Mortgages can be complex, and home financing in Texas is no different. The Lone Star State is one of the more ideal real estate markets in the US, with its abundance of inventory keeping rates and prices competitive. However, high-value properties present their own set of challenges, chief among those being that they can’t be purchased with a conventional mortgage. A jumbo loan Texas lets borrowers work around that limitation and access real estate priced beyond conventional limits.

At Defy Mortgage, we have years of experience in simplifying the home buying process for every type of borrower, from first-time homeowners looking to get an FHA loan to self-employed individuals interested in a P&L loan or bank statement loan. Our 75+ traditional and non-traditional financing solutions, including jumbo loans, are all fully customizable to perfectly fit your unique needs.

Drawing from our long-standing experience providing home loans in Texas, we’ve written this guide to explore everything you need to know about qualifying for jumbo loans in Texas. We’ll talk about credit scores, down payments, and other financial requirements. We’ll also discuss the pros and cons of this loan type and the best practices to follow when applying for one.

Let’s jump right in.

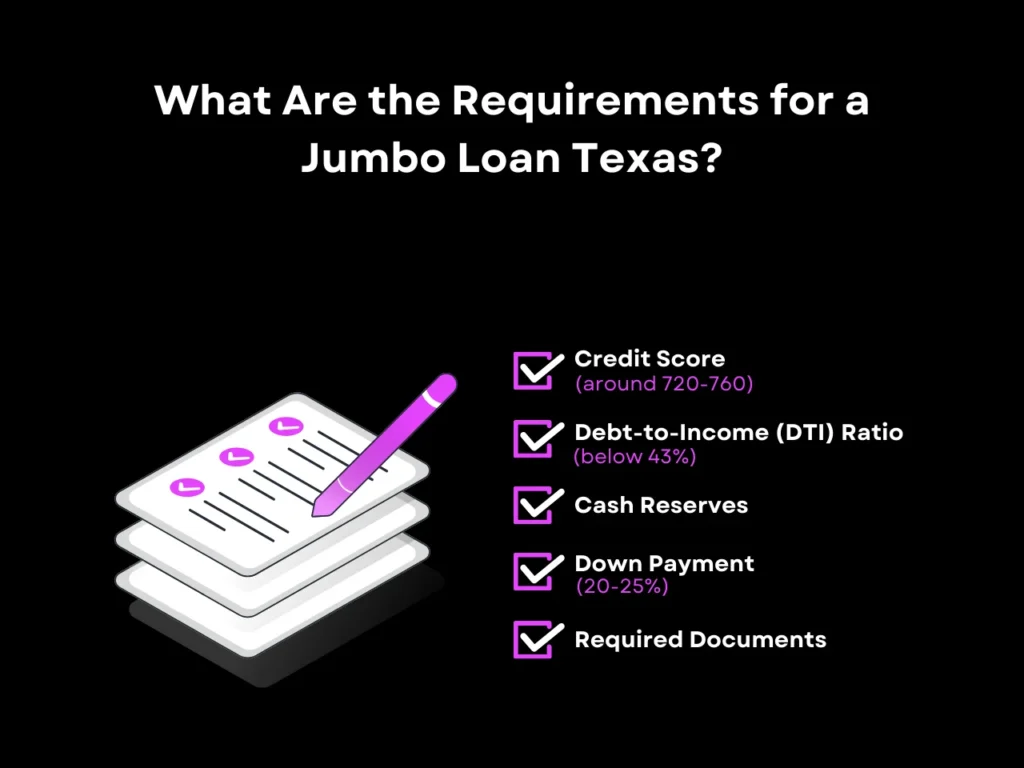

What Are the Requirements for a Jumbo Loan Texas?

Securing a jumbo loan Texas involves the same requirements as in any other part of the country: borrowers must have a strong credit score, low debt-to-income ratio, proof of steady income and assets, and enough cash reserves to cover a large down payment and several months of mortgage payments.

Credit Score

A typical jumbo loan requires the borrower to have a credit score of around 720-760. At Defy, the minimum FICO score we look for is 700, but higher credit scores can unlock better rates, loan terms, and amounts.

Debt-to-Income (DTI) Ratio

Your debt-to-income ratio, or DTI ratio, is the ratio between your monthly income and monthly debt payments. Jumbo loans typically require borrowers to remain below the standard 43% DTI ratio.

If you have a DTI ratio that’s higher than 43%, you may still be able to qualify for a jumbo loan if you have excellent credit or increase your down payment beyond the minimum required amount. However, you may not get ideal loan terms. Most lenders recommend that borrowers keep their DTI ratio below 35% to qualify for the best jumbo loan interest rates and terms.

Private lenders will sometimes approve traditional and jumbo loans for borrowers with DTI ratios as high as 50% and 45%, respectively, if they have a good credit score.

Cash Reserves

To protect against potential income disruptions, jumbo loan borrowers must demonstrate sufficient reserves to cover several months of mortgage payments. At Defy, the minimum we look for is 6 months’ worth of payments in cash reserves, but 12 is ideal.

Down Payment

The average jumbo loan can have a down payment of 20-25%, similar to what’s recommended for conventional loans, but since jumbo loan amounts are much larger, the down payment would also be much larger than that of conventional loans.

Some lenders might offer flexibility based on the borrower’s financial profile, but unlike conventional loans, where down payments can be as low as 3% for borrowers with good credit scores, the lowest possible down payment for jumbo loans is typically 10%.

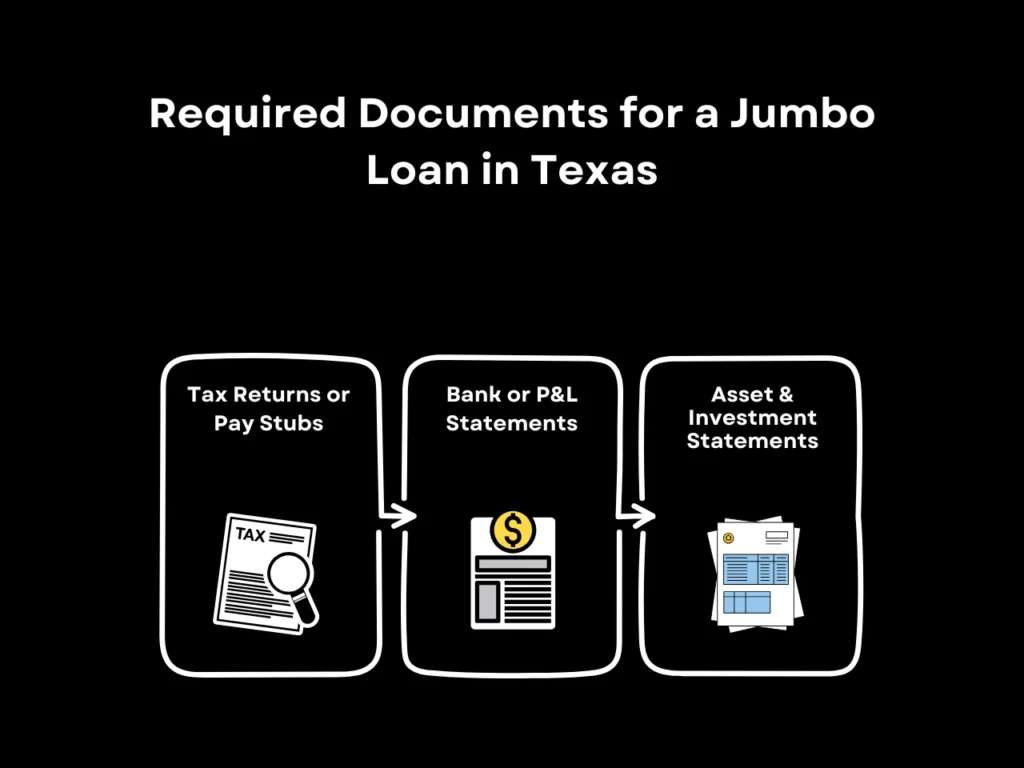

Required Documents

Jumbo mortgage lenders will ask for two years’ worth of the following documents to verify your financial standing:

- Tax Returns or Pay Stubs: These prove that you have a stable income and let lenders verify the exact amount of regular income you receive each month.

- Bank Statements or Profit & Loss Statements: If you have an unconventional source of revenue, lenders may accept bank or profit & loss statements to verify that you have sufficient and stable income. Bank statements are also necessary to prove you have sufficient liquid assets. If you have a regular income, they can also help demonstrate healthy spending habits, increasing lender confidence that you can meet your debt payments at your current rate of lifestyle spending.

- Asset and Investment Statements: Providing documentation of assets that contribute to your net worth and your investments helps lenders form a more complete picture of your finances, which lets them more accurately gauge your ability to manage your jumbo loan obligations.

Pros and Cons of Choosing a Jumbo Loan Texas

Jumbo loans have certain advantages that work well with the unique real estate market opportunities in Texas. However, it does have certain drawbacks that borrowers will need to navigate around. Be aware of these pros and cons when considering a jumbo loan in Texas.

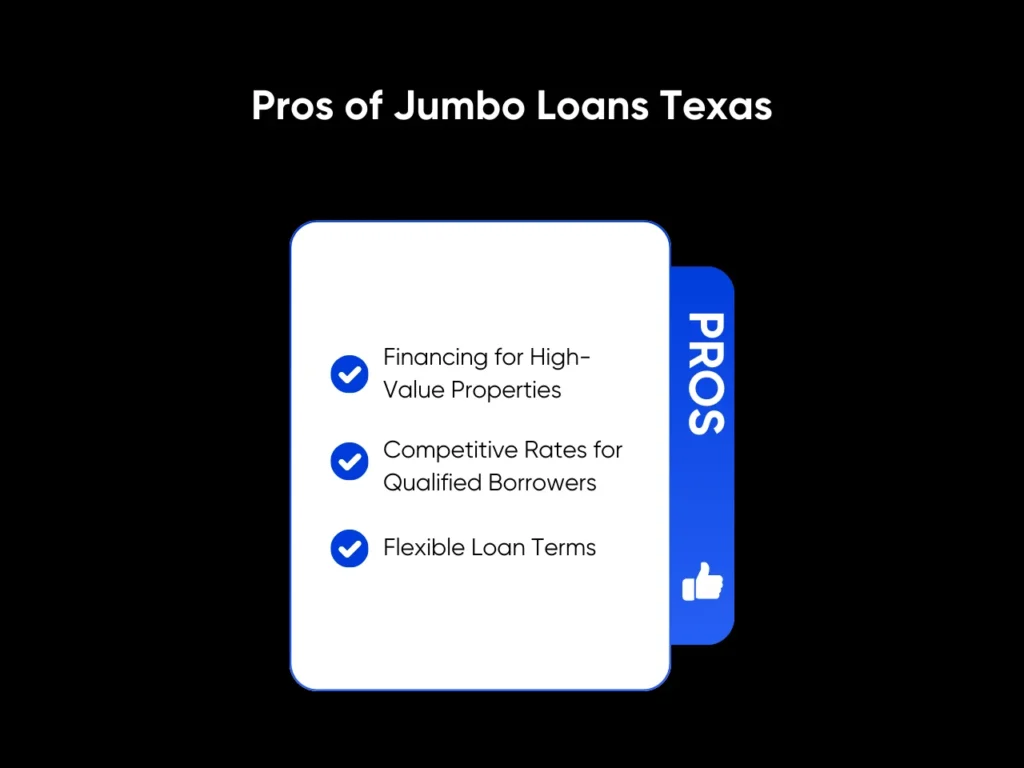

Pros of Jumbo Loans

- Financing for High-Value Properties: Jumbo loans allow borrowers to secure financing for properties that are priced beyond the jumbo loan limit in Texas, which is currently $766,550. They primarily enable borrowers to access upscale real estate in some of the more expensive neighborhoods in Texas, such as around Austin, San Antonio, and Dallas.

- Competitive Rates for Qualified Borrowers: Texas jumbo loan rates are fairly competitive, usually staying close to the national average of around 6.90% (as of November 25, 2024). Although jumbo loan rates are usually higher than those of conforming loans, well-qualified borrowers can still secure attractive rates.

- Flexible Loan Terms: Like other loan products, jumbo loans are available with fixed- and adjustable-rate loan options to suit varying financial plans.

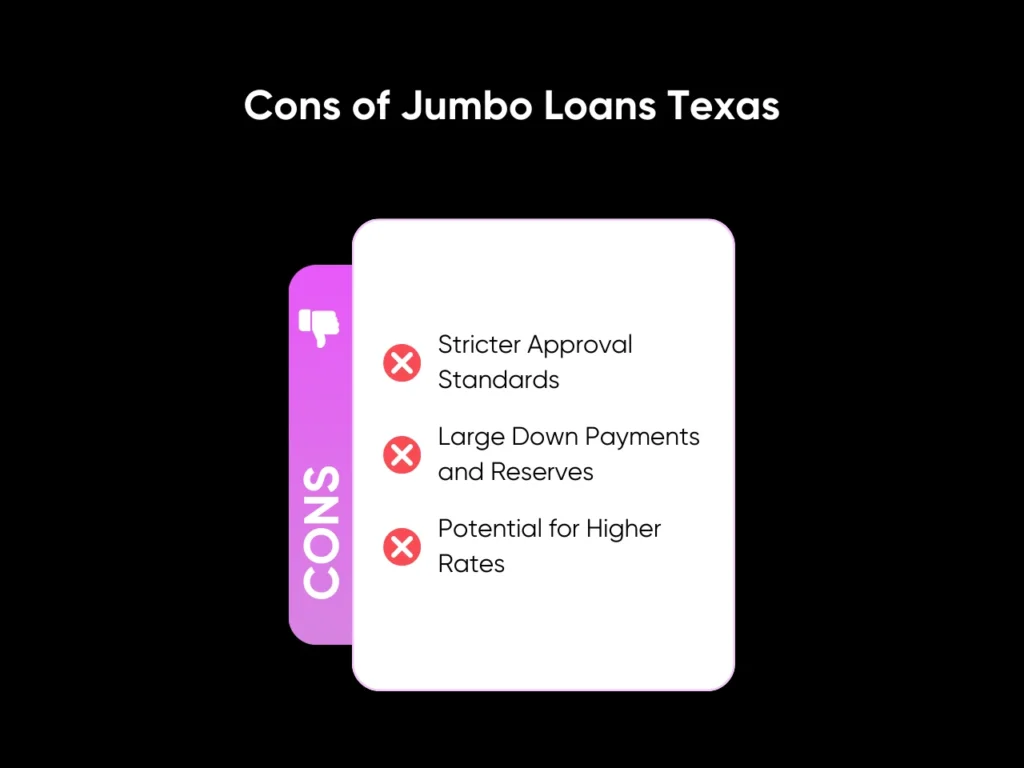

Cons of Jumbo Loans

- Stricter Approval Standards: Because of their higher risk, jumbo loan lenders have higher standards for credit score and financial health. This can make approval challenging if you’re lacking in any of the main eligibility requirements.

- Large Down Payments and Reserves: Jumbo loans usually require similar down payments to traditional mortgages: around 20%. However, since the loan amounts are much larger, the down payment will be higher as well. Jumbo loans can also have significant upfront costs, such as origination fees, appraisal fees, and closing costs, which are often more expensive than the upfront costs on a conventional mortgage.

- Potential for Higher Rates: While borrowers who exceed the minimum requirements can secure better rates, those who just barely meet the requirements can expect higher rates closer to the national average for jumbo loans.

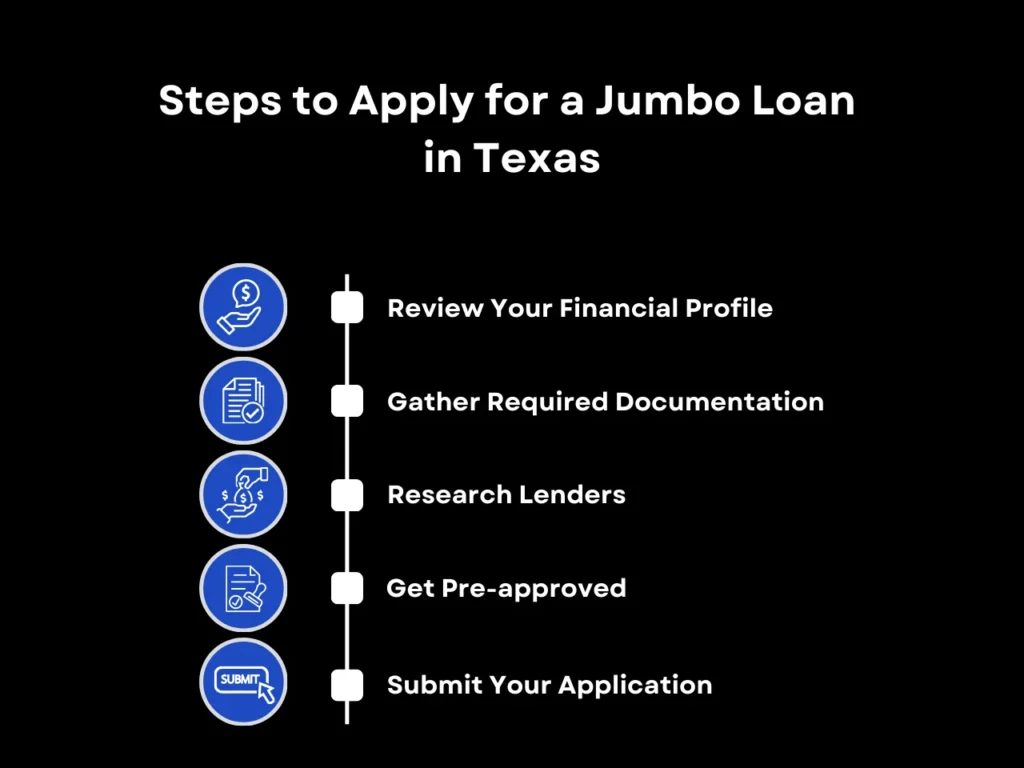

Steps to Apply for a Jumbo Loan in Texas

Jumbo loans in Texas have a similar application procedure as any other type of mortgage but with a few key differences. Make sure to follow these steps for a smooth loan process and to maximize your chances of getting ideal loan terms.

Step 1: Review Your Financial Profile

Ensuring your finances are in top shape before applying for a jumbo loan in Texas increases the likelihood of getting approved with ideal loan terms and higher loan amounts. This would be the time to check credit reports and financial statements for discrepancies and resolve them before proceeding.

Verify that you have enough cash to meet at least 6 monthly mortgage payments. You can estimate how much you’ll have to pay per month by using Defy’s mortgage calculator. It may be worth strengthening your cash reserves to be able to meet up to 12 monthly payments or more to get the best loan terms.

Step 2: Gather Required Documentation

After you’ve verified that your finances are in order, make sure to gather all of the documentation that proves good credit standing, sufficient and stable income, and your non-liquid assets. If you expect to receive gift funds to assist in down payment or upfront costs, lenders typically ask for written consent from your benefactor explicitly stating that the funds sent to you were meant for that purpose.

Step 3: Research Lenders

Once you have all of the jumbo loan qualification requirements ready, start shopping around for Texas-based lenders with the best jumbo loan rates. Assess lenders based on their experience with jumbo loans and familiarity with the Texas real estate market. Local lenders with a strong history of financing Texas real estate purchases will be able to offer valuable insights and competitive terms tailored to the Texas market.

Step 4: Get Pre-Approved

Gaining a pre-approval letter from a lender is optional, but it’s one of the best ways to strengthen your offer on a home. Sellers favor bidders who are pre-approved as they’re most likely to go through with the home purchase.

Pre-approval also allows you to clarify your purchasing power. A pre-approval letter shows the largest loan amount you can get from a lender, so it definitively tells you the price range for your home search.

Step 5: Submit Your Application

Once you’ve selected your ideal property, you can complete the loan application process and prepare for underwriting. During this phase, the lender will often schedule an appraisal to verify the home’s value and that your requested loan amount corresponds to this.

If everything is in order, underwriter approval is given, and you will be asked to sign the closing documents. Once that’s done, the lender will disburse the purchase funds to the seller, who will then give you the keys to your new home.

Jumbo Loan Texas FAQ

What is the minimum credit score for a jumbo loan in Texas?

Typically, a credit score of 700 or higher is required, though some lenders may accept slightly lower scores.

Are jumbo loans available for investment properties?

Yes, jumbo loans can be used for both primary residences and investment properties in Texas.

How do jumbo mortgage rates in Texas compare to conforming loans?

Jumbo loan rates are often slightly higher than that of conforming loans. However, borrowers with strong financial profiles can receive jumbo loans with competitive rates.

Can I refinance a jumbo loan in Texas?

Yes, refinancing options are available for jumbo mortgage loans and may provide opportunities to secure lower rates or adjust loan terms.

What is the jumbo loan limit in Texas for 2024?

The jumbo loan limit in Texas is the same as the baseline conforming loan limit across the US, which is $766,500 as per current federal guidelines for 2024. This means that if you want to take out a loan that exceeds that limit, it will have to be a jumbo loan.

Key Takeaways

With a complete absence of state income and property tax as well as healthy growth in virtually all sectors, buying a home in Texas can be much easier than in other states. However, when it comes to more expensive properties, things can get a little trickier, potentially requiring a jumbo loan Texas, which has stricter requirements to quality for financing.

If you’re interested in a jumbo loan in Texas, ensure that your credit score meets the minimum recommended by your lender, which is often 700 or above. It’s also essential to prove sufficient and stable income and enough cash reserves to sustain several months of loan payments.

Ready to explore your financing options? Talk to Defy today to learn more about jumbo loans and other mortgage products like DSCR loans, home equity lines of credit (HELOCs), and foreign national loans. Whatever your financial goals, Defy is here to make sure you take the right steps on your journey.