For those with unconventional incomes, obtaining a mortgage can be unnecessarily challenging. Traditional lenders often insist on standard income verification methods that may not accurately reflect the cash flow of self-employed workers or business owners. Fortunately, the best bank statement mortgage lenders allow you to qualify using the income on their personal or business bank statements, or even a mix of documentation.

At Defy Mortgage, we specialize in non-traditional loan products such as bank statement loans. With 75+ tailored options in our repertoire, we can provide a solution for just about any scenario. Whether you’re a self-employed worker seeking a bank statement loan or a retiree looking to take advantage of your liquid assets with an asset depletion mortgage, Defy can customize a loan program for you.

In this blog, we’ll talk about:

- The 15 best bank statement mortgage lenders in 2025.

- A brief overview of their target markets.

- The specifics of each of their bank statement offerings.

Let’s get started.

What is a Bank Statement Loan?

A bank statement loan allows borrowers to use their bank statements to verify their income rather than traditional documentation like W2s, pay stubs, and tax returns. The best bank statement mortgage lenders allow both business and personal bank statements, although usually only 50% of business income is counted.

Similar to asset depletion loans, which use liquid assets to prove income, bank statement loans allow borrowers with irregular income structures, such as self-employed professionals and investors, to determine their actual income. This significantly increases the likelihood of approval over a conventional loan application.

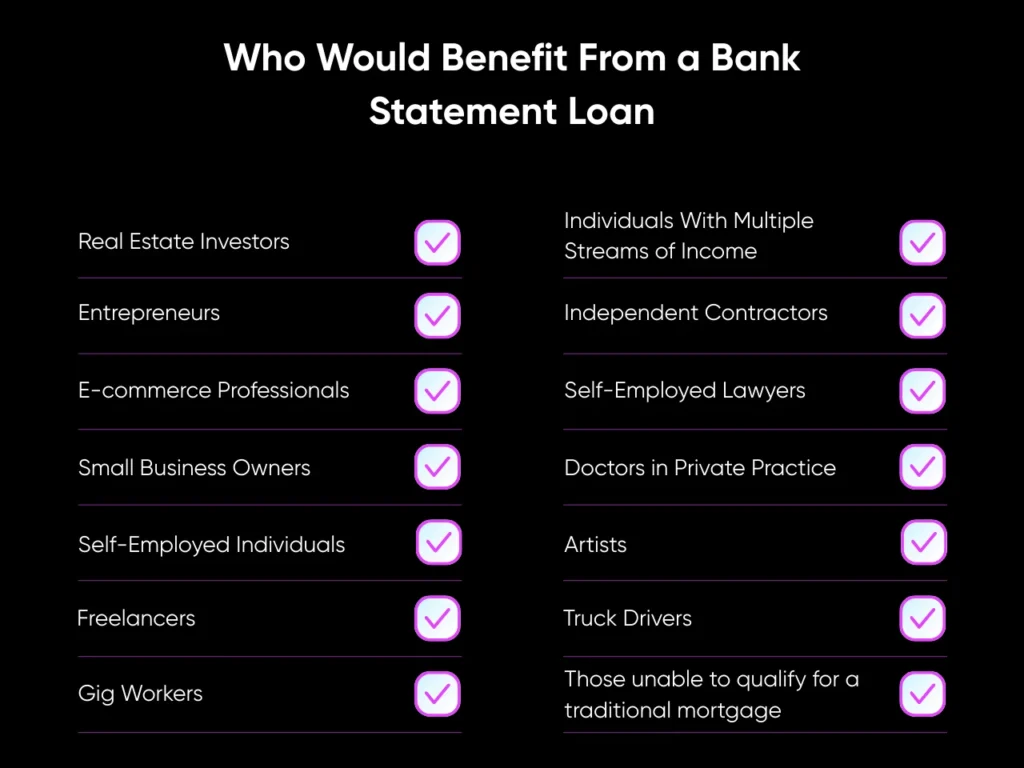

Who Would Benefit From a Bank Statement Loan?

Anyone who has a non-traditional income stream that makes it difficult to verify their income through traditional documents would benefit greatly from a bank statement loan. This includes, but is not limited to:

- Real Estate Investors

- Entrepreneurs

- E-commerce Professionals

- Small Business Owners

- Self-Employed Individuals

- Freelancers

- Gig Workers

- Individuals With Multiple Streams of Income

- Independent Contractors

- Self-Employed Lawyers

- Doctors in Private Practice

- Artists

- Truck Drivers

- Individuals with unique circumstances who would not be able to qualify for a traditional mortgage

If you’re a mortgage broker struggling to target these demographics, Defy also has a TPO business. Defy TPO, or D3 for short, can give you the tools to meet the complex needs of non-traditional borrowers in ways that traditional lenders simply can’t. With our competitive products and decades of experience with underserved borrowers, we empower you to close the tough deals, win more clients, and grow your pipeline with confidence. Reach out to D3 today and find out just how much you can win with us in your corner.

How Was This List Formed?

This list was formed by considering several factors to help determine who the best bank statement lenders are in the industry, including the experience of employees, good reviews, rate transparency, awards, overall brand message, and more. Please note that this list is in no particular order.

The Top 15 Best Bank Statement Mortgage Lenders of 2025

In no particular order, here are our 15 best bank statement mortgage lenders of 2025:

1. Defy Mortgage

Defy Mortgage, a rising force in the industry since 2022, is a lender that aims to empower non-traditional borrowers and revolutionize the mortgage experience. With over 100 years of collective experience, our team specializes in non-QM mortgages for groups like foreign nationals, investors, and self-employed individuals.

Defy empowers these individuals by removing roadblocks to homeownership, whether they’re buying or refinancing. We prioritize a smooth and secure process, centered on the borrower’s experience, and take a full 360-degree look at your unique finances, goals, and background. Not just judging you by some standard checklist.

The requirements and terms for our bank statement loans include:

- Minimum credit score: 620

- Minimum down payment: 10%

- Months of bank statements: 12-24 months

- Max loan amount: $6,000,000

- Minimum reserves: 6 months

- Max DTI: 43%

And here’s what you’re getting when you choose Defy:

- No tax returns required

- 1- to 4-unit properties that are primary homes, second homes, or investment properties.

- Interest-only options are available.

- R/T and cash-out refinance options available.

- ARM or fixed-rate options are available.

- Profit & Loss loan option available for business owners.

- No obligation or application fees EVER.

Our deep market knowledge and CEO Todd Orlando’s 25-year experience in finance position them as a leading force in non-traditional mortgage solutions. When others say no, Defy says yes. Being self-employed shouldn’t and doesn’t make you less qualified for a mortgage. If you defy the traditional, you have a partner who does too.

2. Griffin Funding

Founded in 2013 in San Diego, California, Griffin Funding is a fully digital direct lender specializing in serving veterans, self-employed individuals, and real estate investors.

Bank statement loan requirements:

- Minimum credit score: 620

- Minimum down payment: 10%

- Months of bank statements: 12 months

- Max loan amount: $100,000 – $5,000,000

- Minimum reserves: 3-12 months of PITI

- Max DTI: 50%

- Minimum self-employed or business experience: 2 years

3. Truss Financial Group

Founded in 2006, Truss Financial Group has over 20 years of experience serving small business owners and real estate investors. They offer three types of bank statement programs: a three-month, a 12-month, and a 24-month program.

Bank statement loan requirements:

- Minimum down payment: 10%

- Minimum credit score: 620

- Max loan amount: Up to $4,000,000

- Months of bank statements: 12-24 months

- Max DTI: 55%, but ideally below 43%

- Minimum reserves: No specific amount, but proof of cash reserves required

4. CrossCountry Mortgage

CrossCountry Mortgage was founded in 2003 and has since grown to a nationwide retail mortgage lender with operations in all 50 states, plus DC and Puerto Rico.

Bank statement loan requirements:

- Minimum down payment: 10%

- Minimum credit score: 620

- Max loan amount: Up to $3,000,000

- Months of bank statements: 3-24 months

- Max DTI: 50%

- Minimum reserves: No specific amount, but proof of liquid assets required

- Minimum self-employed or business experience: 2 years

5. Change Home Mortgage

Change Home Mortgage is a CDFI-certified lender that focuses on serving underbanked and diverse borrowers, such as freelancers, gig workers, and foreign nationals. Rather than a bank statement loan program, Change Home Mortgage offers an “Alt-Doc” program that essentially rolls asset depletion loans and bank statement loans into one.

Unfortunately, the requirements for this program are not stated, but Change Home Mortgage does state that their Alt-Doc programs accept self-employed, rental, W-2, bank statement, asset qualifier, and 1099 income statements.

6. New American Funding

New American Funding strongly focuses on using advanced tech to enhance its services, especially for disadvantaged communities such as the Latino and Black communities.

Bank statement loan requirements:

- Minimum down payment: 20%

- Minimum credit score: 620

- Months of bank statements: 12-24 months

- Max DTI: 43%

7. Angel Oak Mortgage Solutions

Angel Oak Mortgage Solutions’ bank statement loans also allow profit-and-loss statements. Borrowers who own as little as 25% of their business can also qualify using business bank statements.

Bank statement loan requirements:

- Minimum down payment: 10%

- Minimum credit score: 640

- Max loan amount: Up to $4,000,000

- Months of bank statements: 12-24 months

8. Rate

Formerly known as Guaranteed Rate, Rate’s bank statement loans require you to provide additional business details to secure lender confidence.

Bank statement loan requirements:

- Minimum down payment: 10%

- Minimum credit score: 660

- Months of bank statements: 12-24 months

- Max DTI: 50%

9. A&D Mortgage

A&D Mortgage’s bank statement loans cap out cash-in-hand at $500,000 for CLTVs (Combined Loan-to-Value) above 65%, and $1,000,000 for CLTVs between 55% and 65%.

Bank statement loan requirements:

- Minimum down payment: 10%

- Minimum credit score: 620, borrowers with no score also allowed

- Max loan amount: Up to $4,000,000

- Months of bank statements: 12-24 months

- Max DTI: 55%

- Minimum reserves: 3 months

10. North American Savings Bank

NASB has roots as a long-standing federally chartered savings bank and is known for combining retail banking with nationwide mortgage lending expertise.

Bank statement loan requirements:

- Minimum down payment: 10%

- Minimum credit score: 700

- Max loan amount: Up to $1,250,000

- Months of bank statements: 12 months

- Max DTI: 50%

- Minimum reserves: No specific amount, but proof of liquid assets required

- Minimum self-employed or business experience: 2 years, but an exception can be made if self-employed for only 1 year if you were in the same line of work prior

11. Acra Lending

Operating in 39 states and DC, Acra Lending offers programs and services through wholesale lending, consumer direct lending, investor lending, and correspondent lending.

Bank statement loan requirements:

- Minimum down payment: 10%

- Minimum credit score: 600

- Max loan amount: Up to $4,000,000

- Months of bank statements: 12 months

- Max DTI: 50%

- Minimum reserves: No specific amount, but proof of liquid assets required for loans above 75% LTV

- Minimum self-employed or business experience: 2 years, but an exception can be made if self-employed for only 1 year if you were in the same line of work prior

12. First National Bank of America

Unlike many other nationally chartered banks, FNBA holds non-QM mortgage expertise and leans heavily towards serving non-traditional borrowers. Their bank statement loans are available in the form of their self-employed loans, which allow blended income documentation to support your application.

Self-employed loan requirements:

- Minimum down payment: 15%

- Months of bank statements: 12 months

- Max DTI: 60%

13. Oaktree Funding

A mortgage banker licensed in multiple states, Oaktree Funding’s bank statement loans are available under their Non-Agency Advantage Program. However, they are unfortunately only available for self-employed borrowers. They’re also restricted to owner-occupied and second homes.

Bank statement loan requirements:

- Minimum down payment: 15%

- Minimum credit score: 660 (680 if second home)

- Max loan amount: Up to $4,000,000 ($3,000,000 for second home)

- Months of bank statements: 12 months

- Max DTI: 50%

- Minimum reserves: 3 months for amounts <1 million, 6 months for amounts 1-1.5 million and interest-only, 12 months for amounts above 1.5 million.

14. United Wholesale Mortgage

As a wholesale lender, UWM offers four prepackaged bank statement programs tailored to different types of self-employed borrowers, namely their Blue, Yellow, Pink, and Orange programs.

Bank statement loan requirements:

- Minimum down payment: 10%

- Max loan amount: Up to $3,000,000

15. E Zip Mortgage

E Zip Mortgage allows borrowers to submit a CPA expense ratio letter to be able to use over 50% of the gross income on their business bank statement loans.

Bank statement loan requirements:

- Minimum down payment: 10%

- Max loan amount: Up to $3,000,000

- Months of bank statements: 3-24 months

- Max DTI: 50%

- Minimum self-employed or business experience: 1 year

How to Choose the Right Bank Statement Mortgage Lender

Each lender has their own approach to evaluating income, credit, and cash flow, so the best option for one borrower may be a poor fit for another. Make sure you keep these considerations in mind when shopping around for the right lender:

Compare lender requirements

Start by listing each lender’s baseline credit, down-payment, cash reserve, and DTI thresholds so you can immediately rule out mismatches. As can be seen above, lenders vary widely on these requirements. Narrowing down the list early lets you avoid wasting time on lenders who won’t qualify you no matter how strong other parts of your profile look. Then you can focus only on lenders who actually fit your financial picture, giving you a clearer path forward.

Match lender flexibility to your self-employment situation

Depending on your specific self-employment setup, you may have a better chance of getting favorable terms with certain lenders. If your income is seasonal or highly variable, for example, prioritize lenders who explicitly state they average deposits over 12–24 months and accept recurring contract or gig-income patterns.

You should also consider lender experience with your industry. Aside from asking them directly, you can investigate their track record by looking up reviews and discussions on external sites. Some underwriters are familiar with creative professions or trades and will interpret irregular deposits more favorably.

At Defy, we’ve been working with unconventional incomes since before our inception. Our Mortgage Consultants each have decades of experience working with irregular-income individuals, so we’re deeply familiar with all of the nuances and difficulties that come with non-salaried income sources. Every Defy loan product is equipped with ground-up customizability precisely to meet the needs of every borrower, regardless of where their income might come from.

Weigh speed-to-close vs. long-term rates

A rapid loan close can be a major advantage in securing a property before competing bidders, but it can also come with relatively higher rates. On the other hand, lenders who offer more competitive long-term pricing may require extra documentation and longer underwriting, which could jeopardize your deal if you’re under time pressure.

You’ll also want to consider rate-lock policies, as a slower process could expose you to market changes that raise your final costs. In short, speed offers short-term certainty, while patience often buys you better affordability over the life of the loan.

Key Takeaways

As with any type of loan, it’s essential to do your research on each lender’s strong suits and how well they fit your strategy. The info we’ve gathered on the 15 best bank statement mortgage lenders should give you a solid head start when comparing lenders, allowing you to go in-depth on the best candidates right away.

Flexibility tends to vary widely among lenders. Some allow a mix of income documentation, from P&L statements to even W-2s as well as bank statements. Others allow applications with only three months of bank statements and only one year of self-employed experience. Paying attention to these differentiators will enable you to secure the best deal for your financial situation.

Want maximum flexibility on your non-QM mortgage journey? Defy offers a variety of options aside from bank statement loans, from investment property loans with a minimum down payment of as low as 15%, to home equity loans and HELOCs up to 80% LTV. Whatever your financial needs, we can come up with a solution.

If you’re a mortgage broker, Defy TPO can give you access to Defy’s ultra-flexible bank statement options, along with 75+ other traditional and non-traditional loan options designed for borrowers with unconventional incomes. Our bank statement loans will enable you to serve clients that most lenders might overlook, and help you establish long-term market dominance.

Got questions about our pricing? Send us your scenarios, and we’ll show you what makes us the best option. Alternatively, try out our AI Pricer for a quick quote.

Best Bank Statement Mortgage Lenders FAQ

What are bank statement loan requirements?

Bank statements are the most important requirement for bank statement loans. The past 12 months to 2 years of bank statements must be submitted to your lender so they can get your average monthly earnings over that period. This amount will be the basis for loan approval and terms. Apart from bank statements, your lender also considers your credit score, debt-to-income ratio (DTI), and, in some cases, your cash reserves.

How to get a bank statement loan?

Getting a bank statement loan is similar to applying for any other type of loan: gather documents, shop around for a lender, and submit your application. It’s also ideal to gain pre-approval to get a clear estimate of the total amount you can borrow and at what rate.

Can I refinance with a bank statement loan program?

Yes! Refinancing to a bank statement loan can be a very viable option if you initially purchased your home with a traditional mortgage, but have since shifted to a non-salaried line of work such as business ownership or self-employment. At Defy, we also offer cash-out refinance to a bank statement loan, allowing you to withdraw up to 90% of your home’s value, no private mortgage insurance (PMI) required.

How many months of bank statements do I need?

While 12 to 24 months is standard, some lenders offer reduced-doc options in specific cases. At Defy, we look for a minimum of 12 months of bank statements, but being able to prove high average income over the past two years can significantly improve your creditworthiness.

Do bank statement loans have higher rates?

Being non-QM loans, bank statement loans can have higher interest rates than conventional loans due to higher risk. However, this can be offset by having a high average income reflected in your bank statements. The higher the income your bank statements show, the better your rates and terms are likely to be.

What Alternative Loans to Bank Statement Loans are Available?

Several alternatives exist to bank statement loans for borrowers who don’t fit into conventional mortgage guidelines. Options include:

- P&L (Profit & Loss) loans: Use profit & loss statements as proof of income instead of W-2s/tax returns.

- Asset depletion loans: Use assets (stocks, bonds, etc.) to substitute for income; the value of assets is “depleted” over the loan life to calculate qualifying income.

- DSCR (Debt Service Coverage Ratio) loans: For rental / investment properties; qualification based on property’s net cash flow vs mortgage payments rather than borrower’s traditional income.

- Interest-only options: Borrower pays interest only for some initial period (up to ~10 years) to ease cash flow, before principal payments begin.

- Foreign national loans: For non-US residents without SSN/US credit, relying on foreign documents and references.

- Fix-and-flip loans: Financing to purchase property, rehabilitate (“fix”) it, then sell (“flip”). Instead of traditional income, the after-repair value (ARV) is considered during your application.

What Are the Pros and Cons of Bank Statement Loans?

Bank statement loans come with clear advantages and drawbacks:

Pros of bank statement loans:

- Ideal for those whose tax returns don’t always tell the whole story.

- Private mortgage insurance is typically not required.

- Debt-to-income ratios up to 50% may be considered.

Cons of bank statement loans:

- Generally, you must be self-employed or in business for at least two years.

- Rates are generally 1%–3% higher than those of conventional loans.

- Expect to put down 10%–20%, with higher requirements possible for lower credit scores.

- Not all lenders offer bank statement loan programs.

How can I qualify for a bank statement mortgage loan?

To qualify for a bank statement mortgage, lenders generally look for:

- 12–24 months of personal or business bank statements

- A credit score of 620 or higher

- A down payment of 10–20%

- A DTI ratio of at most 43%, although some may allow 50% depending on your other qualifications

- If self-employed, at least 2 years of self-employed work history

What should I ask my lender when applying for a bank statement mortgage?

When applying, it’s smart to ask your lender exactly how many months of bank statements they require and whether they prefer personal or business accounts. You’ll also want clarity on the minimum down payment, acceptable credit scores, and debt-to-income ratio requirements.

Other important questions include how income will be calculated from your statements, whether interest-only or adjustable-rate terms are available, and what closing costs or prepayment penalties may apply.

What are the best bank statement mortgage lenders for self-employed individuals?

Among the top options for self-employed borrowers, Defy Mortgage stands out for offering up to $6 million in financing, 90% loan-to-value, and both fixed and adjustable options. Other standout lenders include:

- Griffin Funding: Digital direct lender with a strong focus on veterans, self-employed individuals, and real estate investors.

- Change Home Mortgage: A CDFI-certified lender designed to serve underbanked and diverse borrowers such as freelancers, gig workers, and foreign nationals.

- New American Funding: Uses advanced tech with a mission to expand access to credit for Latino and Black communities.

- First National Bank of America (FNBA): National bank with a strong focus on non-traditional borrowers, offering blended income documentation to support self-employed applicants.