR loans take into account a property’s cash flow in place of the borrower’s income. DSCR loans can be great for investment properties since the cash flow from the rental income can be used as part of the qualifications required for the loan.

Considering that using a property’s cash flow rather than the borrower’s income doesn’t follow the lending standards for a QM loan, a DSCR loan falls under the umbrella of a non-QM loan.

Non-QM Construction Loans: Do They Exist?

Yes, non-QM construction loans exist and are typically available through specialized lenders. Non-QM loans can be used for a wider variety of purposes, including constructing a new property. Generally, the proceeds from a construction loan would be released in stages depending on the progress of the build. In comparison to a regular mortgage, where the entire loan amount is released immediately to the seller to purchase the home. Please note that we currently do not offer residential ground-up construction loans from primary residences at Defy Mortgage.

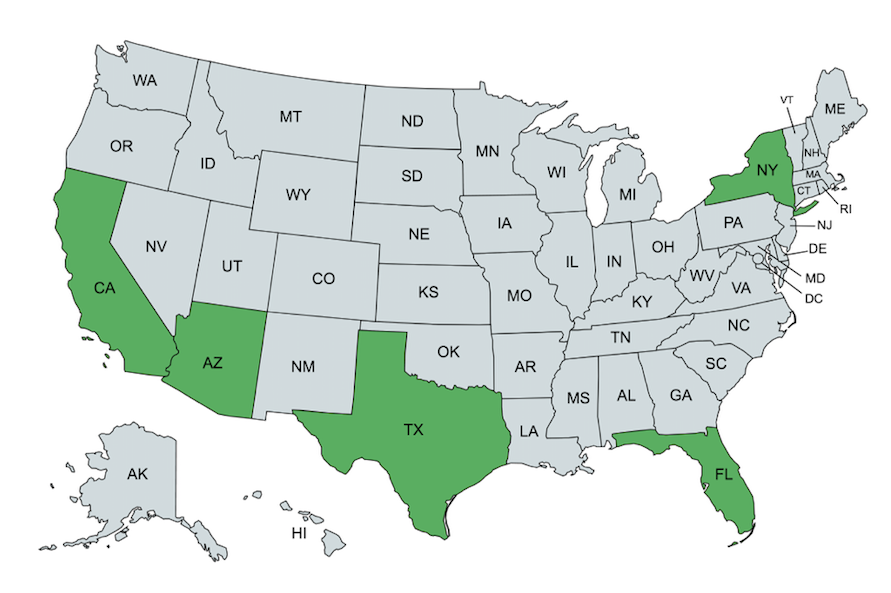

Top 5 Most Popular States for Non-QM Loans

There are some states where non-QM loans are more popular than others. The top five most popular states for non-QM loans are:

- Florida

- Texas

- California

- Arizona

- New York

The Pros and Cons of Non-QM Loans

When it comes to looking for a mortgage, there will always be pros and cons, and non-QM loans are no exception to that. To help you make a more informed decision on whether non-QM loans are right for you, here are some pros and cons to consider:

Pros

- Greater flexibility when it comes to lending requirements, guidelines, and criteria

- Options for those who can’t show tax returns or W2s

- More options for entrepreneurs and self-employed individuals to verify their income

- Opens up the door to homeownership for a wider variety of people

- More flexible underwriting standards for those with liquid assets or foreign nationals

- Typically faster pre-approval process

Cons

- Typically higher interest rates

- Depending on the lender, there could be higher closing fees

- Some lenders may charge prepayment penalties for paying off the loan early

How To Find A Great Non-QM Lender

If you think a non-QM loan is a good fit for you, the next step would be to start looking for a lender. During your lender search, you should take into consideration the following factors:

- Experience: Does the lender have a lot of experience handling non-QM loans? If there’s a specific loan type that you’re considering, do they have experience with that specific loan type as well?

- Reputation: When looking up online reviews of the lender, do other borrowers tend to have a positive experience or a negative experience with them?

- Customer service: Do any of the reviews mention the quality of the lender’s customer service?

- Interest rates and fees: Do the interest rates they offer fall within a reasonable range? Do they charge reasonable fees in comparison to other lenders?

- Down payment requirements: How much of a down payment does the lender require?

- Non-bank lender: Is the lender a large bank or a non-bank lender? Larger banks have stricter guidelines when it comes to loan options which can cause roadbumps.

Applicants of non-QM loans can oftentimes have a unique background or circumstance. Choosing a lender who’s experienced and has handled many different types of non-QM transactions can make the process much smoother. On the other end of it as a borrower, you should be able to ask any questions or bring up any concerns to the lender about the process and feel confident about their answers.

Overall, non-bank lenders or “private lenders” are a good choice for people interested in non-QM loans because of their quicker approval times and more flexible underwriting guidelines. Non-bank lenders, like us at Defy, have more specialized loan products, which means they’re far more experienced with handling non-QM loans.

The Top 5 Non-QM Lenders

1. Griffin Funding

Founded in 2013, Griffin Funding offers a diverse range of non-QM loan products to allow applicants to use alternative ways to prove their reliability as a borrower. They have many happy clients as demonstrated by their 4.87/5 stars on the Better Business Bureau at the time of this writing. Griffin Funding seems to be a reputable and reliable option for those looking for any type of non-QM loan.

Griffin Funding’s Founder and CEO, Bill Lyons, is an experienced entrepreneur and executive with three privately held companies within the real estate and mortgage industries.

2. North American Savings Bank

Based in Kansas City, North American Savings Bank has been serving borrowers nationwide since 1927. With $31 billion in total volume spread across 103,000 home loans within the past decade, North American Savings Bank is a reliable and competitive option.

The CEO of North American Savings Bank, Tom Wagers, was recently elected into the position in 2022. He started his career as an accountant and worked in a variety of operational roles at different banks before joining the North American Savings Bank team in 2013.

3. Defy Mortgage

Defy Mortgage is a non-bank lender with a simple, clear mission: to empower dreams, enrich lives, and elevate the mortgage experience for non-traditional borrowers, such as foreign nationals, real estate investors, business-owners, retirees, and more. An up-and-coming titan of the industry, Defy specializes in non-QM loans and is comprised of a team with over 100+ years of combined industry experience helping non-traditional borrowers obtain home financing.

Considering that the number of gig workers is at an all-time high, Defy understands that borrowers today need different options than what traditional lenders are offering. Their strong understanding of the current market and the CEO’s 25+ years of experience in the mortgage and banking space puts them on the map.

4. Angel Oak Mortgage

Based in Atlanta, Angel Oak Mortgage is one of the largest non-bank originators of non-QM loans. They aim to find “innovative solutions for the underserved borrower”. With an average of 4.8 stars on their Google page, borrowers seem to be happy with their customer service and product offerings.

The co-CEOs of Angel Oak Mortgage Michael Fierman and Sreeni Prabhu, have over 35 years of experience within the banking and finance industry between the two of them.

5. HomeXpress Mortgage

Headquartered in Santa Ana, California, HomeXpress Mortgage was founded by a group of mortgage professionals with a decades-long history of providing flexible home ownership solutions to borrowers. They are affiliated with Seer Capital Management, which is a New York-based investment manager that acts as an advisor and capital partner.

HomeXpress Mortgage’s President and CEO, Kyle Walker, has previously had 14 years of experience working for Fremont Investment & Loan, holding both the CEO and Executive Vice President of Residential Real Estate Lending titles.

The Non-QM Loan Closing Process

The non-QM loan closing process may vary from lender to lender, but it’s typically a similar process to the loan closing process for a traditional loan. Remember to always confirm with your lender what documents are required for closing. Below, we’ve included a rough guideline on what you can expect during the non-QM loan closing process, but it’s by no means an exhaustive list of requirements:

- Apply for a loan with a specific lender. Choose any one of the lenders above, for example, and each one will outline some specific requirements that they have from borrowers

- Assemble the correct documents. Generally, this would include:

- Proof of assets

- Proof of income (this may vary depending on the type of non-QM loan you’re applying for)

- Identification

- Any other required documentation requested by the lender

- Wait for pre-approval.

- Make an offer for a property.

- Wait to see if that offer is accepted.

- Once it’s accepted, you’ll need to obtain:

- A settlement agent (usually a title company recommended by the bank).

- Homeowners insurance. To close, you’ll need to obtain homeowners insurance in the United States.

- Title insurance.

- Review the closing disclosures.

- Obtain access to the property on closing day.

Conclusion

For those who dream of owning a home, but don’t have a traditional source of income, non-QM loans are available as an alternative option. Offering more flexibility with lending requirements, non-QM loans open up the door to homeownership for individuals who can’t qualify for a conventional loan.

Throughout this guide, we’ve covered everything you should know about non-QM loans. Working with an experienced and reliable lender can help make the process smoother. At Defy, our personalized loan service offers a wide range of competitive loan options to meet your needs even if it may be outside of the “traditional” box. Click here to see how we can help you achieve your goal of homeownership.

FAQ:

What Is A Non-QM Loan?

A non-QM loan is a type of mortgage that does not have to meet the lending standards set by the Consumer Financial Protection Bureau (CFPB). Since it does not have to follow these standards, non-QM loans have more flexible qualification criteria for applicants.

What Is Non-QM Lending?

Non-QM lending is not required to meet the standards created by the Consumer Financial Protection Bureau (CFPB) for QM loans.

Are Non-QM Loans Safe?

Yes, non-QM loans are safe if you choose a reputable lender with previous experience handling non-QM loans.

Are Non-QM Loans Conventional?

No, non-QM loans are not considered conventional loans since they don’t follow the strict standards for QM loans that are enforced by Fannie Mae and Freddie Mac.

What Are The Pros and Cons Of Non-QM Loans?

Pros

- Greater flexibility when it comes to lending requirements, guidelines, and criteria

- Options for those who can’t show tax returns or W2s

- More options for entrepreneurs and self-employed individuals to verify their income

- Opens up the door to homeownership for a wider variety of people

- More flexible underwriting standards for those with liquid assets or foreign nationals

- Typically faster pre-approval process

Cons

- Typically higher interest rates

- Depending on the lender, there could be higher closing fees

- Some lenders may charge prepayment penalties for paying off the loan early

Who Offers Non-QM Loans?

Non-QM loans are typically offered by specialized lenders and private banks.

What Are The Requirements For Non-QM Loans?

The requirements for non-QM loans will vary depending on the lender and the type of non-QM loan. However, the requirements for non-QM loans are less strict than the requirements for QM loans.

What Are The Credit Score Requirements For Non-QM Loans?

Exact credit score requirements are determined by each lender, but generally, a minimum credit score of at least 620 is required for most non-QM loans.

What Are The Down Payment Requirements For Non-QM Loans?

The down payment requirements will vary depending on the lender and the type of non-QM loan, but you can expect to put down anywhere between 10-30% of the purchase price.

Can You Get A Non-QM Loan In Florida?

Yes! You can get a non-QM loan in Florida.

Can You Get A Non-QM Loan In Texas?

Yes! You can get a non-QM loan in Texas.

Can You Get A Non-QM Loan In California?

Yes! You can get a non-QM loan in California.

Can You Get A Non-QM Loan For An Investment Property?

Yes! You can get a non-QM loan for an investment property. Non-QM loans are great options for real estate investors who rely on rental income as their main source of income since they can use alternative income verification methods for a non-QM loan.

Can You Get A Non-QM Construction Loan?

Yes! You can get a non-QM construction loan.

Non-QM Jumbo Loans: Do They Exist?

Yes! For those with unique circumstances looking to purchase a high-value property, non-QM jumbo loans do exist.