Your Ultimate Guide to Getting a DSCR Loan in Texas

In the growing Texas real estate market, DSCR loans are a great way to build your rental property portfolio. Understanding the ins and outs of Texas DSCR loans can help you get a leg up in the Lone Star State’s thriving economy. These loans are getting increasingly more popular with 50% of non-QM transactions rated by S&P Global Ratings in 2022 being DSCR loans.

Ready to expand your investment property portfolio in Texas? Our guide covers everything you need to know about getting a Texas DSCR loan.

What is a DSCR loan?

To start with the basics, DSCR stands for “debt-service coverage ratio.” Now, what does this mean exactly? Simply put, it’s a ratio that helps to determine how much of the property’s debt service, including both principal and interest, can be covered by the income generated by the property. The DSCR is one of the main values that lenders look at when determining a borrower’s eligibility for the loan rather than the borrower’s personal income.

How is DSCR Calculated?

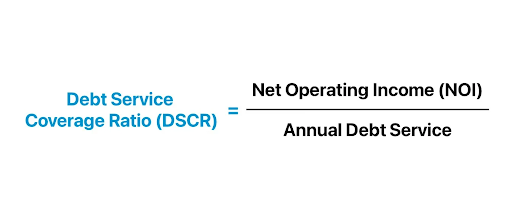

Now that we’ve covered the basics on what a DSCR loan is, let’s dive into how to actually calculate a property’s DSCR. The formula for the ratio is:

In this formula, net operating income (NOI) represents the annual income that the property generates minus operating expenses. Whereas annual debt service represents the annual total of principal and interest payments that are owed to the lender.

Once the calculation is made, here are two ways to interpret the number:

- A DSCR of 1.0 or above indicates that the property is generating enough net income to cover its debt payments

- A DSCR of below 1.0 indicates that the property is not generating enough net income to cover its debt payments

Every lender will have their own minimum DSCR requirements, but a DSCR of 1.25 and over is typically considered to be fairly strong.

Who Should Get a Texas DSCR Loan?

While DSCR loans sound like they’re mainly for real estate investors, it can be a useful tool for many different types of people, such as:

- Real estate investors

- Property developers

- Landlords

- Foreign nationals looking to invest in US property

- First-time homebuyers looking to buy an investment property

- Self-employed individuals

- Small business owners

- Partnerships or corporate entities

- Individuals with complex income situations

DSCR Loans vs. Conventional Loans

DSCR loans and conventional loans mainly differ in the way that income is evaluated to qualify. As we’ve covered above, the borrower’s personal income isn’t required to be eligible for a DSCR loan. Instead, lenders use the property’s DSCR to see if the property can essentially “pay for itself” from the income that it generates.

In contrast, a conventional loan heavily relies on the borrower’s income to determine if they qualify for a loan. Lenders typically ask for extensive documentation, like W2s, pay stubs, and tax returns, to verify income. Beyond that, they also use the debt-to-income (DTI) ratio to calculate your debt payment in relation to your income. With a conventional loan, the lender also uses the borrower’s income to calculate the maximum loan amount that they could qualify for with their current income and DTI.

DSCR Loans vs. Fix-and Flip Loans and Construction Loans

Although DSCR, fix-and-flip, and construction loans all might appeal to real estate investors, they work in different ways. DSCR loans are for income-producing properties, which mean that they’re ideal for properties that are occupied by long-term tenants or are used as short-term rentals.

When it comes to fix-and-flip loans, they’re used to purchase a property that needs a bit of TLC, fixing it up, and then selling it within a short time frame for a profit. These loans tend to have a much shorter term than DSCR loans because of this relatively short time frame in comparison to the usual 30-year mortgage term.

On the other hand, a construction loan is for new construction that’s being built from the ground up. Similar to the fix-and-flip loans, they also have shorter terms as construction projects are typically completed within a shorter time frame. A main difference between a construction loan compared to a DSCR loan or a fix-and-flip loan is that the funds are released in installments as the project progresses.

How Can I Qualify for a Texas DSCR Loan?

When it comes to exact qualification requirements for DSCR loans, each lender sets their own. Contacting individual lenders directly can help you determine whether you’d qualify with certain lenders. To give you a better idea of what qualification requirements to expect, here is our DSCR eligibility criteria at Defy:

- Minimum FICO score of 620+

- Maximum LTV of 85%

- Minimum DSCR ratio of 0.75

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns required

- Interest-only options available

What Are the DSCR Loan Interest Rates?

Similar to standard mortgage rates, DSCR loan interest rates tend to fluctuate based on factors like the specific lender, current market conditions, and your borrower profile. In general, you can expect interest rates for DSCR loans to be slightly higher than conventional mortgage rates. However, this slight increase is often worth it to be able to take advantage of new real estate investment opportunities.

What Are the Pros and Cons of Getting a DSCR Loan in Texas?

Pros:

- Use the property’s rental income to qualify instead of personal income

- No traditional income documents required (e.g. tax returns, W2s, pay stubs)

- Virtually unlimited investment opportunities with no hard limit on how many DSCR loans you can have

- Potentially higher loan amounts depending on property’s income

- Accessible for those who aren’t traditionally employed (e.g. self-employed, real estate investor, gig workers, etc.)

- Available for non-US citizens depending on the lender

Cons:

- Limited availability – not offered by all lenders

- The property’s income could change, which may affect the terms of the loan

- Can have slightly higher interest rates compared to conventional loans

Top Texas Cities for DSCR Loans

Since DSCR loans are a great financing option for investment properties, cities that offer a lot of real estate market opportunities would be the top cities. This could include cities that have steady or promising home value appreciation, a growing population, and relatively low vacancy rates. Considering those factors, these are the top Texas cities for DSCR loans:

- Austin

- Frisco

- McKinney

- San Antonio

- Houston

Alternative Loan Options for Texas Real Estate Investors

As a real estate investor in Texas, you have plenty of loan options. Although DSCR loans can be a great financing tool for those who have income-generating properties, they might not work for everyone. If you find that DSCR loans don’t quite suit what you need, try considering the alternatives below:

- Fix-and-Flip: A loan that’s designed for borrowers to purchase a property, fix it up, and then resell it shortly after for a profit. Perfect for house flippers or rehab investors.

- Construction Loans: A loan for those looking to build a property from the ground up. As construction progresses, more payments are released to fund the next stage. Perfect for real estate investors who want to build property from scratch or property developers.

- Bank Statement Loans: A loan where you could qualify using your bank statements rather than traditional income documents. Income is determined using the average monthly deposits from the statements. Perfect for real estate investors and self-employed individuals who have difficulty proving their income.

- Profit & Loss (P&L) Loans: A loan where you could qualify using your business’ profit & loss (P&L) statements. Perfect for real estate investors with incorporated businesses or small business owners.

Having trouble deciding which loan type would be best for you? Contact us at Defy for a consultation and we can help you determine the best loan type for your situation.

Texas DSCR Loan FAQs:

- What is a DSCR loan?

A DSCR loan is a financing option for investment properties. Instead of using the borrower’s personal income to qualify for the loan, it uses the income that the property produces.

- How do you calculate DSCR?

DSCR is calculated by dividing the property’s annual net income by its annual debt service. A DSCR of 1.0 or over means that the property is generating enough net income to cover its debt obligations.

- Who would benefit from getting a DSCR loan in Texas?

Texas DSCR loans can benefit a wide variety of people depending on their financing needs. This could include:

- Real estate investors

- Property developers

- Landlords

- Foreign nationals looking to invest in US property

- First-time homebuyers looking to buy an investment property

- Self-employed individuals

- Small business owners

- Partnerships or corporate entities

- Individuals with complex income situations

- What else do you need to qualify for a DSCR loan?

Other than the minimum DSCR, you’ll most likely need good credit and a minimum down payment. Full qualification requirements vary by lender. Some lenders may also request information on the property itself along with proof of strong rental income history. At Defy, we would need:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

- Do you need tax returns to get a DSCR loan?

No, tax returns are usually not required to get a DSCR loan. At Defy, we don’t require any personal income documentation like tax returns, pay stubs, or W2s to qualify you for a DSCR loan.

- What credit score do I need to qualify for a DSCR loan?

Specific credit score requirements will vary by lender, but at Defy we require a minimum FICO score of 620+.

- How big of a down payment do you need for a DSCR loan in Texas?

Down payment requirements for a Texas DSCR loan depend on the lender and your credit score. You can expect to put down anywhere between 15-30% of the property’s value.

- Can you get a DSCR loan with no down payment?

While not impossible, it’s very unlikely that you can qualify for a DSCR loan with no money down.

- Can you get down payment assistance for a DSCR loan in Texas?

Unfortunately, down payment assistance programs usually aren’t available for DSCR loans since they don’t rely on your income to qualify.

- What are the DSCR loan interest rates?

The interest rates for DSCR loans vary depending on the lender, your credit score, and current market conditions. However, you can expect them to rise and fall in a similar pattern to the standard 30-year fixed rates.

- What states can I get a DSCR loan in?

DSCR loans are available in most US states, including but not limited to Texas, California, New York, Florida, Illinois, and more.

- Can a first-time homebuyer get a DSCR loan?

Yes! A first-time homebuyer can get a DSCR loan as long as they meet the lender’s qualification requirements.

- Is it possible to get a DSCR loan for a new construction or a flip?

While it’s possible to get a DSCR loan for a new construction or flip, many lenders offer loan options that are specifically designed for these projects. Try searching for a construction loan for a new construction or a fix-and-flip loan for a flip. At Defy, we offer all three loan options and we can help you determine which one is the right fit for your needs.

- Is a DSCR loan a non-QM loan?

Yes! A DSCR loan is a non-QM loan, which stands for non-qualified mortgage. This simply means that the loan isn’t subject to the strict lending standards that are set by Fannie Mae and Freddie Mac.

- Can foreign investors get a DSCR loan in Texas?

Yes! Foreign investors can get a Texas DSCR loan. At Defy, DSCR loans are one of the loan types where we accept non-US citizen borrowers.