Real Estate Investing Made Easy With DSCR Loans for Airbnb and Short-Term Rentals

Real estate investing using Airbnb and short-term rentals is a concept that has recently taken the world by storm. With property management companies taking care of the bulk of the work, Airbnb and short-term rentals are a great way to maximize your returns. Despite talks of the short-term rental market cooling off, it’s still growing at a steady rate and is expected to reach a valuation of $8.9 billion by 2026.

While investing in short-term rentals can be an exciting business venture, most investors may find it tricky to qualify for traditional financing. This is where DSCR loans for Airbnb and short-term rentals save the day.

In this guide, we’ll be exploring everything you need to know about financing your next short-term rental investment. DSCR loans for Airbnb and short-term rentals can be an extremely valuable tool for real estate investors looking to build their portfolio – keep reading to let us show you how!

What Is a DSCR Loan?

A debt-service coverage ratio (DSCR) loan is a type of mortgage that allows you to qualify using your rental property’s income instead of your own. This structure makes it easier for those with non-traditional income to get approved for an investment property loan. DSCR lenders use the DSCR metric to determine whether the property can “pay for itself” without relying on the borrower’s personal income.

DSCR loans fall under the umbrella of non-QM loans (non-qualified mortgages). This simply means that they’re not subject to following the strict lending criteria set by the Consumer Financial Protection Bureau (CFPB), making them more flexible for borrowers who have forged an alternative path.

What Is a Short-Term Rental?

A short-term rental is a property that is rented out for a relatively short period of time, typically ranging from a single night to a few weeks or months. Some common examples of short-term rentals include properties on online platforms like Airbnb, VRBO, and HomeAway.

The main advantage of short-term rentals is the flexibility they provide for both renters and property owners. Renters can find accommodation for specific durations, while owners can generate income from their properties during periods when they are not using them.

It’s important to note that a permit is needed in order for an STR to operate as an STR, and depending on where the property is located, rules and regulations for obtaining the short-term rental property permit can vary.

How to Calculate a Rental Property’s DSCR

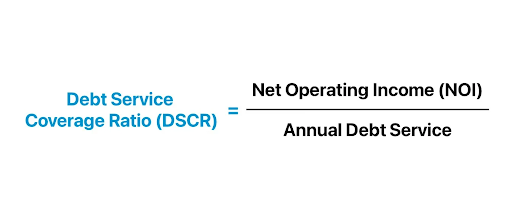

Calculating a rental property’s DSCR isn’t hard. This is the formula:

The number on the top represents the net operating income for the year, which is the property’s income minus any operating expenses. Whereas, the number on the bottom represents the total debt payments for the year, including principal and interest. Keep in mind that some lenders include property taxes and insurance in the annual debt service calculation.

A DSCR value of 1.0 or over means that the property generates enough income to cover its debt payments. In contrast, a DSCR of below 1.0 means the property does not generate enough income to cover its debt payments. Generally, a DSCR of 1.25 is considered “strong” by most lenders.

Why Get DSCR Loans for Airbnb and Short-Term Rentals?

DSCR loans for Airbnb and short-term rentals can be a very valuable tool for anyone looking to expand their investment property portfolio. Since the qualification requirements don’t rely on any personal income information, your income doesn’t act as a barrier to entry into the real estate market. Not to mention that there’s no hard limit on how many DSCR loans you can have. This opens up the door to limitless possibilities in the growing world of real estate investing.

How Can I Qualify for a DSCR Loan?

Qualification requirements for DSCR loans can vary significantly between lenders since they’re a non-QM loan, meaning it’s up to the lenders to set their own criteria. For exact requirements, we recommend reaching out to lenders directly, so you can prepare for the application process.

At Defy, we believe in a streamlined approach to lending. Here’s a breakdown of what we require for our DSCR loans:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

Conventional Loans vs. DSCR Loans for Airbnb and Short-Term Rentals

While both can technically be used for investment properties, conventional loans and DSCR loans are structured fairly differently when it comes to qualification requirements.

Conventional loans are QM loans (qualified mortgages), meaning they’re required to follow the lending standards set by the CFPB. Typically, borrowers have to show extensive income documentation like pay stubs, W2s, and tax returns to qualify. Conventional loans can be much harder to qualify for when purchasing an investment property.

DSCR loans, on the other hand, are non-QM loans, meaning they have more flexible qualification requirements. Instead of using traditional income, lenders assess the property’s income to see if it’s generating enough income to pay the mortgage payments. DSCR loans are much easier to qualify for when purchasing an investment property since it only looks at the property’s income.

Rules and Regulations for Airbnb and Short-Term Rentals

Rules and regulations for Airbnb and short-term rentals vary from state to state and even from county to county. Below, we’ve listed a few government websites for areas that are popular for short-term rentals:

- California

- Florida

- Texas

- Santa Barbara, CA

- Orlando, FL

- Nashville, TN (check out Defy’s case study on STRs in Nashville, TN for “legacied-in” properties)

Before buying an investment property, it’s important to familiarize yourself with the local rules and regulations.

Defy Short-Term Rental (STR) Specialized Financing Details for Nashville Investors

- Existing Permits Made Easy: Investors can maintain permits by purchasing the LLC and property. No deed transfer hassles!

- Flexible Financing: Up to 80 Percent LTV, minimum FICO 640, and loan amounts from $100K to $3MM.

- Smooth Transition: No deed transfer—just a seamless LLC membership change.

- Portfolio Growth: Investors can finance up to 20 properties. Imagine the possibilities!

What Licenses and Permits Are Required for Short-Term Property Managers?

Beyond general rules and regulations, there are several licenses and permits required to legally operate your business. Here are some to keep in mind:

- Business license or permit for commercial venture

- Short-term rental license or permit

- Proof that your investment property is not your primary residence (if required)

- Real estate license (if required)

Similarly to rules and regulations, these required licenses and permits vary depending on the area. To get a thorough understanding of what’s required, contact your local government office, contact your local attorney, contact your local realtor or check your local government website.

Pros and Cons of Getting DSCR Loans for Airbnb and Short-Term Rentals

Pros:

- Qualify with rental income

- No tax returns, W2s, or pay stubs required

- No hard limit on how many DSCR loans you can get

- Faster approval process than conventional loans

- Opportunity to participate in the growing real estate market

Cons:

- May have slightly higher interest rates

- Can have limited availability

- Unexpected stretches of vacancy periods or slow seasons may make it challenging to meet debt payments

DSCR Loan Alternatives for Real Estate Investors

DSCR loans aren’t the only option out there for real estate investors. Below, we’ve outlined several other loan options to consider that may be a better fit for you:

- Bank Statement Loans: Use bank statements and your monthly average deposit to qualify.

- Profit & Loss (P&L) Loans: If you own a business, use your business’ P&L statements to qualify.

- Fix-and-Flip Loans: Provides funds to purchase a worn down home, renovate it, and quickly resell it at a profit.

- Construction Loans: Provides funds in installments to build a home from the ground-up or for major renovations.

DSCR Loans for Airbnb and Short-Term Rentals FAQs

- How does a DSCR loan work?

A DSCR loan focuses on the property’s rental income rather than your personal income. DSCR is calculated using the formula Net Operating Income divided by Annual Debt Service to see if the property can “pay for itself”.

- Why use a DSCR to finance a short-term rental or Airbnb?

Traditional mortgages, like conventional loans, often rely on your personal tax returns and steady employment income. It can be difficult to qualify for a traditional loan for an investment property, especially if you already have one for your primary residence. DSCR loans provide an alternative financing path that mainly relies on the property’s income.

- What are the qualification requirements for a DSCR loan?

Qualification requirements for DSCR loans depend on the lender since each lender can set their own requirements. To give you an idea of what you may need, here are our DSCR requirements at Defy:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

- Can I get a DSCR loan without showing tax returns?

Yes! You can get a DSCR loan without showing tax returns.

- What are the minimum credit score requirements to get a DSCR loan for a short-term rental or Airbnb?

The minimum credit score required to qualify for a DSCR loan will depend on the lender, but at Defy we require a FICO score of at least 620.

- Can I get a DSCR loan in all states?

DSCR loans are available in most states, but not all. It’s important to check with each lender to see which states they’re offered in. At Defy, we offer DSCR loans in 35 states, including California, Texas, Florida, Tennessee, and more.

- What are the down payment requirements for a DSCR loan?

Exact down payment requirements for DSCR loans depend on factors like the lender’s requirements and your credit score. However, you can typically expect to put down anywhere between 15-25% for a down payment.

- Why should I get a DSCR loan instead of a conventional loan?

DSCR loans are a great alternative for those who have non-traditional income since the requirements focus on the property’s income rather than your own. Conventional loans come with strict lending standards that are set by the Consumer Financial Protection Bureau (CFPB), making it much more difficult to qualify for investment property financing.

- Where can I get DSCR loans for Airbnb and short-term rentals?

DSCR loans are offered by private mortgage lenders (like Defy!) who often specialize in alternative lending products.

- Do banks offer DSCR loans for Airbnb and short-term rentals?

Most banks do not offer DSCR loans since they’re considered to be a non-QM alternative loan.

- What other loan options do I have as a real estate investor?

As a real estate investor, you can get a bank statement loan, P&L loan if you have a business, or fix-and-flip or construction loans if you’re looking to rehab or build a property.

- Is getting a DSCR loan for an investment property illegal?

No! Getting a DSCR loan for an investment property is not illegal. It’s a legitimate financing option that’s designed especially for income-generating investment properties.

- Is a DSCR loan considered a non-QM loan?

Yes, DSCR loans are considered to be non-QM (non-qualified mortgages), which means they aren’t required to follow the strict lending standards set by the CFPB.

- Do restrictions for Airbnb and short-term rentals exist?

Yes, there are restrictions that exist for Airbnb and short-term rentals. These restrictions vary by state and county, so it’s important to stay up to date on the rules pertaining to your area.