Tennessee capitals gains tax was effectively removed in 2021 after the final phase-out of the Hall income tax. With no state-level property tax either, Tennessee is one of the most investor-friendly states, especially for real estate investing. However, capital gains at the federal level still apply, which means that small decisions around your timing and cost basis can have a major impact on your net proceeds.

At Defy Mortgage, we design custom mortgage programs that maximize long-term returns while minimizing tax exposure. From DSCR loans for seasoned investors to jumbo loans for high-net-worth property owners, every product is tailored to your investment portfolio, cash flow, and financial goals, so your profits can keep working for you.

In this guide, we’ll discuss:

- How federal capital gains tax works

- How Tennessee investors can take advantage of the state’s unique tax environment

- Practical strategies to minimize taxes and reinvest profits for maximum growth

Disclaimer: This article is for educational purposes only and does not constitute tax advice. Always consult a qualified CPA before making financial decisions.

Federal Capital Gains Tax Framework

Instead of paying Tennessee capital gains tax, the only tax that Tennessee real estate investors have to worry about is federal capital gains tax. All capital gains and losses for the tax year are reported on Schedule D of your Form 1040 federal tax return.

Short-Term vs Long-Term Capital Gains

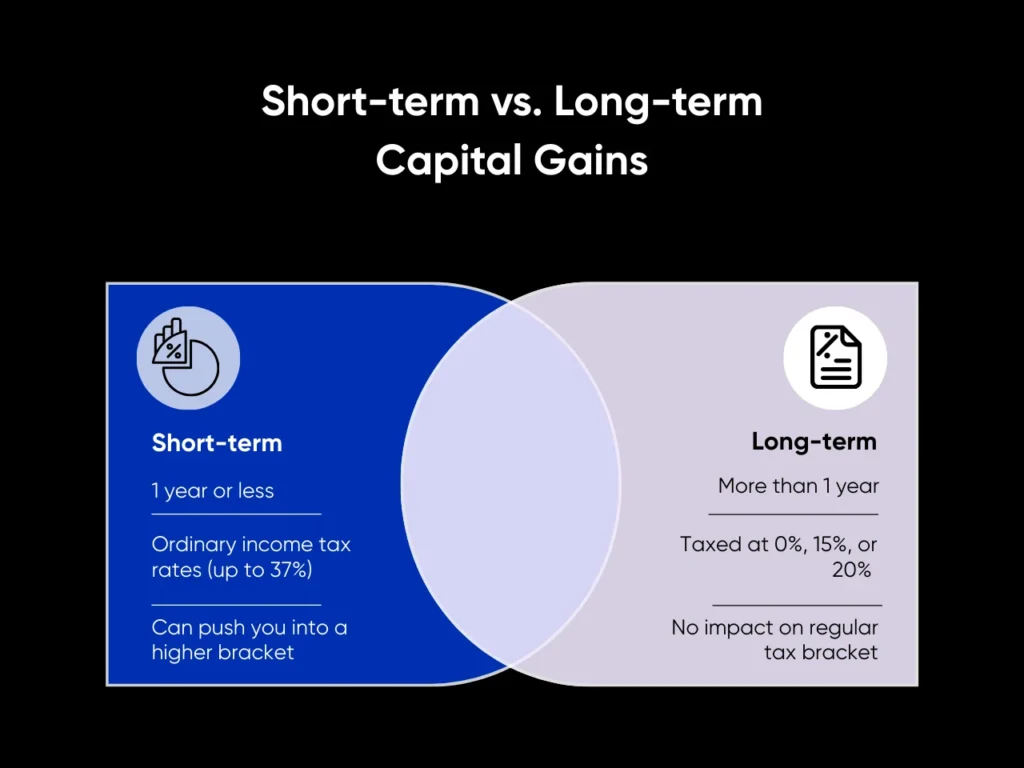

One of the most important distinctions is how long you hold an asset. The U.S. tax code treats gains differently if you’ve owned an investment for more than one year vs. one year or less:

- Short-term capital gains: Occur when you sell an asset (stocks, investment property, etc.) one year or less after purchase. These gains are taxed at the ordinary income tax rate, which can push you into a higher tax bracket. For example, if you’re an investor in Tennessee earning $100,000 in regular income and realize a $100,000 short-term gain, your taxable income rises to $200,000, potentially moving you from the 24% marginal bracket to the 32% bracket (2025 rates for a single filer).

- Long-term capital gains: Apply when you’ve held an asset for more than one year. These are taxed at preferential rates (0%, 15%, or 20%), much more favorable than short-term.

If you bought a vacation home in Chattanooga on July 1, 2024, you wouldn’t qualify for long-term capital gains treatment unless you sell it on or after July 2, 2025. Because 2024 was a leap year, a property bought on July 1, 2023 would need to be sold on or after July 2, 2024, to qualify as long-term capital gains.

Tax Bracket Impact & Federal Rates for 2025

How much capital gains tax you have to pay depends on your civil status and how much you make each year, plus your total realized capital gain.

For the 2025 tax year, the U.S. federal capital gains tax rates are structured as follows:

For example:

- If you’re a single filer making $100,000 per year, your income fills the 0% bracket entirely, with $51,650 “spilling over” into the 15% bracket.

- The 15% bracket spans from $48,351 to $533,400, which means any capital gain realized will be taxed at 15% until the sum of your capital gains and annual income exceeds $533,400.

- If you realize any additional capital gains, they will then be taxed at 20%.

Also, note that there may also be additional taxes or surtaxes, such as the Net Investment Income Tax (NIIT). This can add up to 3.8% tax for high-income individuals if your modified adjusted gross income (MAGI) exceeds certain thresholds.

Disclaimer: These examples are simplified estimates based on the tax brackets for the 2025 tax year. They do not account for deductions, credits, or other taxes. Actual tax liability can vary depending on your complete financial situation. Consult a licensed tax professional or financial advisor for personalized advice.

Basis, Adjustments & Special Rules in Real Estate Context

For real estate investors, calculating your basis and accounting for things like depreciation recapture are essential.

- Cost basis: Is essentially all that you’ve invested into the property, from purchase price to capital improvements and other upgrades. It also includes the money you spend in selling the property, such as closing costs and recording fees. The sale price of the home minus the cost basis equals your realized gain.

- Depreciation recapture: If you’ve claimed depreciation deductions on an investment property, such as a rental in Memphis that got damaged during the April 2025 floods, for example, a portion of the gain is taxed at a higher rate. This rate is applied to any part of the gain that can be attributable to the depreciation deductions.

- Special categories: Gains from selling collectibles, gains from Qualified Small Business Stock, or “unrecaptured §1250” real property gains may have different tax rates or brackets. Of these, only unrecaptured §1250 is of any concern to real estate investors. This tax is paid when you sell depreciable real property and part of your gain is attributable to prior depreciation deductions, taxed at a maximum 25% rate instead of the standard long-term capital gains rate.

Tennessee-Specific Tax Considerations

Tennessee is one of the nine states that do not impose a state-level capital gains tax, alongside other known tax havens such as Florida, Texas, New Hampshire, and Wyoming. But that wasn’t always the case; historically, Tennessee imposed the Hall Income Tax, which taxed interest and dividend income. However, this tax was phased out between 2016 and 2020 and was fully repealed in 2021.

Now, the only state-level tax that Tennessee levies on the sale of real estate is the Real Estate Transfer Tax, which is a flat rate of $0.37 per $100 of the property’s value. This applies to home sales and certain other forms of transfer. In short, this means that if you transfer ownership of a $500,000 property, regardless of the profit you make, you’ll incur $1,850 in taxes. This tax is usually paid at the time of recording the deed with the county register’s office.

Other Tax Concerns in Tennessee

Tennessee does not levy a separate property tax on the state level, but some counties do levy a local property tax. For instance, in Williamson County, property taxes are collected by the county trustee, but cities like Spring Hill also collect their own municipal property taxes.

For investors operating through legal entities like LLCs or corporations, Tennessee imposes Franchise and Excise Taxes (F&E) on entity net earnings or net worth. The Excise Tax is 6.5% of net earnings, while the Franchise Tax is based on the greater of net worth or the appraised value of real and tangible property. However, exemptions exist for family-owned non-corporate entities.

Tennessee’s Tax Advantage Over States With Capital Gains Tax

Compared to states with state-level capital gains tax as well as on the federal level, Tennessee offers a clear advantage to real estate investors. To illustrate that, let’s look at your estimated tax burden for a $500,000 capital gain in states with capital gains taxes:

- California: Investors in California pay state income tax on capital gains at rates up to 13.3%, in addition to federal capital gains taxes. Because the state treats capital gains as ordinary income, a $150,000 annual salary plus a $500,000 gain results in $650,000 of taxable income, placing you in California’s 12.3% bracket. Total state tax: $148,683.

- New York: Like California, New York taxes capital gains as ordinary income, with brackets reaching 10.9%. Using the same $650,000 total income, you fall into the 6.85% state bracket, owing $130,980. New York City residents also pay local income taxes, raising the total tax bill to $150,360.

All of this is in addition to roughly $98,000 in federal taxes on a $500,000 gain. By contrast, investors in Texas only pay federal capital gains tax, capped at 20%, plus a 3.8% Net Investment Income Tax (NIIT) for high earners.

What This Means For Investors

Saving potentially hundreds of thousands with each sale can be a major strategic benefit. That extra cash can be funneled into expanding your portfolio, funding improvements, and purchasing high-end properties.

Defy has loan products for all of those situations. Whether it’s fueling exponential expansion with a DSCR loan, upgrading properties with a bank statement or construction loan, or acquiring a luxury property with a jumbo loan, we have solutions for every investment scenario.

Special Situations and Exemptions

Several federal provisions and strategies can help investors minimize their capital gains tax burden even further:

Section 121 Exclusion: Primary Residence Exemption

Under federal tax law, individuals may qualify for the Section 121 exclusion, which allows for the exclusion of up to $250,000 ($500,000 for married couples filing jointly) of capital gains on the sale of a primary residence.

To qualify, the seller must:

- Have owned the home for at least two of the five years preceding the sale.

- Have used the home as their primary residence for at least two of the five years preceding the sale.

For example, let’s say you purchased your home for $300,000 and sold it for $600,000 for a $300,000 gain. If you’re single, you can reduce your taxable capital gain to $50,000. If you’re married and filing jointly with your spouse, you can potentially take away

Inherited Property: Step-Up in Basis

When you inherit property, the property’s basis is “stepped up” to its fair market value at the date of the decedent’s death. This means that if you sell the inherited property, you will only pay capital gains tax on the appreciation that occurs after the date of inheritance, not from the original purchase price.

For instance, if a relative purchased a property for $100,000, and at the time of their death, property appreciation has brought the value up to $500,000, your basis in the property would be $500,000. If you sell it for $510,000, your taxable gain would be $10,000, rather than $410,000, potentially saving you a substantial amount in taxes.

1031 Like-Kind Exchange: Deferring Capital Gains Tax

A 1031 like-kind exchange allows investors to defer paying capital gains taxes on an investment property when it is sold, as long as another similar property is purchased with the profit gained by the sale. Any piece of real property can be traded for any other piece of real property as long as they’re used for investment or business purposes, not as a primary residence. This means that a multifamily rental can be traded for a commercial building, vacant land for a condo, and so on.

However, strict timelines must be adhered to for the exchange to qualify:

- The seller has 45 days to find a replacement property after the sale.

- The seller has 180 days to close on this new property.

The proceeds of the sale must also be left with a qualified intermediary. The seller cannot take possession of the funds at any point, and the entire sum must be fully reinvested; otherwise, the remainder may be subject to tax.

How Can Real Estate Investors Benefit from the Absence of Tennessee Capital Gains Tax?

Like other states with no capital gains tax, such as Texas and Florida, the lack of capital gains tax in Tennessee opens up various ways to make more of your profits work for you. With all the tools at your disposal, you can strategically structure property sales to maximize investment returns. Here’s how you can get the most mileage out of Tennessee’s tax advantages:

Strategic Tax Planning

By leveraging tools like the Section 121 Exclusion, step-up in basis, and 1031 exchanges, investors can minimize their tax liabilities. Section 121 exclusion and 1031 exchanges in particular can be combined to claim the benefits of both. You only have to meet the 2-years-out-of-5 requirement for Section 121, so you can live in it for two years out of the past five. Then, you can convert it into a rental for at least 12-18 months to remove its primary residence status, after which it can be used for a 1031 exchange.

With Defy’s jumbo loans, you can gain access to higher-value properties. These can turn much higher profits, maximizing the benefit you get from the strategies you can devise around these exemptions.

Smart Reinvestments

The tax exemptions you claim could result in substantial savings. Reinvesting these can set you up for exponential growth, especially if you use the right financing tool. DSCR loans are perfect for this strategy because there’s no hard cap on the number of DSCR loans you can take out, and loan terms are primarily decided by the property’s cash flow.

For example, the tax savings you could claim from the lack of state capital gains tax and Section 121 exclusion could be enough to put 20% down on another property. Instead of a one-time tax saving, you get a capital asset that can generate cash flow indefinitely. At Defy, we offer DSCR loans with down payments as low as 15%, potentially allowing you to acquire several properties with the same tax savings.

Conclusion

The lack of Tennessee capital gains tax and property tax create a highly favorable environment for real estate investors. Although federal capital gains obligations remain, understanding short- and long-term gains, depreciation recapture, and special rules like unrecaptured §1250, can help you minimize liability.

Want to maximize your Tennessee investment while keeping more of your profits working for you? Partnering with Defy Mortgage can further enhance your opportunities through tailored financing solutions. Whether you’re seeking DSCR loans and jumbo loans to fuel your portfolio expansion or bank statement loans and asset depletion loans to leverage your full income, we can craft a loan program that fits your exact needs.

If you’re a mortgage broker, Defy TPO gives you access to competitive products for unconventional borrowers, opening doors to market segments that traditional lenders often overlook.

Curious to find out how Defy’s products can grow your business? Send a scenario our way, and we’ll provide a tailored analysis to show how you can expand your lending opportunities. Alternatively, use our AI Pricer for a quick, customized quote.

FAQs

Does Tennessee have a state capital gains tax in 2025?

No. Tennessee does not levy a state-level capital gains tax on real estate or investment property sales. The Hall Income Tax, which previously applied to interest and dividend income, was fully repealed in 2021. For investors, this means you’re only subject to federal capital gains taxes, potentially saving $50,000–$130,000 or more per million dollars in gains compared to high-tax states like California or New York.

How much can I save on capital gains tax by investing in Tennessee real estate?

The savings are significant. For example, selling property in Tennessee instead of California could save you roughly 13.3%, which amounts to about $133,000 per million in gains. Compared to New York, the savings are roughly 10.9%, or $109,000 per million. Even versus moderate-tax states like North Carolina, which levies a flat rate of 4.25% for all forms of income, Tennessee still saves $42,500 per million. For investors managing multiple properties, these savings can be reinvested, accelerating portfolio growth and cash flow. Defy’s DSCR loans are perfectly suited for this purpose.

How do 1031 exchanges work for Tennessee property investors?

A 1031 like-kind exchange lets you defer federal capital gains taxes when you trade one investment property for another of equal or greater value. Since Tennessee has no state capital gains tax, you’re only deferring federal liability. Tennessee’s varied markets. from Nashville commercial spaces to Smoky Mountain vacation rentals or Memphis industrial properties. make it an ideal location for 1031 exchanges, giving investors both flexibility and strong rental income potential.

What makes Tennessee attractive for real estate investment beyond tax advantages?

Tennessee offers multiple advantages: no state income tax of any kind, affordable property prices compared to coastal markets, strong population and job growth in major metros like Nashville and Chattanooga, and excellent cash flow potential from rental properties. Its diverse markets, urban, suburban, and tourist-driven, provide both appreciation and income opportunities, appealing to sophisticated investors seeking reliable returns.

How do Tennessee’s tax advantages compare to other states that don’t levy capital gains tax?

Tennessee is one of nine states with no capital gains tax, joining Alaska, Florida, Nevada, New Hampshire, South Dakota, Texas, Washington, and Wyoming. What sets Tennessee apart is its combination of no income tax, moderate property taxes, central geographic location with strong connectivity, robust metro job markets, and relatively affordable real estate. Add a favorable climate and lifestyle appeal, and Tennessee becomes a compelling choice for investors looking for long-term growth and tax efficiency.