Real estate investors in Georgia leverage debt service coverage ratio (DSCR) loans to expand their portfolios. A DSCR loan Georgia allows them to use rental income and cash flow to secure financing for investment properties. This loan program evaluates the property’s ability to generate income rather than relying on the borrower’s personal income or credit score, ensuring positive cash flow and stable loan payments.

At Defy Mortgage, we provide comprehensive mortgage solutions designed for real estate investors in Georgia. Our Georgia DSCR loan program provides competitive interest rates and flexible loan terms. We understand the challenges of securing financing for rental and investment properties. Our experienced team offers fast, reliable pre-approvals and a seamless approval process – no stress, no long wait-times, no speedbumps. With over 100+ years of combined industry experience serving real estate investors – nationally and internally – Defy Mortgage is committed to supporting your real estate investing goals, whatever they may be.

Our experience and expertise in DSCR loans have enabled us to create this guide to help you understand the DSCR loan Georgia process. We’ll cover the DSCR loan benefits, how to calculate DSCR for Georgia properties, application requirements, essential documentation, and so much more.

By the end, you’ll be equipped to make informed decisions about real estate investing in Georgia, ensuring your investments yield positive cash flow and long-term success.

Let’s dive in!

DSCR Loan Georgia: How Does It Work?

A DSCR loan in Georgia offers real estate investors a flexible financing option tailored to their needs. It evaluates a borrower’s ability to generate sufficient rental income to qualify for the home loan and doesn’t require tax returns or other income documentation.

While traditional mortgages rely heavily on credit history, DSCR loans in Georgia typically require a minimum credit score of 620, allowing for more flexibility for borrowers. DSCR loans can be used to finance the purchase of any investment properties with 1-4 units, such as single-family homes, condos, townhouses, and small multifamily buildings.

The loan amount can range from $150,000 to $3,000,000, and borrowers should make a down payment of at least 20% of the property’s purchase price. The loan-to-value (LTV) ratio can be up to 80%, but subject to vary depending on the lender and specific loan terms.

What are DSCR Loans?

DSCR loans are rental loans designed for real estate investors seeking to acquire or refinance rental properties. Unlike traditional loans, it focuses on the property’s rental income rather than the borrower’s. These loans consider the debt service coverage ratio (DSCR) to assess the property’s ability to cover its debt obligations.

A higher DSCR indicates a stronger ability to cover property expenses, including taxes and monthly payments. Since DSCR loans don’t follow the lending guidelines set by the CFPB, they’re generally considered part of the non-qualified mortgage (non-QM) market.

Key Benefits of DSCR Loan In Georgia

Real estate investors (seasoned and novice) and business owners can benefit from DSCR loan Georgia. This loan offers flexibility and favorable terms, making it an attractive option for non-traditional borrowers. Here are the top five key benefits:

- Flexible Income Verification: DSCR loans focus on the property’s rental income, eliminating the need for income documents like W2s, pay stubs, or tax returns. Having this flexibility in place makes them ideal for business owners, self-employed individuals, and even those with non-traditional income sources, like royalties.

- Easier and Faster Approval Process: As traditional income documentation isn’t required for DSCR loans, DSCR pre-approvals can be up to 50% faster. With fewer constraints of traditional mortgage requirements, DSCR loan Georgia offers a streamlined approach throughout the approval process.

- Competitive Interest Rates: While DSCR loans may have higher interest rates (usually 1-2% above traditional mortgages), they can still be competitive compared to other investment property financing options, such as hard money loans or private lender loans.

- Allows Borrowing for Multiple Properties: There’s no hard limit on how many properties you can buy using DSCR loans compared to traditional mortgages. However, it’s best to check with the lender about their specific guidelines for multiple property financing with DSCR loans.

- No Employment History Requirement: Employment history is not necessary for DSCR loans, making it suitable for freelancers and entrepreneurs with fluctuating incomes. Traditional loans heavily consider the Debt-to-Income (DTI) ratio, which can be a hurdle for freelancers. DSCR loans skip this step and rather focus on property’s rental income.

The DSCR Loan provides significant advantages for non-traditional borrowers. Flexible income verification, easier approval, competitive rates, the ability to borrow on multiple properties, and no employment history requirement make it a valuable option.

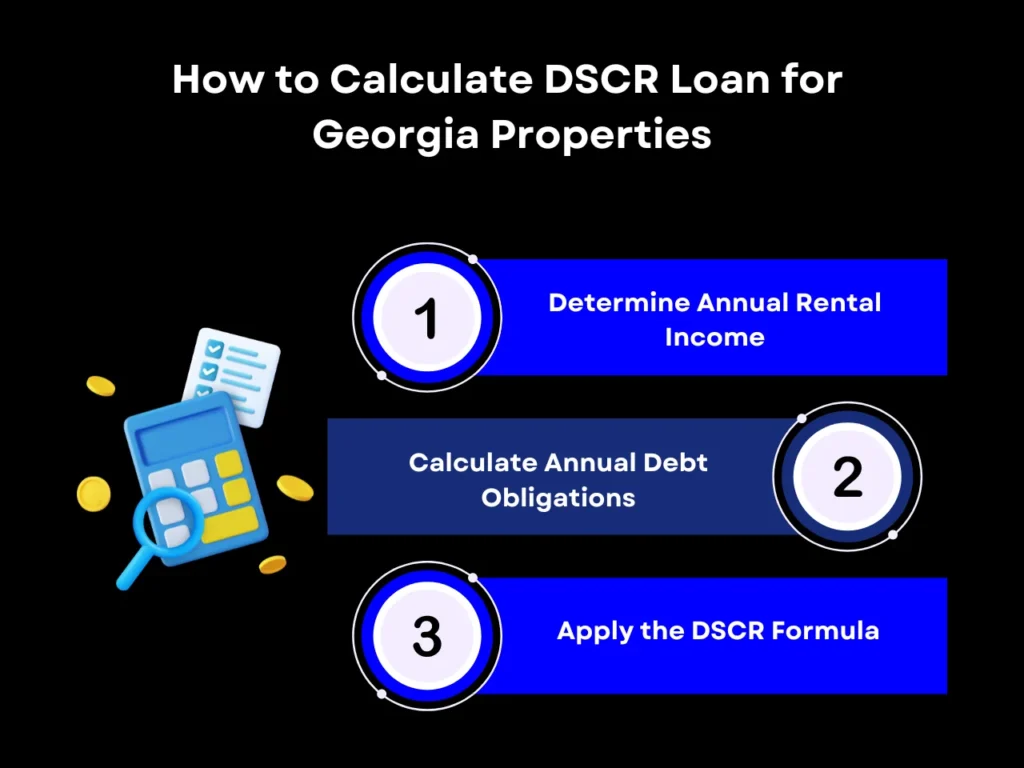

How to Calculate DSCR Loan for Georgia Properties

Calculating the DSCR loan for Georgia properties involves understanding the debt service coverage ratio (DSCR). This ratio helps determine the eligibility for DSCR loans in Georgia. A proper calculation of DSCR is crucial for investors aiming to secure a DSCR loan. Here’s a step-by-step guide to calculating your DSCR:

Step 1: Determine Annual Rental Income

First, gather information on your annual rental income. This involves reviewing lease agreements and utilizing an appraiser who completes a rent schedule on Fannie Mae Form 1007. The lower value between the lease agreements and the appraiser’s estimate will be your rental rate. Alternatively, providing a 12-month history of rental income can also suffice. This step ensures accuracy in determining the rental income for the DSCR loan in Georgia.

Step 2: Calculate Annual Debt Obligations

Next, calculate your annual debt obligations. This includes principal, interest, taxes, insurance, and HOA payments made throughout the year. Accurately summing these expenses provides a comprehensive view of your annual debt obligations, which is essential for DSCR loan Georgia eligibility.

Step 3: Apply the DSCR Formula

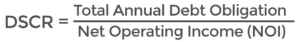

DSCR is calculated by dividing the property’s net operating income (NOI) by the total debt service (including interest and principal payments).

For instance, if your annual rental income is $100,000 and your annual mortgage payments (including principal, interest, taxes, insurance, and HOA) amount to $80,000, your DSCR would be:

DSCR = $100,000 ÷ $80,000 = 1.25

A DSCR exceeding 1 indicates the property generates sufficient revenue to meet its debt obligations. Conversely, a DSCR below 1 suggests the property’s income falls short of covering its debt payments.

Application Requirements and Eligibility for DSCR Loan in Georgia

Obtaining a DSCR loan can streamline investment opportunities, making it crucial for borrowers to understand the application process. Here are the essential factors and requirements to ensure a smooth application:

Eligibility Criteria for Borrowers

While the DSCR loan in Georgia focuses on the property’s income-generating potential, borrowers must still meet specific eligibility criteria:

- Credit Score: Lenders often require a minimum credit score, albeit less stringent than traditional loans. This ensures borrowers have a reasonable credit history.

- Property Type: Eligible properties include single-family homes, multi-family units, and sometimes commercial properties. The property must meet the lender’s guidelines.

- Loan-to-Value (LTV) Ratio: This ratio impacts the down payment and interest rate. A favorable LTV ratio can lead to better loan terms.

- Down Payment: A DSCR loan down payment, typically around 20-25%, is usually required. This lowers the loan amount and showcases the borrower’s commitment. Keep in mind that different lenders have their own risk tolerance and minimum down payment requirements for DSCR loans.

Lenders in Georgia carefully examine the property’s projected income. The property’s condition and location in a strong rental market are vital. Meeting these criteria is crucial for a successful DSCR loan application.

Required Documentation for Applying

The documentation process for a DSCR loan must be prepared to provide various documents to support their application. These typically include:

- Property Appraisal: An appraisal report evaluating the property’s market value is mandatory. This helps determine the loan amount and terms.

- Income Estimation Reports: Documents projecting the property’s income potential are crucial. This includes rent rolls or lease agreements if tenants are already in place.

- Personal Identification: Borrowers need to provide identification documents such as a driver’s license or passport.

- Financial Records: Although less emphasized, personal financial records, such as bank statements and other financial documents, might be required to support the application, depending on the lender.

- Detailed Property Plans: Detailed plans outlining the intended use and income projections are necessary for new or renovated properties, including blueprints and other planning materials.

Preparing these documents thoroughly can expedite the application process and improve the chances of approval.

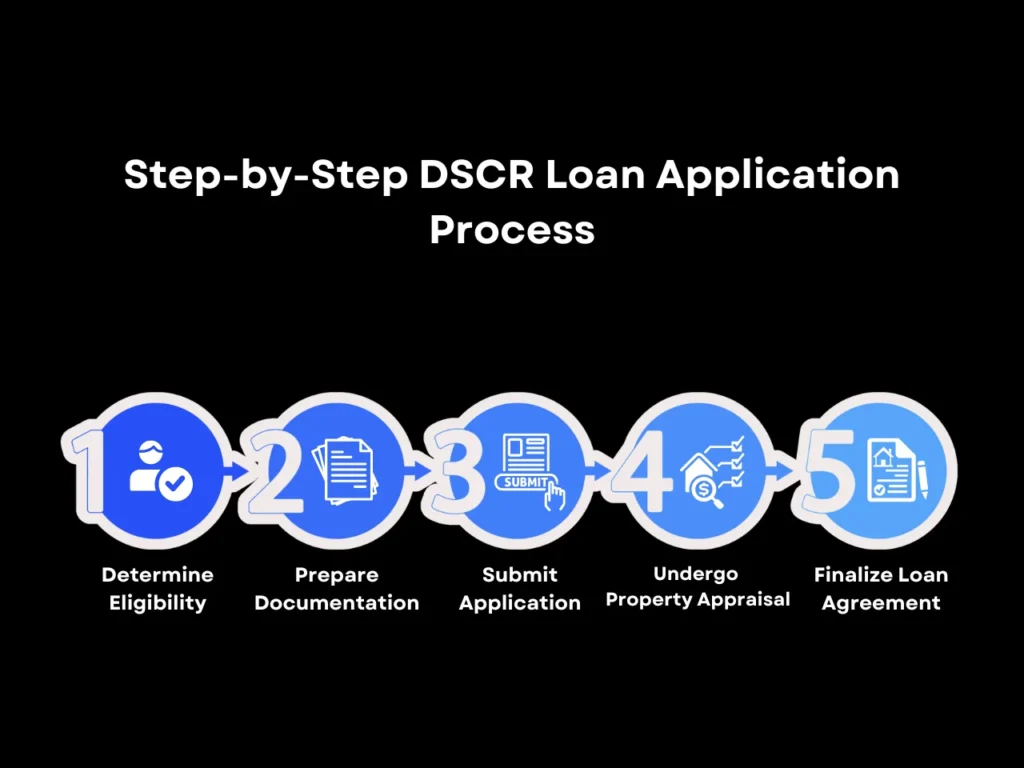

Step-by-Step DSCR Loan Application Process

Applying for a DSCR loan in Georgia involves several key steps that require careful attention to detail. Follow these five essential steps to successfully apply for a DSCR loan, ensuring a smooth and efficient experience. Whether you are a real estate investor, freelancer, or business owner, following these steps will help you navigate the process efficiently and effectively.

Step 1: Determine Eligibility

Applying for a DSCR loan in Georgia starts with checking eligibility. The key factor is the property’s income potential. Make sure your property fits the lender’s criteria, such as DSCR ratios, number of units/property types, and other factors. Also, know the required Loan-to-Value (LTV) ratio, as it affects your down payment and interest rate. Borrowers will also need to meet credit score requirements set by lenders, be able to pay the down payment and show any property documents requested by the lender of their choosing.

Step 2: Prepare Documentation

Gathering the necessary documentation is crucial. Lenders require property appraisal and income estimation reports to assess the property’s income potential. If the property has existing tenants, include rent rolls or lease agreements. Also, be ready to provide personal identification and possibly financial records. If applicable, detailed property-use plans should also be prepared to give lenders a clear understanding of your intentions.

Step 3: Pre-Approval

Research various lender options and speak to multiple lenders to discuss your potential eligibility. Evaluate each lender by considering their terms, interest rates, and requirements. Choose a lender that best fits your needs, focusing on those specializing in non-QM loans, particularly DSCR loans. Obtain a pre-approval from your chosen lender, which will outline the loan amount and terms you qualify for, facilitating a smoother buying process.

Step 4: Submit Application

After gathering all the necessary paperwork, submit your DSCR loan application for a property in Georgia. Ensure your application is comprehensive and filled out accurately to prevent any delays. The application will require details about the property, the anticipated rental income, and your financial circumstances. Providing precise and thorough information assists in expediting the review process swiftly.

Step 5: Undergo Property Appraisal

Once you send your application, the lender will set up a property appraisal. An investment property lender will assess the property’s worth and income-generating capacity during this process. The appraisal makes sure the property meets the lender’s criteria and that its projected income matches their minimum debt service coverage ratio requirement. Passing the appraisal successfully is vital for your application to move ahead.

Step 6: Finalize Loan Agreement

If the property evaluation and supporting papers satisfy the lender’s standards, you’ll move forward to finalize the loan contract. This stage involves examining the loan conditions, such as the DSCR loan interest rate, repayment timeline, and any requirements set by the lender. Carefully review the agreement to ensure you comprehend all terms before signing. After signing the contract, the funds will be released, and you can proceed with your real estate investment.

Key Takeaway

Applying for a DSCR loan offers unique benefits for real estate investors and business owners. The DSCR loan Georgia option proves ideal for those with complex income structures, providing a flexible and efficient financing solution. Understanding the DSCR and its application to Georgia properties can significantly enhance an investor’s portfolio.

However, obtaining a DSCR loan requires careful planning and consideration. Borrowers must meet specific eligibility criteria, including minimum debt service coverage ratios and credit score requirements. Accurate calculation of the DSCR is crucial to ensure loan approval. Proper documentation and selecting the right lender who understands the complexities of DSCR loans can make the application process smoother and more efficient.

Are you ready to leverage your property income with a DSCR loan in Georgia? At Defy Mortgage, we are shaking up the DSCR loan space with competitive terms. With a minimum DSCR ratio of 0.75 – lower than the industry standard of 1.0-1.25 – we make it easier for investors to secure the financing they need at no maximum loan amount. Skip the excessive paperwork and drawn-out processes of traditional mortgage applications. Defy offers a streamlined approach to get you funded faster.

Contact us today to learn more and start your application!

DSCR Loan Georgia FAQs:

- What is a DSCR loan?

A DSCR loan is a financing option for investment properties. Instead of using the borrower’s personal income to qualify for the loan, it uses the income that the property produces.

- How do you calculate DSCR?

DSCR is calculated by dividing the property’s annual net income by its annual debt service. A DSCR of 1.0 or over means that the property is generating enough net income to cover its debt obligations.

- Who would benefit from getting a DSCR loan in Georgia?

DSCR loans in Georgia can benefit a wide variety of people depending on their financing needs. This could include:

- Real estate investors

- Property developers

- Landlords

- Foreign nationals looking to invest in US property

- First-time homebuyers looking to buy an investment property

- Self-employed individuals

- Small business owners

- Partnerships or corporate entities

- Individuals with complex income situations

- What else do you need to qualify for a DSCR loan?

Other than the minimum DSCR, you’ll most likely need good credit and a minimum down payment. Full qualification requirements vary by lender. Some lenders may also request information on the property itself, along with proof of strong rental income history. At Defy, we would need the following to qualify you for a DSCR loan in Georgia:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

- Do you need tax returns to get a DSCR loan?

No, tax returns are usually not required to get a DSCR loan. At Defy, we don’t require any personal income documentation like tax returns, pay stubs, or W2s to qualify you for a DSCR loan.

- What credit score do I need to qualify for a DSCR loan in Georgia?

Specific credit score requirements will vary by lender, but at Defy we require a minimum FICO score of 620+.

- How big of a down payment do you need for a Georgia DSCR loan?

Down payment requirements for a Georgia DSCR loan depend on the lender and your credit score. You can expect to put down anywhere between 15-30% of the property’s value.

- What states can I get a DSCR loan in?

DSCR loans are available in most US states, including but not limited to Texas, California, New York, Florida, Illinois, Tennessee, Massachusetts, and more. For more industry insights and resources, explore the Defy Mortgage blogs today.

- Is it possible to get a DSCR loan for a new construction or a flip in Georgia?

While it’s possible to get a DSCR loan for a new construction or flip in Georgia, many lenders offer loan options that are specifically designed for these projects. Try searching for a construction loan for a new construction or a fix-and-flip loan for a flip. At Defy, we offer all three loan options, and we can help you determine which one is the right fit for your needs.

- Can foreign investors get a DSCR loan in Georgia?

Yes! Foreign investors can get a DSCR loan in Georgia. At Defy, DSCR loans are one of the loan types where we accept non-US citizen borrowers.