With home equity doubling in the last seven years, many homeowners are asking “What is a cashout refinance?”. Cash out refinancing allows homeowners to leverage their home equity for large expenses, such as home renovations or debt consolidation.

At Defy Mortgage, we provide over 75 different conventional and non-traditional lending options. With services ranging from refinances like cash out refinancing to non-QM options such as foreign national loans, we have catered to all kinds of borrowers in the U.S.

With that experience on board, we’ve put together this blog to give the homeowners all they need to know about cash out refinances and what this type of loan can offer. We’ll review all the basics, such as qualification requirements, uses, and benefits. We’ll also discuss the important questions you need to ask to determine if cash out refinancing is right for you in 2025.

Let’s start.

What Is a Cash Out Refinance?

So, what is a cash out refinance? A cash out refinance is a strategic financial refinancing option that allows homeowners to take out a new loan for an amount higher than their existing mortgage, with the difference provided as cash. How much cash you can get depends on your home equity.

To break it down, this refinancing method involves replacing the existing mortgage with a new, larger loan, borrowing more than the current mortgage balance and receiving the difference between the new loan amount and the existing mortgage as a lump sum cash payment. By leveraging the equity built up in their home, owners can obtain needed cash while potentially improving their overall mortgage situation.

Like home equity lines of credit (HELOCs) and home equity loans, cash out refinancing is limited by the equity you’ve built up in your home. Equity reflects how much of your home you own outright, versus what is still owed.

Qualifying for a Cash Out Refinance

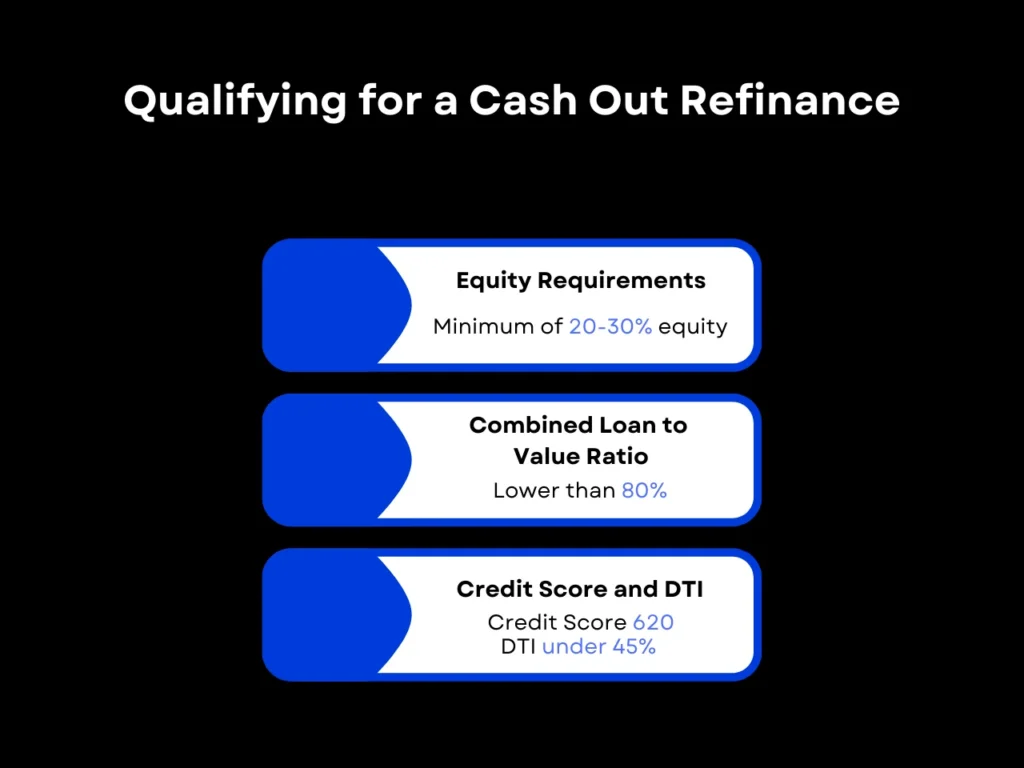

Lenders consider several factors when determining your eligibility for a cash out refinance, including your home’s appraised value, credit score, and loan-to-value (LTV) ratio.

Equity Requirements

Mortgage lenders typically require you to have 20-30% equity in your home before approving a cash out refinance. You must maintain at least 20% equity after refinancing. A home appraisal is necessary to verify your equity, with the costs often included in closing fees.

Combined Loan-to-Value Ratio

For those with a second mortgage, lenders examine your combined loan-to-value (CLTV) ratio. This represents how much you owe on all outstanding loans on the property, including any secondary liens, compared to the home’s value. Lenders typically prefer that your LTV ratio be lower than 80%, usually somewhere between 70-75%, in keeping with the minimum 20% equity requirement.

Credit Score and DTI

Lenders also evaluate your credit score and DTI. The minimum credit score most lenders allow is 620. DTI is best kept at under 45%, but exceeding this may prompt lenders to ask for proof of six months’ worth of debt payments in your bank account.

How Homeowners Can Use Cash from Refinancing

Unlike specific loans like FHA or DSCR loans, a refinance with cash out gives borrowers a lump sum of cash that can be used freely. Some of the most common uses of a cash out refinance include:

- Home Improvements: This option allows homeowners to fund renovations, such as a kitchen upgrade or adding value-increasing features like a deck.

- Debt Consolidation: With enough home equity, a cash out refinance can cover high-interest debts, consolidating them into one monthly mortgage payment, which is especially useful for personal loans or credit card debt.

- Large Expenses: It may make more economic sense to get a cash out refinance for large expenses than conventional loans. Borrowers have used cash out refis for college tuition, purchasing income-generating assets, weddings, and medical bills.

- Business Investments: The amounts made available by a cash out refinance are often large enough to support a business venture or fund a major business expansion.

- Property Investments: If you’ve built up substantial equity, you may be able to withdraw enough cash to purchase rental properties or invest in other real estate opportunities.

- Educational Expenses: A cash out refinance can be a preferable alternative to student loans if rates are lower. It helps reduce outstanding debts and may increase eligibility for other loans.

- Emergency Fund: The cash from refinancing can help build an emergency fund for unforeseen expenses or financial emergencies.

Since cash out refinances give homeowners access to cash, they get the flexibility to use it for a range of financial needs. As an alternative to other types of loans or for debt consolidation, cash out refis can allow borrowers to take advantage of potentially lower mortgage interest rates.

Benefits of Cash Out Refinancing

Cash out refinancing combines several advantages from various financing products. Here are some of its most important benefits:

Lower Interest Rates

Refinancing your mortgage with a refinance with cash out could give you access to funds at a significantly lower rate compared to other borrowing options, especially when timed during periods of low rates or if you live in a particularly low-rate environment.

Debt Consolidation

Even if you don’t use the options of cash out refis to pay off all of your individual debts, it will still combine your first mortgage, mortgage insurance, any second liens, and the cash out refinance itself into a single loan. This can make it more manageable, with only one mortgage payment to worry about each month, and decrease the total number of debts you have, which can affect approval for other loans.

Flexibility

Cash out refinancing provides a lump sum of cash, allowing borrowers to use the funds however they see fit. This gives it an advantage over traditional financing like business loans wherein the lender considers how you plan to use the money. Cash out refinancing can be used for multiple purposes at once, and the sum is also usually a lot larger than you can borrow with a conventional loan or credit card.

Potential Tax Benefits

Depending on how you use the funds, there may be potential tax benefits, particularly if you’re using the money for home improvements. The National Association of Realtors identifies 7 types of tax-deductible home improvements, but your particular state may have its own list of tax-deductible improvements as well.

Potential Credit Boost

Consolidating debt involves using the refinance funds to pay off all your debts in full. This reduces your credit utilization, which can raise your credit score.

Enables Diversification of Your Investment Portfolio

The funds you free up from your home’s equity can be strategically used to diversify your investment portfolio, opening up high-end options such as stocks, mutual funds, or real estate.

Is Cash Out Refinancing Right for You in 2025?

If you’re unsure about pursuing a cash out refinance, remember to assess if your personal financial situation aligns with what the cash out refi can offer you. Although we can’t give you financial advice, we can try to point you in the right direction. Speak with your financial advisor and start by asking key questions:

- How does a cash out refinance work? Do I understand? Knowing that it’s a process where you replace your current mortgage with a larger one, using the extra amount to access your home equity as cash is just the basics. Understanding exactly how a cash out refinance works and the process behind it is equally important.

- Can I answer the following question: “What is a cash out refinance?” Good news is that this article should be able to assist you with that. If you need more information on cash out refis the internet is a great resource (and same with the refinance section of our blog.)

- How Is Your Financial Health? Meeting the minimum requirements may not be enough. If you’re looking to consolidate debt to lower your overall payments, you might need a stronger credit score above 620 to qualify for lower cash out refinance rates. Similarly, consider other factors, such as your DTI and LTV.

- Do You Have Substantial Home Equity? If your home equity isn’t high enough, you may not be able to withdraw enough cash to consolidate your debts or meet your financial targets.

- Can You Handle a Higher Loan Amount? While a cash out refinance could lower interest payments, it may increase your monthly payments due to a larger loan balance. Ensure new payment structure fits your situation.

- Are Current Cash Out Refinance Rates Favorable? Just like primary mortgages, bond yields play a part in current cash out refinance rates. It may be worth waiting for the Fed rate to decrease before deciding on a cash out refinance.

- Are Market Conditions on Your Side? A cash out refinance can be ideal for funding large projects or reducing high-interest debt, but market factors like declining property values may impact your equity or investment returns.

Ultimately, weigh the benefits of cash out refinancing against other options. If interest rate reduction is your primary concern, a rate-and-term refinance may make more sense. Other alternatives, such as a bank statement refinance or a DSCR cash out refinance, may suit your needs more effectively.

Cash Out Refinancing FAQs

How Much Equity Do I Need for a Cash-Out Refinance in 2025?

Most lenders require that you maintain at least 20% equity in your home after completing the cash-out refinance. Because a refinance with cash out gives borrowers a lump sum of cash that can be used freely, how much cash you can get depends on your home equity, and that varies. Usually, LTV for cash out refinance is somewhere between 70-75% depending on the lender, in keeping with the minimum equity requirement.

Can I Use a Cash-Out Refinance for Anything, or Does It Have to Be for Home Improvements?

Yes, you can use the funds from a refinance with cash out for any purpose, whether it’s home improvements, debt consolidation, or personal expenses. However, certain home improvements may qualify you for a tax cut – be sure to speak with your lender about your options before making any decisions.

How Does a Cash-Out Refinance Impact My Credit Score?

Initially, your credit score may drop slightly due to the hard inquiry required, but consistent, on-time payments on your new loan can improve your score over time. Consolidating high interest credit card debt is even better for improving your credit score. With a cash out refinance, you can pay off your outstanding credit card balance in full, effectively rolling them into your mortgage at a much lower interest rate.

What Is the Difference Between a Cash-Out Refinance and a Home Equity Loan?

A cash out refinance replaces your current mortgage with a new one, while a home equity loan is an additional loan on top of your existing mortgage. However, both of them provide a lump sum of cash that the borrower can use for any purpose.

How Do I Find the Best Cash Out Refinance Rates?

Interest rates can vary by lender, so it’s important to shop around and compare offers. Your credit score, loan-to-value ratio, and prevailing market conditions will significantly influence the rate you qualify for.

Key Takeaway

The answer to “What is a cash out refinance?” varies for each homeowner. For some, it’s a tool to consolidate debt and gain peace of mind; for others, it offers a source of capital to improve cash flow. Whatever you intend to do with it, remember to formulate a concrete plan for how you’ll use the funds before closing on the refinance.

Want to learn more about your refinancing options? Let the mortgage experts at Defy fill you in on everything you need to know.