Everything You Need To Know About Getting a Florida DSCR Loan

Investing in Florida’s growing real estate market can be an exciting venture – the sunshine and sprawling beaches tend to easily win people over. Florida home prices were up 3.7% in March 2024 compared to last year, and there’s no signs of it slowing down anytime soon. However, when it comes to investment properties, traditional financing options might not always fit the bill. This is where DSCR loans can come in handy, especially if the property isn’t your primary residence. Whether it’s a vacation home or a rental property you’re after, a Florida DSCR loan is something worth considering.

In this guide, we’ll be diving into everything you need to know about Florida DSCR loans to empower you to make empowered investing decisions.

What Are DSCR Loans?

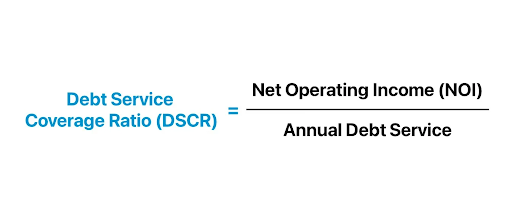

The acronym DSCR stands for “Debt-Service Coverage Ratio”, which is a ratio that’s used to determine your eligibility for the loan. The way the DSCR figure is calculated uses the income that the investment property generates in relation to the debt payments. Using this standardized ratio helps lenders to determine whether a property is making enough money to pay off its own debt. A DSCR loan evaluates a borrower’s eligibility based on the DSCR of their property rather than their own personal financials.

Below, we’ve included the DSCR formula to help you get a better idea of how this ratio is interpreted:

With a DSCR value of 1.0 or over, the property is generating enough income to at least cover the debt payments. Whereas, a DSCR value of less than 1.0 means that the property is not making enough to cover the full debt payment.

Since a DSCR loan doesn’t follow the lending standards of Fannie Mae and Freddie Mac, it’s considered a non-qualified mortgage or non-QM for short. This means that non-QM lenders have the flexibility to mold their own lending criteria, helping underserved borrowers secure home loans. DSCR loans are just one type of loan under the non-QM umbrella.

DSCR Loan Calculation Examples

Example 1:

Property 1 was purchased for $250,000. At a 7.5% interest rate, the total monthly payments are $1,748 for a 30-year fixed mortgage. Due to the location of this property, the landlord is able to collect $2,500 per month in rent. Using the 1% rule that estimates annual maintenance expenses to be equal to 1% of the property’s value, $2,500 is spent yearly on maintaining the property.

Annual debt service: $1,748 x 12 = $20,976

Annual operating income: $2,500 x 12 = $30,000

Annual operating expenses: $250,000 x 1% = $2,500

Annual net operating income: $30,000 – $2,500 = $27,500

Using the DSCR formula:

Net Operating Income / Annual Debt Service

= $27,500 / $20,976

= 1.31

In this example, Property 1’s annual net operating income is enough to cover the debt obligation by 1.31 times, which means it has a relatively strong DSCR.

Example 2:

Property 2 was also purchased for $250,000. At a 7.5% interest rate, the total monthly payments are $1,748 for a 30-year fixed mortgage. The location of this property is slightly less desirable, so the property rents out for only $1,800 per month. Using the 1% rule that estimates annual maintenance expenses to be equal to 1% of the property’s value, $2,500 is spent yearly on maintaining the property.

Annual debt service: $1,748 x 12 = $20,976

Annual operating income: $1,800 x 12 = $21,600

Annual operating expenses: $250,000 x 1% = $2,500

Annual net operating income: $21,600 – $2,500 = $19,100

Using the DSCR formula:

Net Operating Income / Annual Debt Service

= $19,100 / $20,976

= 0.91

In this example, Property 2’s annual net operating income isn’t enough to fully cover the debt obligation. Despite the monthly rent exceeding the monthly mortgage payment by $52 per month, it’s still not enough to cover it after taking into account annual maintenance costs.

Who Would Be a Good Candidate for a DSCR Loan in Florida?

Florida DSCR loans can benefit a wide variety of borrowers, including:

- Real estate investors

- Property developers

- Landlords

- Foreign nationals looking to invest in US property

- First-time homebuyers looking to buy an investment property

- Self-employed individuals

- Small business owners

- Partnerships or corporate entities

- Individuals with complex income situations

DSCR Loans vs. Conventional Loans

The main difference between DSCR loans and conventional loans is how income is evaluated. As we’ve covered in previous sections, DSCR loans use the property’s income to determine whether it can cover the debt obligations. In contrast, conventional loans rely on the borrower’s income using documents like W2s, pay stubs, and tax returns to determine their ability to repay.

DSCR Loans vs. Fix-and-Flip Loans and Construction Loans

While DSCR loans, fix-and-flip loans, and construction loans are all designed for real estate investors, they were each designed for different types of real estate investing. DSCR loans are ideal for properties that have a strong history of rental income. Without any rental income, it can be difficult for lenders to calculate a DSCR value, which can then make it tricky to determine eligibility for the loan.

Taking a look at fix-and-flip loans, they were designed specifically for real estate investors that plan to purchase a property, fix it, and sell it at a profit. These loans typically have much shorter terms since these fix-and-flip projects are completed relatively quickly.

Lastly, with construction loans, they were created for ground-up construction. Similarly to fix-and-flip loans, construction loans typically have shorter terms as well. The main difference between a fix-and-flip loan and a construction loan is the way the funds are disbursed. With a construction loan, funds are usually disbursed in stages as construction progresses, whereas with a fix-and-flip loan, it’s provided in a lump sum.

What Are the Florida DSCR Loan Requirements?

Each lender sets their own DSCR loan requirements, meaning that specific requirements may vary by lender. However, to give you an idea of what requirements to expect, here is what we would need at Defy:

- Minimum FICO score of 620+

- Maximum LTV of 85%

- Minimum DSCR ratio of 0.75

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns required

- Interest-only options available

DSCR Loan Interest Rates

The interest rates for DSCR loans can vary depending on factors like the lender, your borrower profile, and the current market conditions. Although you can expect them to be slightly higher than standard mortgage rates, it can often be worth it to open up the door to a new investment opportunity that would not otherwise be possible without a DSCR loan. Keep in mind that DSCR loan interest rates still tend to rise and fall in tandem with standard 30-year fixed mortgage rates because of market factors.

Pros and Cons of Getting a DSCR Loan in Florida

Pros:

- Qualify for using rental income rather than your personal income

- Opens the door to investment opportunities

- No hard limit on how many DSCR loans you can have

- Potential for higher loan limits

- No tax returns or W2s required

Cons:

- Limited availability

- Can have slightly higher interest rates compared to conventional loans

Top Florida Cities for DSCR Loans

DSCR loans are ideal in cities that have low vacancy rates, steady home value appreciation, and a growing population. Based on those factors, here are the top cities in Florida for DSCR loans:

- Miami

- Orlando

- Tampa

- Jacksonville

- Fort Lauderdale

Alternative Loan Options for Florida Real Estate Investors

Real estate investors are often put into one box, but the reality is that most of them have different needs. This means that a one-size-fits-all solution won’t work. Just because a DSCR loan is a perfect option for one real estate investor, doesn’t mean it will work for everyone. Below, we’ve listed several other non-QM loan options that can be a great option for other real estate investors:

- Fix-and-Flip: Provides funding to purchase a home along with enough to cover renovations to “flip” it for a profit. Ideal for real estate investors who are house flippers or plan to rehab homes.

- Construction Loans: Provides funding to build a new house from the ground up. Funds are provided in installments as the project progresses. Ideal for real estate investors who want to build a home from scratch or property developers.

- Bank Statement Loans: Eligibility is determined by average monthly deposits shown on the borrower’s bank statements. Ideal for real estate investors or any self-employed individuals who have difficulty proving their income without traditional income documents.

- Profit & Loss (P&L) Loans: Eligibility is determined by a business owner’s profit & loss statements. Ideal for real estate investors that have an incorporated business or any small business owners.

Florida DSCR Loan FAQs:

- What are DSCR loans?

DSCR loans are a type of non-QM loan that allows you to qualify for a mortgage with the income that the property produces, rather than your own personal income.

- How is DSCR calculated?

DSCR is calculated by dividing the property’s net operating income (NOI) by its total debt service. A DSCR of 1.0 or over means that the property is generating enough income to cover its debt obligation. Whereas a DSCR of under 1.0 means the property is not making enough income to cover its debt obligation.

- Who are DSCR loans for?

Many different types of borrowers can benefit from DSCR loans, such as:

- Real estate investors

- Property developers

- Landlords

- Foreign nationals looking to invest in US property

- First-time homebuyers looking to buy an investment property

- Self-employed individuals

- Small business owners

- Partnerships or corporate entities

- Individuals with complex income situations

- Are DSCR loans non-QM?

Yes! DSCR loans are non-QM, meaning they don’t conform to the lending criteria set by the Consumer Financial Protection Bureau (CFPB). Non-QM loans give aspiring homeowners with unique circumstances an opportunity to buy property in the US.

- What are the pros and cons of getting a DSCR loan in Florida?

Pros:

- Qualify for the loan using rental income rather than your personal income

- Opens the door to investment opportunities

- No hard limit on how many DSCR loans you can have

- Potential for higher loan limits

- No tax returns required

Cons:

- Limited availability

- Slightly higher interest rates compared to conventional loans

- The property’s income could fluctuate over time

- What credit score do I need to qualify for a DSCR loan?

Specific credit score requirements for a DSCR loan will vary by lender, but at Defy, we require a FICO score of 620+.

- What are the requirements for a DSCR loan in Florida?

If you’re looking to get a Florida DSCR loan, it’s important to note that requirements may vary depending on the lender. At Defy, we require:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

- Where can I get a Florida DSCR loan?

Florida DSCR loans are available through private mortgage lenders like Defy. Traditional banks and credit unions typically don’t offer DSCR loans.

- How much do I need for a DSCR loan down payment?

Specific down payment requirements will vary based on the lender, but you can expect to put down anywhere between 15-25% for a DSCR loan.

- Can you get a DSCR loan with no money down?

Usually, lenders require a down payment for DSCR loans. It would be difficult, if not impossible, to secure a DSCR loan without any money down.

- Is it possible for a first-time homebuyer to get a DSCR loan?

Yes! It’s possible for a first-time homebuyer to get a DSCR loan as long as they meet the eligibility criteria set by the lender.

- Are DSCR loans available in other states?

Yes! DSCR loans are available from coast to coast. Check out our DSCR loan guide for California.

- Can I get a DSCR loan for a new construction or a flip?

Yes, it’s possible to get a DSCR loan for a new construction or a flip. However, lenders may ask for more information and documentation on your plans. A more suitable option in this case would be to apply for a construction loan or fix-and-flip loan, as they’re designed specifically for these types of projects.

- What are the DSCR loan interest rates?

DSCR loan interest rates may vary depending on current market factors and your borrower profile. However, they tend to rise and fall in tandem with standard 30-year fixed mortgage rates.

- Is Defy Mortgage licensed in Florida?

Yes! Defy Mortgage is licensed in Florida. If you think a Florida DSCR loan would be a good fit for you and your investing needs, take the first step and get in touch with us today. We would love to work with you!