Relocating to or expanding your investment portfolio in Georgia? Determining your down payment amount should be a crucial first step. Housing prices can vary widely based on the area, so knowing the current average down payment amount is a great way to build your understanding of the Georgia housing market.

At Defy Mortgage, we streamline the mortgage loan process with 75+ non-traditional solutions tailored to your financial profile, from DSCR loans for investors to bank statement loans and P&L loans to give self-employed individuals an easier path to homeownership. Combined with competitive rates, a fast digital platform, and dedicated end-to-end support, we provide a simplified and uniquely personalized mortgage experience.

In this article, we’ll break down the average down payment on a house in Georgia, and how your credit score, loan type, property selection, and regional price differences all play a role in the minimum amount you need to put down. We’ll also break down the pros of making a bigger down payment versus a smaller one, and give you tips on how to choose the right amount to put down.

Let’s get to it!

Average Down Payment on a House in Georgia

As of 2025, the average down payment on a house in Georgia is approximately $43,485. This is about 12% of the median home price in the state, which is around $365,700. This figure is slightly below the national median down payment of 15%, or $54,310.

Nationally, first-time buyers tend to put down a lower amount than repeat buyers on average (9% versus 23%). Home buyers with proximity to higher-income regions, such as Fayette County and other parts of Metro Atlanta, are usually able to make larger down payments.

What Is a Down Payment and Why Does It Matter?

A down payment is a percentage of the total purchase price that the buyer pays upfront. Although the total out-of-pocket costs may include closing costs, appraisal fees, and home inspection fees, the down payment directly contributes to your equity, reducing the amount of your loan.

Many loans backed by Fannie Mae and Freddie Mac allow for minimal down payments when purchasing a home. However, the typical loan-to-value (LTV) ratio is 80%. This means that if you make a 20% down payment, you will likely improve your chances of loan approval and avoid paying for additional insurance, which could increase your monthly payments.

Why It Matters:

- Borrower commitment: A down payment represents a significant investment from the borrower when purchasing a property. It shows the lender that the borrower is serious about the transaction, which boosts the lender’s confidence and enhances the chances of mortgage approval.

- Loan Amount Reduction: A higher down payment decreases the overall cost of the loan. Putting down 30% instead of 20% on a $300,000 loan, for example, means that interest will only apply to a principal of $210,000 instead of $240,000.

- Loan Availability: The amount of down payment you’re able to afford factors into what types of loans are available to you. If a lender has a loan-to-value (LTV) ratio of 85% for a specific loan product, you may be denied approval if you cannot provide a down payment of 15% of the total property value. Always work with lenders like Defy that can provide alternative options.

- Interest Rates: Larger down payments lead to better terms because it reduces the risk for lenders. Conversely, higher LTV is perceived as higher risk, leading to stricter approval and potentially higher rates.

- Mortgage Insurance: Putting down less than 20% typically requires private mortgage insurance (PMI), adding to your monthly costs.

What Influences How Much You Need for a Down Payment?

Several factors can influence how much you’d need to put down when buying a home. Let’s break it down:

Loan Type

The type of mortgage you choose can directly impact your down payment requirements. For example, DSCR loan down payments depend on the property’s debt service coverage ratio (DSCR). At Defy, we offer as low as 15% down payment for properties with sufficient DSCR. Bank statement loans, on the other hand, can have lower down payments if your bank statements reflect high amounts of income; at Defy, we offer bank statement loans with down payments as low as 10%. Likewise, asset depletion loans can have lower down payments if your assets are highly valued, and so on.

Conversely, some loan types can have lower LTVs (loan-to-value) and thus higher down payments due to their risk profiles. Jumbo loans, for example, usually go no lower than 20-25% because of the high risk involved in purchasing luxury properties. Commercial property loans have similar LTVs and down payment requirements for the same reason.

Home Purchase Price

Down payments represent a percentage of a home’s current market value, which can vary significantly depending on the location within the same state. In Atlanta, the median sale price is approximately $380,000 as of 2025, requiring a 20% down payment of $76,000. In a more rural market like Macon, where the median price is $195,000 in 2025, a 20% down payment would amount to $39,000. You should balance your location preferences with how much you’d be comfortable with putting down.

Credit Score and Financial Profile

Credit score is often the first metric that lenders look at when assessing your application. Higher credit scores of 740 and above unlock the best rates and terms for conventional loans, including down payment options as low as 3%. Those with lower credit scores can still access lower down payment options by choosing loan options that are more lenient with credit score or focus on other factors.

Other aspects of your financial profile can also be scrutinized. Those with higher DTI, for example, can be considered riskier due to their larger proportion of debt compared to their income, so lenders may ask for a higher down payment as a show of their commitment. For some loan types, cash reserves can also be a requirement for eligibility, with lenders possibly requiring a higher down payment if the borrower’s cash reserves are deemed insufficient.

Property Type

Certain properties can also have different down payment requirements due to their nature. For example, condos can have lower purchase prices and thus lower down payments, but they are often excluded from lower down payment options for residential properties, such as Freddie Mac’s Home Possible Advantage mortgage. Multi-family homes are often much more expensive than single-family homes, so their down payments will be higher. However, a DSCR loan can offset this if you want to use it purely as an investment property.

Common Loan Options and Their Down Payment Requirements

Various loan options are available for buying a home in Georgia. Each have specific down payment requirements:

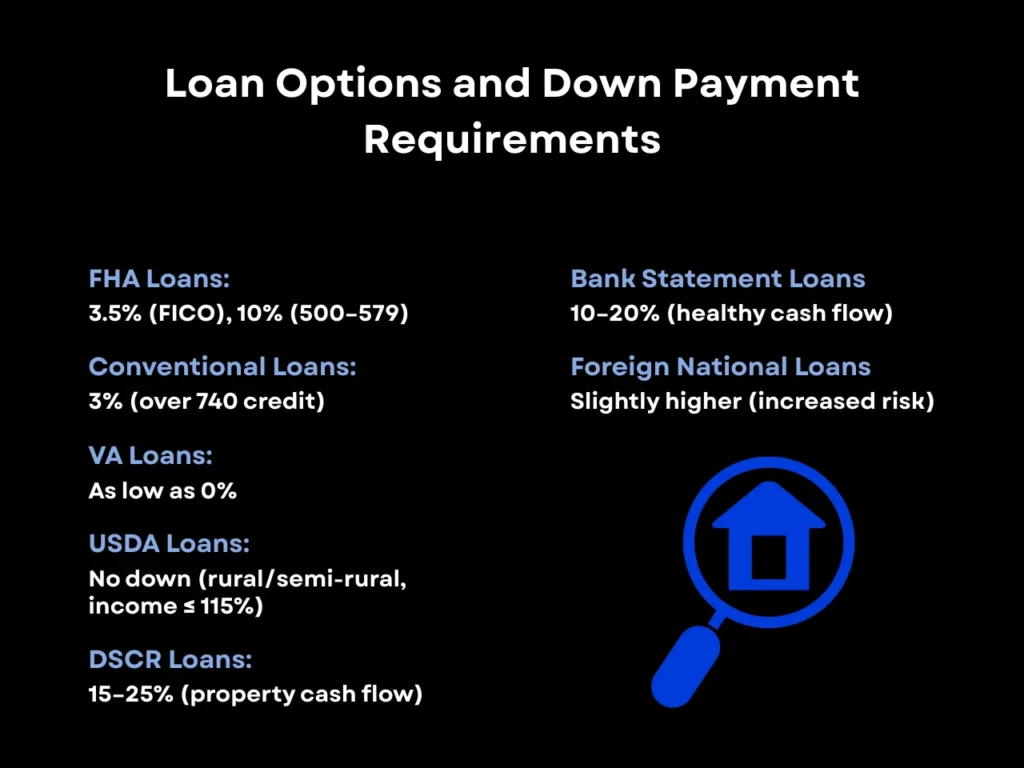

- FHA Loans: Designed to help first-time and disadvantaged homebuyers gain an easier path to homeownership, Federal Housing Administration (FHA) loans allow down payments of as low as 3.5% for borrowers with FICO scores of at least 580. Those with scores between 500-579 can still apply, but will have to put down a minimum of 10%. Keep in mind that mortgage insurance premiums (MIPs) are mandatory for FHA loans regardless of how much your down payment is.

- DSCR Loans: Designed for investment properties, down payments for DSCR loans can typically range between 20-25%. At Defy, however, DSCR loan down payments can be as low as 15% for borrowers with sufficient property cash flow.

- Bank Statement Loans: Perfect for self-employed borrowers, these loans require no tax returns or W-2s, instead using bank statements to verify income. Down payments are typically 20%, but some lenders, like Defy, can go as low as 10% if bank statements show consistent, healthy cash flow.

- Foreign National Loans: Designed for non-U.S. citizens investing in U.S. real estate, foreign national loans encompass various loan types adapted for borrowers who don’t have a US FICO score or Social Security number. Due to the increased risk, down payments for foreign national loans can be slightly higher than their domestic counterparts. However, access to lucrative US property investments and a wide range of alternative income verification methods can counterbalance this.

- VA Loans: Offer as low as 0% down payment for veterans, active-duty service members, and surviving spouses with full entitlement–that is, those who have never used their VA loan benefits, or if they have, have fully repaid their previous VA loan and sold the property. Those with full entitlement also face no loan limits.

- USDA Loans: Require no down payment for properties in areas designated as rural or semi-rural by the USDA, and for borrowers whose income does not exceed 115% of the median income in the area they wish to purchase in.

- Conventional Loans: The minimum down payment required depends on the borrower’s credit score. This can be as little as 3% down with strong (over 740) credit.

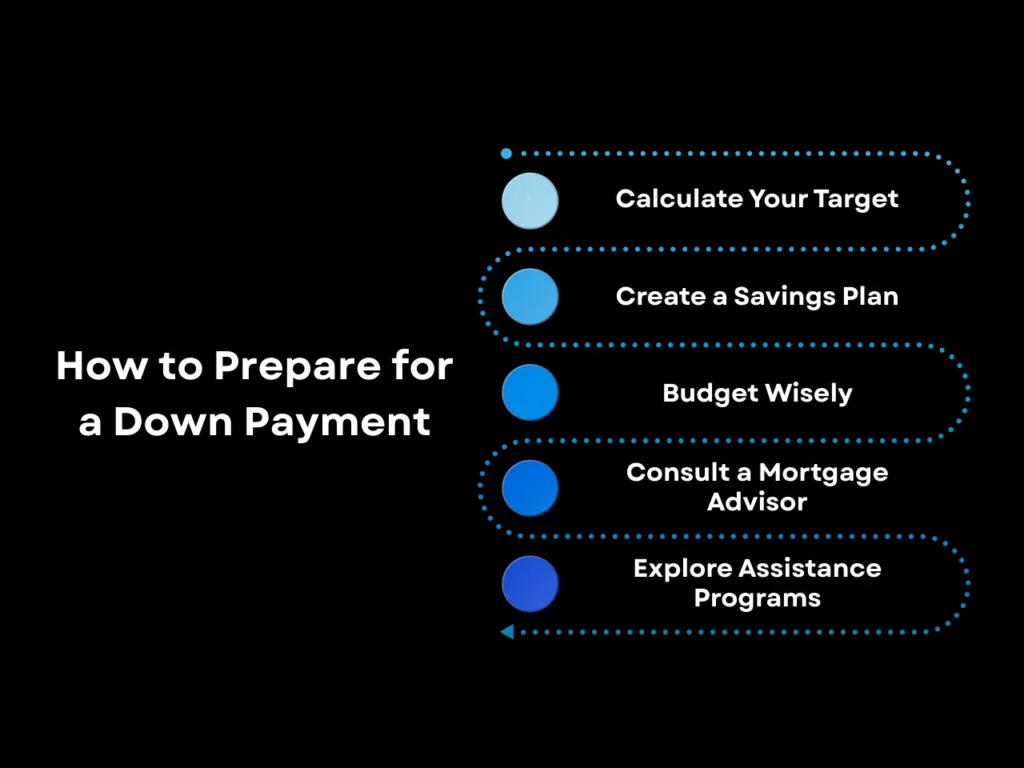

How to Prepare for a Down Payment

Preparing for a down payment involves much of the same steps as saving up for any kind of expense. Here are some steps you can follow to put together your target down payment amount:

- Calculate Your Target: Determine the down payment amount based on your desired home price and loan type.

- Create a Savings Plan: Set a timeline and monthly savings goals to reach your target.

- Budget Wisely: Cut unnecessary expenses and allocate funds towards your down payment savings.

- Consult a Mortgage Advisor: Seek professional advice to understand your options and create a tailored plan. Our mortgage experts at Defy are always standing by to assist you with your concerns.

- Explore Assistance Programs: If you’d like to reduce your down payment, it can be worth looking into state and local programs that offer down payment assistance, such as the Georgia Dream Loan Program, as well as government-backed loans such as FHA, VA, and USDA loans.

Is a Bigger Down Payment Always Better?

While a larger down payment can offer benefits, there are several reasons why you might consider saving your money and opting for a lower down payment. It’s essential to evaluate these advantages against each other to determine the best option for your unique financial situation:

Advantages of a Larger Down Payment:

- Lower Payments Overall: A larger down payment reduces the overall principal and, therefore, the interest you pay on that principal leading to lower monthly debt payments and your total debt service throughout the loan’s lifetime. For example:

- 20% down on a $365,000 property means that your principal is $292,000, and at a fixed mortgage rate of 6.92% over 30 years, your total interest payments would be $401,727.72 and your monthly will be $1,927.02.

- 10% down for a 30-year fixed on a $365,000 at 6.92% means that your principal is $328,500. Your total interest will be $451,943.18, and your monthly will be $2,167.90. Plus, you’ll also pay a total of $17,109.38 in private mortgage insurance over the life of the loan.

- 20% down on a $365,000 property means that your principal is $292,000, and at a fixed mortgage rate of 6.92% over 30 years, your total interest payments would be $401,727.72 and your monthly will be $1,927.02.

These estimates don’t account for other fees such as homeowners insurance, HOA fees, and property taxes. You can use Defy’s Mortgage Calculator to gain a comprehensive estimate on your loan obligations.

- Avoid PMI: For most loans, down payments of 20% or more eliminate the need to purchase private mortgage insurance, further lowering the overall cost of your loan.

- Better Loan Terms: Larger down payments communicate a greater level of commitment to the lender, increasing their confidence and making them more likely to offer better loan terms such as lower interest rates.

Advantages of a Lower Down Payment:

- Increased Liquidity: Putting a significant amount of money into a down payment can reduce your available cash reserves, which can be particularly concerning if you’re an investor. By lowering your down payment, you can improve your cash flow and have more flexibility to enhance your return on investment in other areas, such as upgrading the property’s curb appeal.

- Faster Home Entry: A lower down payment, if a lender accepts, will be much easier to put together than a larger down payment, allowing you to close on the purchase agreement and move in much sooner.

- More Capital For Investments: Reserving liquidity for investments can be highly profitable long-term. Committing funds to a larger down payment can reduce the capital you have available for such ventures.

Average Down Payment on a House in Georgia FAQ

What is the minimum down payment required to buy a house in Georgia?

The minimum down payment depends on the loan type and the borrower’s financial profile. FHA loans allow as low as 3.5% if you have a 580+ FICO score, or 10% if you have a 500-579 FICO score. Conventional loans, on the other hand, allow for down payments as low as 3% for borrowers with over 740 FICO score. Some loan types, such as VA and USDA loans, allow as low as 0% down, while others, such as jumbo loans, require a higher down payment due to their increased risk.

How does the down payment affect my monthly mortgage payment?

A larger down payment reduces the loan amount, leading to lower monthly payments. On the other hand, a smaller down payment increases the loan amount and can significantly raise monthly payments if private mortgage insurance (PMI) is required.

Can I buy a home in Georgia with less than 20% down?

Yes. Many loan options require less than 20% down. There are also state-run programs that provides down payment assistance. Talk to our experts at Defy to find the right option for you.

Does Defy Mortgage offer low down payment loan options in Georgia?

Yes, Defy Mortgage provides a variety of loan options tailored to different financial situations in several US states, including the State of Georgia. If you’re interested in an investment property in Georgia, a DSCR loan can reduce your down payment if your selected property has high cash flow potential. If you’re a business owner, on the other hand, you can avail bank statement loans or P&L loans with as low as 10% down payment if your statements reflect enough income. We also offer lower-down-payment home equity loans, home equity lines of credit (HELOCs), and cash-out refinance for property owners with sufficient home equity.

What are the pros and cons of putting more than the minimum down payment?

Putting more money down means that you’re borrowing less. This will decrease your monthly payments and interest over the long run. You are also more likely to appear as a stronger, more competitive offer.

If you’re putting too much down you may be cash-poor in the short run when it comes to emergencies, home repairs, retirement contributions, or other investment opportunities. Consider these opportunity costs before you decide on how much extra you should be putting down.

Key Takeaway

With the average down payment on a house in Georgia at around 12% in 2025, getting started with a mortgage in the Peach State is an easier path to homeownership than in other parts of the country. Many buyers in Georgia have successfully utilized various resources to secure loans with lower costs. The belief that a 20% down payment is necessary to secure a home is simply a myth.

That said, your actual down payment requirement will ultimately depend on many other considerations like what we’ve discussed above. Credit scores, debt-to-income ratio, location, and even the property type all influence how much lenders will expect you to put down. It’s important to partner with a lender that you truly trust so you can make the most out of the options available to you.

Ready to take the next step and explore low down payment mortgage options in Georgia? Schedule an appointment with Defy and move forward with confidence!

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/