Imagine selling property and reducing your tax burden, completely legally. While the federal government still taxes capital gains, states with no capital gains tax, like Texas, Florida, and Tennessee can save investors thousands of dollars with each sale. So how can you take advantage of this opportunity?

At Defy, our focus is on helping investors and brokers maximize long-term returns by pairing the right financing tools with the right opportunities. From DSCR loans for investors with unconventional incomes to jumbo loans for high-value purchases, we help you scale faster, protect cash flow, and keep more of your gains working for you.

In this blog, we’ll take a deep dive into the profiles of each of the 9 states with no capital gains tax, how they’re taxed, and how to take advantage of the unique opportunities offered by these states.

Let’s get started.

Understanding Capital Gains Tax Basics

Capital gains tax is the tax applied when you sell a capital asset, such as real estate, stocks, or business interests, for more than you paid for it. Capital gains are subject to specific tax brackets at the federal level, but different states handle them differently. In fact, there are 9 states with no capital gains tax, creating favorable conditions for investors.

It’s important to remember that only the profit made from the sale of a property is considered taxable income. The capital gains tax only applies to the profit, not the total sale price.

Federal Tax Rates

When you sell your property, you owe tax to both the state and federal governments. Profits are taxed in a tiered system that includes the seller’s annual income, meaning if you make $50,000 a year and earn capital gains of $100,000, $150,000 will be counted towards your long-term capital gains tax bracket.

If you’ve held the property for more than a year, your profit is considered a long-term capital gain. In 2025, long-term gains fall into three main brackets: 0%, 15%, and 20%. Here are the thresholds for each bracket for the tax year 2025:

That means a $100,000 profit from a sale plus a $50,000 annual salary will be taxed like so:

- The first $48,350 of the total income fills up the 0% bracket, meaning it’s not taxed.

- The remaining $101,650 falls into the 15% tax bracket, and will incur $15,247.50 in taxes.

If the profit exceeded the 20% threshold, say a net profit of $550,000 for a single seller, plus their $50,000 yearly salary, it would be taxed like so:

- The first $48,350 of the total income is not taxed.

- The portion of the net profit in excess of $48,350 but does not exceed $533,400 is taxed at 15%. This amounts to $485,050 * 0.15 = $72,757.50

- The amount exceeding $533,400, which is $18,250, is taxed at 20%. $18,250 * 0.20 = $3,650.

This amounts to a total tax liability of $76,407.50 All of this is separate from what’s owed on the state level. And keep in mind: certain assets, like collectibles or Section 1202 small-business stock, can face even higher federal rates of up to 28%.

Short-Term vs. Long-Term Gains

When you sell a property in less than a year, the profit counts as a short-term capital gain. These gains are taxed at your ordinary federal income tax rate (anywhere from 10% up to 37% depending on your bracket). On top of that, most states also treat short-term gains as regular income.

If you hold your property for more than a year, the tax brackets can be more favorable at the federal level (i.e, 0%, 15%, or 20%, depending on your income). While many states still tax these gains as income, states with no capital gains tax do not tax short- or long-term gains at the state level.

Special Considerations

On the federal level, there are three important rules you should know about:

- Tax-loss harvesting rules: This is when you sell an investment that’s losing money in order to offset profits from another sale. For example, if you made $50,000 selling a rental but lost $10,000 on another property, you could subtract that loss and only pay tax on $40,000 of gains. The IRS allows this, but only up to the amount of your gains.

- Wash sale rules: This prevents you from selling an asset at a loss and then immediately buying it back just to claim the tax break. If you repurchase the same or “substantially identical” investment within 30 days, the IRS won’t let you count the loss right away. This rule usually applies more to stocks than properties.

- Basis adjustment rules: Your “basis” is essentially what you paid for a property, adjusted over time. Improvements like adding a new roof can increase your basis, while things like depreciation or insurance reimbursements reduce it. These adjustments matter because they affect how much gain you report when you sell. For instance, if you bought a property for $300,000, spent $50,000 on improvements, and then later sold it for $400,000, your taxable gain would be $50,000 (not $100,000), since your adjusted basis would be $350,000.

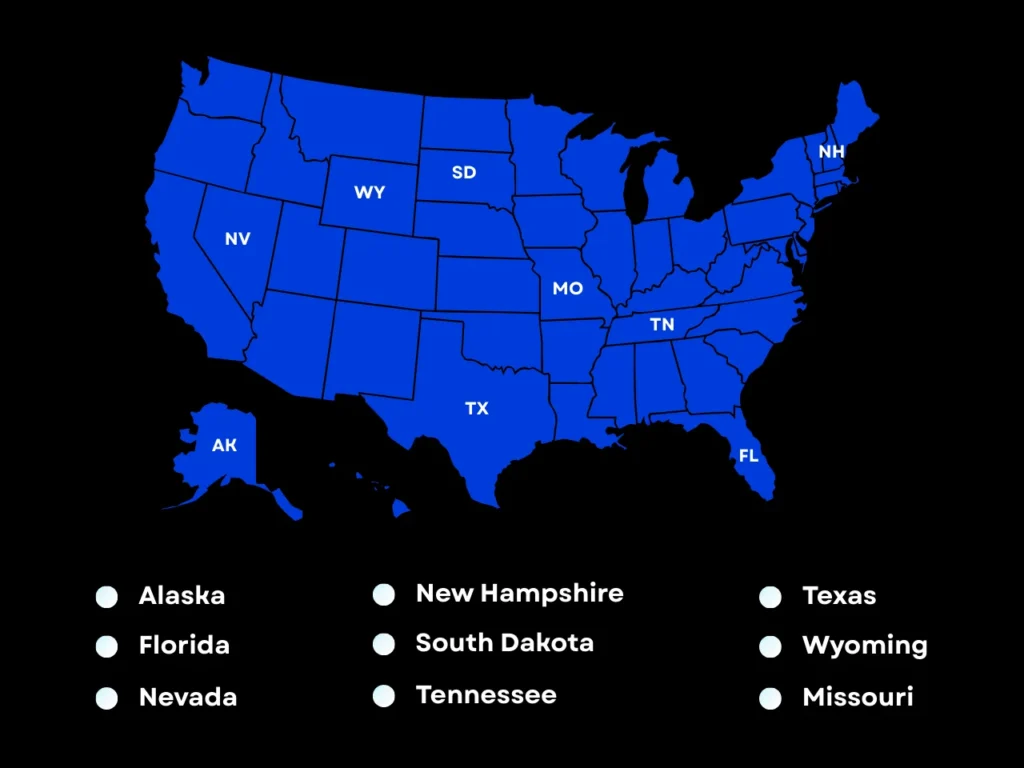

The 9 States Without Capital Gains Tax

As of 2025, nine states impose no state-level capital gains tax. Eight of these levy no income tax at all, and only one imposes a state income tax but makes an exception for capital gains.

Here’s a detailed look at each state, its rules, and what investors should know about:

Alaska

Alaska has had no individual income tax since 1980, and by extension has no capital gains tax. Alaska mainly avoids taxing residents’ income, including capital gains, by drawing most of its funding from oil revenues.

To qualify for this exemption, investors must establish domicile in Alaska. This includes registering to vote, obtaining an Alaska driver’s license, and maintaining a physical residence in the state.

Florida

Florida has not had a personal income tax or capital gains tax since 1855. This historic lack of tax obligations, combined with its booming real estate market, makes it one of the most popular relocation states for investors and high-net-worth individuals.

To become an official Florida resident and take advantage of these benefits, investors must file a sworn Declaration of Domicile with the Clerk of Courts to prove in writing that they intend to make Florida their primary residence. They are also required to update their voter registration and spend at least 183 days a year in the state. Residents are allowed to have homes elsewhere, but their “predominant and principal abode” must be in Florida.

Nevada

Nevada has never imposed a state income or capital gains tax. It’s become a magnet for entrepreneurs and retirees looking to preserve more investment income.

To benefit, individuals must demonstrate residency by obtaining a Nevada driver’s license, registering their vehicles in Nevada, and proving physical presence in the state.

New Hampshire

Historically, New Hampshire taxed interest and dividends at 5%, but this tax was phased out completely by January 1, 2025, leaving no individual income or capital gains tax whatsoever.

Residency requires proving domicile by vehicle registration and voter enrollment. In addition, new residents must be able to prove that they spend a larger percentage of their time in NH than in any other state.

South Dakota

Frequently ranked among the most tax-friendly states for investors, South Dakota does not tax business inventory, corporate income, or gross receipts, in addition to not taxing income and capital gains.

SD is also among the easiest states to establish residency in, allowing new arrivals to become residents in just one day. All you have to do is prove you have a physical address in South Dakota, stay in the state for one night (even if you sleep in a campground!), and get an SD driver’s license.

Tennessee

TN previously levied the Hall Tax on dividends and interests, but this was phased out in 2021. This move was widely praised as a great move for economic growth, and in 2025, Tennessee is considered one of the best states to buy long-term rentals in, especially for foreign investors.

Residency in Tennessee follows standard steps: obtaining a TN driver’s license, voter registration, and a physical domicile.

Texas

Texas combines its lack of state income or capital gains tax with a landlord-friendly environment and lucrative short-term rental potential. However, it does raise significant revenue through property taxes and sales taxes.

To prove intent to establish domicile, you need Texas voter and vehicle registration, as well as two printed documents containing your name and Texas residential address, with one being a DL/ID document proving that you have spent over 30 days in Texas. Those who gain employment, own property in, own a business in, or marry someone with Texas domicile are preferred.

Wyoming

Another one of the most tax-advantaged US states, Wyoming charges no income, capital gains, estate, or gift taxes. Wyoming is also known as a corporate haven, with strong asset protection and trust laws.

Tax residency in Wyoming requires proof of intent to establish domicile, such as Wyoming voter registration, vehicle registration, and driver’s license. You are also required to live in Wyoming more often than any other state, with proof of time spent there. Other requirements include selling or downsizing your primary home in your former state and migrating your trusts to Wyoming.

Missouri

As the latest state to eliminate capital gains tax, Missouri is also the first state to do so while still keeping their state income tax.

To become a Missouri tax resident, taxpayers must establish domicile by spending at least 183 days in Missouri (any portion of a day counts as one full day) and updating their driver’s license and voter registration.

Comparing State Tax Burdens

Being exempt from capital gains can be a huge advantage in wealth building, but factors such as property taxes, insurance premiums, sales taxes, and even the cost of living will impact how profitable your investment strategy will be.

Let’s analyze the effect these can have on your investments.

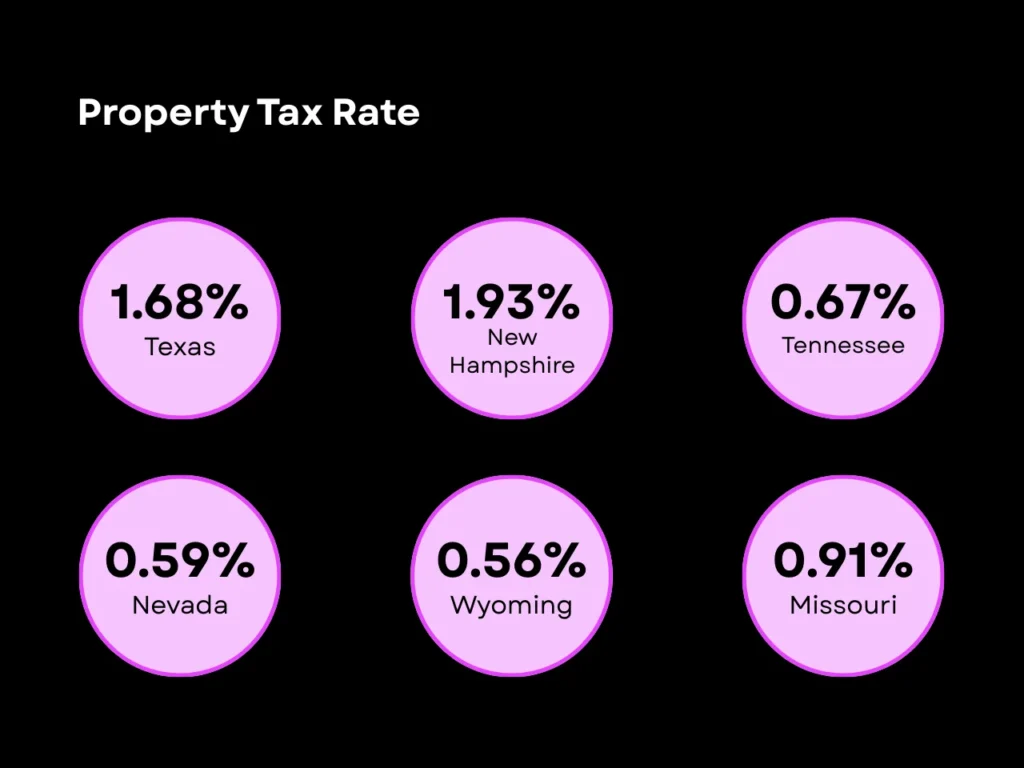

Property Taxes and Insurance

States that don’t tax income often raise revenue elsewhere, and property taxes are one of the most common tools. Texas, for example, has one of the highest effective property tax rates in the country at 1.68%, compared to the national average of 0.90%.

By contrast, effective property taxes in Tennessee, Nevada, and Wyoming are some of the lowest at 0.67%, 0.59%, and 0.56%, respectively. Missouri is closest to the average at 0.91%.

Insurance is another hidden cost that varies widely by state. Florida has some of the steepest premiums in the nation due to hurricane risk, often ranging from $5,730 to $8,770 per year, compared to the national average of $2,397. Texas investors also face above-average premiums, though at roughly half of Florida’s highest levels (around $4,585 annually).

Other Taxes

Beyond property taxes, states can compensate for the lack of capital gains tax revenue by increasing other tax rates. Tennessee, Texas, and Florida lead here, with average combined sales tax rates (state and local taxes) of 9.61%, 8.20%, and 7.02%, respectively.

On the plus side, none of the 9 states with no capital gains tax levies an estate or inheritance tax, which can be a significant advantage for long-term wealth planning. However, Florida levies a documentary-stamp tax on deeds and notes, typically $0.70 per $100 of consideration for deeds, not including county-specific surcharges. Similarly, New Hampshire charges a state real-estate transfer tax to both the purchaser and the seller at a rate of $0.75 per $100 in property being transferred. If we consider the sale or transfer of a $100,000 property, that’s $700 and $750 in taxes charged to you, respectively.

Housing Costs and Cost of Living

If you’re using your investment property as a short-term rental, the cost of living can significantly impact rental demand and pricing. Alaska is notable among the 9 states mentioned above, ranking 5th in cost of living in the US. Higher cost of living can mean that local properties are more expensive to buy and maintain. It can also mean that rental demand will be unsteady or limited.

In short, while no-capital-gains states can be an advantage, you should look at the full picture of your expenses. The examples we listed include: New Hampshire offsets its tax-free status with high property taxes, Florida and Texas with elevated insurance costs, and Alaska with high living expenses.

However, these states also present fruitful opportunities for rental investments, which can be lucrative enough to offset their tax burden. DSCR loans allow you to take full advantage of high rental demand because there’s no hard cap on how many DSCR loans you can hold at once. Instead of being limited by conventional loan restrictions, you can continue acquiring properties as long as the rental income supports it, making portfolio growth both scalable and sustainable.

How to Seize the Opportunity?

Knowing which states don’t tax capital gains is only half the battle. To truly benefit from the tax policies, you need to be strategic about where you invest, how to establish residency, and when you would choose to sell.

The good news is that with the right mix of state selection, residency planning, and tax-efficient financing, you can position your portfolio to maximize returns while minimizing risk. In this section, we’ll walk through practical steps you can take.

Select the Right State

Not every investor can simply pick up and move or shift their portfolio across state lines, but if you have the flexibility to choose where to put your money, selecting the right state can make a meaningful difference in your long-term returns. The nine states with no capital gains tax all offer investors a clear advantage: when you sell a property, more of the profit stays in your pocket instead of going to the state government. That simplicity alone can make these states attractive destinations for building a portfolio.

But tax policy is only one piece of the puzzle. Even in no-tax states, factors like property taxes, insurance premiums, housing costs, and rental demand vary widely and can easily offset the “tax savings”. For investors buying outside their home state, they also may face additional logistics, such as management costs, local regulations, and the challenge of maintaining a close eye on a property from a distance. These practical factors often carry just as much weight as tax rules when determining profitability.

It’s also worth playing devil’s advocate: investing in a state with capital gains taxes isn’t always a bad move. High-tax states, such as California or New York, may offer faster appreciation, stronger rental markets, or unique opportunities that can outweigh the tax burden.

Establish Ironclad Tax Residency

Now that we’ve covered how to select the right state, let’s turn to some practical implementation steps you’ll need to take to actually benefit from its no-capital-gains status.

Capital gains tax applies when you sell the property and realize a profit. That means your state of residency at the time of sale is what determines how your gain is taxed at the state level. Having an ironclad residency means creating an airtight case leading up to the time of sale to ensure that you are taxed in the correct state.

Is it always required? Not necessarily. If you already live in a no-capital-gains state, your residency status is clear. You’re automatically shielded from state-level capital gains taxes on properties you own there or anywhere else. But if you’re moving from a high-tax state into one of the nine no-capital-gains states, then proving ironclad residency is essential.

So what does it take to establish ironclad residency? It comes down to time and intent. Nearly every state requires you to spend at least 183 days there each year, but simply clocking days isn’t enough. You’ll also need to show that the state is your true primary home. That means updating your driver’s license, registering to vote, moving your vehicle registration, and shifting personal and professional ties.

Auditors from high-tax states often scrutinize these claims with surprising detail, reviewing phone records, credit card charges, and even travel logs. That’s why many investors make a clean break: selling or renting out their former primary home, moving key accounts, and keeping meticulous records of their time spent in the new state.

The takeaway: If you live in a no-capital-gains state, you’re covered. But if you’re trying to move from a high-tax state, establishing an ironclad case for residency is the only way to ensure your tax savings actually stick.

Maximize Tax Benefits With Strategic Financing

Saving on capital gains taxes is powerful, but the real opportunity comes when you put those savings back to work. Strategic financing lets you stretch every dollar further and accelerate portfolio growth, but smart financing can make that growth exponential. DSCR loans can serve as an excellent financing vehicle for that purpose.

DSCR loans base qualification and terms on property cash flow rather than personal income, and have no hard limit on the number of properties you can finance at any given time. As long as your chosen properties have a healthy, positive cash flow, you can purchase an indefinite number of them for as little as 15% down and grow your portfolio at your own pace. For non-rental purchases, other non-QM loans like jumbo loans and fix-and-flip loans can also prove useful.

And if you’re a mortgage broker, this is where you can win big. Defy Mortgage’s TPO was built to help brokers expand their offerings without the friction of hidden fees or rigid processes. The Defy TPO team knows the broker’s perspective and has designed programs that help you close faster, deliver smoother service, and compete more effectively. In other words, while your clients are focused on tax savings, you can position yourself as the one providing the financing pathways that make those savings work harder.

Conclusion

Within the larger context of overall tax burdens, demand, cost of living, and insurance, capital gains tax can often make or break the profitability of your real estate strategy. That’s why these 9 states with no capital gains tax offer such a powerful advantage.

But before you can benefit from these tax exemptions, establishing clear residency is essential to ensure that you aren’t audited by your former state, which can jeopardize your returns. Property taxes and insurance can prove to be significant hidden costs, but tools like 1031 exchanges or QOZ investments can help keep your gains coming.

Finally, strategic financing with DSCR, jumbo, or asset depletion loans help turn saved tax dollars into long-term portfolio growth. By reinvesting the money that would’ve otherwise gone to the state, you can secure efficient wealth-building for decades to come. Talk to a Mortgage Consultant at Defy today, or give us a ring at (615) 622-1032 for expert advice on your next winning move.

If you’re a mortgage broker, you can build deeper client relationships and invite more deals by helping investors understand whether moving to a state with no capital gains tax is best for their returns. Whatever the right goal may be, Defy TPO‘s bank statement loans, DSCR loans, and jumbo loans can give you the flexibility you need to make it happen. Try our AI Pricer to get a quick quote on your lending scenarios, or send it to us for a more thorough analysis.

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/