A DSCR loan Oklahoma can be a game-changer for real estate investors, freelancers, or business owners in the state looking to acquire, refinance, or renovate a property. Since DSCR loan terms are primarily based on a property’s financial performance, you can maximize income from a lucrative real estate even if you have a less-than-ideal credit score or irregular income source.

At Defy, we provide tailored financing solutions for virtually any situation. With more than 75 non-traditional loan options such as DSCR loans, bank statement loans, and P&L loans, we have catered to scores of borrowers who have unconventional incomes, such as freelancers and self-employed individuals.

Drawing from our experience with DSCR loans, we have crafted this blog to show you how to qualify and apply for a DSCR loan in Oklahoma. We’ll discuss the eligibility criteria you need to qualify and what lenders consider regarding property types and your financial attributes. We’ll also teach you how to calculate a property’s DSCR so you can plan your investment strategy more accurately.

Let’s dive in.

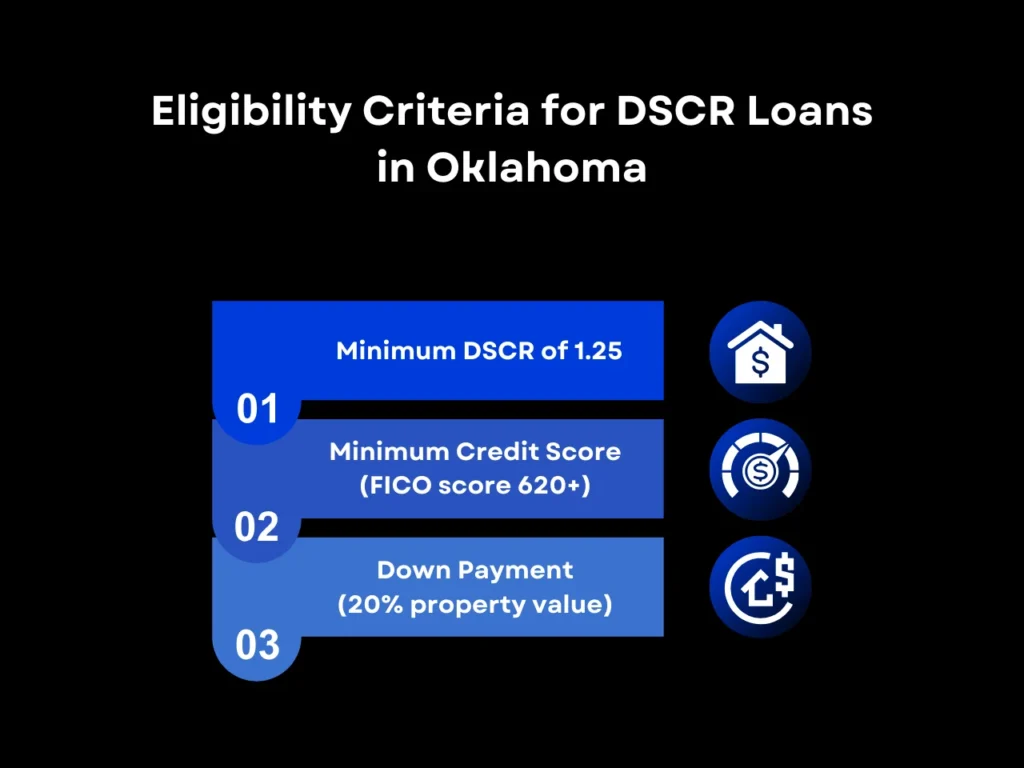

Eligibility Criteria for DSCR Loans

Qualifying for a DSCR loan Oklahoma is much the same as in any other state. Unlike conventional mortgages that rely on W2 forms or reviewing tax returns to assess creditworthiness, debt service coverage ratio (DSCR) loans focus on a property’s cash flow to determine approval and loan terms.

Minimum DSCR

The most important among the DSCR loan requirements is the property’s DSCR. Most lenders look for a minimum DSCR of 1.25, meaning the property should generate at least 25% more profit than required to meet its mortgage debt obligations every year.

A higher DSCR ratio can make getting approved for DSCR loans easier and may lead to better loan terms, such as lower mortgage rates and larger loan amounts. Keep in mind that at Defy, we provide DSCR loans in Oklahoma to real estate investors with DSCR ratios down to 0.75.

Minimum Credit Score

Although DSCR loans tend to be more flexible with credit scores, most lenders still require a minimum credit score of around 650. At Defy, however, we have approved borrowers with FICO scores as low as 620.

Down Payment

You can typically expect to put down at least 20% of the property’s value. Higher down payments can encourage your lender to offer better terms, such as lower interest rates. If you have the funds, it may be prudent to increase your down payment to lower your monthly loan payments.

Some lenders may require borrowers to have enough cash reserves to cover several months of mortgage payments. This will entail a background of your personal finances to verify liquid assets.

Property Types Eligible for DSCR Loans

Technically, any property that generates a positive cash flow can qualify for a DSCR loan program. However, lenders typically prefer properties that have guaranteed income. Here are some of the properties that are eligible for a DSCR loan:

- Rental Properties: DSCR loans are often used to purchase rental properties, such as single-family homes, duplexes, and multifamily units.

- Commercial Real Estate: DSCR loans can also be used to purchase office spaces, retail buildings, and mixed-use properties. These are best in areas with thriving commercial sectors, ensuring consistent demand even through market downturns. One thing to note is that not all lenders offer both commercial and residential mortgages, so be sure to check with the lenders that you are interested in to ensure that they offer the mortgage options for the property type you had in mind.

- Vacation Rentals: Short-term rental properties are becoming increasingly popular in Oklahoma because of the sharp uptick in tourism in recent years. OKC alone generated over $4.5 billion in 2023, making an Oklahoma DSCR loan for strategically placed short term rentals highly viable.

Each property type has its own strengths, which can give it an edge over other properties in certain areas. Tourist-heavy areas might see more rental income from a short-term rental, while commercial real estate performs best in commercial centers like OKC. Residential real estate, however, offers the most consistent income in most locations.

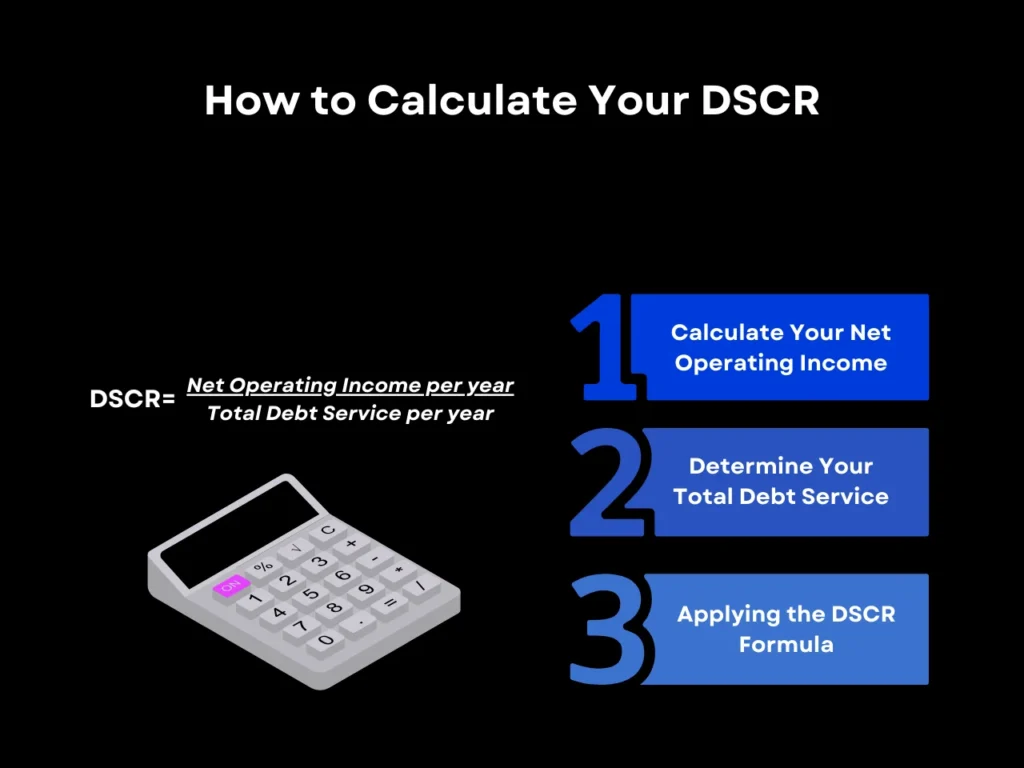

How to Calculate Your DSCR

Calculating the DSCR is key when considering a property for a DSCR loan with favorable terms. Here’s how you can find out the DSCR ratio of a property you have your eye on.

Step-by-Step Guide to DSCR Calculation

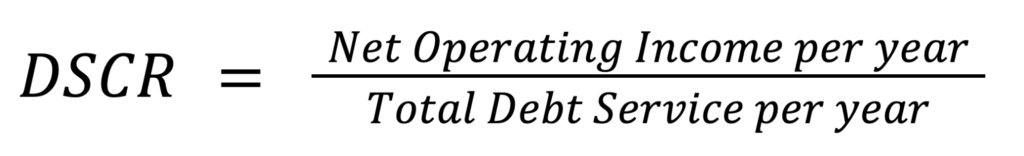

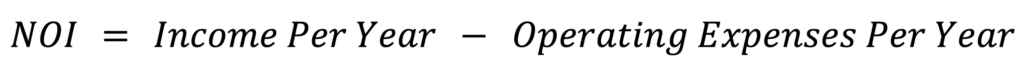

Calculating your DSCR is fairly simple – take the property’s annual income after all operating expenses have been deducted and divide it by all of its debt obligations, including taxes and other dues. The formula for calculating your DSCR is straightforward:

Here’s how you can apply this to any given property.

Step 1: Calculate Your Net Operating Income

Your net operating income (NOI) is the amount your property makes yearly after deducting all operating expenses. It uses this formula:

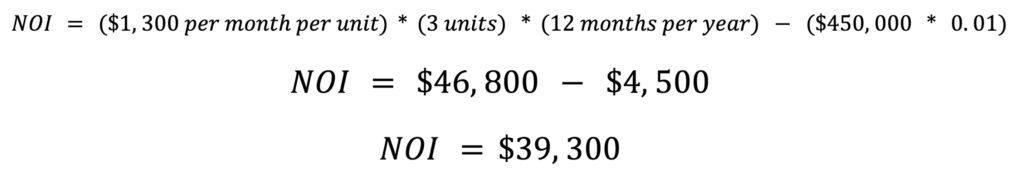

For most rental properties, the only operating expenses are maintenance. According to the One Percent Rule of Maintenance, property owners should allot at least 1% of the property’s market value for upkeep per year.

Let’s say you purchased a 6-bedroom, 4-bathroom property for $450,000, which is close to the usual prices of such a property in Oklahoma City, according to Zillow. Taking one percent of that, we end up with $4,500. Assuming the property is divided into 3 units, with monthly rent at $1,300 per unit, the NOI of the property at full occupancy would be:

Step 2: Determine Your Total Debt Service

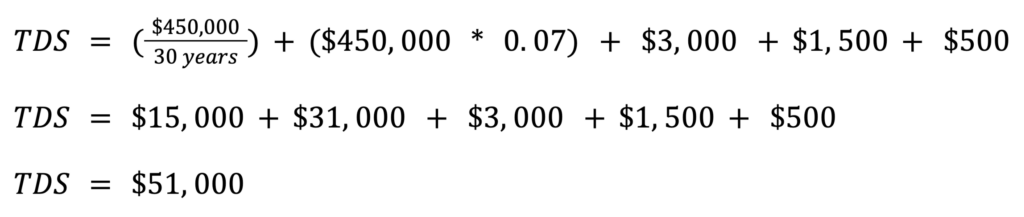

A property’s total debt service (TDS) includes annual mortgage payments and other expenses like property taxes and homeowner’s association dues. The annual mortgage payment covers part of the principal loan amount divided over the repayment period, plus interest payments and other dues. The interest is calculated by multiplying the interest rate by the principal loan amount.

Lenders typically use the national average interest rate for DSCR loans, which is about 7%. A $450,000 loan over 30 years results in $31,000 in annual interest payments. In addition, you’ll need to account for $3,000 in taxes, $1,500 in insurance, and $500 in HOA fees per year.

Step 3: Applying the DSCR Formula

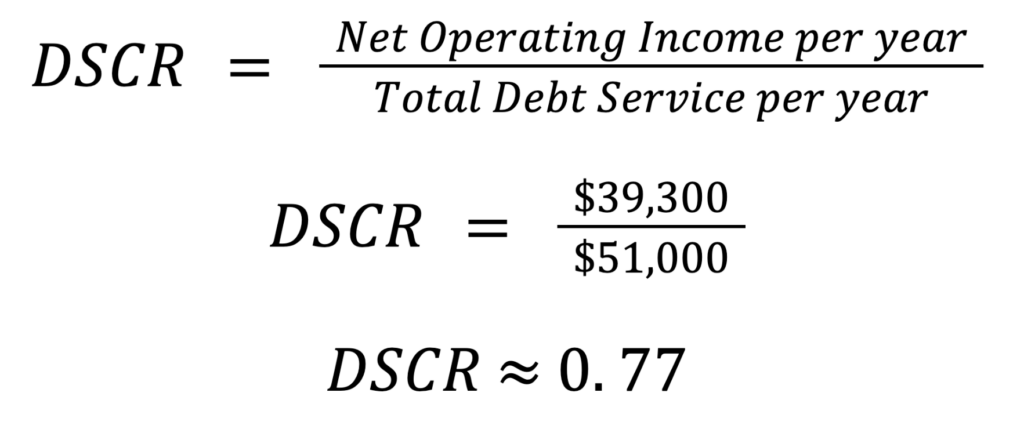

Now that we’ve found both the NOI and TDS, we can apply the DSCR formula. This step is the easiest, as we only need to divide the NOI by the TDS.

A DSCR of 0.77 means the property generates only 77% of its debt obligations, making it unlikely to be approved for a DSCR loan by most lenders, who require a DSCR of 1.25. However, at Defy, we offer loans for properties with DSCRs as low as 0.75.

How DSCR Affects Loan Amounts and Terms

Higher DSCRs improve your chances of securing favorable loan terms. Many DSCR lenders offer lower interest rates and higher loan amounts if your property has a DSCR above 1.25. Conversely, having a DSCR below their minimum might make a lender offer you stricter terms, such as higher interest rates or lower loan amounts.

Applying for a DSCR Loan in Oklahoma

The application process for a DSCR loan in Oklahoma involves gathering important documentation, finding a borrower that aligns with your investment goals, and ensuring that the underwriting process proceeds smoothly.

Documentation Needed for Application

Applying for a DSCR loan requires the submission of certain documents so the lender can verify the property’s income, as well as your personal financial details. These include:

- Property Financials: Lenders require detailed financial statements to assess a property’s income potential. These include rental income, lease agreements, operating expenses, and maintenance costs. If you own multiple properties, you may need to provide similar documents for each.

- Personal Income Documents: Submit credit reports, asset documentation, and other personal financial information to help lenders assess if you can support the property’s debt. At Defy, however, you won’t need to provide W2s or tax returns to qualify for a DSCR loan in Oklahoma – or DSCR loan in any state we are lincensed in for that matter.

Lenders also use rental income statements to gauge how consistently a property can generate enough income. A history of steady rental income even through dips in market demand.

Selecting the Right DSCR Lender in Oklahoma

Choosing the right DSCR lender in Oklahoma is crucial for ensuring maximum ROI from an investment property. In particular, DSCR lenders with experience in Oklahoma’s rental market better understand the nuances of property investing in the state. This can lead to them offering you DSCR loan terms that are more closely aligned with the specific dynamics of Oklahoma’s rental market.

At Defy, we offer DSCR loans across several US states, including California, Texas, Colorado, Maryland, and Indiana. Our mortgage experts are highly knowledgeable about important real estate investing nuances in each of them.

What to Expect for the Underwriting Process

The underwriting process for DSCR loans can vary by lender, but generally, you can expect a thorough review of the property’s financial details. This also involves a comprehensive appraisal of your property.

Lenders will want to make sure everything aligns with the documents you’ve submitted and note other things that the documents may not have covered. Ensuring that your documents are complete and cooperating fully during the appraisal will make for a smooth underwriting process and fast-track your approval.

DSCR Loan Oklahoma FAQs

What Is the Minimum DSCR Required in Oklahoma?

Most DSCR lenders seek a minimum DSCR of 1.25 to approve DSCR loans. A DSCR of 1.25 means that a property generates 25% more profit than its total debt, communicating to the lender that it can meet its debt payments even if it experiences economic difficulties. At Defy, we offer DSCR loans for properties down to 0.75 DSCR.

Can I Qualify for a DSCR Loan with Bad Credit?

Although DSCR mortgage loan terms are primarily based on the property’s ability to generate income, DSCR lenders do pay some attention to a borrower’s financial history, particularly their credit score. Your application can still get approved if you have a lower credit score, but you may face higher interest rates and unfavorable loan terms. At Defy, we offer DSCR loans for those with FICO scores as low as 620, with foreign national loan options for those who don’t have a US credit score or social security number.

How Do Seasonal Rentals Affect DSCR Loan Eligibility?

Seasonal rentals can be very lucrative given Oklahoma’s tourism boom, but lenders may ask for proof that the property has a long history of good and consistent income.

Are There Prepayment Penalties on DSCR Loans?

Many DSCR loan programs have prepayment penalties, ranging from 1% to 5%. Remember to check with your lender about prepayment so you know what to expect. Private lenders can have specific requirements regarding prepayment.

How Long Does the DSCR Loan Process Take in Oklahoma?

The process can take as little as 2 weeks to 60 days, from submitting your loan application to getting approved. Factors like the complexity of your application and missing documents can warrant a more thorough underwriting process, extending the approval timeline.

Key Takeaway

With Oklahoma’s healthy rental market and tourism boom, real estate investment prospects are optimistic. A DSCR loan Oklahoma can help you tap into the growing profitability of the state’s investment properties without needing the traditional income verification characteristic of a conventional loan.

If you’re considering a DSCR loan in Oklahoma, remember to calculate the DSCR of the property on which you intend to use your DSCR loan so you can gauge its profitability. By selecting the right lender and ensuring a smooth underwriting process, you can get approved as soon as possible and secure favorable terms.

Looking for a DSCR loan for properties with a DSCR as low as 0.75? Reach out to Defy today and let our mortgage experts customize a DSCR loan program that fits perfectly with your needs. We also have foreign national loan options for those who don’t have a U.S. credit score or social security number.