Your Guide to Mastering the Massachusetts Real Estate Market with DSCR Loans

Have you ever thought of buying an investment property in the Bay State, but weren’t sure if you’d qualify for a mortgage with your personal income? This is where a Massachusetts DSCR loan can open up the door to a world of real estate investing possibilities. According to Zillow, the median rent in Massachusetts is $3,200 per month at the time of writing, which is 49% higher than the national median. These higher rental yields can present lucrative opportunities for real estate investors.

If financing is what’s stopping you from getting the Massachusetts rental property of your dreams, there’s a solution. In this article, we’ll be diving into everything you need to know about Massachusetts DSCR loans. Let’s get started!

What Is a DSCR Loan?

A Debt-Service Coverage Ratio (DSCR) loan is a type of home loan that allows you to qualify with the property’s rental income rather than your personal income. Lenders use the DSCR metric to assess the property’s potential to cover its own expenses. Using the property’s income instead of your own makes it much easier to get financing if you have limited personal income or are self-employed. Not to mention that there’s no hard limit on how many DSCR loans that you can get, which can help you build your investment property portfolio without the limitations of your personal income.

How Do You Calculate DSCR?

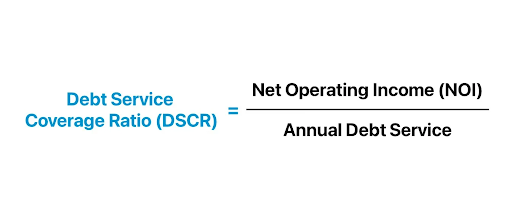

If you’re not good at math, don’t worry – calculating DSCR is easy. Here is the general DSCR formula:

Breaking this down a little further:

- Net Operating Income represents the property’s annual rental income minus any expenses like repairs and maintenance.

- Annual Debt Service represents the total mortgage payments that need to be paid back to the lender over the course of the year, including principal and interest. Keep in mind that some lenders also factor in taxes and insurance in their annual debt service calculation.

Now that you’ve calculated your DSCR, what does this number mean? Interpreting a DSCR value is also rather simple.

- DSCR of 1.0 or above: The property is generating enough income to cover its debt payments. DSCRs above 1.0 indicate that the property’s cash flow is positive, meaning the investor will make a profit.

- DSCR of below 1.0: The property isn’t generating enough income to cover its debt payments.

Generally, lenders consider a strong DSCR to be 1.25 or above. However, if your DSCR is below 1.0, you still have plenty of options. At Defy, we only require a minimum DSCR of 0.75, meaning you can still qualify and build your investment property portfolio.

Is a DSCR Loan Non-QM?

Yes, a DSCR loan is a non-QM loan (non-qualified mortgage), which means it doesn’t have to follow the strict lending standards set by the Consumer Financial Protection Bureau (CFPB). These lending standards include the “Ability-to-Repay” rule that involves a qualified mortgage (QM) lender to assess a borrower’s traditional income, along with their assets and debt, to determine whether they can reasonably repay the loan.

Without having to follow the “Ability-to-Repay” rule, non-QM lenders can choose their own lending requirements for each type of loan that they offer depending on their risk tolerance. For borrowers, this results in more flexible requirements including lower minimum credit scores and alternative income verification. Since DSCR loans use the property’s income rather than the borrower’s personal income, this is considered to be alternative income verification.

Who Would Benefit From a Massachusetts DSCR Loan?

Anyone who’s interested in purchasing an income-generating investment property should consider getting a Massachusetts DSCR loan. Whether you’re looking at purchasing your first investment property or your tenth, a DSCR loan is a great option for financing that opens up the doors to limitless possibilities.

A Massachusetts DSCR loan would be ideal for:

- Novice or experienced real estate investors

- Property developers

- Landlords

- Foreign nationals looking to invest in US property

- First-time homebuyers looking to buy an investment property

- Self-employed individuals

- Small business owners

- Partnerships or corporate entities

- Individuals with complex income situations

Why Get an Investment Property in Massachusetts Using a DSCR Loan?

Massachusetts is a prime location to invest in rental properties with a DSCR loan with a unique advantage: diverse rental opportunities. The state has a booming tourism industry fueled by its rich history, attracting visitors all year-round who need short-term accommodations.

Seasonal changes create demand for both ski homes and beach rentals, allowing you to maximize your property’s earning potential. As for long-term rentals, a strong job market and top-tier schools make Massachusetts a desirable location for families. On top of that, the abundance of colleges and universities ensures a steady stream of student renters.

Beyond rental potential, property values in Massachusetts have appreciated steadily in the past. Restrictive zoning laws paired with limited available land in certain areas limit rental supply even more, pushing rent prices upwards. This, combined with the state’s stable job market and thriving tourism industry, creates great potential for reliable rental income – the key factor for qualifying for a DSCR loan.

What Do I Need to Qualify for a Massachusetts DSCR Loan?

Since DSCR loans are non-QM, the qualification requirements can vary significantly between lenders. To find out exactly what you’d need to qualify, we recommend reaching out to lenders directly to ask them about their criteria.

While different lenders may have their own requirements, this is what we require at Defy:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

Pros and Cons of Getting a Massachusetts DSCR Loan

Similar to making any other investment decision, you’ll most likely want to evaluate the pros and cons of getting a DSCR loan to finance your investment property. Below, we’ve outlined some of the pros and cons to consider:

Pros:

- No tax returns or other traditional income documents needed (W2s, paystubs, etc.)

- Qualify using your property’s rental income

- No hard limit on how many DSCR loans you can get

- Faster approval process

- Opportunity to grow your investment property portfolio in a lucrative market

Cons:

- Limited availability

- May have slightly higher interest rates

- Potential fluctuations in rental income may make it challenging to meet debt payments at times

Top Massachusetts Areas for DSCR Loans

Ideal areas for a rental property have a strong rental market and a diverse economy. Several areas in the Bay State to consider for a Massachusetts DSCR loan are:

- Boston

- Middlesex County (including Cambridge)

- Worcester

- Cape Cod

- Springfield

- The Berkshires (like Lenox or Great Barrington)

What’s the Difference Between DSCR Loans and Conventional Loans?

The main difference between DSCR loans and conventional loans is their classification within the non-QM and QM categories, which results in different qualification criteria required.

As mentioned earlier in this article, DSCR loans are non-QM loans, meaning they’re not required to follow the strict lending criteria set by the CFPB. With DSCR loans, borrowers don’t need to show any traditional income documentation, like W2s, pay stubs, or tax returns. When it comes to income, DSCR lenders only want to see the property’s historical or projected rental income to determine whether the property can “pay for itself.” This method of alternative income verification makes it much easier for real estate investors to qualify for investment property financing without being capped by their personal income.

Shifting gears to look at conventional loans, these loans are QM loans, meaning they have to follow the CFPB’s “Ability-to-Repay” rule. This rule requires QM lenders to use a borrower’s traditional income, assets, and debt-to-income ratio (DTI) to determine whether they can repay the loan. While it’s possible to use a conventional loan to finance an investment property, it can be much more difficult to qualify for, especially if you already have a mortgage. Due to the required debt assessment, an existing mortgage can cause you to exceed the strict DTI limitations, making it difficult to qualify for more than one property with conventional loans.

What Are the DSCR Loan Interest Rates?

The exact interest rate you’ll get for a DSCR loan depends on a few different factors, including your credit score, the lender, and the current market rates. DSCR loan interest rates tend to fluctuate similarly to standard mortgage rates, but you can expect them to be slightly higher. For real estate investors who are looking to grow their rental property portfolio, this slightly higher rate is often worth it for the potential profit from an additional property.

Alternative Loan Options for Massachusetts Real Estate Investors

DSCR loans aren’t the only option out there for real estate investors. If you think that a DSCR loan doesn’t work for your situation, consider these other loan types:

- Bank Statement Loans: These loans allow you to qualify with your bank statements (typically 12 to 24 months’ worth) instead of traditional income documents or rental income. Lenders take your average monthly deposit and determine how much “home” you can afford. This is a great option for those with a non-traditional income or multiple income sources like self-employed individuals and freelancers.

- Profit & Loss (P&L) Loans: These loans allow you to qualify with your business’ P&L statements instead of traditional income documents or rental income. This is a great option for business owners that make most of their income through their business.

- Fix-and-Flip Loans: These loans provide short-term funding to purchase a property, fix it up, and resell it for a profit. The proceeds from the sale are then used to repay the loan. This is a great option for property flippers.

- Construction Loans: These loans are typically used for ground-up construction or for major renovations. The funds are released in stages as construction progresses. This is a great option for anyone who wants to build a custom home or needs funding to do a major reno.

If you’re still unsure of which loan option is right for you, we’ll be happy to help! Defy offers all of these loan options and more – contact us for a personalized consultation.

Massachusetts DSCR Loan FAQs:

- What is a DSCR loan?

A debt-service coverage ratio (DSCR) loan is a mortgage that allows you to qualify for it based on the property’s rental income instead of your personal income.

- How does a DSCR loan work in Massachusetts?

In Massachusetts, DSCR loans work the same way as they do in any other state. Lenders use the DSCR metric to determine whether the property’s income is enough to cover the debt payments.

- How do you calculate DSCR?

DSCR is calculated by dividing the property’s net operating income (income minus expenses) by the expected debt obligation (including interest and principal). Keep in mind that some lenders include property taxes and insurance in their DSCR calculations. If the DSCR is 1.0 or over, it means the property can cover its debt payments vs. if the DSCR is below 1.0, the property isn’t generating enough income to cover its debt payments.

- Is a DSCR loan a non-QM loan?

Yes, a DSCR loan is a non-QM loan (non-qualified mortgage). This means that it has more flexible qualification requirements since it doesn’t have to follow the strict lending standards set by the Consumer Financial Protection Bureau (CFPB).

- Who should get a DSCR loan in Massachusetts?

Anyone who’s looking to buy a rental property in Massachusetts should consider getting a DSCR loan. Whether you’re a novice or experienced real estate investor, DSCR loans are a great way to grow your real estate portfolio.

- Other than a strong DSCR, what else do I need to qualify for a DSCR loan?

Exact requirements may vary significantly between lenders since they can set their own criteria. At Defy, these are our requirements for DSCR loans:

- A FICO score of 620+

- A maximum LTV of 85%

- A minimum DSCR ratio of 0.75

- 3 months cash reserve

- No income documents or tax returns required

- Foreign nationals allowed

- Interest-only option available

- No maximum loan amount

- Do you need tax returns to qualify for a DSCR loan?

No! You don’t need tax returns to qualify for a DSCR loan since lenders don’t need any personal income information to evaluate your eligibility.

- What’s the minimum credit score required for a DSCR loan?

Minimum credit score requirements for DSCR loans may vary between lenders, but they generally fall between 620 and 680. At Defy, we require a minimum FICO score of 620 or above for our DSCR loans.

- What’s the minimum down payment required for a DSCR loan?

The minimum down payment required for a DSCR loan depends on factors like the lender and your credit score. Generally, you can expect to put down anywhere between 15-30% of the property’s purchase price.

- Is it possible to get a DSCR loan with no down payment?

No, it’s very unlikely that you can get a DSCR loan with no down payment. Most lenders will require at least 15% down.

- What are the DSCR loan interest rates?

DSCR loan interest rates depend on several factors like the lender, your credit score, and current market rates.

- Besides Massachusetts, can I get a DSCR loan in any other state?

Yes! You can get a DSCR loan in most states, including Florida, California, Texas, Tennessee, and more.

- Can I get a DSCR loan as a first-time homebuyer?

Yes! You can get a DSCR loan as a first-time homebuyer as long as you can meet the qualification requirements.

- Can I get a DSCR loan for a new construction or a flip?

Yes, it’s possible to get a DSCR loan for a new construction or flip if you can provide solid rental income projections. However, we recommend considering construction loans or fix-and-flip loans instead since they’re designed to finance these types of projects.

- Are foreign investors eligible for a DSCR loan?

While this may vary by lender, generally, yes! Foreign investors can qualify for a DSCR loan. At Defy, we’re more than happy to consider foreign investors for our DSCR loans.

- What are some alternatives to a DSCR loan?

Some alternatives to a DSCR loan include bank statement loans, P&L loans, construction loans, and fix-and-flip loans.