Creative financing in real estate is a novel approach to funding property investments without relying solely on traditional bank loans. The various financing methods under this category all focus on removing financial barriers, leading to a faster overall process and insulating the borrower from issues such as job loss and irregular cash flow.

At Defy Mortgage, we provide 75+ non-traditional loan options, each fully customizable to fit your unique financial situation. Whether you’re an entrepreneur, freelancer, or real estate investor, our mortgage experts can formulate a creative solution to help you reach your goals. We’re highly familiar with creative financing techniques and offer various mortgage products that streamline the path to investment real estate financing.

In this article, we’ll explore various creative financing strategies, their advantages, and the challenges you can face when opting for these loan types for your next real estate deal. We’ll also discuss some best practices to keep in mind to maximize their benefits.

Let’s get started.

What Is Creative Financing in Real Estate?

Creative financing in real estate refers to unconventional strategies or methods used to fund property purchases, usually bypassing traditional loans. These options are especially desirable when they help investors overcome credit constraints, close deals faster, and minimize the need for cash upfront.

Pros and Cons of Using Creative Financing

Creative financing offers more flexibility and accessibility for investors who are looking to grow their real estate portfolios. When leveraged correctly, these options will allow you to maximize your return on your next investment property. Before you determine which type of financing is right for you, be sure to consider its benefits and risks:

Benefits of Using Creative Financing

- Flexibility: Creative financing allows for customized payment terms and financing structures tailored to the specific needs of the investment. Investors can negotiate everything from interest rates to repayment schedules, creating solutions that wouldn’t be possible with traditional loans.

- Accessibility: Creative financing provides an alternative path to property investment that traditional lenders might deny for individuals with limited credit history, poor credit scores, or irregular income streams.

- Lower Upfront Costs: Many creative financing methods have low down payment requirements, making it easier to acquire properties without a large cash reserve. This lowers the barrier to entry for new investors or those looking to expand their portfolios quickly.

- Faster Closures: Creative financing can significantly shorten the time it takes to close a deal by bypassing traditional bank approval processes. This is especially beneficial in competitive markets where speed is crucial.

- More Options For More Borrowers: Entrepreneurs, real estate investors, gig-economy workers, contract workers, retirees, those with several income streams, foreign nationals — all of these borrowers have more customizable loan options with creative financing on the non-QM side of things.

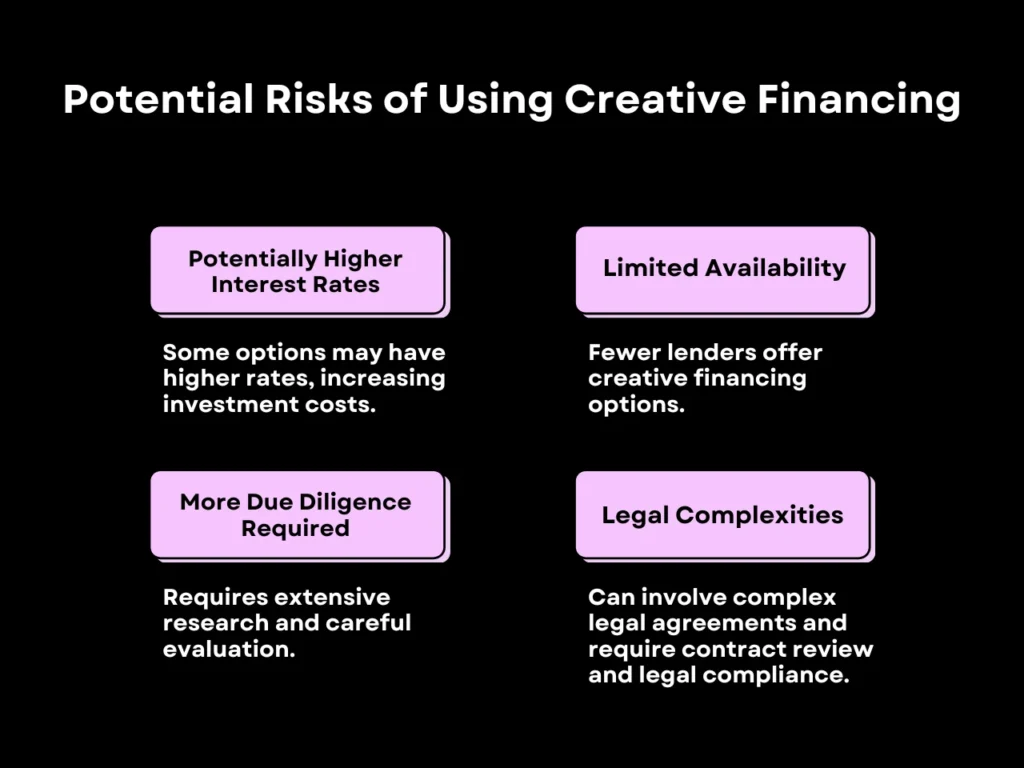

Potential Risks of Using Creative Financing

- Potentially Higher Interest Rates: Some creative financing options, such as private loans or seller financing, can have higher interest rates than traditional mortgages. This can increase the overall cost of the investment over time.

- Limited Availability: Not every lender offers creative financing options and there can be fewer resources than traditional offerings.

- More Due Diligence Required: Because availability is limited, creative financing often requires thorough research, careful evaluation, and keen oversight.

- Legal Complexities: Certain creative financing agreements, particularly those that involve sellers or third parties, can involve intricate legal arrangements that require a thorough review of contracts and compliance with local laws.

Note that these cons can easily be managed by selecting a trusted lender that specializes in non-traditional lending solutions, such as Defy.

Common Types of Creative Financing

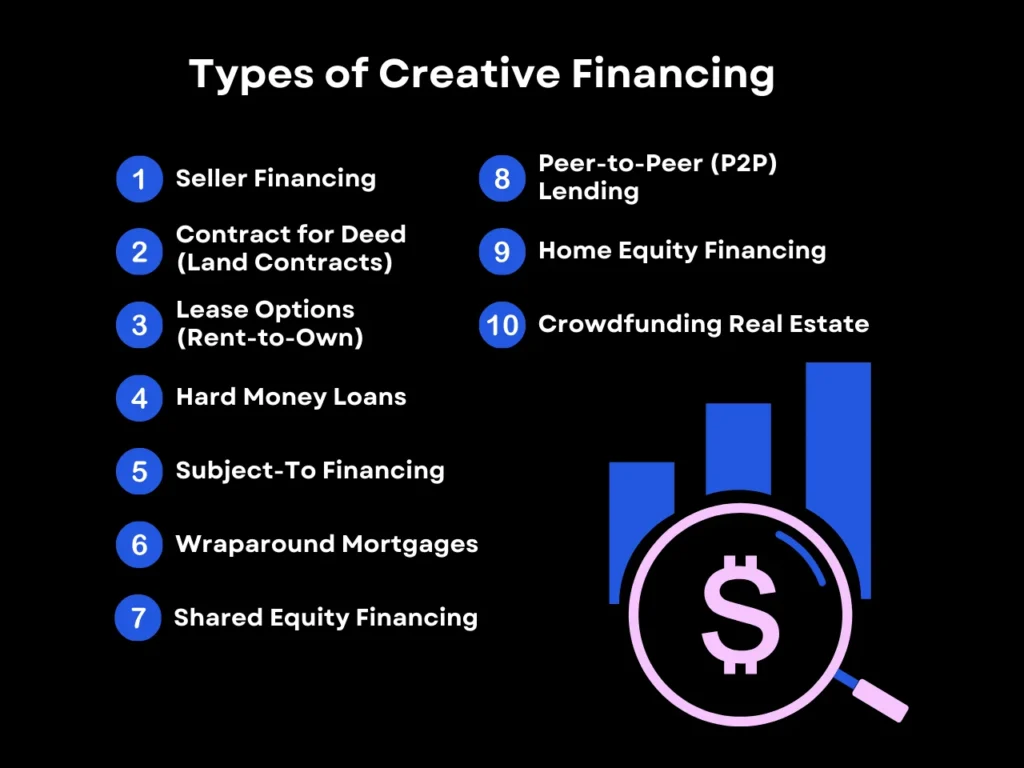

Creative financing is an umbrella term that includes various loan products and financing methods. Some source funds from private lenders, while others can be accessed from traditional financial institutions or even through negotiation with third parties or the sellers themselves.

Here are some of the most common types of creative financing. Keep in mind that not every lender offers all of these and not every creative financing option is noted in the image below, like non-QM financing for instance:

DSCR Loans

Debt Service Coverage Ratio (DSCR) loans rely on a property’s generated income to qualify for financing. The debt service coverage ratio, which refers to the ratio between the annual net income and the annual debt payments, is the primary factor that determines loan terms.

With a favorable DSCR, investors can secure funding at a very high loan-to-value (LTV) ratio. At Defy, we offer DSCR loans with LTV up to 85%, meaning that the investor will only have to pay 15% of the property’s value as a down payment to purchase it. High LTVs and greater emphasis on property performance make these loans ideal for investors.

Interest-Only Loans

Interest-only loans allow investors to pay only the interest for a set period, usually 5-10 years. By eliminating principal payments during this time, your monthly payments are significantly lower, which makes them attractive for those who want to free up their cash flow for other purposes, such as property renovations, operational expenses, or additional investments.

By strategically leveraging interest-only loans, investors can optimize their financial resources for short-term or transitional property needs.

Alternative Income Verification Loans

For real estate investors with non-traditional income streams, creative financing options can make purchasing property more accessible. By working with lenders like Defy, you can explore tailored loan solutions that fit your unique financial situation. Examples include:

- Bank statement loans: These mortgages verify income using bank statements. Lenders estimate whether you can pay back the loan based on the average deposits over the past 2 years, often accounting for the borrower’s average spending as well.

- Asset depletion loans: This loan type enables borrowers to use liquid assets such as savings accounts and retirement funds to effectively serve as their income.

- Profit-and-loss statement loans: These loans assess income based on what is reported by profit-and-loss (P&L) statements, enabling lenders to closely align loan terms with the borrower’s business performance.

These alternative verification methods are designed for self-employed individuals, freelancers, or business owners whose income may not fit the traditional molds of tax returns or W-2 income.

Project-Based Financing

These mortgages provide funding that’s tailored to the needs of specific real estate projects, offering practicality to support the renovation process. This category includes loans such as:

- Fix-and-Flip loans: Allocates funds for extensive renovation as well as purchasing. Funds are disbursed in stages as the renovation gets completed.

- Construction loans: Short-term loans that finance the building or significant renovation of properties. Similar to fix-and-flip loans, funds are released at each construction milestone.

- Hard money loans: Loans secured by the property itself with minimal underwriting requirements, making them ideal for purchases that require quick funding. They are best suited for properties that need minimal renovation and can be resold quickly.

It’s also worth noting that although hard money loans technically qualify as creative financing due to their speed and minimal requirements, they often have low loan-to-value (LTV) ratios to offset lender’s risk.

Home Equity Financing

Home equity financing involves leveraging the equity in the borrower’s primary residence to fund the purchase of another. The maximum amount of money a borrower can get from this type of financing is defined by how much equity they have in their home. This can be done through the following options:

- Home equity loan: A second mortgage that provides a one-time lump sum that the borrower can use however they see fit.

- Home equity line of credit (HELOCs): HELOCs are also second liens, but differ from home equity loans in that the borrower can have more control over their debt obligation, withdrawing funds as-needed instead of having to pay interest on a large lump sum.

- Cash-out refinancing: A cash-out refi replaces your mortgage with a larger one, often at a lower interest rate, giving you the difference in cash. This lets you avoid having to pay for two mortgages.

Lease and Ownership Transition Strategies

Lease and ownership transition strategies allow buyers to ease into property ownership over time while leveraging existing financial arrangements. These include lease options (rent-to-own), where renters can save for a down payment while living in the property, and subject-to financing, which allows buyers to take over the seller’s existing mortgage payments without formally assuming the loan.

Collaborative Lending Solutions

Collaborative lending solutions offer alternatives to traditional financing through partnerships or private investors. These include shared equity financing, where investors partner with buyers in exchange for a share of equity or profit, and peer-to-peer lending, which connects borrowers and lenders through online platforms for flexible loan options.

In some cases, it may also be viable to crowdfund (pool money from a large group of individuals) a real estate purchase, and in exchange, you may promise to give each donor a share of the property.

How to Leverage Creative Financing for Your Investments

The unconventional nature of creative financing means that the best practices for using them differ slightly from those for more traditional financing. While we can’t provide financial advice, we can offer some guidance if you’re considering this type of loan for your next real estate investment. Keep these steps in mind:

Step 1: Identify Your Financing Needs

The creative financing option that’s best for you will largely depend on the type of investment you want to undertake. You can start by clarifying your investment goals and understanding the financial requirements of your target property. Here are some guidelines you can follow to determine how much you need:

- Assess your investment goals: Determine the type of property and return on investment (ROI) you’re aiming for.

- Choose ideal candidates for purchase: Research and select properties that align with your financial and strategic objectives.

- Account for all costs: Consider expenses beyond the purchase price, such as closing costs, repairs, property taxes, and maintenance fees. This will help you accurately gauge the amount of financing needed.

Step 2: Research Your Financing Options

Explore various creative financing methods to identify the best fit for your needs and circumstances.

- Evaluate suitability: Each financing strategy fits certain types of investment situations best. DSCR loans are perfect for properties that can perform well from the start, while interest-only loans work better for properties that need more time to reach their full income potential.

- Explore multiple options: Consider diverse approaches to maximize your funding possibilities. For example, crowdfunding or seller financing may work well for community-oriented projects. Similarly, a construction loan may be a better alternative to a fix and flip loan if you aren’t confident that you can sell the property in a short timeframe and operating the property yourself remains a viable option.

Step 3: Seek Out Specialized Lenders and Loan Products

Creative financing often requires working with lenders who specialize in tailored loan products that align with your investment goals. Focusing on lenders with expertise in products like DSCR loans, interest-only options, or alternative income verification loans can increase the likelihood of approval and better terms.

- Research lenders: Identify mortgage providers or brokers experienced with creative loans. Client testimonials and discussions on online forums are often the best sources to gauge a lender’s quality.

- Compare loan products: Evaluate options to match the lender’s offerings with your specific investment needs, such as funding for construction or rental property purchases.

- Gain preapproval: Prequalifying with each of the lenders you’ve selected allows you to create a shortlist of which lenders would like to work with you and how much they’re willing to lend you. From here, you can compare each lender’s preapproved terms to arrive at the best one to borrow from. Sellers also favor pre-approved bidders over ones who aren’t.

Specialized lenders understand the unique requirements of creative financing borrowers and are more likely to offer flexible solutions that traditional banks cannot, helping you secure financing faster and with fewer hurdles. As a non-QM loan specialist, Defy offers most of the creative financing options mentioned earlier.

Step 4: Consult Experts for Legal and Financial Advice

This is a good idea regardless of your level of experience. Gathering insights from real estate attorneys, financial advisors, fellow investors, and mentors will help you gain a more complete framework for proceeding with your creatively financed investment. Here’s how you can tap into expert advice to avoid pitfalls and stay on track.

- Seek professional guidance: Work with real estate attorneys, financial advisors, and experienced investors to gain insights and validate your plans.

- Verify compliance: Ensure your financing strategy adheres to local laws and regulations to avoid legal complications.

Legal and financial professionals, as well as investing mentors, can help you avoid costly mistakes and provide insights you might not have considered. A well-informed strategy ensures your creative financing efforts are not only legally sound but also optimized for success, giving you a solid foundation for your real estate investment journey.

Step 5: Negotiate the Best Terms

Creative financing thrives on flexibility, and negotiation is key to optimizing its benefits. By strategically discussing terms, you can structure deals that minimize your financial contribution while still securing favorable arrangements for all involved parties.

- Focus on key terms: Dive into critical aspects like down payments, interest rates, and payment schedules. Negotiate deferred payments or lower initial costs to preserve your cash reserves.

- Highlight bargaining chips: Use factors like the property’s cash flow potential, a strong payment history, additional collateral, or your willingness to take on renovation costs as leverage to negotiate better terms. Highlighting these strengths can sway the lender or seller to provide more favorable conditions.

- Explore creative alternatives: To further reduce your upfront costs, it may be worth exploring options such as shared equity arrangements or seller concessions.

Effective negotiation can maximize your return on creative financing while minimizing personal financial strain. This has the added bonus of allowing you to reinvest in future opportunities and grow your portfolio.

Creative Financing Real Estate FAQ

Does creative financing include non-QM lending options?

Yes, creative financing typically includes non-QM (non-qualified mortgage) lending options. Non-QM loans are alternative financing methods that fall outside traditional mortgage standards, offering more flexibility for borrowers who may not qualify for conventional loans. These can include: Bank statement loans, Foreign national loans, Investment property loans like DSCR loans, and more. Non-QM lending provides options for self-employed individuals, real estate investors, and borrowers with unique financial circumstances.

What types of properties are best suited for creative financing?

Creative financing can be used for various property types, including residential homes, multi-family units, and commercial properties. It’s also a popular choice for fix-and-flip projects, where investors need flexibility to cover acquisition and renovation costs.

Is creative financing legal, and what are the risks involved?

Yes, the majority of creative financing loan programs are legal. However, there may be potential contractual disputes if agreements are not clearly defined, particularly in creative financing agreements that involve the sellers or third parties. Consulting legal and financial experts before proceeding is crucial to minimizing these risks.

How does seller financing differ from traditional mortgages?

Seller financing eliminates the need for banks and private lending institutions by allowing the property owner to act as the lender. This method offers more flexibility in negotiating terms like interest rates, down payments, and repayment schedules. It also speeds up the buying process by avoiding lengthy approval procedures required by traditional lenders. However, buyers need to ensure the terms are fair and legally binding.

Can creative financing help if I have poor credit?

Creative financing is often an excellent option for individuals with poor credit. Methods such as lease-to-own agreements and private money lending focus more on the property’s value and the buyer’s potential rather than traditional credit scores.

What’s the best way to approach a seller about creative financing options?

Transparency and preparation are key when approaching a seller. Clearly outline your goals and explain how creative financing can benefit both parties. Highlight advantages for the seller, such as steady monthly payments, a faster transaction, or avoiding traditional sales processes. Having a well-prepared plan and demonstrating your commitment can make the negotiation more successful.

Key Takeaway

Creative financing in real estate presents a variety of options for investors who want to explore the most efficient ways of achieving their property goals. The flexibility, accessibility, and unique opportunities that options like DSCR can provide can be even more effective than conventional financing.

If you’re considering any of the loans mentioned, remember to thoroughly evaluate your options, understand the associated risks, and build strong relationships with sellers or investors. A clear plan and expert guidance can maximize the benefits of this approach while minimizing potential risks. Ready to kickstart your real estate career with creative financing options? Defy is a reputable company that has helped countless investors achieve their financing goals. We offer many loan products, including home equity lines of credit (HELOCs) and debt service coverage ratio (DSCR) loans.

If you’re ready to explore your loan options, book a call with Defy Mortgage today or give us a call at (615) 622-1032. Let’s help you achieve your homeownership goals with confidence!