Your Guide to Investing Without Limits Using Tennessee DSCR Loans

Tennessee has a lot to offer – from its bustling music scene to historical sights. There’s no wonder why Tennessee has the eighth highest population growth rate in the country. With such a promising outlook for growth, investing in Tennessee real estate can be a strategic move for both seasoned and novice investors alike. Despite facing the highest average 30-year fixed mortgage rates that we’ve seen within the past decade, Tennessee’s average median home sale price still increased 8.3% year-over-year in April 2024.

If you’re looking for a way to finance your next investment property in the Volunteer State but your income doesn’t fit the traditional mold, Tennessee DSCR loans can be a life-saver. In this article, we’ll be explaining everything you need to know about getting a DSCR loan in Tennessee to help you navigate this game-changing tool.

What is a DSCR Loan?

A DSCR loan stands for a Debt-Service Coverage Ratio loan and is a type of mortgage for real estate investors to qualify with the property’s income rather than their own. Because of the alternative income verification method to qualify for this loan, it’s considered to be a non-QM loan (non-qualified mortgage). Non-QM loans aren’t confined to the strict lending criteria set by the Consumer Financial Protection Bureau (CFPB). DSCR loans give real estate investors a way to easily expand their portfolio without needing to show any proof of traditional income.

How Do You Calculate DSCR?

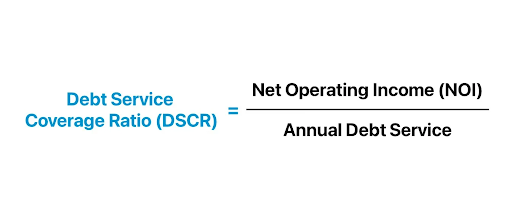

DSCR is a formula that lenders use to evaluate the property’s cash flow against its debt obligation. To calculate DSCR, take the annual net operating income of the property (income minus expenses) and then divide that by the annual debt service (including principal and interest).

If you get a figure that’s below 1.0, that means the property isn’t generating enough income to cover its debt obligation. In contrast, if you get a figure that’s above 1.0, that means the property is generating more income than its debt obligation. A “strong” DSCR is typically considered to be 1.25 or more.

Should I Get a DSCR Loan in Tennessee?

If you’re someone who is looking to buy an investment property in Tennessee, then DSCR loans are definitely worth considering. Gone are the days where you have to provide extensive traditional income documentation like tax returns, W2s, and pay stubs. Now, you can experience the limitless possibilities of real estate investing with DSCR loans.

DSCR Loans vs. Conventional Loans

The main difference between DSCR loans and conventional loans is how income is assessed to qualify for each one. As we mentioned earlier in the article, DSCR loans primarily focus on the property’s income and lenders look at the DSCR metric as one of the main factors for qualification. On the other hand, conventional loans use traditional income documents to verify your personal income to qualify for the loan and do not take the property’s income into consideration.

Tennessee DSCR Loan Requirements

DSCR loan requirements can vary greatly between lenders since each lender can set their own criteria. While we can’t speak for other lenders, here’s what we would need at Defy:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

Tennessee DSCR Loan Interest Rates

Interest rates for DSCR loans can vary due to different factors like the current market rates, your credit score, and the lender. Generally, you can expect DSCR loans to be slightly higher than standard 30-year fixed mortgage rates. While a slightly higher rate doesn’t seem ideal, it may be worth it to have the opportunity to get your foot in the door of the real estate market. It’s also important to keep in mind that similarly to market interest rates, DSCR loan rates tend to rise and fall in a similar pattern.

Pros and Cons of Getting a DSCR Loan in Tennessee

Pros:

- Qualify using your property’s rental income

- No tax returns, W2s, or pay stubs needed

- Faster approval process

- Opportunity to own an investment property in a growing market

- No hard limit on how many DSCR loans you can have

Cons:

- Limited availability

- Can have slightly higher interest rates

- Unexpected vacancy periods can potentially make it challenging to meet debt payments

Things to Consider Before Getting a Tennessee DSCR Loan

Before getting a DSCR loan, it’s important to evaluate your investment goals and personal risk tolerance. Some additional factors to consider include the property’s DSCR and the area’s vacancy rates to assess if an investment property would be profitable. It’s also a good idea to keep a cash reserve as a buffer in case of any unexpected vacancy periods, repairs, or required maintenance on the property.

Tennessee DSCR Loan FAQs

- What are DSCR loans?

DSCR loans stands for Debt-Service Coverage Ratio loans and allow real estate investors to qualify for financing based on the rental income of a property, not their personal income.

- How is DSCR calculated?

DSCR is calculated by dividing the property’s annual net operating income, which is rental income minus any expenses, by the annual debt obligation, which includes principal and interest payments.

- I’ve calculated my DSCR – now what does it mean?

DSCRs that are under 1.0 indicate that the property isn’t generating enough income to cover its debt obligation. Whereas, DSCRs that are over 1.0 indicate that the property is making enough income to at least cover its debt obligation. A “strong” DSCR is usually considered to be 1.25 or above.

- Who should get a Tennessee DSCR loan?

Anyone who has an interest in purchasing a rental property in Tennessee should consider a DSCR loan, especially if you have non-traditional income sources that aren’t as easy to document.

- Are DSCR loans non-QM?

Yes, DSCR loans are non-QM loans, meaning that they’re not subject to the strict lending standards set by the Consumer Financial Protection Bureau (CFPB). This means that DSCR lenders can create their own lending criteria, resulting in more flexible requirements compared to a conventional loan.

- What are the pros and cons of getting a DSCR loan in Tennessee?

Pros:

- You can qualify based on property income

- No traditional income documents required (e.g. tax returns, pay stubs, W2s)

- No hard limit on how many DSCR loans you can have

- Faster approval process

- More flexible qualification criteria

Cons:

- Potentially higher interest rates

- Limited availability

- May be challenging to keep up with mortgage payments during unexpected vacancy periods

- What are the Tennessee DSCR loan qualification requirements?

While requirements may vary between lenders, here’s what we require at Defy for our Tennessee DSCR loans:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

- Can you get a Tennessee DSCR loan without a down payment?

No, most lenders require some percentage of the purchase price as a down payment. It’s unlikely that a lender will approve a DSCR loan without any down payment.

- How big of a down payment do I need for a Tennessee DSCR loan?

The exact down payment you’ll need will vary depending on the lender and your credit score. However, you can expect to pay anywhere between 10-30% down.

- What are the interest rates for Tennessee DSCR loans?

Interest rates for Tennessee DSCR loans may vary based on several factors like the lender, the current market rate, and your credit score.

- Can I get a DSCR loan in other states besides Tennessee?

Yes! You can get a DSCR loan in many other states, such as Texas, Florida, California, and more.