As an investor, you care about how much your property can appreciate each year and what steps you can take to push those returns higher. Appreciation has long been one of the most reliable ways to build wealth. But rather than relying on time alone, you can be more in control of your gains by understanding the key factors that drive average home appreciation per year.

At Defy Mortgage, we have a keen understanding of property appreciation rates and the factors that affect them, so we can help our customers identify investments that have the potential for the best return. Each of our 75+ non-traditional loan options can be customized to help each venture reach its optimal outcome.

Here’s what we’ll cover in this article:

- How home appreciation works

- The major factors that push up (or hold back) the purchase price of a home

- Practical ways to maximize future appreciation and put it to work for your goals

Let’s get right into it.

What Is House Appreciation?

House appreciation is the increase in a property’s value over time due to factors such as demand, inflation, and local market conditions. Average home appreciation per year tends to vary by region, but historically, US homes have appreciated around 3-5% annually.

The balance between supply and demand dictates house appreciation. When demand for housing in an area is higher than supply, property value naturally appreciates. Over time, this dynamic contributes to a gradual increase in property value, which is one of the main attractions of real estate investment and home ownership.

This means a home purchased for $300,000 could increase in value to between $309,000 and $315,000 within a year. It’s important to note that while long-term trends tend to average out, real estate markets typically have short-term fluctuations year-to-year.

How to Calculate Average Home Appreciation Per Year

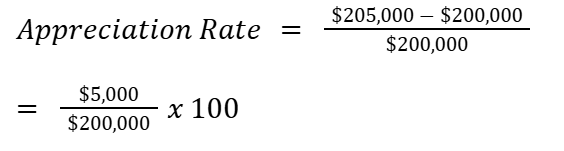

You can calculate the appreciation rate on your home using the formula below. Be sure to use real data so the estimates can be as accurate as possible:

Finding your home’s current value often involves getting an appraisal, but you can work off of a rough estimate taken from similar homes in the area that are in a comparable state in terms of livability and level of improvement. Online tools can provide a quick ballpark, but keep in mind these estimates may not always be accurate. For a more precise valuation, consider consulting a real estate professional who can perform a comparative market analysis (CMA) tailored to your property.

As an example, let’s say you bought a house for $200,000 and its current value after a year is $205,000, the appreciation rate would be:

To get the percentage annual home value increase, simply multiply the rate by 100

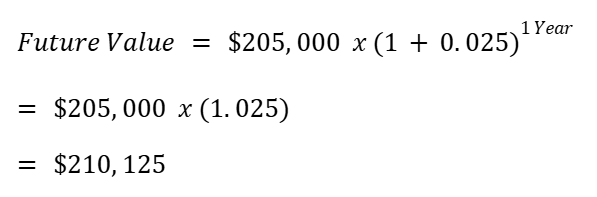

Also, keep in mind that appreciation compounds. This means the appreciation rate applies to your home’s total value in any given year and includes any prior increases. For example, in year 3 of the scenario described above, the 2.5% rate will apply to the $205,000 attained in year 2.

To calculate compound appreciation over multiple years, apply the annual appreciation rate using:

Continuing the above example, the value of your home in year 3 would be:

As you can see, as appreciation compounds, it can lead to a large increase in home equity over time. The longer you hold a property, the more significant the impact of appreciation becomes, as each year’s growth builds on the previous year’s gains.

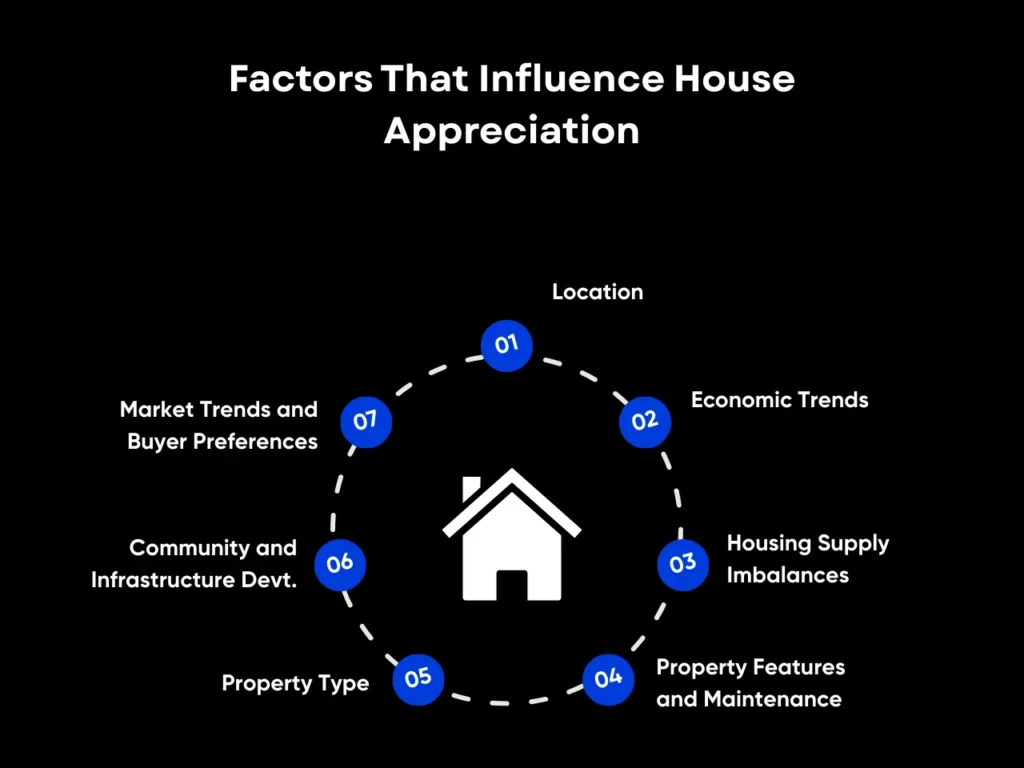

Factors That Influence House Appreciation

Like any commodity, the change in the value of houses is driven by the law of supply and demand. When demand for housing in an area outpaces supply, home prices rise; when supply exceeds demand, appreciation slows or even reverses. Local economic conditions, job opportunities, population growth, and even interest rates all play a role in shifting that balance.

1. Location

Where your home is situated makes the biggest difference in terms of average real estate appreciation rate. Homes in safe neighborhoods with proximity to good schools, public transit, parks, and other amenities appreciate faster because demand is higher.

For example, Nashville, Tennessee, saw a 136.5% increase in prices between 2014 and 2024, according to Construction Coverage. Many relocate to the city to seek opportunities in its booming healthcare and tech industries, as well as due to its reputation as a music and entertainment hub. Pull factors like these are the primary driver of appeal and resale value.

2. Economic Trends

The strength of your region’s economy is another major driver of home appreciation. If the people living in it don’t have the economic power to purchase homes, there won’t be any demand, and prices will fall. Conversely, sheer economic growth can drive up the prices even in an area with average locational benefits.

This was exhibited by home prices in Northwest Arkansas in 2023. Since 2020, the region has been responsible for over half of Arkansas’s job growth. And sure enough, the median price of single-family homes in the area rose 55% between 2019 and 2023.

3. Housing Supply Imbalances

If there aren’t enough homes to meet demand, prices tend to rise. That’s true especially in places with restrictive zoning, slow permitting, or limited available land. A clear recent example of this is Florida, which is currently cooling at a rate faster than the nation’s already cooling real estate market. In Tampa, listings have risen 16.6% year over year as of September 20, 2025, and over a quarter of homes in the area experienced price cuts.

4. Property Features and Maintenance

In 2025, features matter more than ever. Buyers are paying more attention to energy efficiency, modern layouts, and amenities. Of these, smart home technology is a rising priority. Recent buyer surveys show that 77% of home buyers are interested in homes with smart tech, with security systems and thermostats among the highest items on their wishlists.

But shiny features aren’t all that buyers look for. Staying on top of maintenance, like roofing, plumbing, or foundational integrity, lets you avoid critical issues that could reduce property value. Keeping up with these ensures that any upgrades you invest in add on top of your baseline value, not make up for deferred maintenance.

5. Property Type

What kind of home you have, whether it’s single-family, multifamily, or mixed-use, really matters for appreciation, especially depending on local demand. For example, while apartments have consistently high occupancy in the US, single-family rentals (SFRs) are also a growing piece of the market. In 2022, there were about 14.1 million US households renting SFRs; now, there are over 18 million.

In university towns like the Fayetteville-Springdale-Rogers area around the University of Arkansas, small apartments, particularly multifamily homes, have 97.1% occupancy, versus the national average of 95%. Knowing which property types grow fastest in your area helps you adjust your strategy to maximize appreciation potential.

6. Community and Infrastructure Development

Similar to how existing amenities raise the desirability and perceived quality of a neighborhood, new infrastructure and community investments indicate to buyers that a location is well-planned, cared for, and likely to appreciate over time. A good track record of green infrastructure projects like improvements to parks, stormwater systems, and green spaces, can translate into measurable value gains.

Something as small as a public garden can have a big impact; the University of Wisconsin–Milwaukee Center for Economic Development found that a recreational rooftop garden in Milwaukee increased property values in the area by as much as 11%. General infrastructure developments, such as highways and schools, can have similar effects.

7. Market Trends and Buyer Preferences

Lately, trends like remote work have really shaken up where people want to live. Suburban and rural areas are seeing a surge, especially “exurban” spots just beyond city limits. In 2023, for example, Haines, Florida, welcomed around 30,000 new residents, mostly remote workers.

But it’s not just about jobs. Shifts in buyer preferences and lifestyle choices can push the market in surprising ways. Some people, for instance, are choosing to live off-grid or in more rural areas, valuing independence and space over proximity to the city. The results of this shift are very clear: Realtor.com found that homes in rural counties grew 64% in value from 2019 to 2025, compared to only 42% for homes in metro counties.

Tips to Maximize Home Appreciation

You can maximize your home appreciation by making it as desirable as possible to buyers. By strategically investing in home improvement over time, you can potentially see a strong return on investment through higher property value when you sell. Although we can’t give financial advice, we can share some proven ways that could help raise a home’s appreciation rate:

1. Invest in High-ROI Renovations

One of the most effective ways to up your average home value increase per year is through targeted renovations and providing upgrades that are consistently in demand, such as adding energy-efficient appliances and quartz countertops, changing to an open-concept layout, or updating bathrooms with contemporary fixtures. These can typically yield a return in the long run by making your home more appealing to future buyers.

In order to maximize your ROI, it is best to align these upgrades with your neighborhood standards. For example, if your neighborhood typically attracts buyers looking for economical choices rather than luxury upgrades, investing in high-end improvements could lead to diminishing returns. Tailoring your upgrades to what buyers in your area value most ensures you get the best bang for your buck.

2. Stay Informed About the Market

Understanding your local real estate market empowers you to make well-timed decisions. Monitoring housing trends, such as average appreciation rates and pricing in your neighborhood, can help you gauge how your previous decisions have affected your property value and identify opportunities to enhance it.

Additionally, research future developments in your area that can add to property demand, such as new schools, shopping centers, or transportation projects. This can give you an idea of how much your property value could grow from neighborhood improvements.

Knowing when to sell is crucial. Buying during a market dip or selling when demand peaks can significantly impact your returns. Leverage local market reports or consult real estate experts to stay ahead of the curve.

3. Improve and Maintain Curb Appeal

First impressions matter, and curb appeal plays a pivotal role in determining a home’s perceived value. Even simple external improvements, like a fresh coat of paint, well-maintained landscaping, or replacing old fixtures such as outdoor lights or door handles, can make a big difference.

Beyond maintenance, it’d be prudent to stage your home before an appraisal or viewing. Staging involves deep cleaning, redecorating, and rearranging furniture for maximum aesthetic appeal, allowing you to put your best foot forward for both valuation and attracting potential buyers. This can help eliminate undesirable factors that could compromise your property’s curb appeal, thus supporting a fairer and accurate assessment from appraisers and buyers.

How to Benefit from Real Estate Appreciation with the Right Mortgage

Seeing your property’s resale value rise over the years is one of the most rewarding parts of property ownership. But with the right mortgage strategy, you can amplify your appreciation gains several times over. Here’s how:

1. Choose the Right Mortgage Type

Selecting the right financing is critical for capturing appreciation gains. Investment property loans like DSCR loans, jumbo loans, and bank statement loans each have their uses; the key is knowing which one best suits your strategy. Jumbo loans are great for purchasing high-end properties that realize higher gains from appreciation, while DSCR loans are perfect for those interested in rental properties to boost their overall cash flow.

2. Leverage Home Equity

Home equity is the value stored in your home, calculated by taking the difference between your home’s market value and your outstanding loan balance. But since appreciation makes your home more valuable over time, you can own much more in home equity than what you’ve paid on your mortgage so far, especially if inflation has pushed property values further up.

This can make home equity an incredibly powerful tool for investors. Using home equity loans and home equity lines of credit (HELOCs), you can gain access to a large pool of funds that can fuel rapid strategic expansion. This large boost in liquidity can be used to fund repairs, high-ROI upgrades, and perhaps most impactfully, more properties. Depending on your equity, you can potentially use one home to fund another, effectively doubling your portfolio.

3. Refinance Strategically

If mortgage rates drop after you secured your original loan, a well-timed refinance can let you secure a lower interest rate. If you have a portfolio full of rental properties, this can significantly lower your mortgage payments, allowing you to pocket more of the profits. This not only improves your financial position but can also free up funds for renovations or upgrades that can increase your property’s value.

Cash-out refinancing can also provide liquidity to invest in more properties, pay off higher-interest debt, or fund large renovations, all while maintaining ownership of your appreciating assets.

Start Your Home Investment Journey

Interested in becoming a real estate investor? Whether you’re a traditional W-2 worker or self-employed, real estate can be one of the most effective ways to build wealth. The key is to start with a clear plan, the right financing, and a willingness to grow step by step.

Step 1: Define Your Investment Goals

Before diving in, find out what you aim to achieve with your investments. Are you looking to create a long-term stream of passive income using rentals, short-term property flips, or long-term holds? Defining your goals will help shape your strategy and guide your decisions.

Step 2: Educate Yourself on Real Estate Investment Basics

Understanding the fundamentals of real estate investing is essential. Familiarize yourself with key concepts such as cash flow, return on investment (ROI), property valuation, and market analysis. We have plenty of articles to get you started at Defy!

Step 3: Assess Your Financial Situation

Evaluate your current financial standing, including savings, credit score, and existing debts. This assessment will help you determine how much you can afford to invest and what financing options are available to you.

Step 4: Explore Financing Options

With your goals, finances, and basic strategy established, you can then start considering various financing options. At Defy, real estate investors have several, including but not limited to:

- DSCR Loans: Designed for investors, these loans focus on the property’s rental income rather than personal income. Regardless of how much you make each month, as long as a property can generate enough income to pay its mortgage payments, you can secure financing for it. There’s also no hard cap on how many DSCR loans you can have at any time, so you can grow your portfolio as fast as you want.

- Jumbo loans: Offer loan amounts higher than local conforming loan limits, giving you access to high-end and luxury properties.

- Bank statement loans: Allow you to qualify for a mortgage using bank statements to represent your entire income picture; perfect for business owners, self-employed workers, and other individuals with complex incomes.

- Asset depletion loans: Qualify for a mortgage using liquid assets like stocks, bonds, retirement accounts, and mutual funds. The value of these assets is summed up and treated as the borrower’s income.

Real estate investing is much easier with Defy providing the financing. Each of these options is fully customizable to each investor’s exact needs and situation. Whether you’re a self-employed investor or a retiree with significant assets, we can craft a solution that gives you access to the properties you need to build wealth, while keeping your financing flexible.

Step 5: Start Small and Scale Gradually

Start with a more manageable investment, like a single-family rental or a duplex. These have lower maintenance needs and are easier to finance and operate when you’re just starting out.

Depending on your experience with real estate, it helps to build a reliable team early. Surround yourself with professionals who can support your investment journey:

- Real Estate Agents: Specialize in investment properties.

- Contractors: For property renovations and maintenance.

- Accountants: Manage finances and tax implications.

- Property Managers: Handle the day-to-day operations of rental properties.

As you gain experience and confidence, you can expand your portfolio to include multi-family units or commercial properties. Regularly review your investments to ensure they align with your goals, and be prepared to make adjustments based on market conditions, property performance, and personal circumstances.

Key Takeaway

Market factors like location, economic trends, and other regional conditions are all major drivers behind the average home appreciation per year. Understanding these is the first step to positioning yourself towards long-term gains.

But more than selecting a favorable property, smart home improvement planning can significantly accelerate the rate of appreciation, especially if strategically targeted towards the market sector that favors your property.

Ready to start your real estate investing journey? Defy’s got your back. With tailored loan options designed for investors and self-employed borrowers, you can access financing that matches your growth goals, no matter your financial background. Reach out to us on our site, call us at (615) 622-1032, or shoot us an email at team@defymortgage.com. We’re always excited to hear from you!

If you’re a mortgage broker, Defy also has a TPO business to help you bring Defy’s ultra-flexible products to investors who may find it difficult to get off the ground. DefyTPO empowers you with competitive programs, broker support, and fast closings, giving your clients access to the same appreciation-driven wealth strategies used by top investors. Still not convinced? Send a pricing scenario our way and we’ll show you exactly how Defy builds a solution around our borrowers’ needs. Alternatively, try our AI Pricer for a quote.

Frequently Asked Questions About the Average Home Appreciation Per Year

What is the difference between house appreciation and market value?

House appreciation refers to the increase in a property’s value over time, while market value is the current price of a home at a given point in time.

How to prevent depreciation in your home

One of the best ways to prevent depreciation is to stay proactive with maintenance and improvements. Maintenance is perhaps the most important of these, as neglected repairs can decrease a home’s value by up to 10%. Apart from that, you can stave off depreciation by updating your home’s features and increasing curb appeal.

How long does it take for a house to double in value?

It depends on several factors, and no one can truly predict changing market conditions. However, you can apply the rule of 72 and get a quick estimate of when your investment might double in value.

Do all houses appreciate at the same rate?

No, appreciation rates vary by location, property features, and the dynamics of the housing market. Homes in high-demand areas generally appreciate faster.

Is inflation good for homeowners?

It might sound counterintuitive, but inflation can actually benefit homeowners. With a fixed-rate mortgage, your payment stays the same, but because the dollar value is decreasing, that amount is now worth less than it was at the time you locked in your mortgage. And because the cost of everything goes up, so do home values, meaning that inflation can actually make your home appreciate faster.

How to invest in houses that appreciate more rapidly?

Focus on properties in growing markets with strong economic indicators. Areas that are experiencing increased growth due to migration trends and commercial booms are likely to see higher home values due to increased demand in the future. It can be challenging to tell right away which areas are likely to grow due to economic trends, so speaking to experts is advisable to be fully informed before going through with an investment. Defy’s mortgage experts offer free consultations for all of our potential borrowers – simply book an appointment on our site, call us at (615) 622-1032, or email us at team@defymortgage.com

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/