Navigating the mortgage landscape can be challenging, especially for first-time homebuyers in the dynamic real estate market of Texas. An FHA loan Texas can offer a promising pathway to homeownership for beginners, particularly for those who might not qualify for conventional loans. However, there can be a few hangups for beginners to get stuck on.

At Defy Mortgage, we deliver a complete mortgage solution that streamlines the home-buying process for both beginner and seasoned homebuyers. Whether you’re an entrepreneur, freelancer, real estate investor, or others, we offer seamless nontraditional lending solutions with no delays, from application to approval. Our platform features competitive rates and effortless mortgage management, specializing in DSCR loans, bank statement loans, and foreign national loans.

Drawing on our extensive experience in the Texas housing market and both non-qm and qualified mortgage (QM) loans, we’ve designed this blog to familiarize you with FHA loan requirements in Texas. Below, we’ll pinpoint common mistakes that first-time homebuyers often make and discuss their consequences. Afterward, we’ll provide effective solutions and strategies to help you sidestep the pitfalls of taking out an FHA loan Texas, saving you time, money, and stress.

Let’s dive into the details.

FHA Loan Texas: How Does It Work?

An FHA loan Texas is a mortgage backed by the federal government designed to make homeownership more accessible, especially for first-time homebuyers or individuals with lower credit scores. FHA loans are issued by lenders approved and insured by the Federal Housing Administration (FHA).

The FHA program operates under the U.S. Department of Housing and Urban Development (HUD). It aims to increase homeownership by providing mortgage insurance on loans made by FHA-approved lenders. This insurance helps reduce lenders’ risk, making it easier for borrowers to qualify for a mortgage.

Key Benefits of FHA Loans

FHA loans offer several advantages that make homeownership more accessible and affordable. Here are some of the most notable benefits:

- Lower Down Payments: Down payments for FHA loans are typically as low as 3.5% of the purchase price, making it easier for buyers to enter the housing market.

- Lenient Credit Score Requirements: The minimum credit score required to take out an FHA loan is generally lower than those for conventional loans, often as low as 580.

- Suits Borrowers With Past Credit Issues: Even with past credit issues such as bankruptcy or foreclosure, borrowers can still avail of FHA loans to rebuild their credit. While 2-4-year waiting periods still apply, they are generally shorter than conventional loans, which are typically around 7 years, depending on extenuating circumstances.

- Assumable Loans: FHA loans can be transferred to a new buyer, which can be an attractive selling point if you decide to sell your home. Factors such as the loan origination date, buyer qualifications, and lender fees can influence the process.

- More flexible debt-to-income ratio (DTI) requirements: Some FHA lenders permit a front-end DTI as high as 31% and a back-end DTI as high as 50%. FHA loans are designed to accommodate borrowers with more flexibility.

Keep in mind, however, that the exact terms and credit requirements can change over time and may vary slightly depending on the mortgage lender. Checking the FHA guidelines or consulting with lenders for up-to-date and personalized information is highly advisable.

Eligibility Criteria

To qualify for an FHA loan in Texas, applicants must meet these requirements:

- Credit Score: A credit score of at least 580 is needed to get the lowest down payment rate of 3.5%. Applicants with credit scores between 500 and 579 can still qualify but will have to make a higher down payment, typically around 10%.

- Debt-to-Income Ratio: The FHA recommends that the borrowers’ DTI ratio be around 43% and not exceed 50%. The gross mortgage payment should also not be more than 31% of the borrower’s gross monthly income. A higher DTI can limit your borrowing power even if you have a good credit score.

- Primary Residence: The property has to be registered as the borrower’s primary residence. If the borrower has a different primary residence, they must register the new home as their primary residence and occupy it for at least one year.

- Proof of Income and Employment: Borrowers must demonstrate stable employment and provide proof of income.

- Mortgage Insurance: Borrowers must pay mortgage insurance premiums (MIP) upfront at closing and monthly as part of their loan payment.

- Down Payment Requirements: With an FHA loan, you could be eligible to put down as little as 3.5%. However, generally, lenders will only allow borrowers to put down 3.5% if their credit score is above 580. Borrowers with a credit score between 500-579 may need to put down up to 10%.

If you have issues with any of these criteria, it may be time to consider a non-QM loan over an FHA loan. FHA loans are typically Qualified Mortgages (QM) and are thus subject to strict compliance regulations.

Comparison with Conventional and VA Loans

When considering FHA loans in Texas, it’s best to compare them with conventional and VA loans. Each type of loan has its own advantages and criteria that may make it more appealing in specific scenarios.

- Conventional Loans: Conventional loans require higher credit scores and larger down payments from borrowers. One key advantage is that no mortgage insurance is required when you make a down payment of 20% or more. These loans are widely available through private lenders, can be used for various types of properties, and are not subject to the stringent requirements of FHA loans. Likewise, conventional loans are not government-backed, don’t have loan limits and only require PMI if there is less than 20% equity in the home.

- VA Loans: VA loans cater exclusively to veterans and active military members. They feature zero down payment and no mortgage insurance, although they come with stringent eligibility requirements. These loans are backed by the Department of Veterans Affairs (VA) – meaning they are government-backed and are known for their favorable terms and protections for military personnel. VA loans have no loan limilts and have more basic property standards.

Common Mistakes to Avoid as a First-Time FHA Loan Applicant

Applying for an FHA loan in Texas can be an exciting step toward homeownership, but there are certain pitfalls that first-time FHA loan applicants tend to get trapped in. Being well-informed and prepared can save you time, money, and stress. Make sure you avoid these common mistakes:

Overlooking Total Housing Costs

Many first-time homebuyers tend to focus only on the mortgage’s monthly payment and overlook other housing costs, such as property taxes. Property taxes in Texas are the seventh highest in the United States and are the largest tax Texans pay. On average, a Texas homeowner pays $3,797 in property taxes annually. To avoid getting caught off guard by unexpected costs, it’s essential to properly budget for housing expenses like taxes, insurance, and maintenance.

Ignoring these costs can lead to significant financial strain, following which, in many cases, a borrower defaults. In Texas, natural disasters like hurricanes or tornadoes are common, so maintenance is a crucial aspect of homeownership in the state. Proper planning can help prevent an expensive repair job that may cause you to miss out on loan repayments.

Ignoring Loan Comparison Shopping

Texas has a competitive mortgage market due to its diverse economy, population growth, and housing affordability. Because of this, there are a large number of lenders that offer FHA loans in Texas, so it’s best to compare loan offers from as many of them as possible to find the best deal. Additionally, for self-employed individuals, exploring alternative options like Texas P&L loans can provide a viable pathway to homeownership.

Remember to consider the interest rate, loan term, lender fees, and other costs associated with the loan offer. For instance, certain Texas state laws can impact closing costs, so understanding how these regulations factor into loan offers can give you a clearer picture of your total repayment obligations. Take your time to explore various options and make an informed choice that best suits your financial situation.

Not Checking Credit Report Before Applying

Make sure to review your credit report before applying for an FHA loan Texas. Errors or outdated information in your report can lead to a higher interest rate and may prevent you from being eligible for the loan in the first place. Correct any mistakes to qualify for better loan terms, such as lower interest rates and more favorable repayment options.

Credit scores in Texas can significantly impact FHA mortgage rates. The insurance market in the state is also highly competitive, and the region’s susceptibility to natural disasters affects how insurers assess risk and determine premiums. Monitoring your credit regularly can help you spot issues early and take steps to improve your creditworthiness.

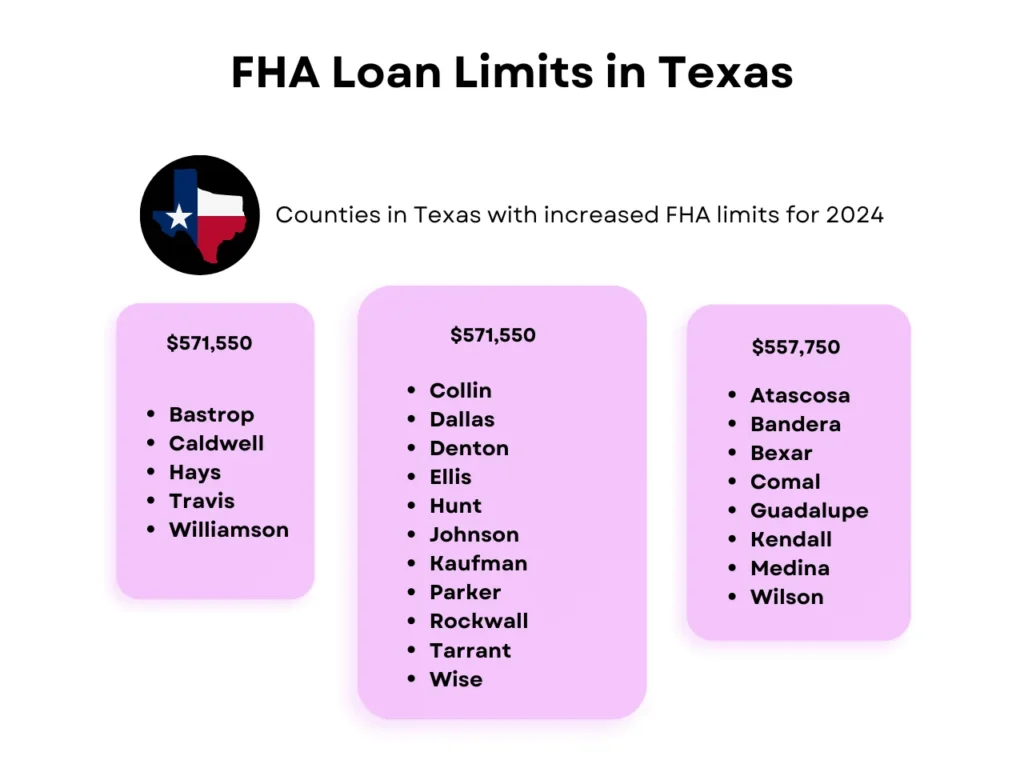

FHA Loan Limits in Texas

FHA mortgage lending limits in Texas vary across different counties based on local housing market conditions and are adjusted every year depending on changes in property values. Most counties in Texas have an FHA loan limit of $498,257 for a single-family home. However, counties with higher property values have higher limits to accommodate more expensive houses in the market. Let’s explore this in more detail below.

Texas Counties with Higher FHA Loan Limits in 2024

Counties | Units | |||

| Single | Duplex | Triplex | Fourplex | |

| Atascosa | $557,750 | $714,000 | $863,100 | $1,072,600 |

| Bandera | $557,750 | $714,000 | $863,100 | $1,072,600 |

| Bastrop | $571,550 | $731,700 | $884,450 | $1,099,150 |

| Bexar | $557,750 | $714,000 | $863,100 | $1,072,600 |

| Caldwell | $571,550 | $731,700 | $884,450 | $1,099,150 |

| Collin | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Comal | $557,750 | $714,000 | $863,100 | $1,072,600 |

| Dallas | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Denton | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Ellis | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Guadalupe | $557,750 | $714,000 | $863,100 | $1,072,600 |

| Hays | $571,550 | $731,700 | $884,450 | $1,099,150 |

| Hunt | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Johnson | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Kaufman | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Kendall | $557,750 | $714,000 | $863,100 | $1,072,600 |

| Medina | $557,750 | $714,000 | $863,100 | $1,072,600 |

| Parker | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Rockwall | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Tarrant | $563,500 | $721,400 | $872,000 | $1,083,650 |

| Travis | $571,550 | $731,700 | $884,450 | $1,099,150 |

| Williamson | $571,550 | $731,700 | $884,450 | $1,099,150 |

| Wilson | $557,750 | $714,000 | $863,100 | $1,072,600 |

| Wise | $563,500 | $721,400 | $872,000 | $1,083,650 |

Depending on the unit, buying a home from Atascosa, Bandera, Bexar, etc., will give you the highest loan limits and also the highest home prices. Keep in mind that the Department of Housing and Urban Development (HUD) revises these limits annually to keep pace with housing market trends. For more information, visit the FHA website to learn more about the FHA loan limits for Texas counties in 2024.

Strategies For Maximizing Your FHA Loan

The FHA loan limits for your county will define your total borrowing capacity. If the loan limit in your desired area is lower than the price of the home you want to buy and other costs you’re anticipating, you may need to make certain adjustments. Consider these strategies to expand your options:

- Consider Other Counties: Several Texas counties have higher FHA loan limits to compensate for their more expensive local housing prices. It’s worth shopping around to find the county that strikes the perfect balance between loan limits and housing prices.

- Adjust the Loan Amount: If choosing a different county to buy a home is not possible, opting for a smaller loan may be a good strategy. You may need to source additional funds from savings or other financing options, such as a Texas DSCR loan.

- Choose a Different Property Type: If you need a larger FHA loan limit, consider buying a multi-family home. Alternatively, it may also be worth considering a smaller home if the loan limit for a larger property in your chosen county is insufficient.

Using these strategies can help you find a home that fits your needs and stays within your financial limits. Making a more informed decision about your home purchase will allow you to save more money in the long run.

FHA Loan Texas FAQs

1. What is the minimum credit score for an FHA loan Texas?

The minimum credit score required for an FHA loan in Texas is typically 580 to get the highest loan amount allowed by the loan limit in your chosen county, as well as the lowest downpayment of 3.5 percent. However, some lenders may have higher requirements depending on their specific requirements and policies regarding underwriting and lending.

2. Can I apply for an FHA loan with a co-borrower?

Yes, you can apply for an FHA loan in Texas with a co-borrower who has a strong credit history and stable income. A co-borrower is not obligated to live in the property you’re buying, increasing your chances of being approved while securing better loan terms. However, there are different down payment requirements depending on whether the co-borrower is a relative or not.

3. What are the mortgage insurance requirements for FHA loans?

FHA loans require mortgage insurance premiums (MIP) both upfront and annually. This insurance is required by lenders to protect them in case of default. The upfront MIP is typically 1.75% of the loan amount, while the annual MIP varies based on the loan amount, term, and loan-to-value ratio.

4. How do FHA loan interest rates compare to conventional loans?

FHA loan interest rates can be much lower than that of conventional loans. However, this is dependent on mortgage insurance requirements and other factors such as the borrower’s credit score, down payment amount, and overall financial profile. Additionally, while FHA loans offer lower rates, the required mortgage insurance premiums may offset some of these savings.

5. Can I get an FHA loan if I already own a home?

Yes, you are allowed to get an FHA loan in Texas even if you already own a home. However, you will have to register the newly purchased home as your primary residence. The FHA also mandates that borrowers live in their new primary residence for at least one year, meaning that they will have to vacate their first home.

6. Difference between FHA loans and non-QM loans?

- Government backing: FHA loans have it, non-QM loans don’t.

- Conformity to standards: FHA loans adhere to Fannie Mae and Freddie Mac guidelines, while non-QM loans aren’t bound by these rules.

- Lending criteria: For non-QM loans, individual lenders set their own requirements, allowing for more flexibility to accommodate borrowers with atypical situations.

Key Takeaway

Securing an FHA loan Texas has a number of nuances and hurdles that first-time homebuyers should understand to ensure a smooth experience. Understand the eligibility requirements and gather all essential documentation ahead of time to streamline the application requirements. Remember that property requirements vary in different counties to avoid potential setbacks.

If you’re a first-time, novice homebuyer in Texas, make sure to budget for all housing costs, compare loan offers, and check your credit report before applying for an FHA loan Texas. You can get the most ideal offers by considering a variety of Texas counties to buy in, as well as the size of the property and the loan amount you need.

Looking for more tailored mortgage solutions and expert guidance on FHA loans? Defy Mortgage is here to help. If you’re looking for another blog post on FHA loans, check out our Florida FHA Loans and Lenders Complete Guide.

At Defy, we make homeownership accessible and are committed to redefining your mortgage experience in both non- and the “traditional” ways. Explore our other QM mortgage options, including jumbo loans, conforming, and HELOCs today, and let Defy Mortgage guide you towards achieving your dream home.