For property investors, few things shape your bottom line more than taxes on sale profits. That’s why Wyoming stands out. Wyoming capital gains tax is completely nonexistent on the state and local level, so whether you prefer Jackson’s luxury markets or Cheyenne’s steady growth, you’ve got a major edge. However, federal rules on depreciation recapture, holding periods, and surtaxes still apply. Those factors can easily swing your net proceeds.

At Defy Mortgage, we provide tailored financing solutions for real estate investors, self-employed individuals, entrepreneurs, and other borrowers with unique financial profiles. Our full 360-degree approach to lending means we account for the various challenges they’ll face on their ventures. Whether it’s capital gains taxes in real estate investing or tailored underwriting for first-time homebuyers, we craft flexible loan packages and provide 24/7 guidance through underwriting, closing, and beyond.

By reading this guide, you’ll discover:

- Why Wyoming’s lack of state capital gains tax gives investors an edge

- How federal tax brackets and rules still apply to your property sales

- Strategic planning moves, including 1031 exchanges, that can reduce your tax burden

- Common pitfalls to avoid when filing and documenting real estate transactions

Let’s jump right in.

Disclaimer: This article is for informational purposes only and should not be considered tax or legal advice.

Understanding Federal Capital Gains Tax Obligations

Although you don’t have to worry about Wyoming capital gains tax, you still have to pay federal capital gains tax. This encompasses any profit made from selling assets like stocks, real estate, and collectibles. What you owe depends on the asset’s holding period, your taxable income, and filing status.

Short-Term vs. Long-Term Capital Gains

The most important distinction between short-term and long-term capital gains is how long you hold the property. If you sell in under 12 months, the profit is treated as short-term capital gains and taxed as ordinary income. That means the gain is added directly to your wages, self-employment income, or retirement withdrawals, potentially pushing you into a higher tax bracket.

For instance, let’s say you earn $100,000 annually, and you purchase a row of cabins in Teton County to flip later on. After 10 months, you sell them all for a total $500,000 gain. Since it’s been less than a year since you purchased the properties, that $500,000 is taxed as ordinary income. This means that instead of paying income tax for your $100,000 regular income, your total taxable income will be $600,000.

However, if you hold the same cabin for at least a full year and a day, the IRS applies the more favorable long-term capital gains rates of 0%, 15%, or 20%, depending on your total taxable income.

2025 Federal Capital Gains Brackets

Because capital gains are “stacked” on top of ordinary income, even middle-income investors in places like Cheyenne or Casper may find themselves partially in the 20% bracket if their gain is large enough.

Federal capital gains tax rates for the tax year 2025:

| Filing status | 0% | 15% | 20% |

| Single | Up to $48,350 | $48,351 – $533,400 | Over $533,400 |

| Married filing separately | Up to $48,350 | $48,351 – $300,000 | Over $300,000 |

| Married filing jointly or qualifying surviving spouse | Up to $96,700 | $96,701 – $600,050 | Over $600,050 |

| Head of household | Up to $64,750 | $64,751 – $566,700 | Over $566,700 |

Suppose you’re a Wyoming real estate investor making $100,000 of taxable ordinary income in the year, and you realize a $500,000 long-term capital gain from selling a vacation rental in Jackson. Let’s run a simulation using the 2025 long-term capital gains brackets:

- Taxed at 0%:

- The 0% capital-gains band covers up to $48,350.

- Your $100,000 ordinary income fills up the $48,350 of space in the 0% band, leaving $100,000 − $48,350 = $51,650.

- This leftover amount “spills over” into the 15% band.

- Taxed at 15%:

- The 15% band tops out at $533,400, so remaining room = $533,400 − $100,000 = $433,400.

- Therefore, $433,400 of your total gain goes into the 15% band. This leaves $533,400 – $433,400 = $66,600 to spill over into the 20% band.

- $433,400 * 0.15 = $65,010 to your total federal tax obligation.

- Taxed at 20%:

- The last $66,600 of your gain settles into the 20% band.

- $66,600 * 0.2 = an additional $13,320 to your total federal tax obligation.

- Total federal long-term capital gains tax:

- $65,010 + $13,320 = $78,330.

Compared to a short-term gain, holding a property for more than a year before selling for a $500,000 capital gain can result in nearly $100,000 in tax savings (provided you make $100,000 a year).

Disclaimer: This estimate is based on 2025 federal capital gains tax brackets and is provided for general informational purposes only. It does not take into account deductions, credits, or other applicable taxes. Your actual tax liability may differ depending on your full financial circumstances. For personalized guidance, consult a licensed tax professional or financial advisor.

Special Considerations

When it comes to capital gains on real estate, it’s not just the basic tax brackets you need to think about. There are a few special rules, surtaxes, and carve-outs that can sneak up on you and significantly change your final tax bill. Here are some of the most important ones to keep in mind:

- Medicare Tax (NIIT): The net investment income tax (NIIT), also known as the Medicare Tax, is a 3.8% surtax that can apply to investment-type income (including capital gains) for taxpayers whose modified adjusted gross income (MAGI) exceeds statutory thresholds (e.g., $200,000 single; $250,000 married filing jointly).

- Primary residence exclusion: If you’re selling your primary residence, you can exclude up to $250,000 if you’re a single filer or up to $500,000 if married filing jointly. However, you must have lived in the home for two of the past five years to qualify for primary residence exclusion.

- Depreciation recapture and unrecaptured Section 1250 gain: When you sell, the IRS makes you “give back” the tax break you get from depreciation. How much you have to pay depends on the depreciation method you used; accelerated depreciation is recaptured as ordinary income, subject to tax rates up to 37%, while straight-line depreciation is taxed separately as “unrecaptured Section 1250 gain” at a maximum rate of 25%.

- Cost-basis adjustment for inherited properties: If you inherited a property that was purchased for a lower amount, your cost basis will be adjusted to the present-day fair market value of the property. For example, let’s say you inherited a property that was purchased at $100,000. By the time you inherited it, the home’s value had appreciated to $500,000. If you sell it for $510,000, only $10,000 of that income will be taxable, even though you technically made a $410,000 capital gain.

- Collectibles and special rates: Gains from collectibles (coins, art, antiques) are taxed at a maximum 28% long-term rate. However, this typically does not affect real estate, unless any collectibles were bundled in the sale.

- Foreign-seller withholding (FIRPTA): If the seller is a foreign person, FIRPTA generally requires the buyer (transferee) to withhold 15% of the amount realized at closing unless a reduced-withholding certificate is obtained.

- Qualified Opportunity Funds (QOF): Reinvesting gains into a Qualified Opportunity Fund within 180 days in 2025 will allow you to defer paying tax until December 31, 2026, or until you sell the QOF investment. Holding the QOF for at least 10 years can also allow you to exclude any appreciation gains you can get from it.

Wyoming’s Tax Advantages for Property Investors

Wyoming is one of the 9 states with no capital gains tax, having levied no state income tax since its inception. Instead, it generates most of its tax income from a 4% sales tax (with local additions bringing the total to approximately 5.4-5.5%). In addition to not having a capital gains tax, it also offers other advantages for potential investors:

Low Assessment Rate for Residential Properties

In Wyoming, only 9.5% of a residential property’s market value is considered taxable. Even the property taxes levied by local jurisdictions abide by this rule. So if you have a property worth $500,000, only $47,500 of its value will be taxable.

This taxable amount is then multiplied by the local mill rate of the Wyoming county that you’re in. On average, this is 68 mills, which equates to $68 per $1,000 of taxable value. That means that on average, a $500,000 Wyoming property costs $3,230 in property taxes to hold each year. This is significantly lower than the national average of $4,495 for a $500,000 property.

No State Estate or Inheritance Tax

Wyoming has no state estate or inheritance tax, meaning that neither the beneficiaries nor the estate as a whole will have tax obligations to the state. Your only possible tax obligation in an inheritance scenario would be federal estate tax, and that is only levied if the total value of the estate exceeds $13.99 million, unless the deceased passed away before 2025 and you were late in filing taxes.

No State-Level Real Estate Transfer Tax

Wyoming doesn’t impose a statewide transfer (conveyance) tax on property transfers, giving investors one less cost to worry about. That said, when transferring real property, you’ll still face county or municipal recording fees and local land-record costs. However, this is usually nominal, amounting to $12 for the first page and $3 for each additional page of the land deed, with exact amounts varying by county.

Comparison: Wyoming vs. Neighboring States

| State | State Income / Cap Gains Tax | Other taxes | Total tax obligation for a $200,000 gain on a $500,000 sale, held for 1 year, with $150,000 annual income |

| Wyoming | None | Average property tax rate: 0.55%Estate tax: NoneInheritance tax: NoneTransfer tax: None | State capital gains tax: $0 Federal capital gains tax: $35,700Property tax for 1 year: $2,750Transfer tax/fees: <$100Total: $38,450 |

| Colorado | 4.4% Capital gains are taxed as regular income | Average property tax rate: 0.530%Estate tax: NoneInheritance tax: NoneTransfer tax: $0.10 per $1,000 of the property’s sale price | State capital gains tax: $8,800 Federal capital gains tax: $35,700Property tax for 1 year: $2,650Transfer tax/fees: $50Total: $47,200 |

| Nebraska | 2.46%-5.2% Capital gains are taxed as regular income | Average property tax rate: 1.61%Estate tax: NoneInheritance tax: Up to 15% of the clear market value of the propertyTransfer tax: $2.25 per $1,000 of the property’s sale price | State capital gains tax: $11,680 Federal capital gains tax: $35,700Property tax for 1 year: $8,050Transfer tax/fees: $1,125Total: $56,555 |

| South Dakota | None | Average property tax rate: 1.14%Estate tax: NoneInheritance tax: NoneTransfer tax: $2 per $1,000 of the property’s sale price | State capital gains tax: $0 Federal capital gains tax: $35,700Property tax for 1 year: $5,700Transfer tax/fees: $1,000Total: $42,400 |

As you can see above, a $200,000 capital gain in Wyoming can be taxed at up to $20,000 less than in a neighboring state like Nebraska. These substantial savings can be reinvested in even more properties, letting you expand your portfolio even faster. DSCR loans are perfect for this purpose because there’s no hard cap on how many DSCR loans you can take out as long as the properties you choose have enough cash flow to cover their debt payments.

Tax Planning Strategies for Wyoming Property Investors

Even though federal obligations still apply, investors can employ careful planning to minimize tax exposure, making Wyoming property investment as profitable as possible:

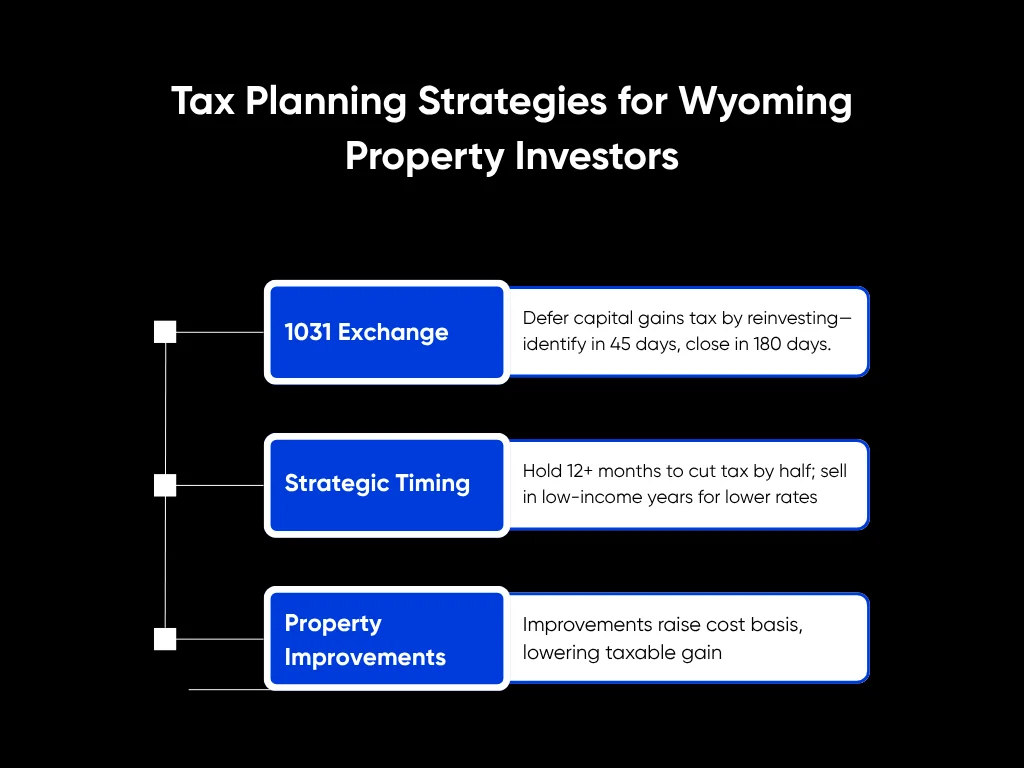

1031 Exchange Opportunities

A 1031 exchange allows investors to defer federal capital gains tax by reinvesting proceeds from one property into another “like-kind” property. This strategy essentially allows you to reinvest the entire proceeds of a sale, instead of the amount after tax.

To qualify:

- You must identify replacement property within 45 days of selling the property

- You must close on this new property within 180 days of selling the previous one

Strategic Timing

Carefully timing the sale can let you claim even more tax savings. We’ve discussed that holding the property for at least 12 months can cut your tax bill by up to half. But you can decrease your tax obligation further if you sell during years in which your income is lower. For example, selling the year you retire from active work or during a lull in business can put you in the 15% federal capital gains tax bracket instead of 20%. Low-income years are particularly favorable opportunities to offload high-end properties you purchased using jumbo loans, allowing you to enjoy the capital gains without having to pay 20% tax on a significant portion of it.

The legal entity you choose for holding property also affects timing and tax outcomes. For instance, owning rentals through an LLC can protect personal assets and allow pass-through taxation, while partnerships and S-corporations can offer additional flexibility in allocating income or losses. Choosing the most compatible entity structure helps you maximize deductions and minimize tax exposure.

Property Improvements

Property improvements not only boost resale value but also adjust your cost basis. This means that if you have a $300,000 property and invest $50,000 in qualifying improvements, your adjusted basis rises to $350,000. So when you later sell for $500,000, your taxable gain is $150,000 instead of $200,000.

But that’s not all. Certain improvements, such as energy-efficient windows, insulation, heat pumps, or biomass boilers, may qualify for tax credits, directly reducing your tax liability. Be sure to keep records of all improvements to substantiate your cost basis adjustments.

Defy Mortgage offers a wide range of easy financing solutions to fund improvements like these, from home equity loans and DSCR cash-out refinances. We offer DSCR cash-out refinances up to 80% LTV, with loan amounts up to $3M at 65% LTV. Options available for multi-families up to 4 units and no-ratio DSCR structures. Zero tax returns required. Zero W2s. Fund based on the properties’ rental income.

Common Pitfalls and How to Avoid Them

Investing in Wyoming real estate offers unique benefits, but it also comes with potential mistakes that can erode returns if not addressed early. Understanding these pitfalls will help you safeguard your portfolio:

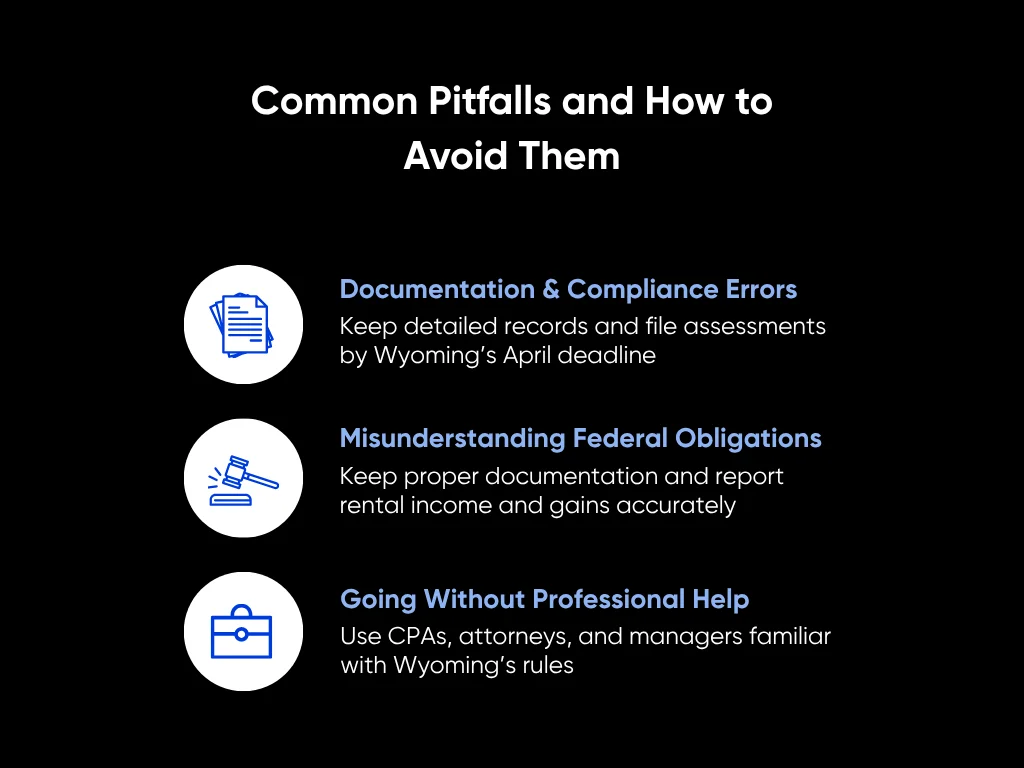

1. Documentation and Compliance Errors

Poor record-keeping and compliance slipups can create disputes with county assessors, delay property sales, or even result in unexpected tax bills and penalties. Maintain detailed records of deposits, expenses, inspections, rent collection, and other documentation surrounding the property. Make sure property assessments are filed before Wyoming’s deadline, which is usually on or before the fourth Monday in April, to avoid disputes or penalties.

2. Misunderstanding Federal Obligations

Remember, rental income and capital gains are still fully taxable at the federal level. Failing to report this income or misunderstanding deduction rules can trigger IRS audits and costly penalties. Make sure you have proper documentation for all of the deductions you intend to claim.

3. Going Without Professional Assistance

Trying to navigate real estate and tax obligations alone can lead you to make costly mistakes. CPAs, attorneys, and property managers familiar with Wyoming’s specific requirements can help you minimize liability, identify overlooked deductions, and ensure filings are accurate and on time. They can also advise on structuring ownership through LLCs or trusts to maximize legal protection and tax efficiency.

Conclusion

The absence of Wyoming capital gains tax makes it a highly investor-friendly tax environment. However, even though there’s no state capital gains tax Wyoming investors still have to account for the federal layer when realizing their gains.

Want a mortgage partner that helps you build your investment strategy around smart tax planning and flexible financing? Look no further than Defy Mortgage. Each of our mortgage products is tailored from the ground up to help you tap into every advantage available to you. Whether you need a bank statement loan to start a high-value 1031 exchange chain or a DSCR loan to scale your portfolio under Wyoming’s investor-friendly tax landscape, Defy makes sure your financing aligns with your investment strategy.

If you’re a mortgage broker, those same perks can be leveraged to win more investor clients and command your market with lending solutions competitors can’t match. Defy TPO arms you with the tools, products, and speed to close deals others can’t even quote, making you the go-to broker for serious investors. Still not convinced? Send us your pricing scenarios, and we’ll show you just how much you can win with Defy’s products. Alternatively, check out our AI Pricer for a quick quote.

FAQ

Does Wyoming have capital gains tax on property sales?

No, as of October 2025, Wyoming has no state-level capital gains tax because Wyoming does not impose a personal income tax.

How much can Wyoming property investors save compared to investors in other states?

That depends on the tax policies of the specific state you’re comparing Wyoming to. If we take a high-tax neighboring state like Nebraska, tax savings can amount to nearly $20,000 for a $200,000 gain on a $500,000 investment property sale if you’re making $150,000 a year. The savings compared to a fellow tax haven like South Dakota are smaller, at just above $4,000.

How does the one-year holding period affect my taxes on Wyoming properties?

Federal tax law treats gains from assets held one year or less as short-term, which are taxed as ordinary income at your marginal rates (up to 37% for 2025). Assets held more than one year qualify for long-term capital gains rates (0%, 15%, or 20% depending on taxable income). If you’re making $150,000 a year and make a total capital gain of $500,000, holding a property for one more day after the one-year mark can mean a difference of up to $100,000 in taxes.

What are Non-QM loans, and why are they beneficial for Wyoming property investors?

Based on Defy Mortgage’s article, Non-Qualified Mortgage (Non-QM) loans are mortgages that don’t meet the CFPB’s “qualified mortgage” standards (they often permit alternative income documentation and different underwriting). They’re useful for Wyoming investors with non-traditional income (ranch revenue, seasonal tourism income, 1099/self-employment, or owners of multiple rental properties) because lenders can underwrite using bank statements, asset qualification, or DSCR instead of standard W-2/tax-return approaches.

How do I find reputable Non-QM loan providers for Wyoming investment properties?

- Prefer specialized investor lenders and Non-QM shops. At Defy, we’ve built our brand on helping borrowers with unique financial profiles, such as investors, navigate complex financing scenarios.

- Look for lenders that demonstrate local market familiarity. Defy’s Mortgage Consultants have over 100 years of collective experience in diverse real estate markets throughout the United States.

For Wyoming investors, Defy mainly offers DSCR loan options to finance properties using rental income instead of personal or business income. Our DSCR purchase loans start with credit score as low as 640 and require a minimum of three months’ reserves.

Qualified borrowers can access up to 85% LTV with 740+ FICO and a DSCR of 1.00 or higher on loan amounts up to $1.5. Our maximum amount goes up to $3.5M depending on LTV and credit score. Running STRs? We have a dedicated STR program tailored for Airbnb and vacation rental operators. Other allowable properties include SFR, PUD, Town Home, Row Home, Site Built Condo, Modular Home, Warrantable/Non-Warrantable Condos, Co-ops, and Condotels. Options available for foreign nationals.

We also offer DSCR cash-out refinances up to 80% LTV, with loan amounts reaching $3 million at 65% LTV. Options available for multi-family properties up to 4 units and no-ratio DSCR structures. Fund based on the properties’ rental income with zero tax returns or W2s required.

What are DSCR loans, and how do they work for Wyoming rental properties?

DSCR (Debt Service Coverage Ratio) loans underwrite the property on its rental income rather than borrower W-2s. Debt service coverage ratio, which is the ratio between net operating income NOI and annual debt service, is the primary approval metric.