Selecting the right real estate investment financing options is critical for investors looking to maximize returns and minimize risks. Each loan type has its own advantages, disadvantages, terms, and costs. With a clear understanding of your investment goals, you’ll be able to find the best solution for your unique situation.

At Defy Mortgage, we deliver 75+ comprehensive solutions designed to simplify the mortgage process, whatever your goals may be. Whether you’re a freelancer or self-employed individual looking to buy your first home or an entrepreneur trying your hand at real estate investing, our non-traditional lending options can be fully tailored to meet your unique needs. Our expertise includes DSCR loans, bank statement loans, foreign national loans, and other non-QM offerings.

With our years of experience working with investors, we’ve put together this blog to help you understand the investment property mortgage options available to you. We’ll discuss how to establish your investment goals, narrow down your loan options, and identify the investment loan that’s right for you.

Let’s begin!

Understanding Your Real Estate Investment Goals

Real estate investment financing options are mostly geared towards either buying and selling or long-term investment. Understanding your real estate investment goals, whether it’s flipping houses, building a rental portfolio, or securing long-term appreciation, allows you to choose the financing option that aligns best with your strategy.

Short-Term vs. Long-Term Goals

Real estate investment usually falls under one of two categories: resale and rental. Investment property loan products are typically geared towards one of these two.

For example, short-term loans like fix-and-flip loans are designed for investors who want to renovate and sell properties quickly. They provide fast funding with quick repayment schedules–usually between 18 months and 3 years. The shorter loan term adds pressure to sell as soon as possible, but it can also reduce total interest and increase profit.

If your goal is to purchase a property to collect rental income over time, you may benefit from an investment loan that’s structured more like a traditional 30-year mortgage, such as a Debt Service Coverage Ratio (DSCR) Loan or a conventional loan. These have much lower monthly payments that better align with rental property cash flow.

Property Types

Your property type can significantly influence your financing options. For example, DSCR is often best suited for residential properties because the consistency in rental income aligns well with a property’s debt service coverage ratio requirements.

On the other hand, commercial real estate loans are often best for larger commercial properties like retail space, office buildings, or apartment complexes with more than 5 units as they usually require larger loan amounts. That said, DSCR loans can still finance smaller-scale commercial and mixed-use properties as long as they have a positive cash flow.

Risk Tolerance

Understanding your risk tolerance and investment timelines helps narrow down options. If you have a low risk tolerance, purchasing rental properties with a DSCR or conventional loan can give you more consistent rental income over time.

If you have a high risk tolerance and prefer shorter investment timelines, you might consider short-term loans like fix-and-flip or construction loans to quickly turn a profit. Keep in mind that these options come with greater complexity and higher financial risk.

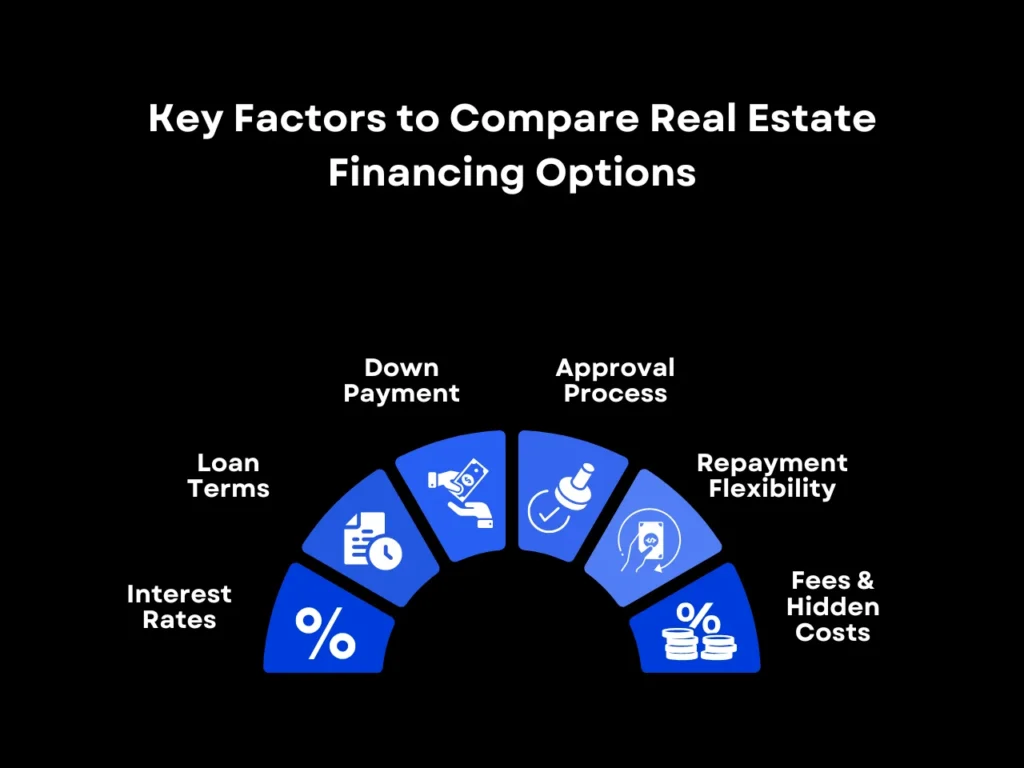

Key Factors to Compare Real Estate Financing Options

Each real estate financing option suits different lending scenarios and borrower profiles. Consider the following factors when choosing the best option for your needs:

Interest Rates

Mortgage rates directly impact your ROI by decreasing your profitability relative to your investment cost. When choosing between similar loan options, always check whether one offers lower rates for your financial profile.

For example, if you have a good to excellent credit score, you may qualify for lower rates with a conventional loan. However, if your credit is fair but your property has strong income potential, a DSCR loan may offer better rates since it prioritizes the property’s earning potential over your personal credit score.

Loan Terms

The choice between short-term and long-term loans or 15-year vs. 30-year loan terms depends on your financial goals and investment strategy. If you plan to maximize your cash flow and have the ability to invest in additional properties, a 30-year DSCR loan may better align with your objectives. In contrast, a 20-year commercial loan might suit investors aiming to build equity quickly, minimize interest payments, and prepare for a potential future sale with lower debt levels.

Down Payment Requirements

Some loans require a higher down payment due to higher lending risk. This can raise the barrier to entry, requiring you to pay more out of pocket upfront. Additionally, a larger down payment may also be required to secure a lower interest rate.

When exploring your options, also consider government-backed loans such as VA loans and FHA loans, as these could offer low or even no down payment on your loan. While these loans cannot directly be used for an an investment property, there is a pathway for you to convert a primary residence purchased with an FHA loan into an investment property after a certain period, depending on various factors.

Approval Process

Each loan type has its own criteria for approval and terms. While you may just meet the minimum qualifications for one loan, you could exceed the requirements for another. It’s important to take the requirements into account when selecting the best financing option.

You should also inquire about the expected timeline for loan approval. The amount of checks, appraisals, and other underwriting processes required can impact how quickly the loan can be finalized. Loans with lengthy approval timelines may not be ideal for investment opportunities that require immediate action.

Repayment Flexibility

A loan’s repayment structure also plays a crucial role in your investment strategy. Some loans offer interest-only payments during the early years of the loan term, helping investors keep their monthly payments low while reinvesting profits into renovations, property expansion, or other income-generating activities.

Balloon payments are another option, where smaller regular payments lead to a large lump-sum payment at the end of the loan term. This can be risky, as it requires you to either sell or refinance the property before the final payment is due, but it can be advantageous for seasoned investors who are confident in the property’s appreciation or resale value. Keep in mind that not all lenders offer balloon payment options.

In contrast, conventional loans follow a fully amortized structure. While paying both interest and principal from the start can be less flexible, the predictable month-to-month cost offers more stability and is ideal for buy-and-hold investors.

Fees and Hidden Costs

Other fees, such as appraisal and origination fees, can also affect your overall ROI. Origination fees, which the lender charges for processing your loan application, typically range from 0.5% to 1% of the total loan amount.

Closing costs can include appraisal fees, title insurance, legal fees, and other charges related to the property purchase or refinance. For most real estate loans, closing costs range from 2% to 5% of the property’s purchase price. Government-backed loans may offer lower closing costs or waive them entirely for borrowers with full eligibility, while private lenders may charge more depending on the complexity of the loan.

One of the most significant “hidden costs” is the prepayment penalty. This can apply if you pay off your loan early, which can limit your flexibility to refinance or sell. For a $400K home, closing costs can fall between $8,000 and $20,000, depending on the lender and loan type. If a prepayment penalty applies, it could add another $3,200 to $9,600. This is why it’s essential to factor these potential expenses into your loan decision.

Popular Real Estate Financing Options to Compare

Let’s explore some of the most common real estate financing options to help you determine which one aligns with your investment strategy. Each type of financing comes with its own advantages and limitations for specific scenarios.

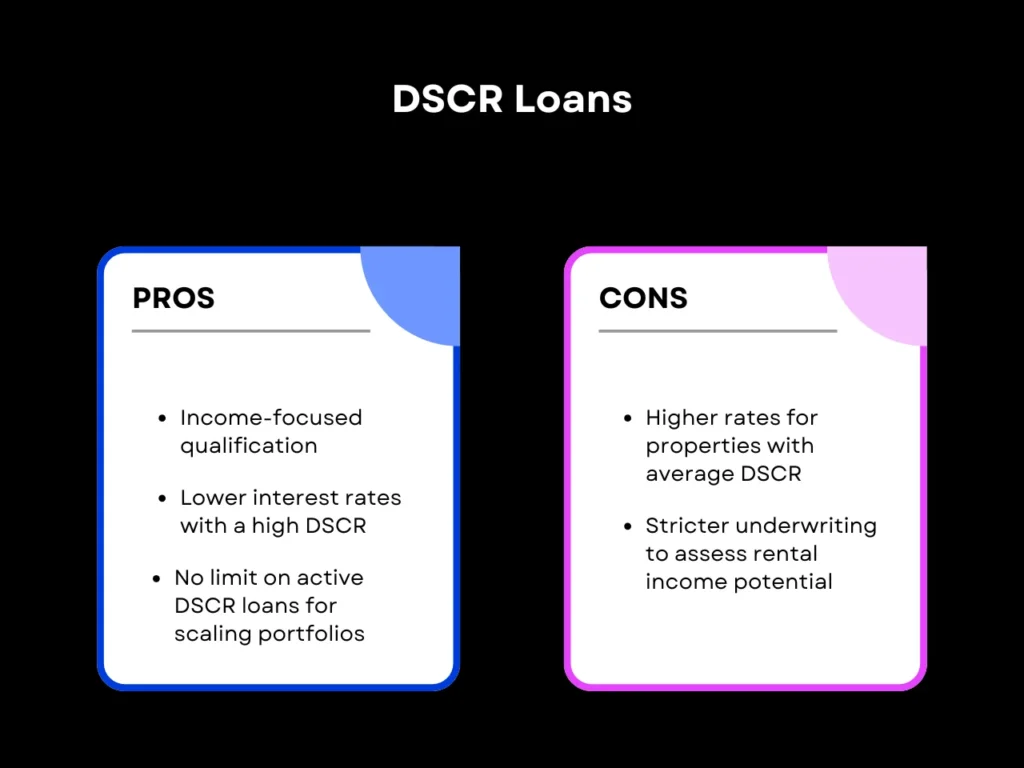

DSCR Loans (Debt Service Coverage Ratio Loans)

Debt service coverage ratio loans focus on the debt service coverage ratio of the property to determine eligibility and loan terms. DSCR is the ratio between a property’s annual income (after operating expenses) and its annual debt obligation, which includes mortgage payments, taxes, and HOA fees. DSCR is an attractive option for investors with irregular income or imperfect credit because it prioritizes the property’s income over the borrower’s personal financial situation.

Pros:

- Qualification focused on property income

- Can get lower interest rates if property’s DSCR is high enough

- No hard limit on active DSCR loans which supports scaling investment portfolios

Cons:

- Potentially higher rates for properties with average DSCR

- Stricter underwriting procedures to ascertain the rental income potential of the property

DSCR loans have been steadily gaining popularity over the past few years because of their focus on property income, making real estate investment much more accessible to a wider range of investors.

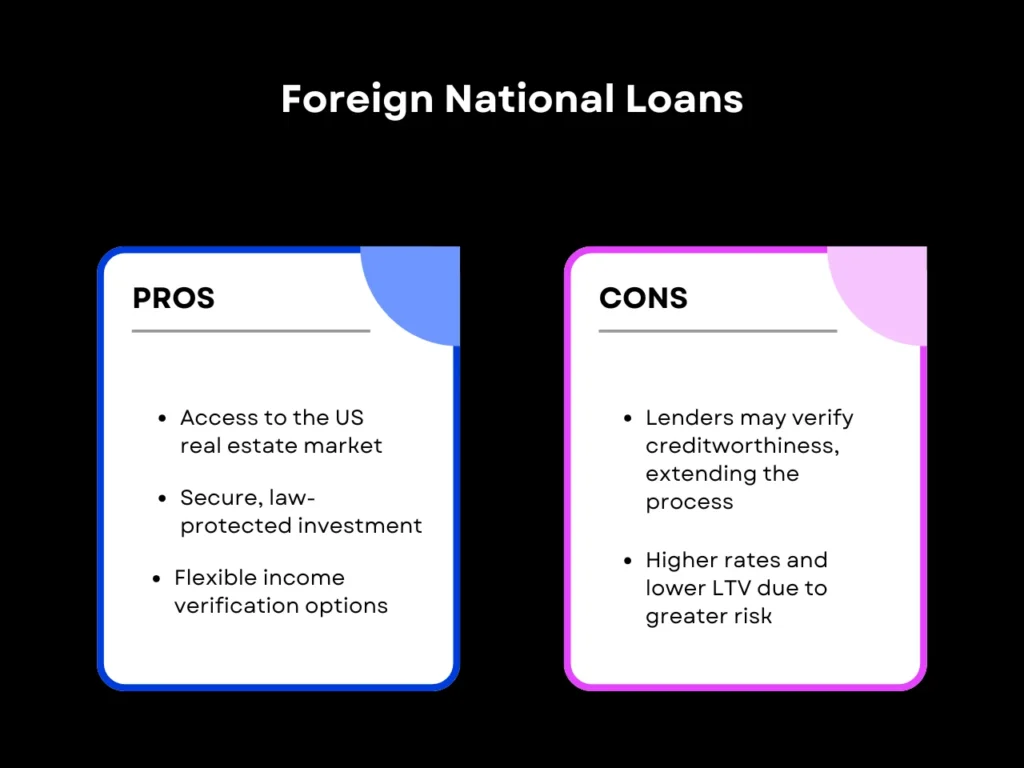

Foreign National Loans

Foreign national loans are a subset of loan products directed at non-US citizens who do not have a US Social Security number or FICO score. Depending on the lender, foreign national loans can encompass various loan types, from conventional to construction loans.

Pros:

- Opens the door to the highly lucrative US real estate market

- Provides access to a safe and secure investment protected by US laws

- Allows diverse forms of credentials to verify income, such as bank statements and letters of recommendation from banks in the borrower’s home country

Cons:

- Lenders can employ various methods to thoroughly verify your creditworthiness, such as contacting employers or business partners, which can extend the application process

- Can have higher rates and slightly lower loan-to-value (LTV) ratio than other loans due to greater risk

While income verification for foreign national loans can be a bit more inconvenient for foreign investors, it can be well worth it considering the wealth of options offered by the American real estate investment market.

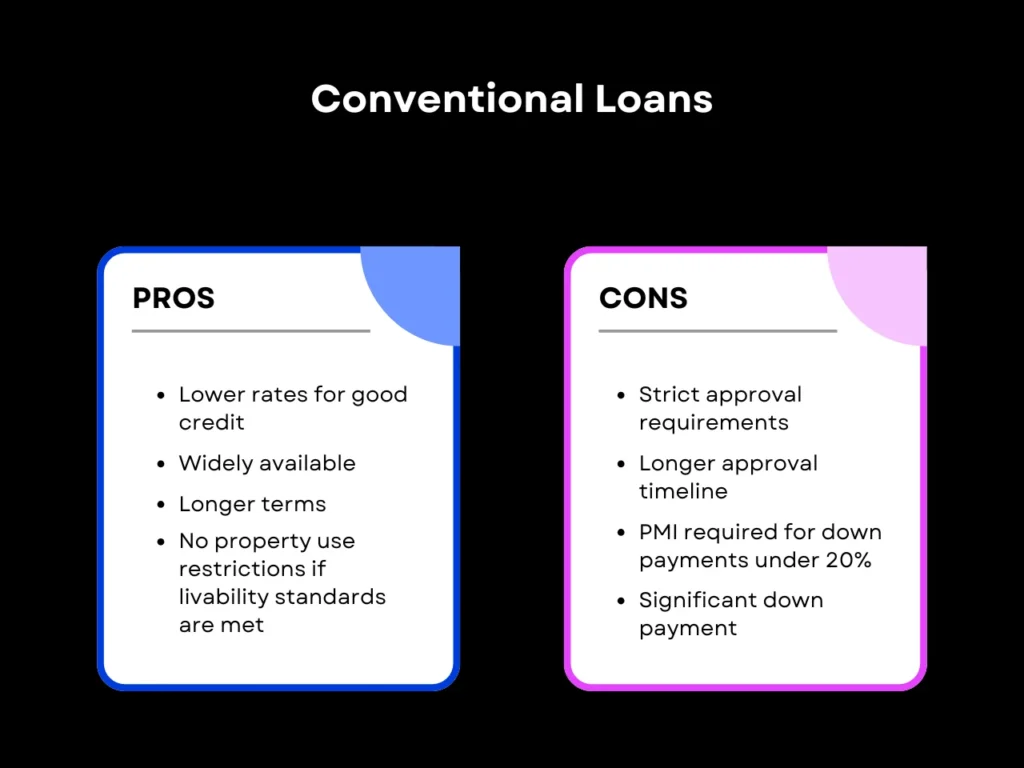

Conventional Loans

Conventional loans are standard loan products offered by banks, financial institutions, and private lenders. They are widely available and typically feature competitive rates. However, due to being regulated by entities such as Fannie Mae and Freddie Mac, they often require strong credit scores and larger down payments. They are a solid option for those who have a strong financial profile.

Pros:

- Lower interest rates for those with good credit

- Widely available from various lenders

- Longer terms and more manageable monthly payments

- No restrictions on property use as long as the property meets livability standards

Cons:

- Strict approval requirements including income verification

- Longer approval timeline compared to other options due to underwriting processes

- Private Mortgage Insurance (PMI) is required if the down payment is below 20%

- Significant down payment needed upfront to secure the loan

Conventional loans provide stability and affordability for long-term investors with strong credit profiles. However, their strict requirements and substantial down payments make them less accessible for some.

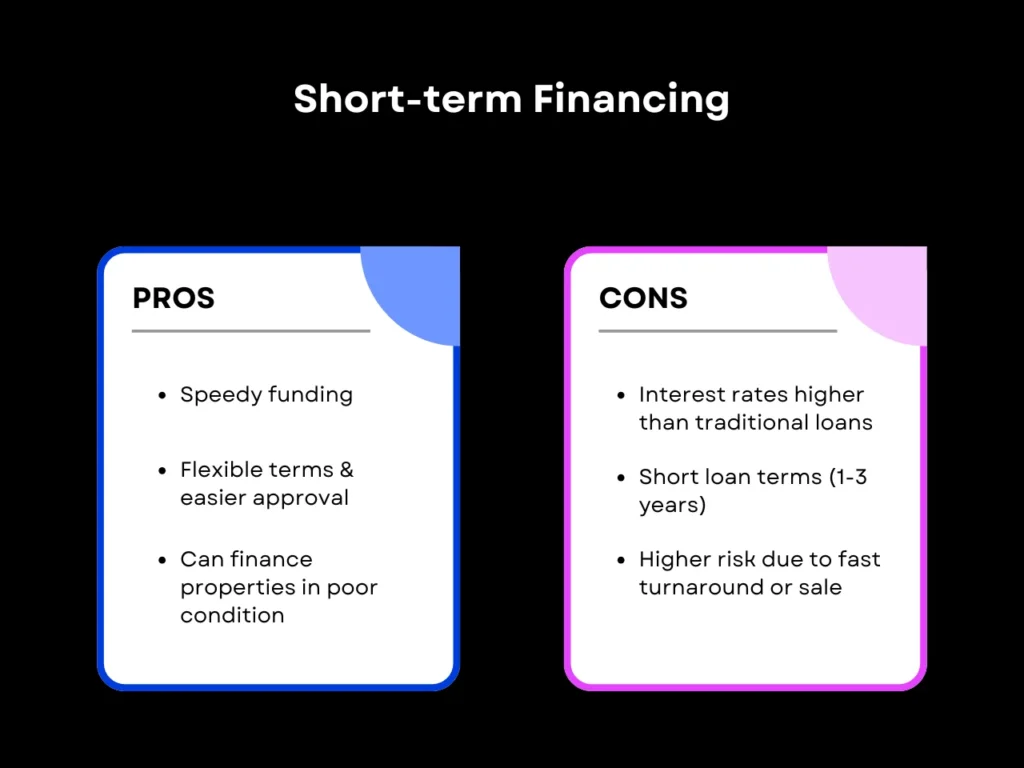

Short-term Financing

Short-term loans, including fix-and-flip loans, construction loans, hard money loans, and bridge loans, are often used for house-flipping projects or other time-sensitive investments. These loans can be quicker to approve and offer more flexible terms, making them a great option for shorter-term investment needs.

Pros:

- Speedy funding for time-sensitive projects

- Flexible terms and less stringent approval process compared to traditional loans

- Ability to finance properties in poor condition, which may not qualify for other loan types

Cons:

- Higher interest rate, often significantly higher than traditional loans

- Shorter loan terms (usually 1-3 years), requiring a quicker exit strategy

- Increased risk due to pressure for fast property turnaround or sale

Short-term financing options are suitable for investors needing fast access to capital and more flexible underwriting, especially for fast-paced projects like property flips. However, due to their higher costs, they require careful planning to ensure profitability.

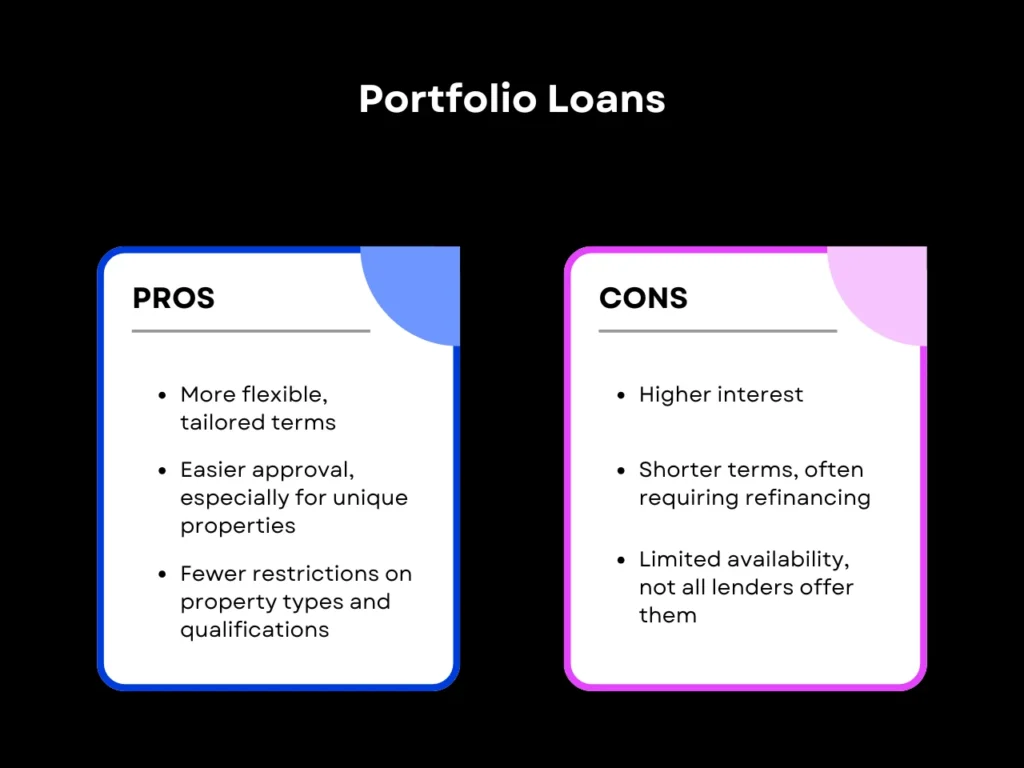

Portfolio Loans

Portfolio loans are kept by the lender in their own portfolio rather than being sold on the secondary market. This allows for more flexible terms and greater customization to meet the borrower’s specific needs.

Pros:

- Terms are more flexible and tailored to the borrower’s unique situation

- Easier approval process compared to conventional loans, especially for unique properties

- Fewer restrictions on property types or borrower qualifications

Cons:

- Higher interest rates than traditional mortgages

- Shorter loan terms, often requiring refinancing or repayment sooner

- Limited availability, as not all lenders offer portfolio loans

Portfolio loans offer flexible, customized financing for borrowers with unique needs, though higher interest rates and shorter terms may require careful planning.

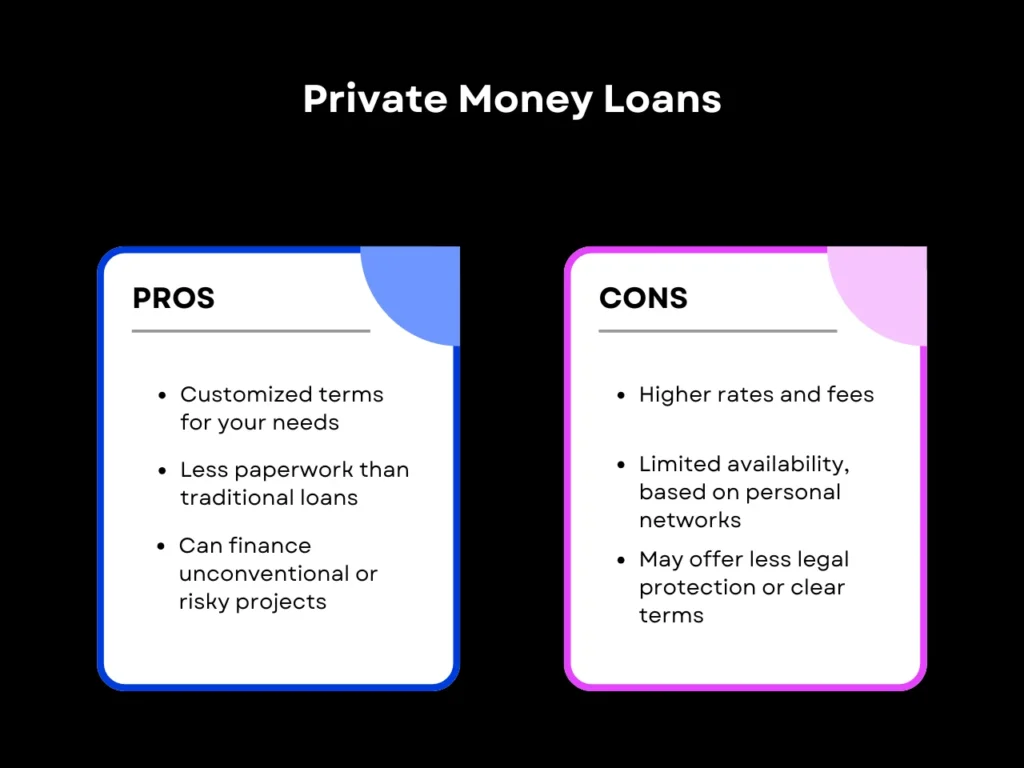

Private Money Loans

Private money loans are relationship-based loans offered by individuals or private investors. They provide flexibility and are often tailored to unique situations, but they may come with higher interest rates and can be harder to secure.

Pros:

- Customized terms based on your specific needs

- Fewer formalities and less paperwork compared to traditional loans

- Can be used for unconventional or higher-risk projects that banks may reject

Cons:

- Potentially higher interest rates and fees compared to institutional lenders

- Limited availability, as they typically rely on personal relationships

- May involve less legal protection or standardized terms

Private money loans offer flexible, personalized financing solutions for unconventional projects or borrowers who may not qualify for traditional loans. However, the higher costs and limited availability require weighing the risks carefully before pursuing this option.

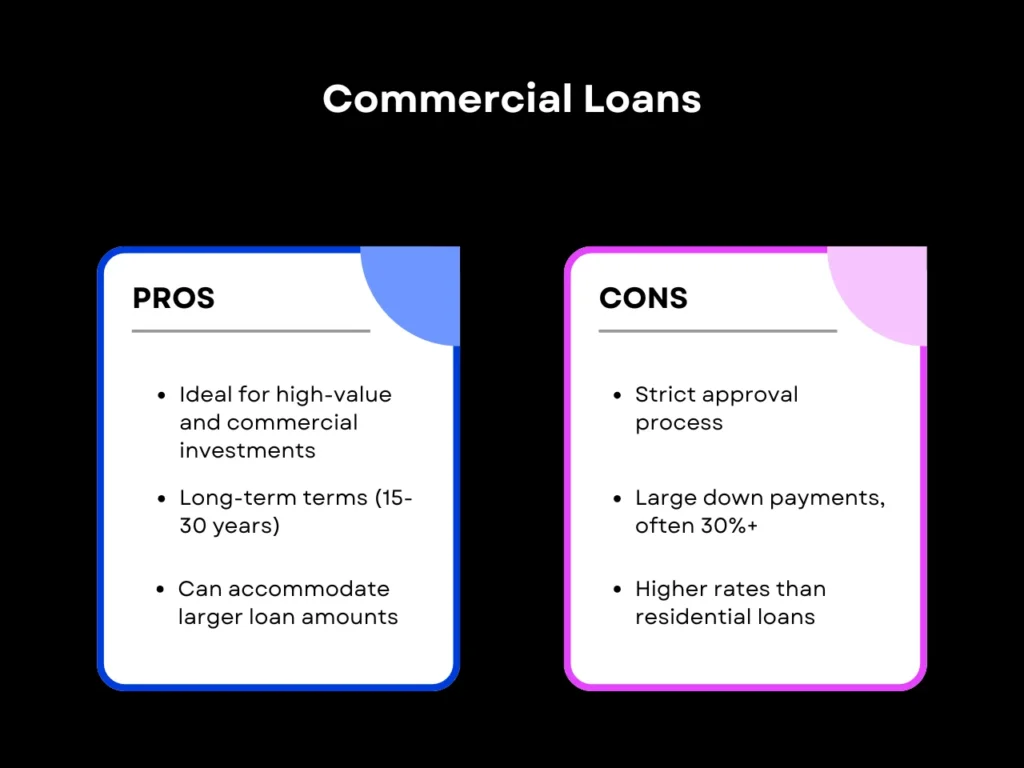

Commercial Loans

Commercial loans are designed for larger-scale investments or multi-unit properties. These loans typically require strong property income and substantial down payments but offer financing for high-value investments with long-term potential. Keep in mind that not all residential lenders offer commercial loans and vice versa.

Pros:

- Ideal for high-value investments and commercial real estate projects

- Long-term potential, often with terms ranging from 15 to 30 years

- Can accommodate larger loan amounts for expansive properties

Cons:

- Intensive approval process with stringent underwriting requirements

- Significant down payments, sometimes 30% or more, required upfront

- Higher interest rates compared to residential loans

Commercial loans are best suited for large investments or multi-unit properties, offering long-term financing options for substantial projects. However, the intensive approval process and large upfront costs require careful consideration and planning.

Real Estate Investment Financing Options FAQ

What is the best loan type for rental properties?

The best loan type depends on your investment strategy and financial profile. For example, DSCR loans are best for investors who want the property’s income to be the main factor considered for loan terms, while commercial loans cater to investors who want to purchase more large-scale rental properties.

How do DSCR loans work for real estate investments?

DSCR loans focus on the income potential of a property rather than the borrower’s credit score. This makes them ideal for rental property investors, as they are based on the property’s ability to generate enough income to cover debt payments. The loan is typically easier to qualify for than traditional loans, especially for investors with less-than-perfect credit, but the property must have positive cash flow.

What is the down payment for a DSCR loan?

The minimum down payment for a DSCR loan depends on the maximum LTV offered by the lender. If a lender offers an 80% LTV, your down payment will be 20%. Similarly, a 75% LTV will result in a 25% down payment. These are the most common offers lenders will provide. At Defy, we offer up to 85% LTV for DSCR loans. For qualified borrowers, your minimum down payment can be as low as 15%.

How can I get approved for a real estate loan with poor credit?

If you have poor credit, there are still options to secure financing. Alternative loans, such as portfolio loans or DSCR loans typically have more flexible approval criteria and may rely more on the property’s income potential than your credit score.

What’s the difference between hard money loans and conventional loans?

Hard money loans are short-term loans typically used for fix-and-flip projects, offering quick approvals and flexible terms but with higher interest rates and shorter repayment periods.

On the other hand, conventional loans are longer-term loans that offer stability, lower interest rates, and predictable payments but require a strong credit score, a substantial down payment, and a more intensive approval process.

How do interest rates affect real estate investment returns?

Interest rates directly impact overall investment returns, with higher interest rates increasing your borrowing costs and making you pay more in interest over the life of the loan, reducing long-term profitability. Conversely, lower interest rates reduce borrowing costs, allowing for better cash flow and a higher return on investment.

Key Takeaway

Navigating your real estate investment financing options requires a clear understanding of your goals and the factors influencing each loan type. By evaluating interest rates, loan terms, and approval processes, you can make informed decisions to maximize your investments.

Whether you’re exploring DSCR loans, conventional loans, or short-term financing, remember to align your choice with your investment strategy, cash flow goals, and risk tolerance to ensure long-term success.

Ready to explore your investment property loan options? Contact Defy today to learn about our various offerings. You can schedule an appointment, call us at (615) 622-1032, or email team@defymortgage.com.